Raymond James Financial Services Advisors Divests 1644 Shares of Summit Materials,

February 1, 2023

Trending News ☀️

Raymond James Financial Services Advisors Inc. recently announced the divestment of 1644 shares of Summit Materials ($NYSE:SUM), Inc. Summit Materials is a leading supplier of construction materials and related services in the United States and Canada. The company’s portfolio includes cement, ready-mix concrete, asphalt, aggregates, and related products and services. Summit Materials also has a number of strategic partnerships with leading companies in the industry, such as Vulcan Materials Company, U.S. Concrete, and LafargeHolcim. These terminals provide an efficient means of shipping coal from mines to power plants and other end users.

As one of the largest producers of construction materials in North America, Summit Materials is well-positioned to capitalize on growth opportunities in the sector. The company’s experienced management team and strategic partnerships provide it with a competitive advantage that should enable it to remain an industry leader for years to come.

Market Price

On Monday, the stock of Summit Materials opened at $31.8, and closed at the same price, down by 0.8% from its previous closing price of $32.0. The divestiture of 1644 shares is of significant importance to investors in Summit Materials, as it could potentially influence their decision-making when it comes to buying and selling shares. The news could also have implications for the company’s stock price in the near future, as investors may be more cautious when making their decisions. This could be a sign that the company has experienced a downturn in performance, or that Raymond James Financial Services Advisors Inc. has made the decision for other reasons.

Overall, the divestiture of 1644 shares of Summit Materials, Inc. is an important development, and one that investors will be keeping a close eye on in the coming days and weeks. The stock market reaction to this news could provide further insight into how investors are viewing the company, and whether they will continue to invest in it in the long-term. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Summit Materials. More…

| Total Revenues | Net Income | Net Margin |

| 2.46k | 286.15 | 5.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Summit Materials. More…

| Operations | Investing | Financing |

| 286.75 | 163 | -234.52 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Summit Materials. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.28k | 2.31k | 16.55 |

Key Ratios Snapshot

Some of the financial key ratios for Summit Materials are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.4% | 11.6% | 18.6% |

| FCF Margin | ROE | ROA |

| 2.3% | 14.7% | 6.7% |

Analysis

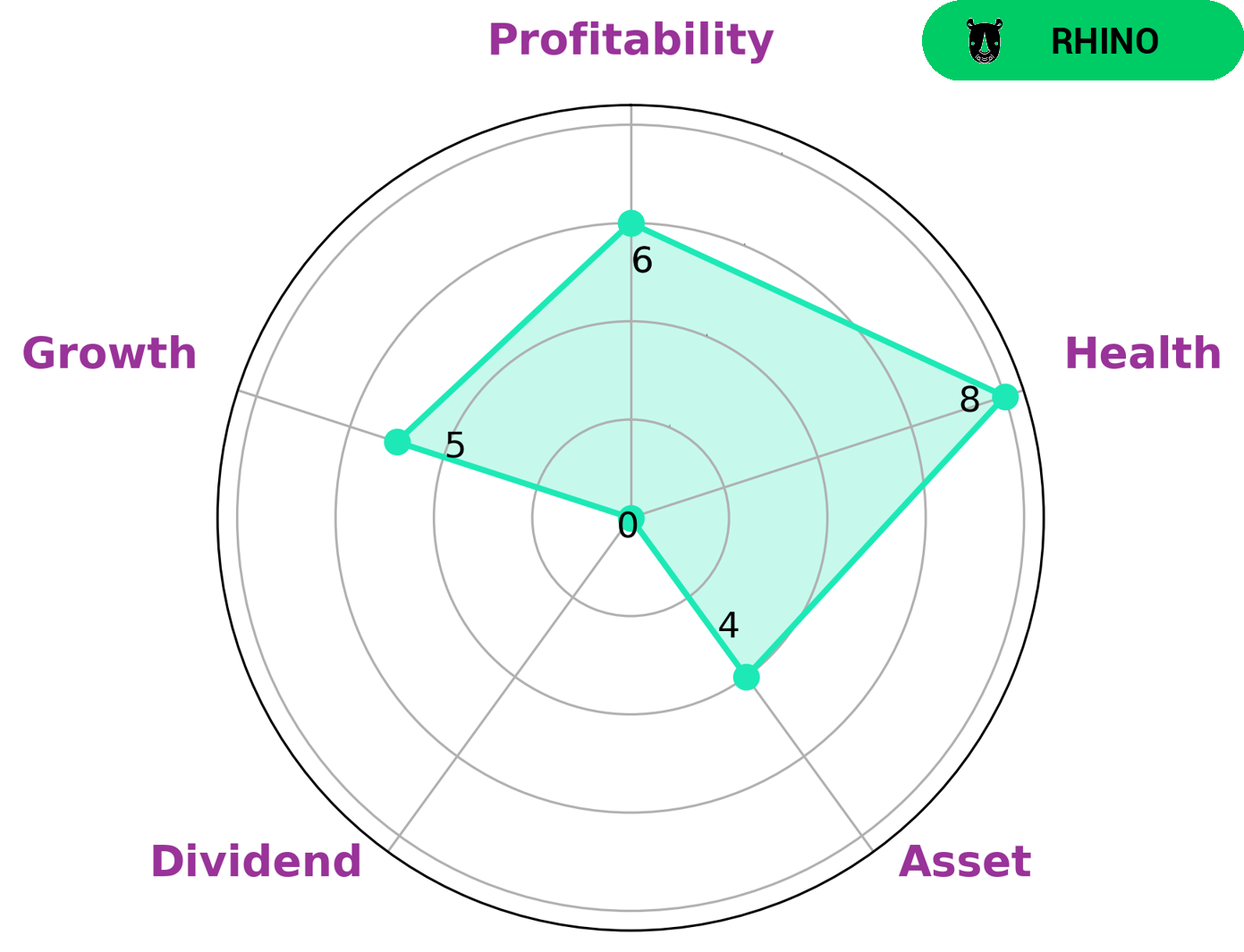

GoodWhale has conducted an analysis of SUMMIT MATERIALS‘s financials, and the Star Chart shows that the company is strong in assets, medium in growth, profitability, and weak in dividend. This classifies SUMMIT MATERIALS as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Such companies tend to be attractive to investors who are looking for a stable return on their investments, as well as those who are looking to capitalize on potential upside. SUMMIT MATERIALS has a high health score of 8/10, indicating that the company is able to both pay off debt and fund future operations. This makes it attractive to value investors, who are looking for companies with low risk but solid returns. Additionally, growth investors may be drawn to the company due to its potential for higher returns. The company also attracts income investors due to its weak dividend payments. While SUMMIT MATERIALS does not offer the large dividends found in some other companies, it does provide consistent returns for those looking for a steady income stream. Overall, SUMMIT MATERIALS is an attractive option for a variety of investors due to its strong financials and moderate growth potential. It is also well-positioned to pay off debt and fund future operations, making it a safe investment for those looking for a low-risk return. More…

Peers

In the construction materials industry, there is intense competition between Summit Materials Inc and its main competitors JK Lakshmi Cement Ltd, Prism Johnson Ltd, and Shree Cement Ltd. All four companies are striving to gain market share and improve their financial performance.

– JK Lakshmi Cement Ltd ($BSE:500380)

JK Lakshmi Cement Ltd is an Indian cement company. The company has a market cap of 62.76B as of 2022 and a return on equity of 18.75%. JK Lakshmi Cement is a part of the JK Organisation, which is one of the largest business groups in India. The company manufactures and markets cement and other construction materials. It has a network of over 6,000 dealers and distributors across India. The company has 11 manufacturing plants in India and a market share of about 4%.

– Prism Johnson Ltd ($BSE:500338)

Prism Johnson Ltd is one of the largest diversified business groups in India with a market cap of 61.99B as of 2022. The company has a Return on Equity of 11.43%. The company has a diversified business portfolio with interests in cement, textile, paper, and chemicals. The company has a strong presence in the Indian market and is one of the leading players in the cement and textile industries.

– Shree Cement Ltd ($BSE:500387)

Shree Cement Ltd. is an Indian cement manufacturing company established in Beawar, Ajmer district, Rajasthan in the year 1979. The company has a market cap of 755.51B as of 2022 and a Return on Equity of 7.65%. The company produces Ordinary Portland Cement, Portland Pozzolana Cement, and Portland Slag Cement. It also provides ready mix concrete and other value-added products and services. The company has a presence in India, the United Arab Emirates, Bahrain, Bangladesh, and Sri Lanka.

Summary

Summit Materials, Inc. is an attractive investment opportunity for those looking to capitalize on the current market cycle. The company’s stock has seen impressive gains in the last year, and analysts are predicting further increases in the future. Raymond James Financial Services Advisors Inc. recently divested 1644 shares of Summit Materials, Inc., indicating that it believes the stock is currently overvalued. This has led to much speculation about the company’s prospects.

Investing analysis suggests that Summit Materials, Inc. is a solid choice for those who are seeking medium-term capital gains, although there is no guarantee of future performance. The company’s product portfolio and geographic reach are both impressive, and its financials remain strong. Investors should conduct their own research before investing in this stock.

Recent Posts