fuboTV Sees Share Price Surge and Reaches Cash Flow Milestones

June 14, 2023

☀️Trending News

FUBOTV ($NYSE:FUBO): FuboTV Inc, a streaming television company, has seen its share price surge and achieved noteworthy cash flow milestones. This surge has been driven by strong customer growth, expanding content offerings, and a successful upgrade of the fuboTV platform.

Additionally, fuboTV recently announced strong growth in monthly recurring revenues, and achieved positive adjusted EBITDA for the first time. These milestones demonstrate fuboTV’s commitment to providing an industry-leading streaming experience for its customers. The company has also added content from networks such as CBS, NBC, Fox and ESPN to its line-up. The platform also offers features such as personalized recommendations, cloud DVR with no storage limits, and the ability to stream on multiple devices. This news is promising for fuboTV’s shareholders as well as current and potential customers. It indicates that fuboTV is on the right track to becoming a leader in the streaming TV industry. It is an exciting time for the company and its stakeholders as they continue to strive for success.

Stock Price

On Tuesday, FUBOTV INC saw its stock price surge, as it opened at $2.0 and closed at $2.2 – an increase of 15.7% from its prior closing price of $1.9. This surge in stock price was linked to the company reaching a number of key milestones and cash flow targets. The impressive performance was attributed to an increase in subscribers, as well as the launch of new features and content. With their growing subscriber base and excellent performance in the market, FUBOTV INC is set to continue to excel and reach further milestones in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Fubotv Inc. More…

| Total Revenues | Net Income | Net Margin |

| 1.09k | -504.37 | -33.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Fubotv Inc. More…

| Operations | Investing | Financing |

| -268.2 | -10.45 | 190.75 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Fubotv Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.3k | 860.2 | 1.54 |

Key Ratios Snapshot

Some of the financial key ratios for Fubotv Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 355.2% | – | -32.7% |

| FCF Margin | ROE | ROA |

| -25.3% | -51.8% | -17.2% |

Analysis

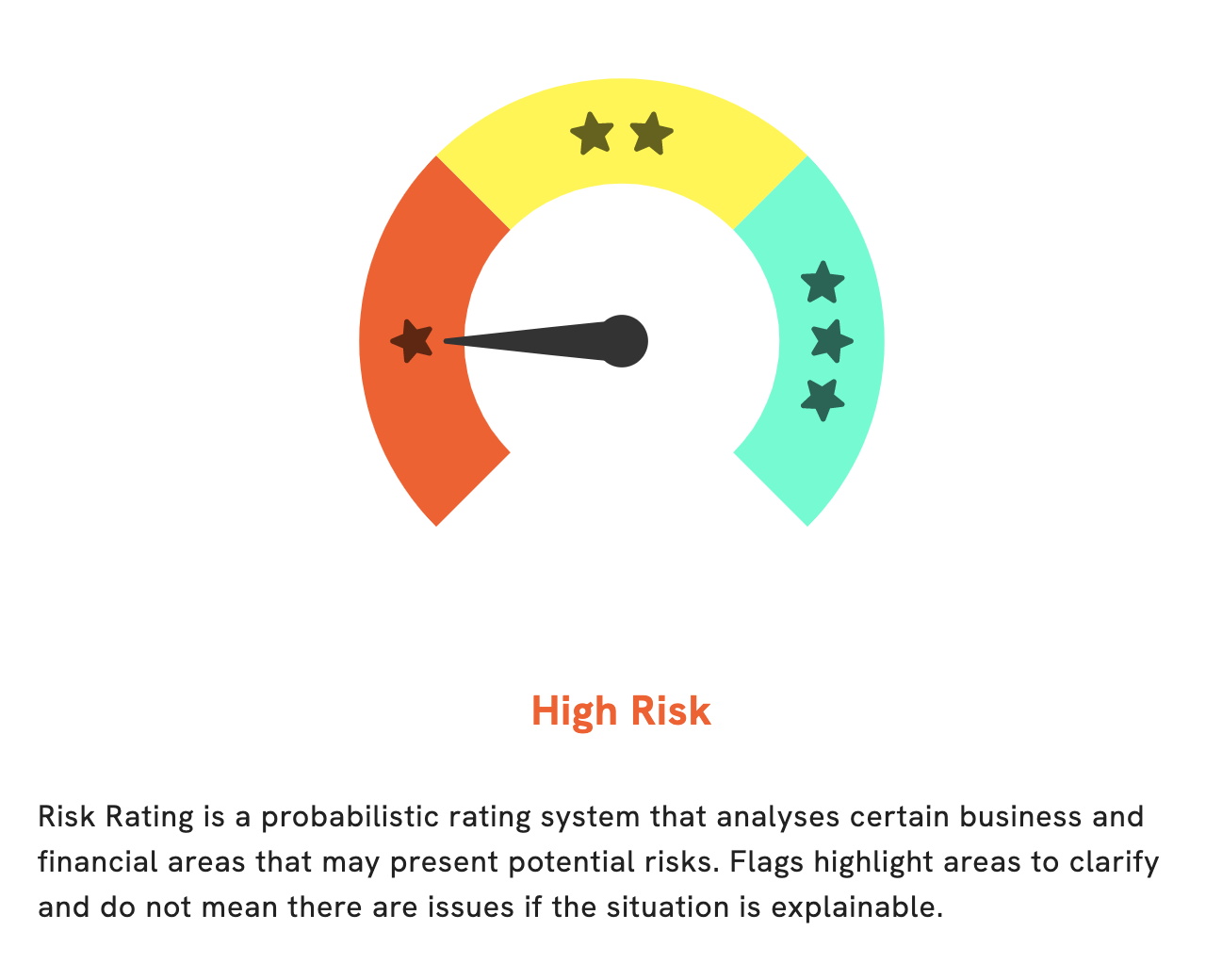

GoodWhale recently conducted an analysis of FUBOTV INC‘s wellbeing. According to our Risk Rating, they are a high risk investment in terms of financial and business aspects. During our thorough research, we detected 3 risk warnings in their income sheet, balance sheet, and cashflow statement. As part of our commitment to help make smart investment decisions, we have made these risk warnings available to registered GoodWhale users. By becoming a registered user with GoodWhale, you can have access to this data and more, allowing you to make the right decisions when it comes to which investments are best for you. More…

Peers

The Walt Disney Co, Netflix Inc, Roku Inc, are all in competition with each other. They all offer different streaming services that allow users to watch TV shows, movies, and other videos. FuboTV Inc is a company that provides a streaming service for live sports. It has been gaining in popularity due to its unique offering.

– The Walt Disney Co ($NYSE:DIS)

Walt Disney Company is an American entertainment company. The company operates in four business segments: Media Networks, Parks and Resorts, Studio Entertainment, and Consumer Products & Interactive Media.

The company has a market capitalization of 177.44 billion as of 2022 and a return on equity of 4.53%. The company’s media networks segment includes cable and broadcast television networks, television production and distribution, and radio networks and stations. The company’s parks and resorts segment owns and operates theme parks, resorts, and vacation clubs. The company’s studio entertainment segment produces and acquires live-action and animated motion pictures, direct-to-video content, musical recordings, and live stage plays. The company’s consumer products & interactive media segment licenses the company’s trade names, characters, and visual and literary properties across the globe.

– Netflix Inc ($NASDAQ:NFLX)

Netflix, Inc. is an American entertainment company that specializes in streaming television and movies. It has a market cap of 109B as of 2022 and a Return on Equity of 22.38%. The company was founded in 1997 and is headquartered in Los Gatos, California. Netflix offers its services to subscribers in over 190 countries. The company has over 167 million subscribers worldwide.

– Roku Inc ($NASDAQ:ROKU)

Roku Inc is a publicly traded company that designs and manufactures streaming devices for use with the Roku platform. The company was founded in 2002 and is headquartered in Los Gatos, California.

Roku Inc has a market cap of 7.25B as of 2022. The company’s return on equity is -0.84%. Roku Inc designs and manufactures streaming devices for use with the Roku platform. The company was founded in 2002 and is headquartered in Los Gatos, California.

Summary

FuboTV Inc. has seen its stock price surge recently, and it is garnering attention among investors. This impressive growth has been driven by a surge in demand for FuboTV’s services, as customers flock to the platform. Additionally, FuboTV has diversified its revenue streams, which have bolstered their financial situation. With these positive developments, investors are optimistic about the potential of FuboTV’s stock, which could continue to rise in value.

Recent Posts