Aaon Intrinsic Stock Value – AAON Announces 2022 ESG Sustainability Goals

June 10, 2023

🌥️Trending News

AAON ($NASDAQ:AAON) Inc., a leading manufacturer of heating and air conditioning products, announced today the launch of their 2022 Environmental, Social, and Governance (ESG) Sustainability Initiative. This initiative will help the company reach their long-term sustainability objectives. The company is committed to reducing their carbon emissions, promoting environmentally-friendly product designs, and improving their overall business practices. AAON Inc. is a publicly traded company that manufactures air conditioning and heating equipment for commercial and residential use. Their products range from rooftop units to indoor air handling systems, and many of their innovations are designed to reduce energy costs and promote sustainability.

The company is also dedicated to providing top-level customer service and delivering high-quality products. The new ESG Sustainability Initiative will focus on increasing energy efficiency, reducing packaging waste, and making use of renewable energy sources whenever possible. AAON will also strive to improve employee working conditions and create more opportunities for local communities to benefit from their operations. The company is confident that these efforts will help them achieve their long-term sustainability goals while also contributing to the greater good.

Stock Price

On Friday, AAON stock opened at $95.1 and closed at $95.5, up by 0.4% from prior closing price of 95.1. This came following the announcement by AAON of their 2022 ESG Sustainability Goals. The goals set by the company include reducing energy and water use intensity, reducing waste and increasing renewable energy use.

Moreover, AAON plans to double its total donations to charity and to double the number of employees engaged in social activities. All of these goals are aimed at promoting sustainability and social responsibility. aaon&utm_title=AAON_Announces_2022_ESG_Sustainability_Goals”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Aaon. aaon&utm_title=AAON_Announces_2022_ESG_Sustainability_Goals”>More…

| Total Revenues | Net Income | Net Margin |

| 971.97 | 119.13 | 12.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Aaon. aaon&utm_title=AAON_Announces_2022_ESG_Sustainability_Goals”>More…

| Operations | Investing | Financing |

| 72.94 | -90.77 | 14.58 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Aaon. aaon&utm_title=AAON_Announces_2022_ESG_Sustainability_Goals”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 867.91 | 258.5 | 11.24 |

Key Ratios Snapshot

Some of the financial key ratios for Aaon are shown below. aaon&utm_title=AAON_Announces_2022_ESG_Sustainability_Goals”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 25.4% | 20.7% | 15.3% |

| FCF Margin | ROE | ROA |

| -1.9% | 15.9% | 10.7% |

Analysis – Aaon Intrinsic Stock Value

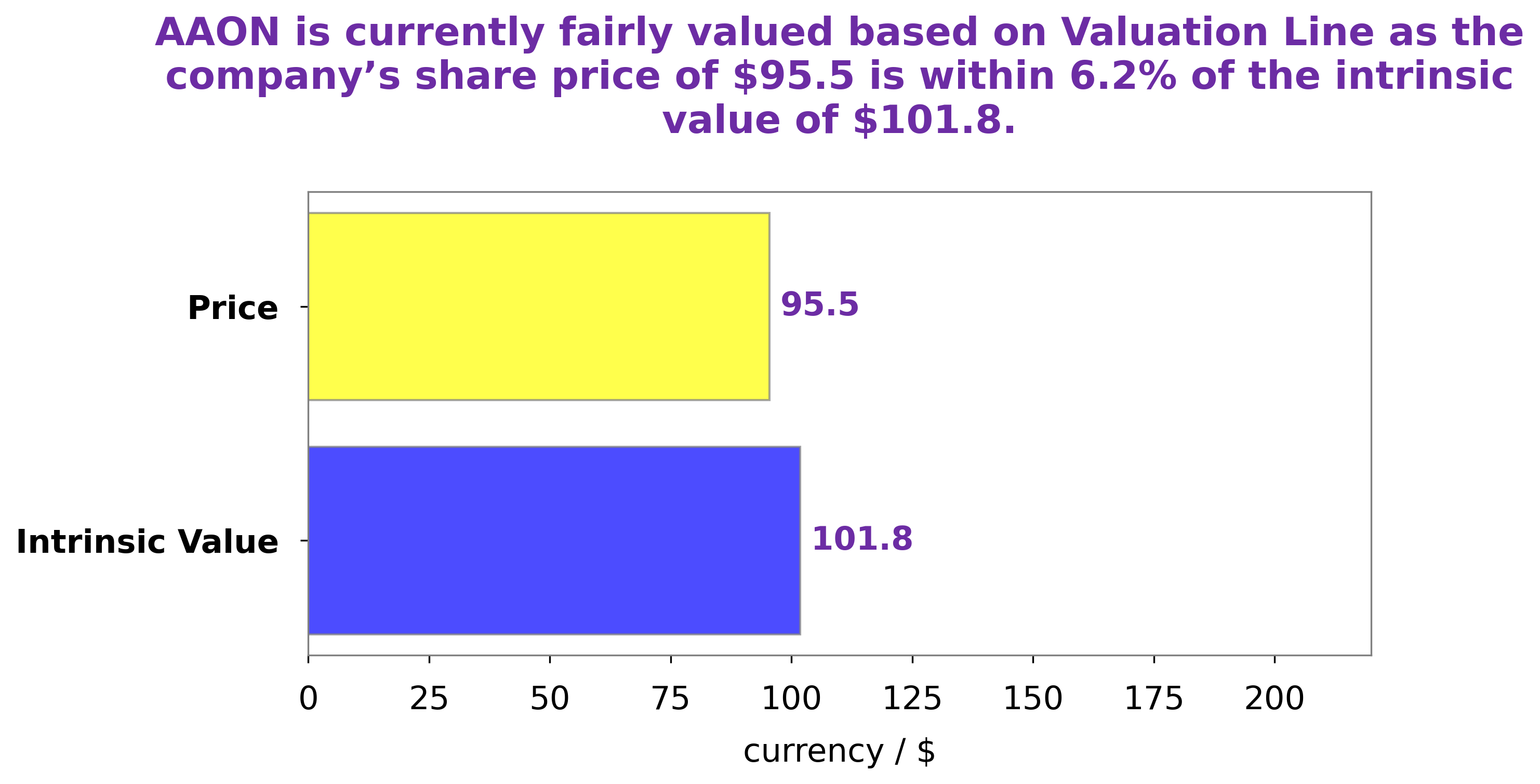

At GoodWhale, we recently conducted an analysis of AAON’s fundamentals. Through our proprietary Valuation Line, we calculated the intrinsic value of an AAON share is around $101.8. Currently, the stock is traded at $95.5, providing investors with an opportunity to purchase a fair price that is undervalued by 6.2%. aaon&utm_title=AAON_Announces_2022_ESG_Sustainability_Goals”>More…

Peers

The competition between AAON Inc and its competitors is fierce. Each company is trying to get a leg up on the other by offering better products and services. Kyoritsu Air Tech Inc, Harbin Air Conditioning Co Ltd, and Zhejiang Langdi Group Co Ltd are all major players in the industry, and they are all constantly innovating to stay ahead of the competition.

– Kyoritsu Air Tech Inc ($TSE:5997)

Kyoritsu Air Tech Inc has a market cap of 2.25B as of 2022, a Return on Equity of 4.9%. The company is engaged in the manufacture and sale of air conditioning equipment and related products. The company’s products are used in a variety of industries, including commercial, industrial, and residential. Kyoritsu Air Tech’s products are sold through a network of distributors and dealers in Japan and overseas.

– Harbin Air Conditioning Co Ltd ($SHSE:600202)

Harbin Air Conditioning Co Ltd is a Chinese company that manufactures air conditioners. The company has a market capitalization of 1.97 billion as of 2022 and a return on equity of 4.63%. The company’s products are sold in over 60 countries and regions. Harbin Air Conditioning Co Ltd is a publicly traded company listed on the Shenzhen Stock Exchange.

– Zhejiang Langdi Group Co Ltd ($SHSE:603726)

Zhejiang Langdi Group Co Ltd is a Chinese company that manufactures and sells construction materials. The company has a market cap of 2.88 billion as of 2022 and a return on equity of 7.03%. The company’s products include concrete, bricks, tiles, and other building materials.

Summary

AAON, Inc. recently released its 2022 Environmental, Social and Governance (ESG) Sustainability Report. The report highlights the company’s efforts to reduce its environmental footprint, promote safe and ethical business practices, and invest in the communities where it operates. AAON has implemented a variety of initiatives to maximize the financial, operational and environmental performance of its operations. These include investments in renewable energy, improving energy efficiency, reducing greenhouse gas emissions, and water conservation.

Additionally, the company has adopted policies to ensure safe working conditions and to promote ethical labor practices. In terms of governance, AAON established a corporate compliance program and implemented a whistleblower protection plan for employees. The company also developed a comprehensive code of ethics to guide its business decisions and practices. Lastly, AAON invests in local communities through philanthropic giving, development programs, workforce education and development, and economic revitalization.

Recent Posts