Crh Plc Stock Intrinsic Value – CRH PLC Announces Restructuring of Business Segments

April 20, 2023

Trending News 🌥️

CRH PLC ($LSE:CRH), a world-leading provider of building materials, has announced the restructuring of its business segments. This announcement was made on 2 March and has resulted in revised segment information for the company. CRH PLC is a global leader in the building materials industry and supplies cement, concrete, aggregate and asphalt to customers in Europe, North America, and South America. The company’s shares are traded on the London Stock Exchange and Euronext Dublin. This restructuring will see CRH PLC move from four operating segments to three. This will make it easier for the company to operate and strengthen its focus on customers. The new segments are Europe Materials, America Materials and Distribution.

The Europe Materials segment will include the activities of its existing European Materials & Distribution, EMEA Aggregates and European Cement segments. The America Materials segment will include the activities of its existing United States & Canada Materials & Distribution, Americas Aggregates and Americas Cement segments. The new Distribution segment will include the activities of its existing Distribution Services and Product Solutions segments. The restructuring is part of CRH PLC’s long-term vision of becoming the most efficient, profitable and customer-centric building materials provider. This move is expected to help the company make better use of resources, improve customer service and drive growth in the future.

Share Price

CRH PLC, a global building materials group, announced on Wednesday that it has decided to restructure its business segments. This restructuring is designed to ensure the company meets its strategic objectives and maximizes long-term value for all stakeholders. At the start of trading on Wednesday, CRH PLC stock opened at £39.8 and closed at £40.1, up by 0.5% from the previous closing price of 39.9. This indicates that investors welcomed the restructuring plan and have confidence in the company’s plans to move forward. The restructuring will involve reorganizing its current business of five main segments into three main segments and will result in simplified decision-making and improved operational efficiencies.

The new structure will allow the company to focus on growth opportunities and cost savings in all markets where it operates. CRH PLC is confident the reorganization will deliver better performance and long-term value to its shareholders. The company remains committed to investing in innovative solutions and expanding its portfolio of products and services to create additional value for all its stakeholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Crh Plc. More…

| Total Revenues | Net Income | Net Margin |

| 32.72k | 3.85k | 8.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Crh Plc. More…

| Operations | Investing | Financing |

| 3.95k | -884 | -2.69k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Crh Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 45.19k | 22.85k | 29.13 |

Key Ratios Snapshot

Some of the financial key ratios for Crh Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.1% | 11.7% | 11.9% |

| FCF Margin | ROE | ROA |

| 7.4% | 11.4% | 5.4% |

Analysis – Crh Plc Stock Intrinsic Value

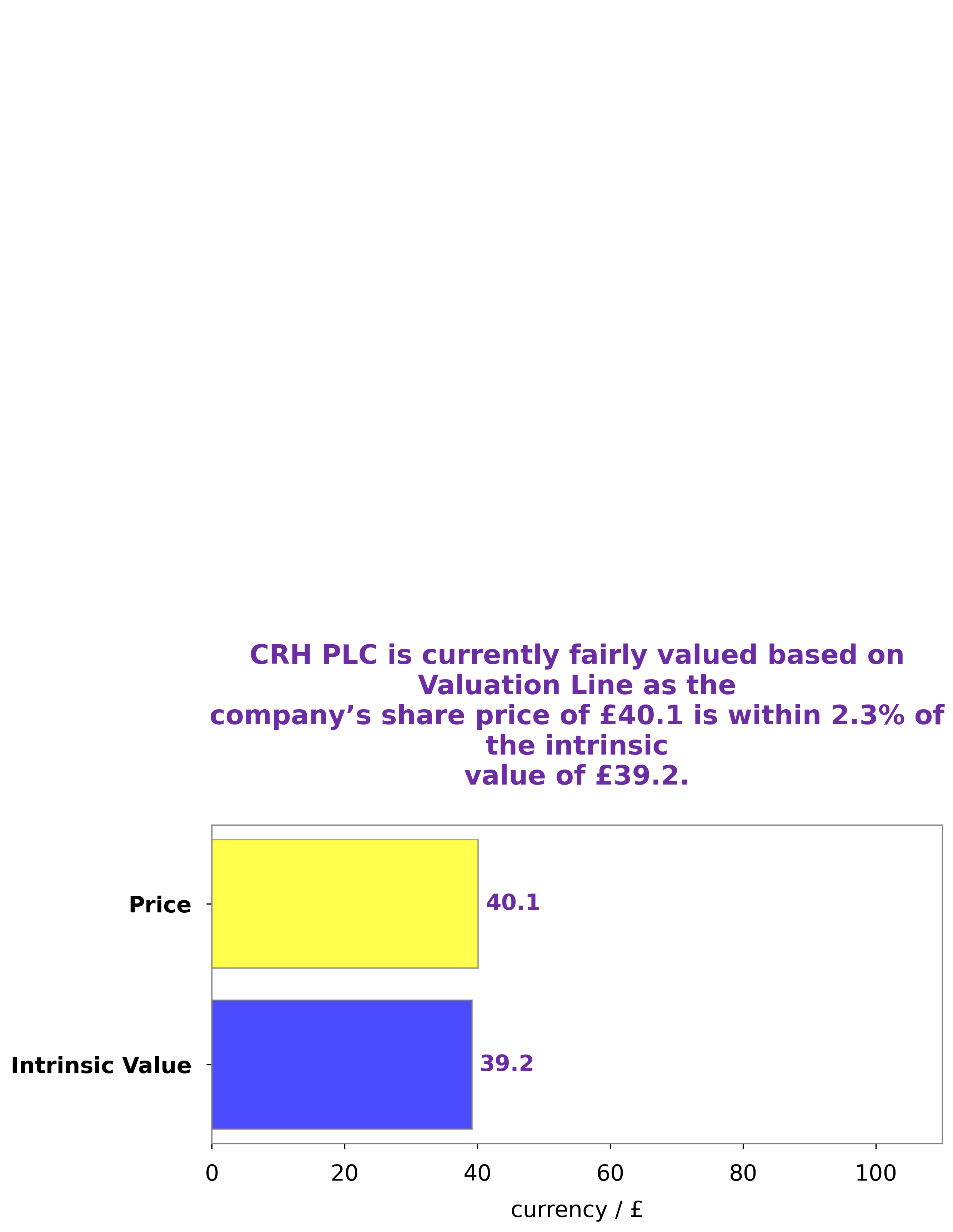

GoodWhale has conducted an analysis of CRH PLC‘s fundamentals and found that the intrinsic value of CRH PLC shares is estimated to be around £39.2. This value was determined using our proprietary Valuation Line. Currently, CRH PLC stock is trading at £40.1, which provides a fair price, albeit one that is slightly overvalued by 2.3%. More…

Peers

It has operations in 40 countries and employs c. 85,000 people at over 3,600 locations. CRH’s principal products are cement, aggregates (crushed stone, sand and gravel), ready-mixed concrete, asphalt, and precast concrete products. The Group is also a major producer of other building materials, including concrete products, asphalt and bitumen. CRH is a FTSE 100 company and had a market capitalisation of €23.4 billion at 30 June 2018. CRH’s competitors are H+H International A/S, HeidelbergCement AG, and CPanel PCL.

– H+H International A/S ($LTS:0M6J)

H+H International A/S is a Danish company that manufactures and supplies building materials. It has a market cap of 1.76B as of 2022 and a Return on Equity of 16.4%. The company’s products include aircrete, bricks, and concrete pipes.

– HeidelbergCement AG ($OTCPK:HLBZF)

HeidelbergCement AG, together with its subsidiaries, engages in the production, distribution, and sale of cement, ready-mixed concrete, aggregate, and other construction materials. The company has a market cap of 8.32B and a ROE of 10.92%. HeidelbergCement AG was founded in 1896 and is headquartered in Heidelberg, Germany.

– CPanel PCL ($SET:CPANEL)

CPanel is a leader in web hosting automation software. Its flagship product, cPanel & WHM, is the most widely used control panel in the world. It enables hosting providers to manage their servers and customers’ websites with ease. The company has a strong market position and a loyal customer base. Its products are used by some of the largest hosting providers in the world. The company has a strong financial position, with a strong balance sheet and a healthy cash flow. It is well-positioned for growth in the future.

Summary

CRH PLC is a global leader in building materials solutions and is an attractive investment opportunity due to its recent transition to a new organizational structure. The transition has had a positive effect on the company’s financial performance, resulting in higher net earnings, dividend income, and total shareholders’ equity. Additionally, the company has experienced an increase in long-term debt and cash flows from operating activities. Investors should take advantage of this opportunity given its strong fundamentals and attractive returns. Furthermore, CRH PLC has a low debt-to-equity ratio and has consistently maintained a strong balance sheet.

However, investors should also be aware of the risks associated with investing in the company, including its exposure to macroeconomic conditions and competitive market dynamics.

Recent Posts