TEGNA Reports Third Quarter Earnings Results for FY2023

November 27, 2023

🌥️Earnings Overview

TEGNA INC ($NYSE:TGNA) reported their earnings results for the third quarter of FY2023, ending September 30 2023. Total revenue for the quarter was USD 713.2 million, a decrease of 11.2% compared to the same period in the previous year. Net income over the same period declined 34.0%, amounting to USD 96.2 million.

Share Price

On Tuesday, TEGNA Inc., a media and digital company, reported their third quarter financial results for the fiscal year of 2023. TEGNA Inc.’s Chairman and CEO, Peter Kern, said in a statement that the company was pleased with their performance in the third quarter and that they are confident about the future. He noted that TEGNA has been able to make strategic investments in key areas like digital and content that have enabled them to remain competitive in an ever-changing landscape. Overall, TEGNA Inc. appears to be on track to reach their goals for the year and is well-positioned for continued growth in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tegna Inc. More…

| Total Revenues | Net Income | Net Margin |

| 3.1k | 617.8 | 16.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tegna Inc. More…

| Operations | Investing | Financing |

| 620.28 | -18.27 | -425.63 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tegna Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.2k | 4.22k | 15.03 |

Key Ratios Snapshot

Some of the financial key ratios for Tegna Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.8% | 6.5% | 31.1% |

| FCF Margin | ROE | ROA |

| 18.5% | 20.6% | 8.4% |

Analysis

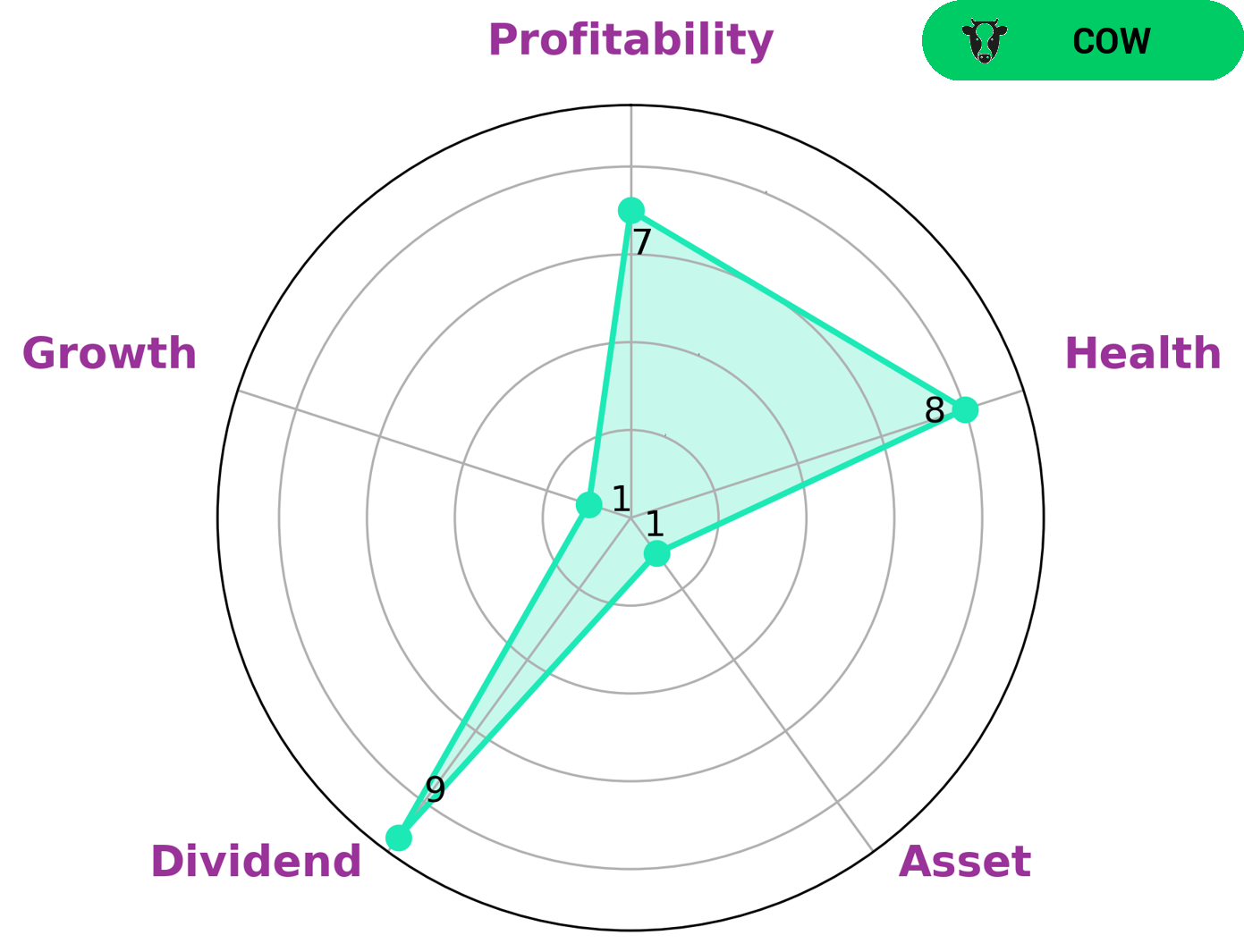

As GoodWhale, we recently conducted an analysis of TEGNA INC‘s wellbeing. Our Star Chart analysis revealed that TEGNA INC is strongest in dividend and profitability, while its asset and growth were weaker. Given these results, we believe that certain types of investors may be interested in this company. These include those who value dividend payments, as well as those who are looking for a steady company that can weather a crisis. Our health score for TEGNA INC was 9/10 with regard to its cashflows and debt, indicating that it is capable of safely riding out any crisis without the risk of bankruptcy. More…

Peers

It operates in various segments including broadcasting, digital media, and marketing services. The company’s broadcasting segment owns and operates television stations. The digital media segment comprises Cars.com, a leading online vehicle shopping destination, and CareerBuilder, a leading online job site. The marketing services segment provides advertising and marketing solutions to businesses. Tegna’s competitors include Entravision Communications Corp, Cumulus Media Inc, and Sharpline Broadcast Ltd.

– Entravision Communications Corp ($NYSE:EVC)

Entravision Communications Corporation is a diversified Spanish-language media company that owns and operates radio and television stations in the United States, as well as digital media properties. The company’s radio stations broadcast Spanish-language programming, while its television stations broadcast English-language programming targeted at the Hispanic market. Entravision also operates a number of websites and digital platforms that reach Hispanic audiences.

Entravision’s radio stations reach approximately 4.8 million listeners each week, while its television stations reach approximately 3.5 million households. The company’s digital media properties reach approximately 7 million unique visitors each month. Entravision is headquartered in Santa Monica, California.

– Cumulus Media Inc ($NASDAQ:CMLS)

Cumulus Media Inc. is one of the largest radio station groups in the United States, with 446 stations across the country. The company’s stations reach nearly 150 million people each week. Cumulus Media also owns and operates Westwood One, a national radio network that provides programming and content to over 7,500 radio stations. In addition to its radio operations, Cumulus Media also owns and operates a number of digital media properties.

Cumulus Media has a market cap of 137.91M as of 2022 and a Return on Equity of 25.91%. The company’s strong financial performance is due in part to its large scale radio operations. Cumulus Media’s stations reach nearly 150 million people each week, and the company also owns and operates Westwood One, a national radio network. In addition to its radio operations, Cumulus Media also owns and operates a number of digital media properties, which gives it a diversified revenue stream.

– Sharpline Broadcast Ltd ($BSE:543341)

The company’s market cap is 124.31M as of 2022. The company’s ROE is 3.53%. The company is engaged in the business of providing radio broadcasting services.

Summary

TEGNA Inc. experienced a decline in revenue and net income for their third quarter of FY2023 compared to the same period in the previous year. This could be a sign of weaker performance in the company’s core operations, and investors should be aware of the potential risks associated with investing in this stock. Investors should also consider the company’s current market position, financials, and competitive landscape prior to making any decisions.

Recent Posts