Boise Cascade stock dividend – Boise Cascade Company Declares Steady $0.15 Quarterly Dividend with Forward Yield of 0.77%.

February 8, 2023

Trending News 🌥️

Boise Cascade stock dividend – Boise Cascade ($NYSE:BCC) Company is a leading manufacturer and distributor of building materials in North America. The company produces particleboard, plywood, lumber, engineered wood products, and other items used in the construction industry. Boise Cascade’s products are distributed through a network of wholesalers and retailers throughout the country. The company has recently declared a quarterly dividend of $0.15 per share. This dividend is consistent with the prior dividend and is payable on March 15 to shareholders of record on February 22, with an ex-dividend date of February 21. Investors interested in more information about this dividend should check out the BCC Dividend Scorecard, Yield Chart, and Dividend Growth.

The scorecard provides a detailed breakdown of the company’s dividend metrics such as payout ratio, dividend growth rate, and return-on-invested capital. The yield chart provides a graphical representation of the current yield compared to the historical yield of the stock. Finally, the dividend growth rate tracks the company’s historical dividend growth rate over the past five years. Overall, Boise Cascade’s dividend yields provide investors with an attractive dividend income stream. The company has a solid track record of paying dividends and offers a steady and reliable income source for investors looking for a low risk investment option. With its consistent dividend, Boise Cascade is an attractive option for income investors seeking consistent income.

Dividends – Boise Cascade stock dividend

The company has consistently paid a dividend in the past three years with an annual dividend per share of 0.48, 0.42 and 0.4 USD respectively. This shows that the company is committed to rewarding its shareholders with consistent and reliable dividends. The dividend yields for 2020-2022 are 0.7%, 0.81% and 1.2% respectively. This indicates that the company is committed to providing its shareholders with a steady return on investment and is confident in its ability to continue to do so in the future. Boise Cascade Company’s commitment to providing reliable dividends to its shareholders is testament to their strong performance and financial stability.

Investors are encouraged to take advantage of this opportunity to earn a steady return on their investments. This will no doubt be attractive to many investors who are looking for reliable sources of income.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Boise Cascade. More…

| Total Revenues | Net Income | Net Margin |

| 8.54k | 909.37 | 10.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Boise Cascade. More…

| Operations | Investing | Financing |

| 954.02 | -630.38 | -243.46 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Boise Cascade. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.35k | 1.37k | 50.27 |

Key Ratios Snapshot

Some of the financial key ratios for Boise Cascade are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.8% | 169.3% | 14.5% |

| FCF Margin | ROE | ROA |

| 9.8% | 41.2% | 23.1% |

Market Price

On Tuesday, Boise Cascade Company, a leading supplier of wood products, building materials, and engineered wood products, declared a steady $0.15 quarterly dividend for its shareholders. The stock opened at $76.4 and closed at $77.9, which was a 1.4% increase from its last closing price of $76.8. The news of the dividend resulted in a positive reaction from the stock market with Boise Cascade’s stock increasing in value. This dividend is a reflection of the company’s consistent performance over the past couple of years. The company has focused on delivering value to its shareholders by consistently paying dividends, creating shareholder value, and generating positive returns on equity. Boise Cascade has continued to make strategic investments in order to stay ahead of the competition and remain profitable.

The company is also actively engaged in cost-cutting measures to maximize profits and reduce costs. This strategy has enabled Boise Cascade to remain competitive in a volatile market environment. This dividend declaration is yet another sign of the company’s strong financial performance and commitment to its shareholders. Boise Cascade is continuing its focus on providing value to its shareholders through dividends and other financial strategies. With the stock continuing to rise, investors are likely to be encouraged by the company’s strong financial standing and commitment to shareholders. Live Quote…

Analysis

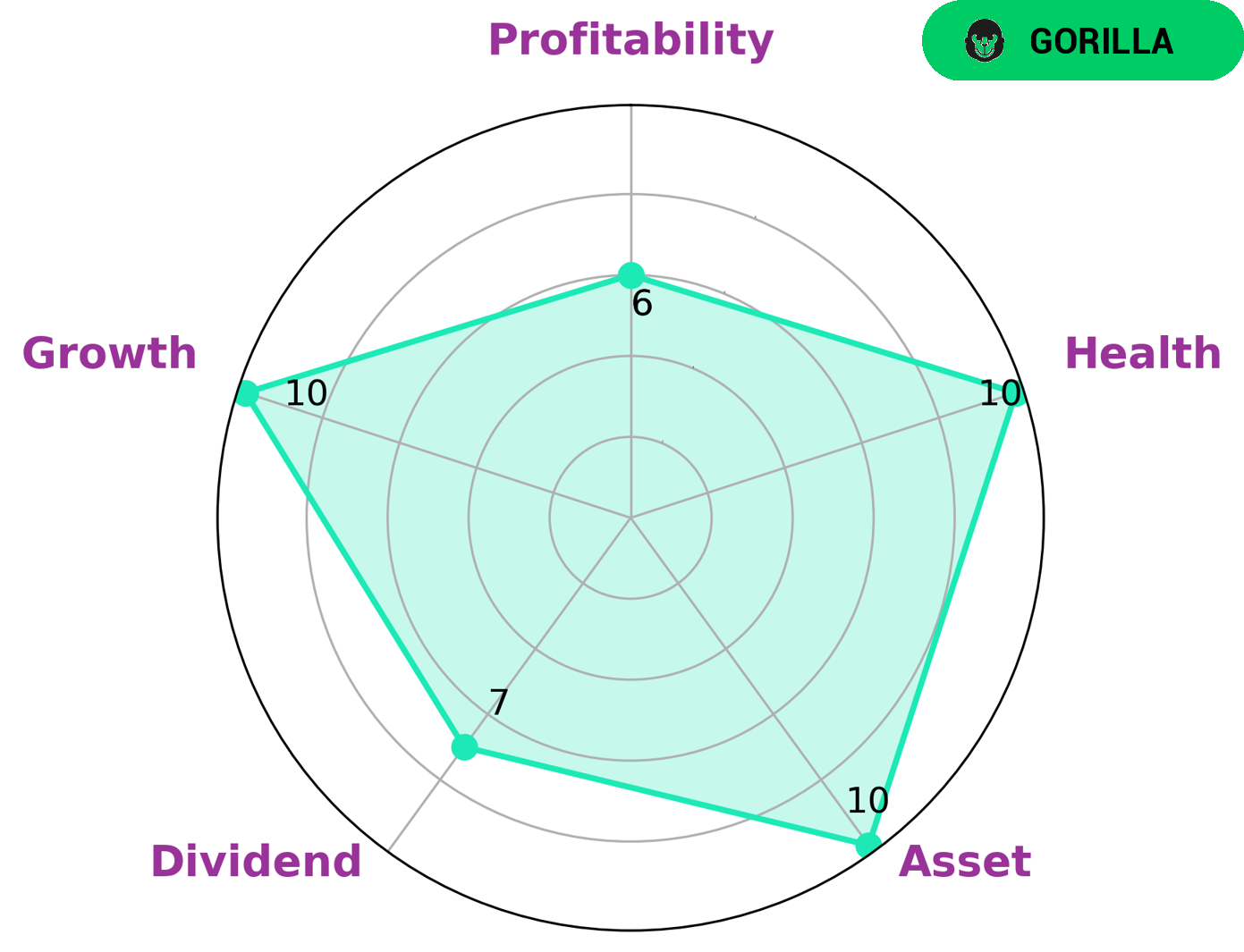

GoodWhale’s analysis of BOISE CASCADE‘s fundamentals shows that the company is strong in asset, dividend, and growth. Its profitability is considered to be medium. BOISE CASCADE is classified as a ‘gorilla’ company, meaning that it has achieved stable and high revenue or earning growth due to its strong competitive advantage. BOISE CASCADE is an attractive investment for those looking for a stable and reliable company with a strong competitive advantage. The company has a high health score of 10/10 with respect to its cashflows and debt, indicating that it is capable of paying off debt and funding future operations. Investors looking for a long-term, secure investment with strong growth potential may find BOISE CASCADE to be a good fit. BOISE CASCADE is also an attractive option for those interested in dividend investing. The company has a track record of paying out dividends to its investors, which can provide an additional source of income. Furthermore, the company has strong growth potential, which could increase the value of the stock over time. In summary, BOISE CASCADE is an attractive investment opportunity for those looking for a reliable and secure company with a strong competitive advantage. The company has a high health score, making it capable of paying off debt and funding future operations. The company also has a track record of paying out dividends, as well as strong growth potential. This makes BOISE CASCADE an attractive option for investors looking for long-term security and potential growth. More…

Peers

Its competitors include Megaron SA, H+H International A/S, and Doman Building Materials Group Ltd. Boise Cascade has a strong market position and offers a wide range of products, making it a good choice for customers looking for a one-stop shop.

– Megaron SA ($LTS:0Q3S)

Megaron SA is a publicly traded company with a market capitalization of 5.1 million as of 2022. The company has a return on equity of 7.34%. Megaron SA is engaged in the business of providing engineering and construction services. The company has its headquarters in Santiago, Chile.

– H+H International A/S ($LTS:0M6J)

H+H International A/S is a Danish building materials company. It is the world’s largest producer of aircrete and the second largest producer of autoclaved aerated concrete (AAC) products. The company has a market cap of 1.92B as of 2022 and a Return on Equity of 16.4%. H+H International A/S produces a range of building materials, including aircrete, AAC products, bricks, blocks, pavers, and roof tiles. The company’s products are used in a variety of applications, such as residential and commercial construction, infrastructure projects, and industrial and agricultural buildings.

– Doman Building Materials Group Ltd ($TSX:DBM)

Doman Building Materials Group Ltd is a building materials company with a market cap of 481.03M as of 2022 and a Return on Equity of 15.49%. The company produces and sells cement, concrete, and other building materials. It operates in China, Hong Kong, Macau, and Taiwan. The company was founded in 2003 and is headquartered in Beijing, China.

Summary

Boise Cascade is an attractive investment opportunity for investors looking for steady income. In addition, Boise Cascade has a history of increasing dividends, providing investors with the potential for further income growth. Furthermore, the stock is currently trading at a relatively low valuation compared to its peers, making it an attractive option for long-term investors seeking value.

Recent Posts