Alpha Pro Tech Receives Downgrade to ‘Hold’ Rating from Analysts

June 17, 2023

🌥️Trending News

Analysts from Wall Street have recently downgraded the rating on Alpha Pro Tech ($NYSEAM:APT) stock to ‘Hold’ from its previous ‘Buy’ rating. Alpha Pro Tech is a leading manufacturer of protective apparel and building supplies used for construction, renovations, and maintenance projects. It also offers a variety of infection control and contamination control products such as face masks, gowns, shoe covers, wipes, and cleaning supplies. Due to Alpha Pro Tech’s consistent growth, analysts initially rated the company with a ‘Buy’ rating.

However, in light of recent market events, analysts have downgraded their recommendation to ‘Hold’. This decision was made based on potential risks associated with current uncertainties in the market. Investors should take this rating downgrade into account before making any decisions about investing in Alpha Pro Tech. Despite this, Alpha Pro Tech’s long-term prospects remain optimistic due to the company’s strong fundamentals and resilient business model.

Stock Price

At the opening bell, ALPHA PRO TECH’s share price was $3.8, which is unchanged from the previous day’s closing price. Despite the downgrade, the stock closed at $3.8, a 0.3% increase from the previous closing price. This suggests that investors may still see potential in ALPHA PRO TECH despite the analysts’ ‘Hold’ rating. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for APT. More…

| Total Revenues | Net Income | Net Margin |

| 58.12 | 2.31 | 4.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for APT. More…

| Operations | Investing | Financing |

| 3.76 | -0.65 | -3.53 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for APT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 64.06 | 3.07 | 4.93 |

Key Ratios Snapshot

Some of the financial key ratios for APT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.4% | -20.6% | 5.4% |

| FCF Margin | ROE | ROA |

| 5.4% | 3.2% | 3.1% |

Analysis

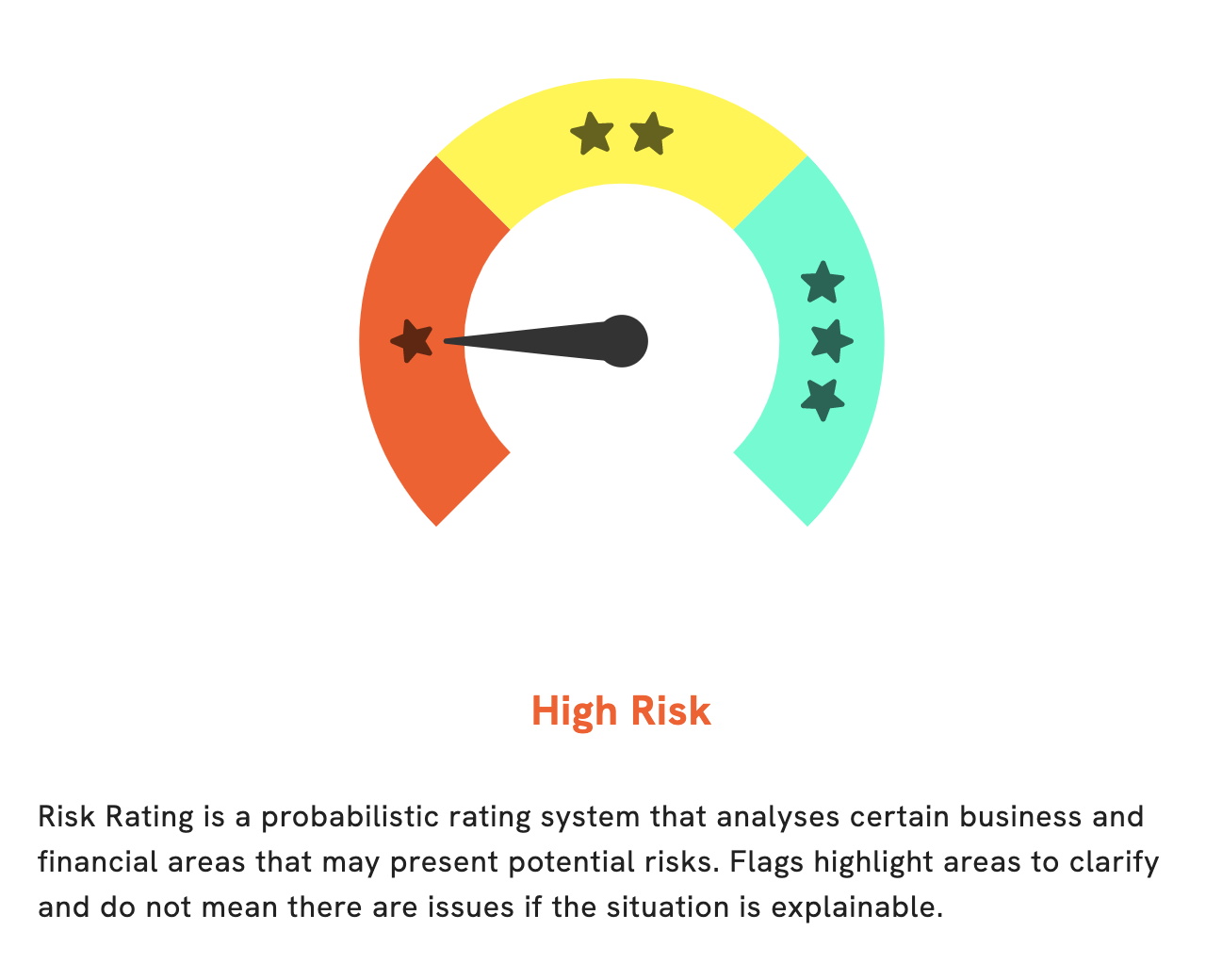

GoodWhale is here to help you analyze ALPHA PRO TECH’s fundamentals. We provide a comprehensive analysis of the financial and business aspects of the company so you can make an informed decision on your investment. Our Risk Rating puts ALPHA PRO TECH in the high risk category, as there have been some risk warnings detected in its balance sheet and cash flow statement. If you’d like to learn more about these issues, register with us to access this information. More…

Peers

The company has over 50 years of experience and operates in North America, Europe, and Asia. Its products are used in a variety of applications, including residential and commercial construction, renovation, and repair. The company’s primary competitors are Ravileela Granites Ltd, PGT Innovations Inc, and BlueLinx Holdings Inc. These companies are all publicly traded and have a significant presence in the building products industry. Each company has a different focus, but all are competing for market share in the highly competitive building products industry.

– Ravileela Granites Ltd ($BSE:526095)

Ravileela Granites Ltd is a publicly traded company with a market capitalization of 372.63M as of 2022. The company has a return on equity of 22.41%. Ravileela Granites Ltd is engaged in the business of quarrying, processing and exporting granite. The company has its own quarries in Andhra Pradesh and Karnataka, and a processing unit in Bangalore.

– PGT Innovations Inc ($NYSE:PGTI)

PGT Innovations Inc is a company that manufactures impact-resistant windows and doors. The company has a market cap of 1.17B as of 2022 and a Return on Equity of 17.81%. PGT Innovations Inc is a company that manufactures impact-resistant windows and doors. The company has a market cap of 1.17B as of 2022 and a Return on Equity of 17.81%. PGT Innovations Inc is a company that manufactures impact-resistant windows and doors. The company has a market cap of 1.17B as of 2022 and a Return on Equity of 17.81%.

– BlueLinx Holdings Inc ($NYSE:BXC)

As of 2022, BlueLinx Holdings Inc. had a market cap of 616.67 million and a return on equity of 58.79%. The company is a provider of building products and services in North America. It distributes products from over 10,000 manufacturers to more than 15,000 customers through its network of more than 70 warehouses.

Summary

Alpha Pro Tech is a company that specializes in products that provide protection from airborne and liquid particles. Recently, Alpha Pro Tech’s stock has been devalued due to a less than stellar earnings report. Analysts are suggesting investors downgrade their shares to a “hold” position. They cite the company’s sluggish growth as a major factor in the lowered outlook.

Alpha Pro Tech has failed to keep up with its competitors in terms of generating revenue and has seen a decrease in its gross margin. Furthermore, analysts have expressed concern over the company’s lack of adequate resources to expand its product lines and enter new markets. Ultimately, analysts recommend investors wait for further news on the company’s performance before deciding whether or not to invest in Alpha Pro Tech.

Recent Posts