Takashima dividend calculator – TAKASHIMA Announces 70.0 Cash Dividend for Shareholders

March 23, 2023

Dividends Yield

On March 1, 2023, TAKASHIMA ($TSE:8007) announced a 70.0 cash dividend for its shareholders. This marks another impressive dividend payout from the company and could make it an attractive choice for those looking to add dividend stocks to their portfolios. The company has been consistently paying dividends over the last three years, at 200.0 JPY, 130.0 JPY, and 60.0 JPY per share respectively, resulting in dividend yields of 9.69%, 7.59%, and 3.73% for the 2021-2023 period. This averages out to a 7.0% dividend yield for this time period, which is quite attractive for prospective investors.

The ex-dividend date for TAKASHIMA is March 30, 2023, so those who buy before then can expect to receive the 70.0 dividend payment in due time. Given their consistent dividend payments, TAKASHIMA is definitely worth considering if you’re looking to increase your yield.

Price History

The stock opened at JP¥3015.0 and closed at the same value, a slight decrease from its prior closing price of JP¥3020.0. This news follows a series of positive results for the company, further strengthening its position in the market. The announcement of this cash dividend is an indication of the company’s continued commitment to rewarding its shareholders.

The dividend payment is part of a larger strategy to maximize value for shareholders in the long-term. With a strong financial performance in the past year and a promising future, TAKASHIMA is set to continue to reward shareholders with dividends and other benefits. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Takashima. More…

| Total Revenues | Net Income | Net Margin |

| 77.75k | 1.05k | 1.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Takashima. More…

| Operations | Investing | Financing |

| 483 | -654 | 2.31k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Takashima. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 54.89k | 35.78k | 4.3k |

Key Ratios Snapshot

Some of the financial key ratios for Takashima are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.6% | -7.7% | 2.0% |

| FCF Margin | ROE | ROA |

| -0.5% | 5.2% | 1.8% |

Analysis

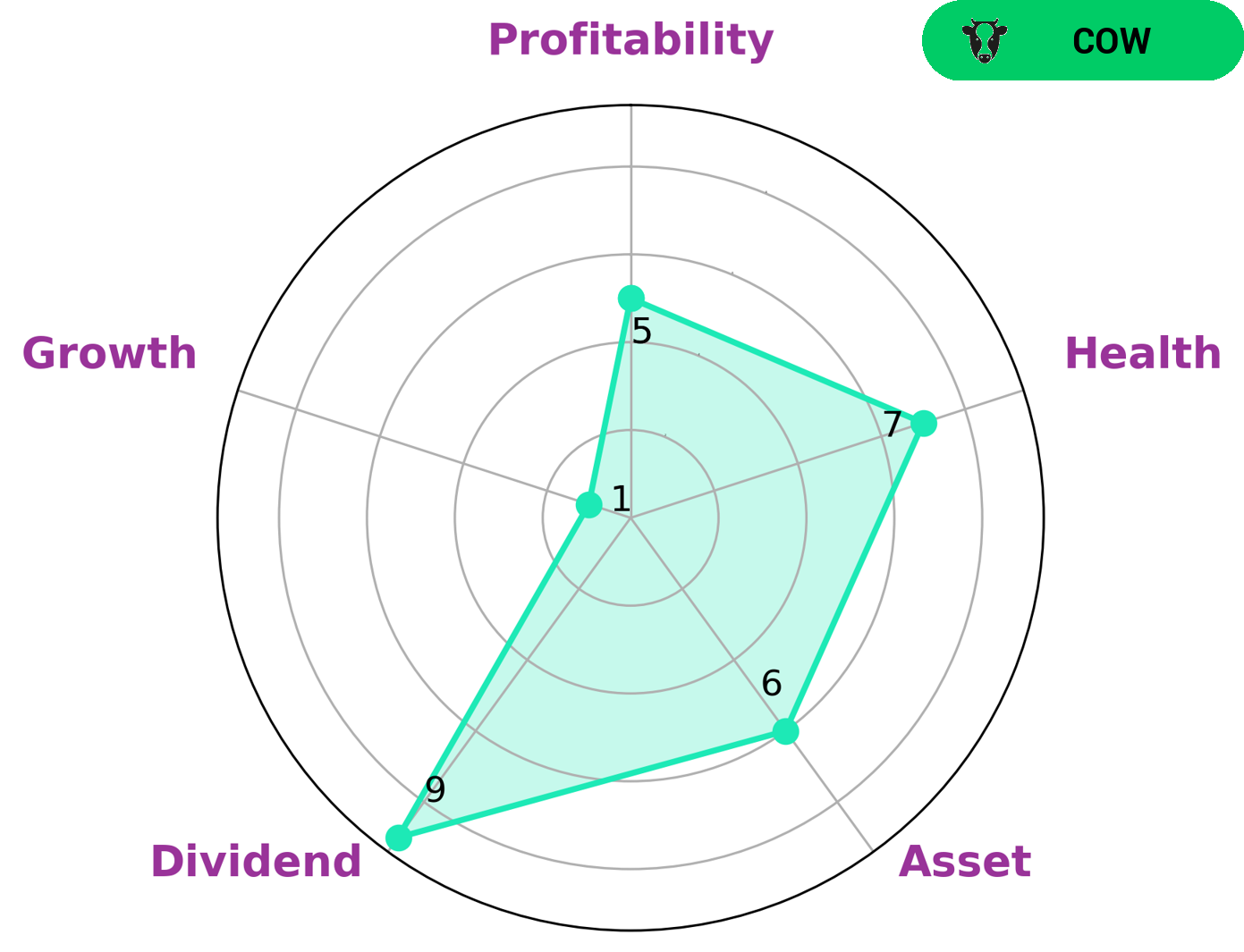

GoodWhale conducted an analysis of TAKASHIMA‘s fundamentals and according to our Star Chart, TAKASHIMA is strong in dividend, medium in asset, profitability and weak in growth. We classify TAKASHIMA as a ‘cow’, a type of company that we conclude has the track record of paying out consistent and sustainable dividends. Investors interested in dividend-yielding companies as well as those looking for steady growth potential may find TAKASHIMA’s fundamentals attractive. Additionally, TAKASHIMA has a high health score of 7/10 when it comes to cashflows and debt, indicating that it is capable to pay off debt and fund future operations. More…

Peers

The competition between Takashima & Co Ltd and its competitors, Nippon Chuzo K.K., Carlit Holdings Co Ltd, and Tongyang Inc is fierce. Every company is vying for a market share of the industry in order to increase their profits and expand their customer base. Every company is trying to out-do the others in terms of quality and customer service, in order to gain the loyalty of customers and make their products more successful.

– Nippon Chuzo K.K. ($TSE:5609)

Nippon Chuzo K.K. is a Japanese company engaged in the packaging, preservation and distribution of food products such as canned fish, fruits and vegetables. The company has a market cap of 4.14B as of 2023, which indicates its strong financial performance and market presence. Its return on equity also stands at 4.69%, which signifies the company’s ability to generate returns from its shareholders’ investments. The company has been in the business of food processing for over 50 years and has earned a reputation for its high quality products. It has a wide range of products and services to offer and is one of the leading companies in the industry.

– Carlit Holdings Co Ltd ($TSE:4275)

Carlit Holdings Co Ltd is a company based in China that specializes in the manufacture and distribution of consumer electronics such as smartphones, televisions, and computers. The company currently has a market cap of 15.95 billion as of 2023. The market cap is an important measure of the value of a company and is often used to determine the size of a company relative to its peers. Furthermore, the company currently has a Return on Equity (ROE) of 5.78%. ROE is a measure of how efficiently the company is using its shareholders’ equity to generate profits and is calculated by dividing net income by total equity. This indicates that the company is using its shareholders’ equity to generate profits efficiently.

– Tongyang Inc ($KOSE:001520)

Tongyang Inc is a multinational corporation that engages in the production and sale of construction materials, real estate, and other goods and services. As of 2023, the company has a market cap of 200.88B, which makes it one of the most valuable companies in the world. Tongyang Inc’s Return on Equity (ROE) is 1.25%, which is significantly higher than the industry average ROE of 0.7%. This indicates that the company is performing well in terms of profitability and efficiently utilizing its assets. The company’s strong performance and high market cap highlights its success in the industry.

Summary

Investing in TAKASHIMA can be a good option for those looking to add dividend stocks to their portfolio. Over the past 3 years, the company has offered annual dividends per share of 200.0 JPY, 130.0 JPY, and 60.0 JPY, resulting in dividend yields of 9.69%, 7.59%, and 3.73% respectively. The average dividend yield for this time period is 7.0%. This could be a beneficial investment for those looking for a steady income stream and a good return on their investments.

Recent Posts