ReTo Eco-Solutions Launches Stock Offering to Raise $6.6 Million

May 20, 2023

Trending News 🌥️

RETO ($NASDAQ:RETO): ReTo Eco-Solutions is a leading environmental solutions company with a mission to create lasting, sustainable solutions for the world’s most pressing environmental issues. The company has just announced a stock offering that will raise $6.6 million in capital to further their groundbreaking environmental initiatives. ReTo Eco-Solutions was founded to provide innovative solutions to the world’s most pressing environmental problems. Their mission is to use renewable resources in a sustainable manner, and to reduce the negative impact that traditional development has on the environment. They are currently working on projects such as creating alternative energy sources, developing clean water solutions, and creating new technologies to reduce global pollution.

The stock offering is intended to give investors the opportunity to become part of ReTo Eco-Solutions’ mission to make the world a better place. The capital raised during the offering will be used to support the company’s innovative environmental initiatives, and help them expand their reach. The offering also allows for investors to benefit from potential upside in the short-term and long-term growth of the company. Their stock offering is an opportunity for investors to get involved in their mission and help them to positively impact the future of our planet.

Stock Price

On Friday, ReTo Eco-Solutions publicly launched an offering of stock to raise $6.6 million. The stock opened at $2.3 and closed at $2.2, a drop of 9.3% from the prior closing price of $2.4. This offering marks a major milestone for the company as it looks to expand operations and build upon its existing portfolio of eco-solutions. The stock offering is seen by many as a sign of the company’s commitment to environmental sustainability and their dedication to finding ways to reduce the impact of climate change.

As the demand for eco-friendly solutions increases, ReTo Eco-Solutions is positioned to become a major player in the industry, and the additional capital will help them achieve this goal. The company is confident that this offering will provide them with the resources necessary to expand their operations, and they are confident that their investments in new technologies and methods will enable them to make a positive contribution towards fighting climate change. The company also believes that this offering will increase shareholder value in the long-term, as they continue to find more innovative solutions for an increasingly sustainable future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Reto Eco-solutions. More…

| Total Revenues | Net Income | Net Margin |

| 6.47 | -14.63 | -191.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Reto Eco-solutions. More…

| Operations | Investing | Financing |

| -9.96 | 4.24 | 4.76 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Reto Eco-solutions. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 24.06 | 18.98 | 0.1 |

Key Ratios Snapshot

Some of the financial key ratios for Reto Eco-solutions are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -39.7% | -41.3% | -232.9% |

| FCF Margin | ROE | ROA |

| -176.3% | -106.2% | -39.2% |

Analysis

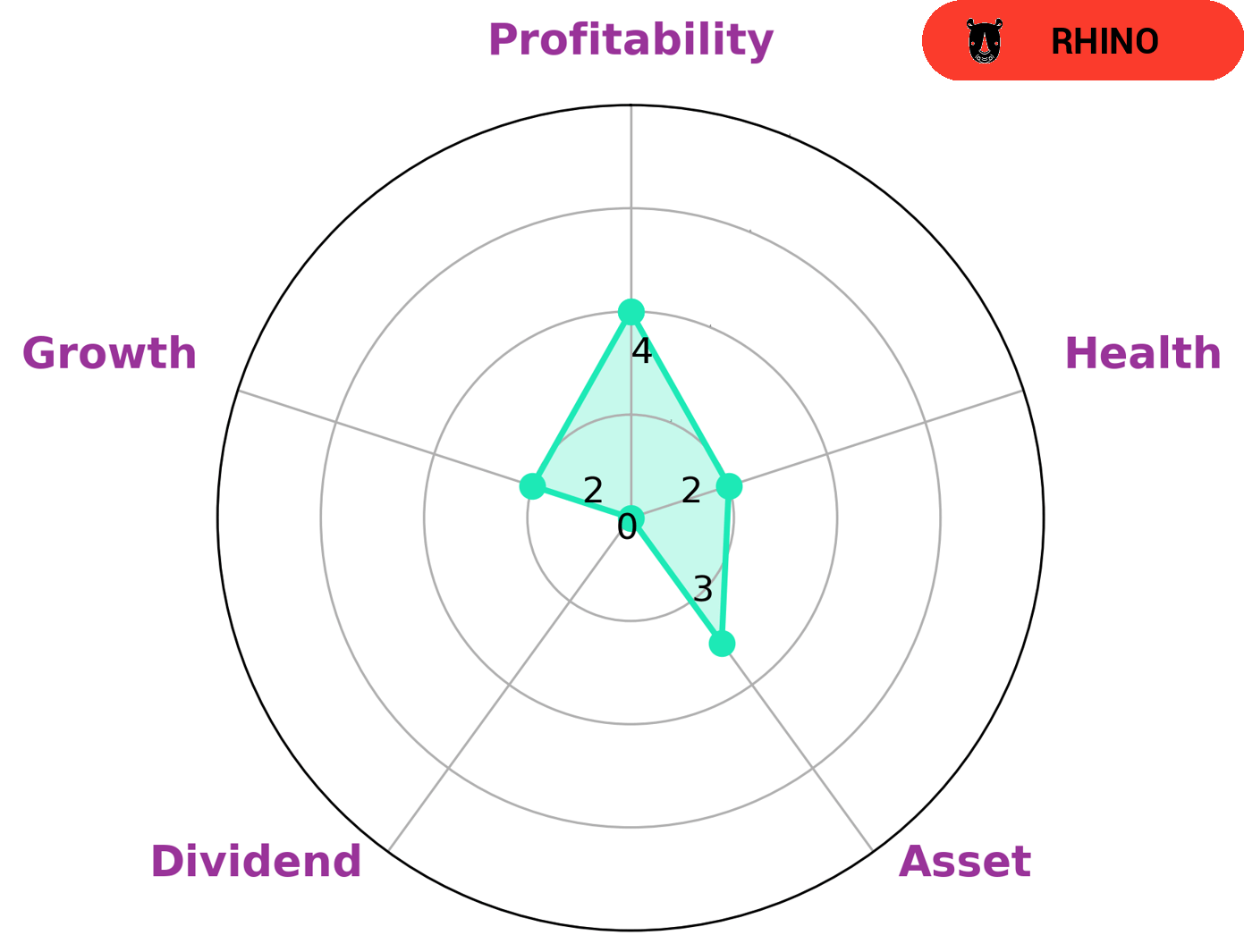

GoodWhale has performed an analysis of RETO ECO-SOLUTIONS‘s wellbeing which shows that they are strong in some areas, medium in others, and weak in others. According to our Star Chart, RETO ECO-SOLUTIONS is strong in revenue, medium in profitability and weak in asset, dividend, and growth. However, RETO ECO-SOLUTIONS has a low health score of 2/10 when it comes to cashflows and debt, meaning that they are less likely to be able to pay off their debt and fund future operations. These types of businesses may be of interest to investors looking for steady returns with limited risk. Investors with a long-term focus may find RETO ECO-SOLUTIONS an attractive proposition, as their performance has been solid even in the face of adversity. Those looking for high growth or rapid returns should be aware that the company may not be able to provide them with the results they desire. More…

Peers

The intense competition between ReTo Eco-Solutions Inc and its competitors—Petro Song DA Trading and Investment JSC, Wagners Holding Co Ltd, and Nichireki Co Ltd—has been a driving force in the global market. Both ReTo Eco-Solutions Inc and its competitors have been striving to stay ahead of the game by innovating and offering cutting-edge solutions to their customers. This competitive spirit is sure to benefit all involved, as it leads to better products and services for consumers.

– Petro Song DA Trading and Investment JSC ($HNX:SDP)

Wagners Holding Co Ltd is a diversified construction, infrastructure and agricultural materials business in Australia. It has a market capitalization of 133.21M as of 2023, which indicates the value of the company’s outstanding shares. The company also has a strong Return on Equity of 4.02%, which is a measure of how effectively it is using its shareholders’ equity to generate income. This figure suggests that the company is effectively managing its resources and is operating in a profitable manner. With such a strong financial performance, investors may be interested in Wagners Holding Co Ltd as an investment.

– Wagners Holding Co Ltd ($ASX:WGN)

Nichireki Co Ltd is a Japanese company that specializes in providing innovative business solutions to the global market. With its market cap of 53.4B as of 2023, the company is one of the biggest players in the industry. Additionally, its Return on Equity (ROE) of 8.53% affirms its success in managing financial resources. Nichireki Co Ltd’s impressive performance and steady growth have given investors confidence to invest in the company.

Summary

ReTo Eco-Solutions recently launched a stock offering to raise $6.6M. The offering represented a significant investment opportunity, but investor reaction was not what the company had hoped for. On the day of the offering, the stock price moved down significantly, indicating that investors were not as keen on the investment opportunity as initially anticipated.

Analysts suggest that there may have been some concern regarding the company’s financials or other factors that caused the negative reaction. As a result, investors should exercise caution when considering investing in ReTo Eco-Solutions.

Recent Posts