Forterra PLC “Pleased” With Positive Results Despite Challenging Trading Conditions.

May 20, 2023

Trending News ☀️

Forterra ($LSE:FORT) PLC, the leading manufacturer of clay and concrete building products, has declared itself “delighted” with its performance over the four months ending April 30th 2023, despite the challenging trading conditions. Forterra PLC is a British based building materials company that manufactures a wide range of building products for construction, infrastructure, and energy markets. Their products are used in projects ranging from small home repairs to large-scale industrial projects. The company has also announced a very positive outlook for the remainder of 2023, with trading conditions expected to improve due to their continued focus on innovative products and cost-saving measures. This was largely driven by strong cost control and an efficient supply chain, enabling the company to remain competitive in an increasingly competitive environment. The company’s board of directors expressed their pleasure at the results, stating that the performance was “pleasing” despite the challenging trading conditions.

They emphasised the importance of continued focus on their strategic goals and the need to be proactive in responding to market trends. Overall, Forterra PLC’s performance under difficult conditions is an impressive accomplishment. The company’s strategic investments have enabled them to remain competitive in a challenging environment, and their positive outlook for the rest of 2023 suggests that they are well-positioned to capitalise on future opportunities.

Stock Price

On Wednesday, FORTERRA PLC stock opened at £1.9 and closed at £1.9, down by 0.7% from its previous closing price of 1.9. Despite this minor drop, the company is pleased with the results, given the challenging trading conditions of the market. Despite the difficult circumstances, FORTERRA PLC has managed to maintain its positive performance. The company has worked hard to ensure that it continues to deliver positive results, while also operating within the confines of the current economic climate.

This has enabled FORTERRA PLC to remain competitive and be able to provide its customers with quality products and services. In short, FORTERRA PLC is pleased with its results and continues to strive for success in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Forterra Plc. More…

| Total Revenues | Net Income | Net Margin |

| 455.5 | 58.8 | 12.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Forterra Plc. More…

| Operations | Investing | Financing |

| 75.6 | -41.2 | -41.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Forterra Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 397.6 | 177.1 | 1.05 |

Key Ratios Snapshot

Some of the financial key ratios for Forterra Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.2% | 7.7% | 16.4% |

| FCF Margin | ROE | ROA |

| 6.9% | 20.7% | 11.8% |

Analysis

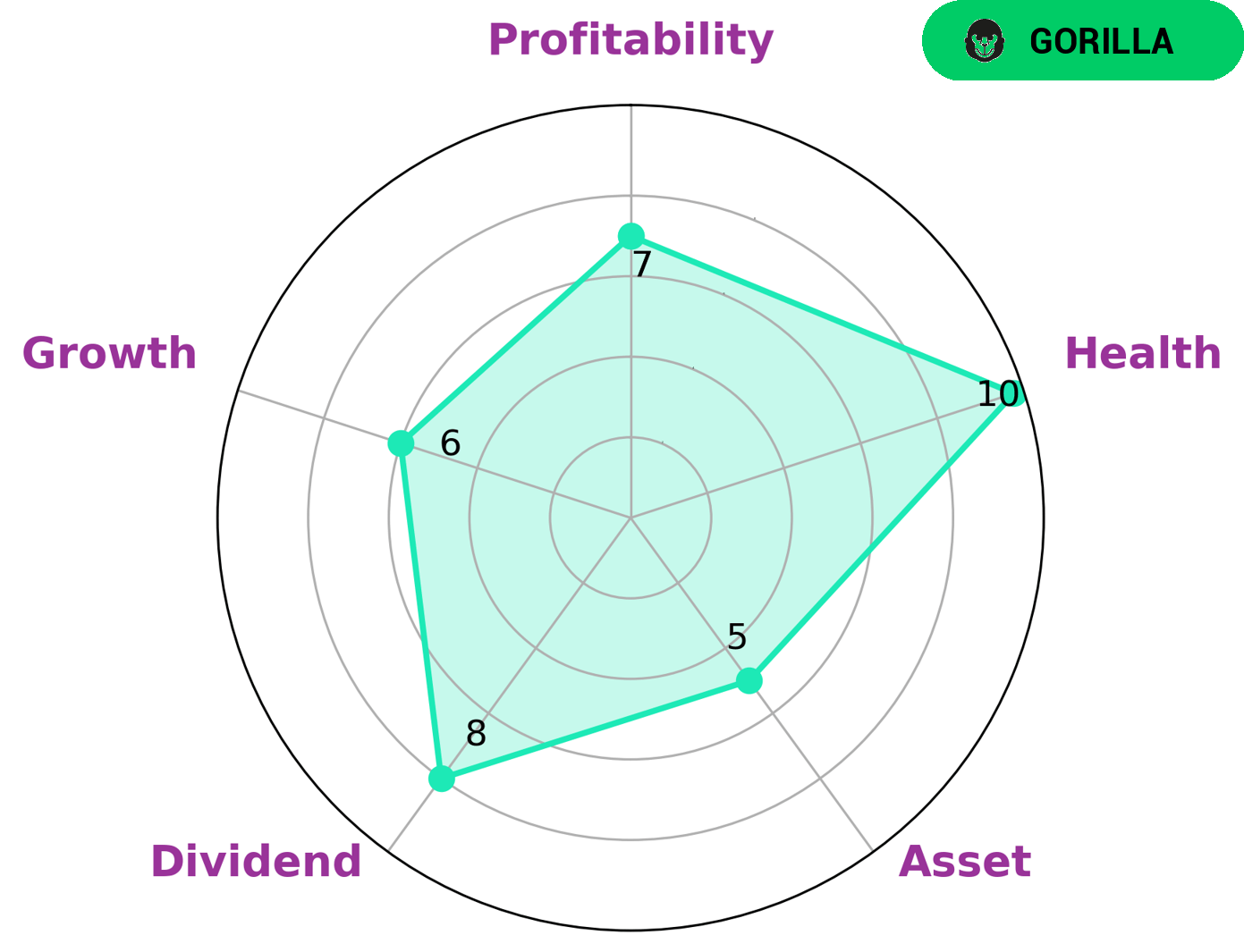

GoodWhale recently conducted an analysis of FORTERRA PLC‘s fundamentals. Results from the Star Chart Assessment indicated that FORTERRA PLC was strongly positioned in dividend payouts, profitability, and moderately strong in asset growth. Given the strengths of FORTERRA PLC, investors interested in dividend payouts, long-term profitability, and asset growth could find this company attractive. Furthermore, FORTERRA PLC has an impressive health score of 10/10, meaning that it is capable of paying off debt and funding future operations. Therefore, investors with a long-term outlook may be interested in investing in this company. More…

Peers

Forterra PLC is one of the leading providers of precast and prestressed concrete products in the Southeast Asian region. It competes with other major players such as Yong Concrete PCL, Sirakorn PCL, and Southern Concrete Pile PCL. All four companies are committed to delivering high-quality concrete products that meet the needs of their customers.

– Yong Concrete PCL ($SET:YONG)

Yong Concrete PCL is a leading supplier of cement, concrete, and related building materials in Thailand. With a market capitalization of 1.74 billion dollars as of 2023, the company continues to be a leader in its industry. Yong Concrete PCL’s Return on Equity, a measure of profitability, stands at 12.06%, indicating a healthy financial performance. The company’s success can be attributed to its commitment to quality and customer service as well as its focus on technological advancement.

– Sirakorn PCL ($SET:SK)

Sirakorn PCL is a Thai-based company providing a wide range of services in the areas of construction, infrastructure, and engineering. As of 2023, the company has a market cap of 450.8M, which demonstrates the strong position of the company in the industry. The company’s Return on Equity (ROE) is also impressive at 2.05%, indicating that the company is successfully utilizing its assets to generate returns for its shareholders.

– Southern Concrete Pile PCL ($SET:SCP)

Southern Concrete Pile PCL is a leading Asian infrastructure company specializing in the production of reinforced concrete piles, which are used in the construction of civil and structural engineering projects. The company has a market capitalization of 1.44 billion USD as of 2023, indicating its strong financial position and market share in the industry. Its Return on Equity (ROE) of 2.8% indicates that the company is able to effectively use its equity to generate profits. Southern Concrete Pile PCL continues to be a major player in the infrastructure industry, providing quality products and services to customers around the world.

Summary

Forterra PLC has reported positive results for the four months ending April 30, 2023. In spite of the challenging trading conditions, the manufacturer of clay and concrete building products has seen an increase in sales and profits. In addition, the company has reduced debt and invested in infrastructure projects, which will further bolster its resilience in the long-term. With a strong balance sheet and a good outlook, Forterra PLC remains an attractive investment opportunity.

Recent Posts