Fubotv Inc Intrinsic Value Calculation – fuboTV Subscribers Soar as Ads Boost Popularity

December 18, 2023

☀️Trending News

FUBOTV ($NYSE:FUBO): FuboTV Inc., a sports-focused streaming service, has seen its subscriber base and revenue skyrocket in recent months following a strategic decision to place digital ads. Its recent foray into advertising has proven to be successful, as it has bolstered the company’s subscriber base and, in turn, revenue. The company’s decision to invest in digital advertising has paid off in a big way. This move has allowed it to reach more potential customers and increase its visibility.

Additionally, as more people become aware of the streaming service, fuboTV’s popularity has grown and its subscriber base has surged. This in turn has allowed the company to increase its revenue and invest in more content and features for its customers. In addition to its attention-grabbing advertising campaign, fuboTV has also invested in improving its product offerings. The company offers an extensive library of sports content as well as news and entertainment programming. It is also continually expanding its content offering, adding new channels and exclusive deals with premium networks. This, combined with its lower cost than other streaming services, has made it a popular choice among users. All of these moves have contributed to fuboTV’s success, and its continued growth is expected to increase both its subscriber base and revenue. Thanks to its strategic decision to invest in digital ads, the streaming service will likely remain a major player in the industry for many years to come.

Market Price

On Tuesday, FUBOTV INC saw its stock soar as advertisements boosted its overall popularity. The stock opened at $3.2 and closed at the same price, up by 0.3% from its last closing price of $3.2. This surge in stock price was attributed to the recent marketing campaigns that FUBOTV INC has implemented in order to boost its visibility among potential customers. The company has sought to increase its customer base by focusing on advertising, which has in turn led to increased subscriptions and viewership. FUBOTV INC’s recent campaigns have featured a variety of content, including live sports, news, and entertainment programming. This diverse range of content has helped attract a larger and more diverse audience.

Additionally, the company has also implemented promotional offers, such as discounts and free trials, that have further boosted its visibility and customer base. Overall, FUBOTV INC’s stock has seen a positive reaction due to its recent advertising campaigns. The company has seen an upsurge in subscriptions and viewership as a result of its marketing efforts, which in turn has caused its stock to increase in value. This trend is expected to continue as FUBOTV INC continues to reach new customers and build upon its current base. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Fubotv Inc. More…

| Total Revenues | Net Income | Net Margin |

| 1.28k | -369.35 | -24.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Fubotv Inc. More…

| Operations | Investing | Financing |

| -196.44 | 82.27 | 177.57 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Fubotv Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.22k | 887.04 | 1.18 |

Key Ratios Snapshot

Some of the financial key ratios for Fubotv Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 125.7% | – | -24.4% |

| FCF Margin | ROE | ROA |

| -16.8% | -50.9% | -16.0% |

Analysis – Fubotv Inc Intrinsic Value Calculation

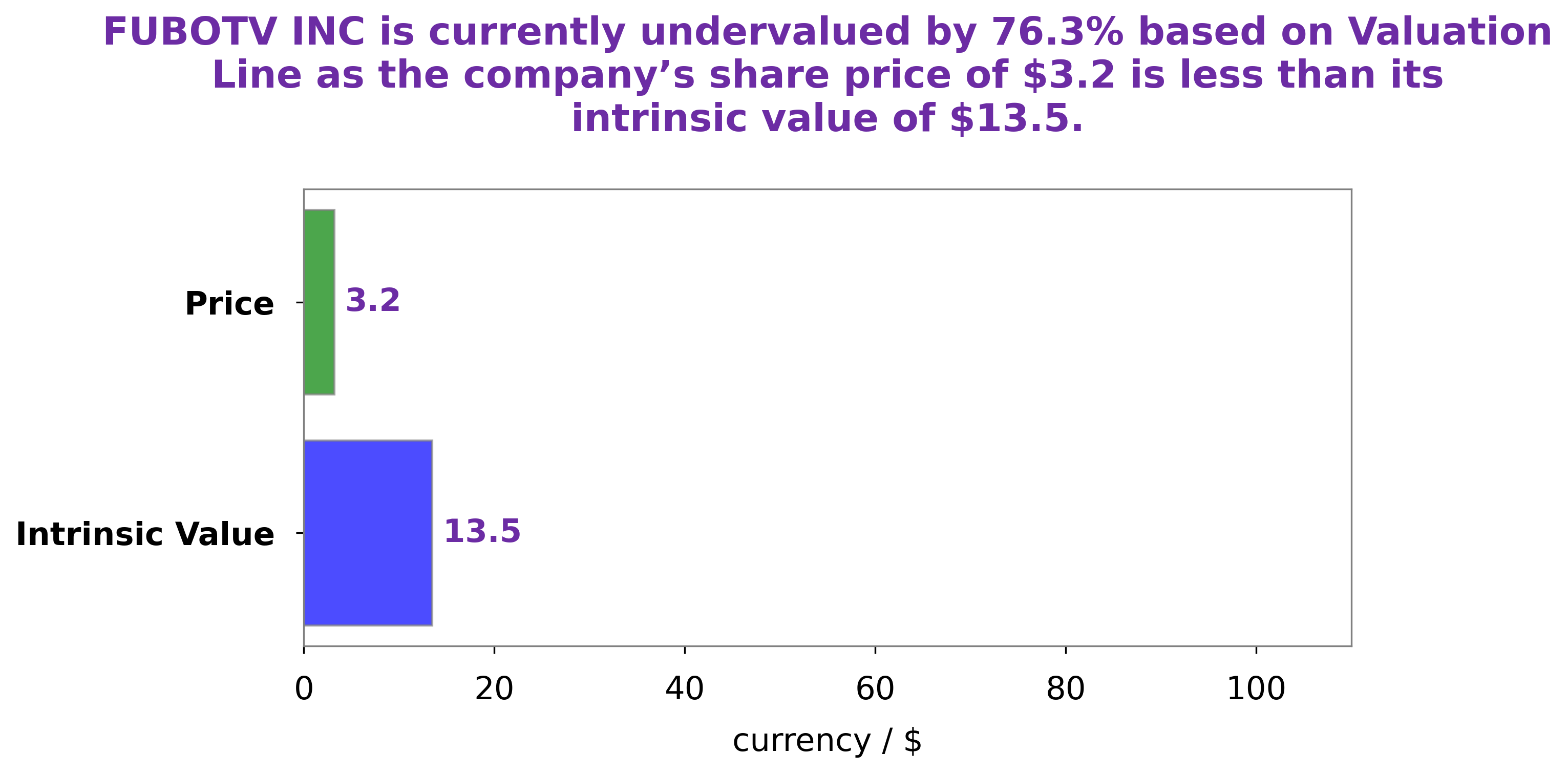

GoodWhale has conducted an analysis of FUBOTV INC‘s fundamentals and found that the intrinsic value of FUBOTV INC’s share is estimated at around $14.3, as calculated by our proprietary Valuation Line. This means that the current market price of $3.2 for FUBOTV INC stock is undervalued by 77.6%. More…

Peers

The Walt Disney Co, Netflix Inc, Roku Inc, are all in competition with each other. They all offer different streaming services that allow users to watch TV shows, movies, and other videos. FuboTV Inc is a company that provides a streaming service for live sports. It has been gaining in popularity due to its unique offering.

– The Walt Disney Co ($NYSE:DIS)

Walt Disney Company is an American entertainment company. The company operates in four business segments: Media Networks, Parks and Resorts, Studio Entertainment, and Consumer Products & Interactive Media.

The company has a market capitalization of 177.44 billion as of 2022 and a return on equity of 4.53%. The company’s media networks segment includes cable and broadcast television networks, television production and distribution, and radio networks and stations. The company’s parks and resorts segment owns and operates theme parks, resorts, and vacation clubs. The company’s studio entertainment segment produces and acquires live-action and animated motion pictures, direct-to-video content, musical recordings, and live stage plays. The company’s consumer products & interactive media segment licenses the company’s trade names, characters, and visual and literary properties across the globe.

– Netflix Inc ($NASDAQ:NFLX)

Netflix, Inc. is an American entertainment company that specializes in streaming television and movies. It has a market cap of 109B as of 2022 and a Return on Equity of 22.38%. The company was founded in 1997 and is headquartered in Los Gatos, California. Netflix offers its services to subscribers in over 190 countries. The company has over 167 million subscribers worldwide.

– Roku Inc ($NASDAQ:ROKU)

Roku Inc is a publicly traded company that designs and manufactures streaming devices for use with the Roku platform. The company was founded in 2002 and is headquartered in Los Gatos, California.

Roku Inc has a market cap of 7.25B as of 2022. The company’s return on equity is -0.84%. Roku Inc designs and manufactures streaming devices for use with the Roku platform. The company was founded in 2002 and is headquartered in Los Gatos, California.

Summary

The stock has been on a steady upward trend, and the company’s business model of subscription-based streaming services has helped tip the scales in its favor. Further, with the help of advertisements, the company has been able to expand its reach and increase revenue. Moreover, investors are also seeing a growing trend of customers who are willing to pay for the services offered by FuboTV, which is expected to result in higher profits for the company. With an impressive growth story and a solid business model, FuboTV Inc. is an attractive investment option.

Recent Posts