ReTo Eco-Solutions Reaches Nasdaq Bid Price Requirement Compliance

May 31, 2023

☀️Trending News

RETO ($NASDAQ:RETO): ReTo Eco-Solutions, a leading provider of innovative environmental solutions and products, has achieved compliance with the Nasdaq bid price requirement. This marks a major milestone for the company, as it moves closer to being listed on Nasdaq. The bid price requirement stipulates that the company’s stock must maintain a minimum bid price for a certain period of time in order to be listed on the exchange. ReTo Eco-Solutions has been able to demonstrate its financial stability and maintain a bid price of at least $1 over the required period, thereby satisfying the Nasdaq listing condition. ReTo Eco-Solutions is a rapidly growing green technology solutions provider, offering products and services designed to reduce energy consumption and increase sustainability.

The company has developed green energy solutions such as solar panel systems, LED lighting systems, water conservation systems, and energy efficient building materials. ReTo Eco-Solutions has become a major player in the sustainable energy industry, with its products and services being used across the globe. Being listed on Nasdaq will enable the company to attract additional investment and expand its reach even further.

Market Price

On Tuesday, RETO ECO-SOLUTIONS, a company dedicated to providing innovative eco-solutions to promote environmental sustainability, reached its Nasdaq bid price requirement compliance. RETO ECO-SOLUTIONS stock opened at $1.6 and closed at $1.5, dropping by 6.4% from its previous closing price of 1.6. The company has been striving to meet the Nasdaq bid price requirement, and now can secure their compliance after trading on Nasdaq for 10 consecutive business days.

This is a major accomplishment for RETO ECO-SOLUTIONS, as it demonstrates their commitment to providing safe and sustainable products and services to their customers. With this milestone, the company sets an example of how a business can promote environmental sustainability while also meeting financial requirements. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Reto Eco-solutions. More…

| Total Revenues | Net Income | Net Margin |

| 6.47 | -14.63 | -191.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Reto Eco-solutions. More…

| Operations | Investing | Financing |

| -9.96 | 4.24 | 4.76 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Reto Eco-solutions. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 24.06 | 18.98 | 0.1 |

Key Ratios Snapshot

Some of the financial key ratios for Reto Eco-solutions are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -39.7% | -41.3% | -232.9% |

| FCF Margin | ROE | ROA |

| -176.3% | -106.2% | -39.2% |

Analysis

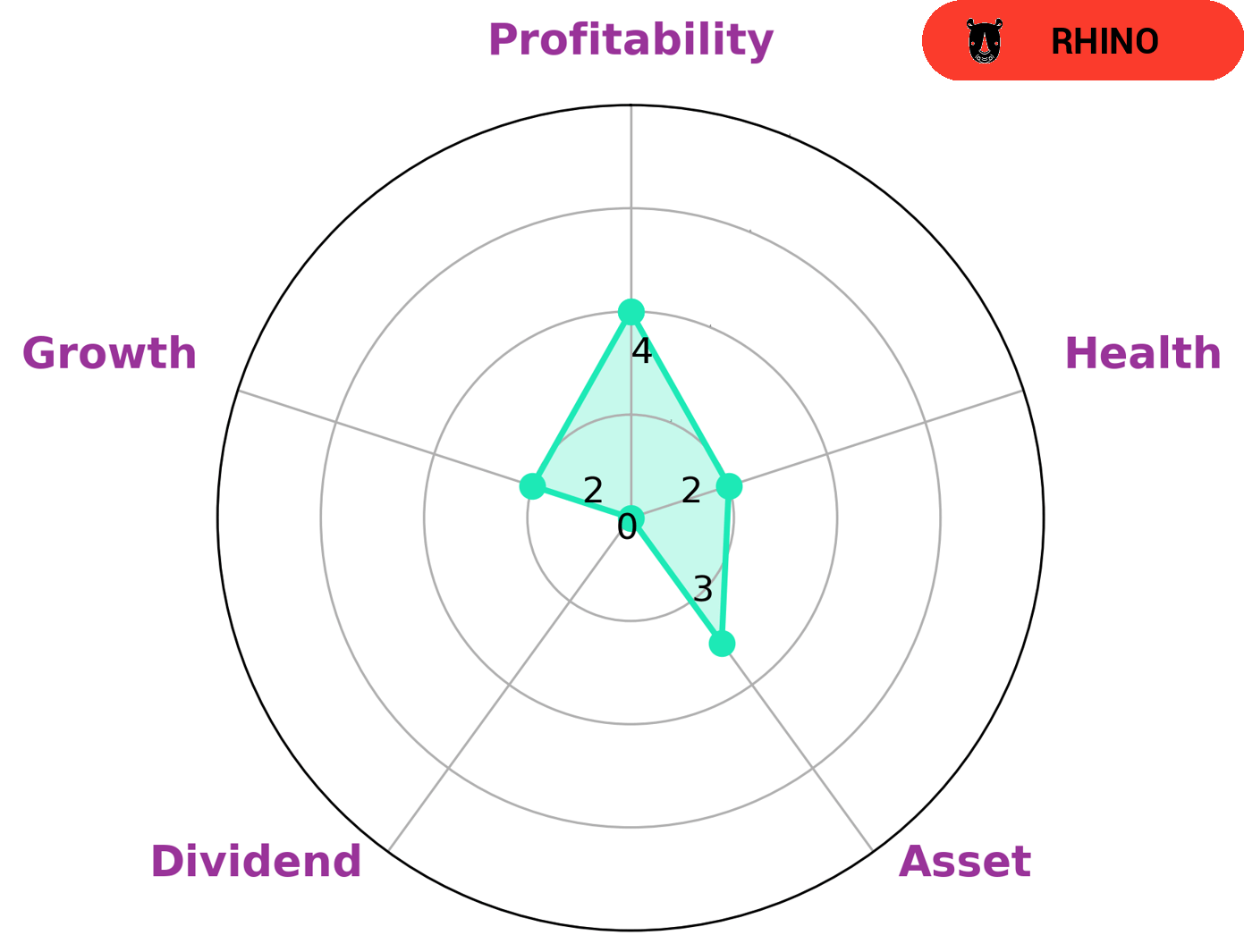

At GoodWhale, we conducted a financial analysis of RETO ECO-SOLUTIONS. According to our Star Chart, the company has a low health score of 2/10, indicating that it is less likely to safely ride out any crisis without the risk of bankruptcy. We classify RETO ECO-SOLUTIONS as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. RETO ECO-SOLUTIONS is strong in liquidity, medium in profitability, and weak in assets, dividend, and growth. As such, investors with an appetite for risk may be interested in investing in this company. It is important for them to understand the risks involved before investing to ensure they are able to make an informed decision. More…

Peers

The intense competition between ReTo Eco-Solutions Inc and its competitors—Petro Song DA Trading and Investment JSC, Wagners Holding Co Ltd, and Nichireki Co Ltd—has been a driving force in the global market. Both ReTo Eco-Solutions Inc and its competitors have been striving to stay ahead of the game by innovating and offering cutting-edge solutions to their customers. This competitive spirit is sure to benefit all involved, as it leads to better products and services for consumers.

– Petro Song DA Trading and Investment JSC ($HNX:SDP)

Wagners Holding Co Ltd is a diversified construction, infrastructure and agricultural materials business in Australia. It has a market capitalization of 133.21M as of 2023, which indicates the value of the company’s outstanding shares. The company also has a strong Return on Equity of 4.02%, which is a measure of how effectively it is using its shareholders’ equity to generate income. This figure suggests that the company is effectively managing its resources and is operating in a profitable manner. With such a strong financial performance, investors may be interested in Wagners Holding Co Ltd as an investment.

– Wagners Holding Co Ltd ($ASX:WGN)

Nichireki Co Ltd is a Japanese company that specializes in providing innovative business solutions to the global market. With its market cap of 53.4B as of 2023, the company is one of the biggest players in the industry. Additionally, its Return on Equity (ROE) of 8.53% affirms its success in managing financial resources. Nichireki Co Ltd’s impressive performance and steady growth have given investors confidence to invest in the company.

Summary

Reto Eco-Solutions recently regained compliance with Nasdaq’s minimum bid price requirement.

However, the stock price dropped the same day it regained compliance, indicating a weak performance in the market. Investors should pay close attention to the company’s financials, current competitive landscape, and projected growth prospects. It is important to examine the company’s dividend policy, the balance of debt and equity, and the stability of cash flows.

Additionally, investors should research the industry, its trends, and the company’s competitive advantage to better understand Reto Eco-Solutions’s potential for long-term profitability.

Recent Posts