Boise Cascade Intrinsic Value – Boise Cascade Reports Q4 Earnings of $2.43, Beating Analyst Estimates by $0.76 and Revenue by $60M

May 5, 2023

Trending News 🌧️

Revenue came in at $1.54 billion, beating expectations by $60 million. Boise Cascade ($NYSE:BCC) is a leading manufacturer and distributor of building materials, including wood products, engineered wood products, plywood and other materials used in the construction, maintenance and repair of homes and other buildings. Boise Cascade operates through two main segments, wholesale distribution and manufacturing. The wholesale distribution segment serves professional contractors, industrial manufacturers and retail dealers with a wide range of products and services such as lumber, engineered wood, windows, doors and other building materials.

The manufacturing segment manufactures and sells plywood, particleboard, lumber, medium density fiberboard and other engineered wood products. The company reported a solid quarter with earnings that exceeded analyst estimates, driven by strong demand for its products.

Earnings

Net income was reported at $117.36 million USD, a 30.6% decrease from the previous year. Despite this, analyst estimates were beaten by $0.76 and revenue by $60 million. The reported earnings of $2.43 beat analyst estimates and marks a significant improvement for the company’s financial outlook.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Boise Cascade. More…

| Total Revenues | Net Income | Net Margin |

| 8.39k | 857.66 | 10.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Boise Cascade. More…

| Operations | Investing | Financing |

| 1.04k | -625.46 | -166.33 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Boise Cascade. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.24k | 1.18k | 52.15 |

Key Ratios Snapshot

Some of the financial key ratios for Boise Cascade are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 21.8% | 105.2% | 14.0% |

| FCF Margin | ROE | ROA |

| 11.1% | 36.2% | 22.6% |

Stock Price

While the news sent the stock prices up initially, it closed at $67.6, down 1.0% from its prior closing price of 68.3. This was likely due to investors taking profit to avoid potential risks. Overall, the results were generally in line with earlier expectations, indicating that the company is continuing to perform well. Live Quote…

Analysis – Boise Cascade Intrinsic Value

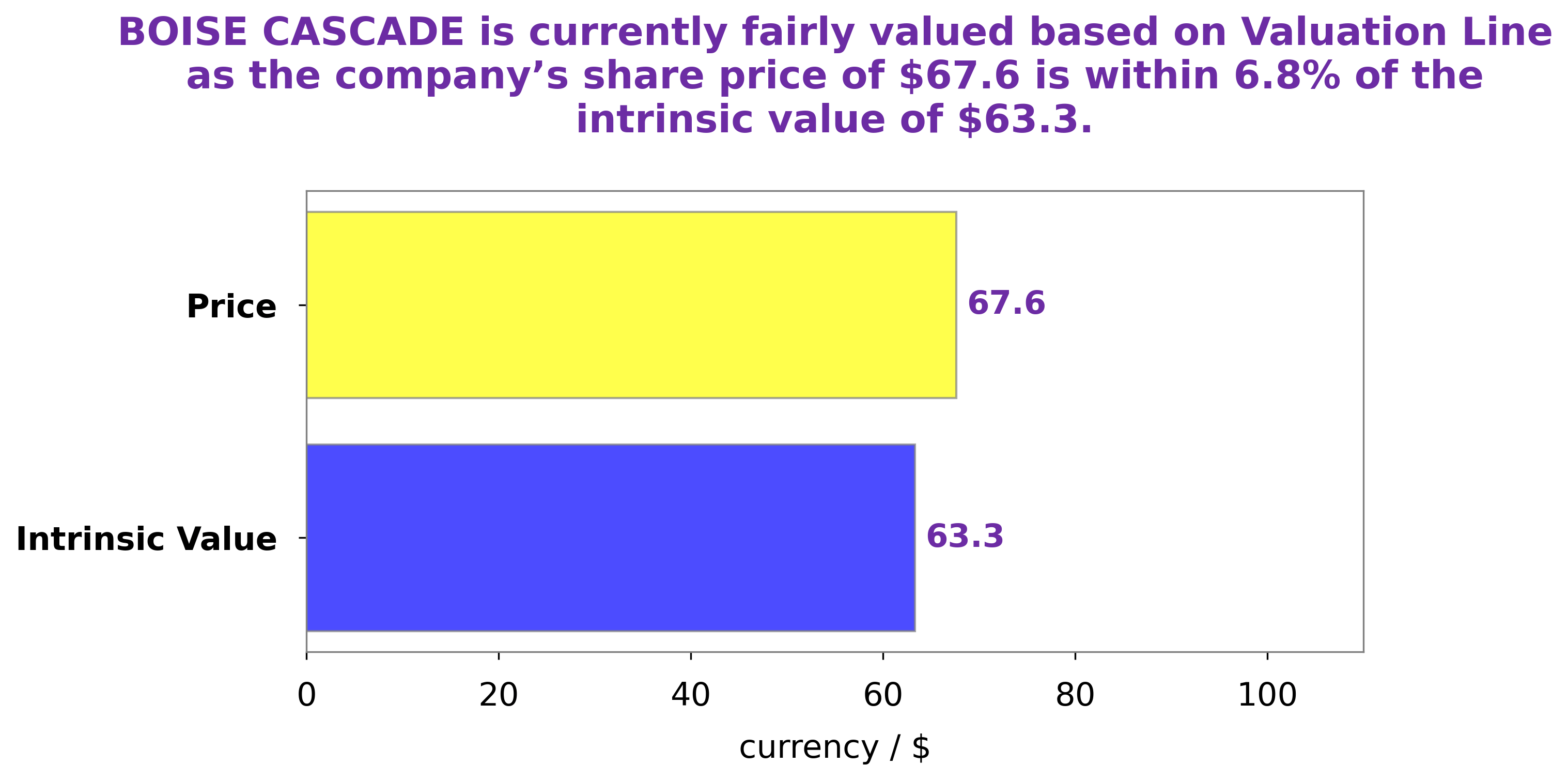

At GoodWhale, we have conducted an analysis of BOISE CASCADE’s wellbeing. Our proprietary Valuation Line calculated a fair value of the BOISE CASCADE share at around $63.3. Currently, BOISE CASCADE stock is traded at $67.6, which implies a fair price that is overvalued by 6.7%. We believe that this is an important piece of information for any investor who is looking to invest in BOISE CASCADE. More…

Peers

Its competitors include Megaron SA, H+H International A/S, and Doman Building Materials Group Ltd. Boise Cascade has a strong market position and offers a wide range of products, making it a good choice for customers looking for a one-stop shop.

– Megaron SA ($LTS:0Q3S)

Megaron SA is a publicly traded company with a market capitalization of 5.1 million as of 2022. The company has a return on equity of 7.34%. Megaron SA is engaged in the business of providing engineering and construction services. The company has its headquarters in Santiago, Chile.

– H+H International A/S ($LTS:0M6J)

H+H International A/S is a Danish building materials company. It is the world’s largest producer of aircrete and the second largest producer of autoclaved aerated concrete (AAC) products. The company has a market cap of 1.92B as of 2022 and a Return on Equity of 16.4%. H+H International A/S produces a range of building materials, including aircrete, AAC products, bricks, blocks, pavers, and roof tiles. The company’s products are used in a variety of applications, such as residential and commercial construction, infrastructure projects, and industrial and agricultural buildings.

– Doman Building Materials Group Ltd ($TSX:DBM)

Doman Building Materials Group Ltd is a building materials company with a market cap of 481.03M as of 2022 and a Return on Equity of 15.49%. The company produces and sells cement, concrete, and other building materials. It operates in China, Hong Kong, Macau, and Taiwan. The company was founded in 2003 and is headquartered in Beijing, China.

Summary

Boise Cascade is a timber products manufacturer and building materials distributor. Investment analyses of their performance have recently shown a positive outlook. The company recently reported GAAP earnings-per-share (EPS) of $2.43, which beat analyst estimates by $0.76. Revenue of $1.54 billion also exceeded expectations by $60 million.

Shares have risen in response to these strong earnings reports, signaling market optimism towards the company’s future prospects. Analysts also note that Boise Cascade has demonstrated financial strength with consistent cash flow and a commitment to paying dividends to shareholders. Investors are encouraged to continue to watch Boise Cascade’s performance in the coming quarters.

Recent Posts