Zentalis Pharmaceuticals to Showcase at Two Upcoming Investor Conferences

February 5, 2023

Trending News 🌥️

Zentalis Pharmaceuticals ($NASDAQ:ZNTL) is an emerging biopharmaceutical company that is focused on the discovery, development, and commercialization of innovative therapies for cancer and other serious diseases. The company has recently announced that it will be attending two upcoming investor conferences, both of which will provide an opportunity for investors to learn more about their cutting-edge products and research. Zentalis Pharmaceuticals is dedicated to developing targeted therapies that have the potential to improve patients’ lives and offer a better quality of care in terms of healthcare cost savings and outcomes. Their pipeline consists of both small molecule and antibody-based therapies for the treatment of cancers and other serious diseases. The company is also dedicated to advancing their research and development through collaborations with other leading organizations in the biopharmaceutical space. The two upcoming investor conferences will be held in New York City and San Francisco in June. During the conferences, investors will get an exclusive look at Zentalis Pharmaceuticals’ portfolio of products, as well as an in-depth overview of the company’s ongoing research and clinical trials.

In addition, investors will have the opportunity to meet with the executive team and ask questions about the company’s growth strategy and future plans. Zentalis Pharmaceuticals is committed to providing investors with the latest news and updates about their products and research. By attending these two upcoming investor conferences, they hope to provide an opportunity to share their story with the investment community and gain valuable insights into their current and future projects. With their commitment to providing innovative therapies to the market, Zentalis Pharmaceuticals is sure to make a positive impact on the industry.

Market Price

At the time of writing, news surrounding Zentalis Pharmaceuticals has mostly been negative.

However, the company has recently announced that they will be showcasing at two upcoming investor conferences. On Wednesday, Zentalis Pharmaceuticals stock opened at $23.5 and closed at $23.6, up by 0.2% from the previous closing price of $23.6. The two upcoming investor conferences that Zentalis Pharmaceuticals will be participating in are the JPMorgan Healthcare Conference and the UBS Global Healthcare Conference. Both conferences will take place in San Francisco, California and will provide Zentalis Pharmaceuticals with the opportunity to showcase its innovative pipeline of therapies to investors and industry professionals. At the conferences, Zentalis Pharmaceuticals will have the chance to meet with potential partners, industry leaders, and decision-makers to discuss their current and future products and services. The company will also be able to gain valuable insights into industry trends, exchange ideas with experts, and gain exposure to potential investors. The conferences should provide Zentalis Pharmaceuticals with a great platform to further increase its visibility in the industry, create meaningful connections, and develop a strong reputation amongst investors and industry professionals. This could potentially lead to increased investor confidence in the company and improved stock performance in the long run. Overall, Zentalis Pharmaceuticals’ participation in these upcoming investor conferences should provide them with a great opportunity to promote their products and services and build relationships with investors and industry professionals. This could potentially lead to better stock performance and overall success for the company in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Zentalis Pharmaceuticals. More…

| Total Revenues | Net Income | Net Margin |

| 15.47 | -115.82 | -756.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Zentalis Pharmaceuticals. More…

| Operations | Investing | Financing |

| -101.23 | 20.92 | 80.52 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Zentalis Pharmaceuticals. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 197.42 | 63.74 | 4.78 |

Key Ratios Snapshot

Some of the financial key ratios for Zentalis Pharmaceuticals are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -711.5% |

| FCF Margin | ROE | ROA |

| -718.7% | -76.7% | -40.7% |

Analysis

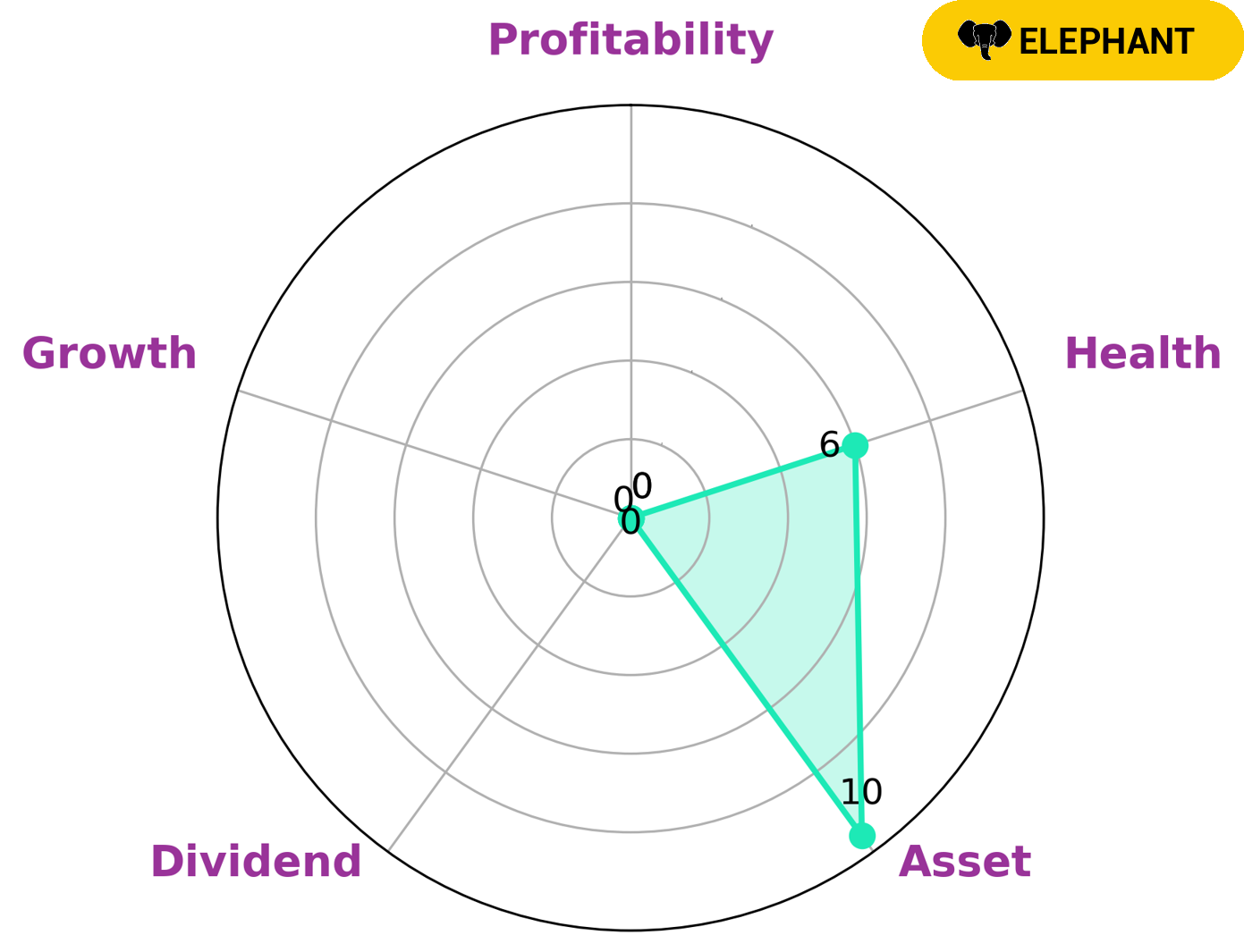

GoodWhale has conducted an analysis of ZENTALIS PHARMACEUTICALS’s wellbeing. The Star Chart has classified the company as ‘elephant’, indicating it is rich in assets after deducting its liabilities. This type of company may be of interest to certain investors such as those looking for long-term investments or those looking for stable cashflows. ZENTALIS PHARMACEUTICALS has an intermediate health score of 6/10, taking into account its cashflows and debt. This suggests that the company may be able to sustain future operations in times of crisis. However, there are some weaknesses that need to be addressed. The company is strong in terms of assets, but is weak in terms of dividend, growth and profitability. In order to improve its wellbeing, ZENTALIS PHARMACEUTICALS should focus on strategies that strengthen its dividend, growth and profitability. This includes investing in research and development, expanding into new markets and finding ways to reduce costs. Additionally, it should focus on improving its cashflows and debt situation by reducing its liabilities and increasing its liquidity. Overall, the analysis conducted by GoodWhale suggests that ZENTALIS PHARMACEUTICALS is a company with good potential but needs to address some weaknesses in order to reach its full potential. With the right strategies in place, the company can become a more attractive option for investors. More…

Peers

Focusing on small molecule therapeutics, it stands out among its competitors Kinnate Biopharma Inc, Pliant Therapeutics Inc, and Fulcrum Therapeutics Inc as it works to discover, develop and commercialize new therapies.

– Kinnate Biopharma Inc ($NASDAQ:KNTE)

Kinnate Biopharma Inc is a clinical-stage biopharmaceutical company focused on developing innovative therapies for the treatment of cancer and other diseases. The company has a market cap of 282.21M as of 2023 and a Return on Equity of -27.29%. Market capitalization is a measure of the company’s size, or its total value in the stock market, and is calculated by multiplying the number of outstanding shares by their current market price. A negative return on equity can reflect either a company’s failure to generate profits or its inability to use its assets efficiently. Kinnate Biopharma Inc’s negative return may indicate potential problems with the way it is managing its operations.

– Pliant Therapeutics Inc ($NASDAQ:PLRX)

Pliant Therapeutics Inc is a biopharmaceutical company that focuses on discovering and developing therapies to treat patients with serious cardiometabolic diseases. The company has a market cap of 935.69M as of 2023, which indicates its current value and potential for growth. Additionally, Pliant Therapeutics Inc has a Return on Equity (ROE) of -29.5%. This suggests that the company is not generating any positive returns on the shareholders’ investment and is underperforming the industry average in terms of profitability.

– Fulcrum Therapeutics Inc ($NASDAQ:FULC)

Fulcrum Therapeutics Inc is a biopharmaceutical company focused on developing treatments for serious genetic and epigenetic diseases. As of 2023, the company has a market cap of 485.12M and a Return on Equity of -35.22%. The market cap measures the company’s size and reflects the value of the company’s stock at the current market price. While the ROE is used to measure how much money shareholders are making from their investments and how efficiently the company is using its capital to generate profits. Despite the negative ROE, Fulcrum Therapeutics is well positioned to continue to grow its market cap and increase its ROE as it develops treatments for more diseases.

Summary

Zentalis Pharmaceuticals is an up-and-coming biopharmaceutical company that has recently been gaining attention from investors. The company is set to showcase at two upcoming investor conferences, providing further exposure to potential shareholders. Analysts have noted favorable financials and a promising pipeline of products, making Zentalis a potential investment for those looking for upside.

Additionally, the company has achieved several positive clinical trial results and has developed strong partnerships that have helped to bring their products to market. With its potential for future growth, Zentalis Pharmaceuticals is a company to watch for investors looking for a potential long-term investment.

Recent Posts