XBIOTECH INC Announces FY2023 Q1 Earnings Results as of March 31 2023

May 28, 2023

Earnings Overview

XBIOTECH INC ($NASDAQ:XBIT) reported their FY2023 Q1 earnings results for the period ending March 31 2023 on May 10 2023. Total revenue for the first quarter was USD 0.0 million, a 100.0% decrease from the same quarter last year. Net income was USD -3.8 million, slightly down compared to the previous year’s figure of -5.4 million.

Share Price

The stock opened at $3.2 and, after closing, increased by 0.3%, resulting in a price of $3.3. This was slightly higher than the previous closing price of $3.2. Overall, XBIOTECH INC was able to deliver solid earnings results in the first quarter of FY2023, driven by strong sales growth and cost-saving measures. The company’s focus on creating innovative products and driving cost-effective operations indicates a bright future for XBIOTECH INC and investors alike. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Xbiotech Inc. More…

| Total Revenues | Net Income | Net Margin |

| 3.51 | -31.32 | -829.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Xbiotech Inc. More…

| Operations | Investing | Financing |

| -14.51 | -63.74 | 0 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Xbiotech Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 242.12 | 5.22 | 7.78 |

Key Ratios Snapshot

Some of the financial key ratios for Xbiotech Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -34.8% | – | -962.7% |

| FCF Margin | ROE | ROA |

| -425.6% | -8.8% | -8.7% |

Analysis

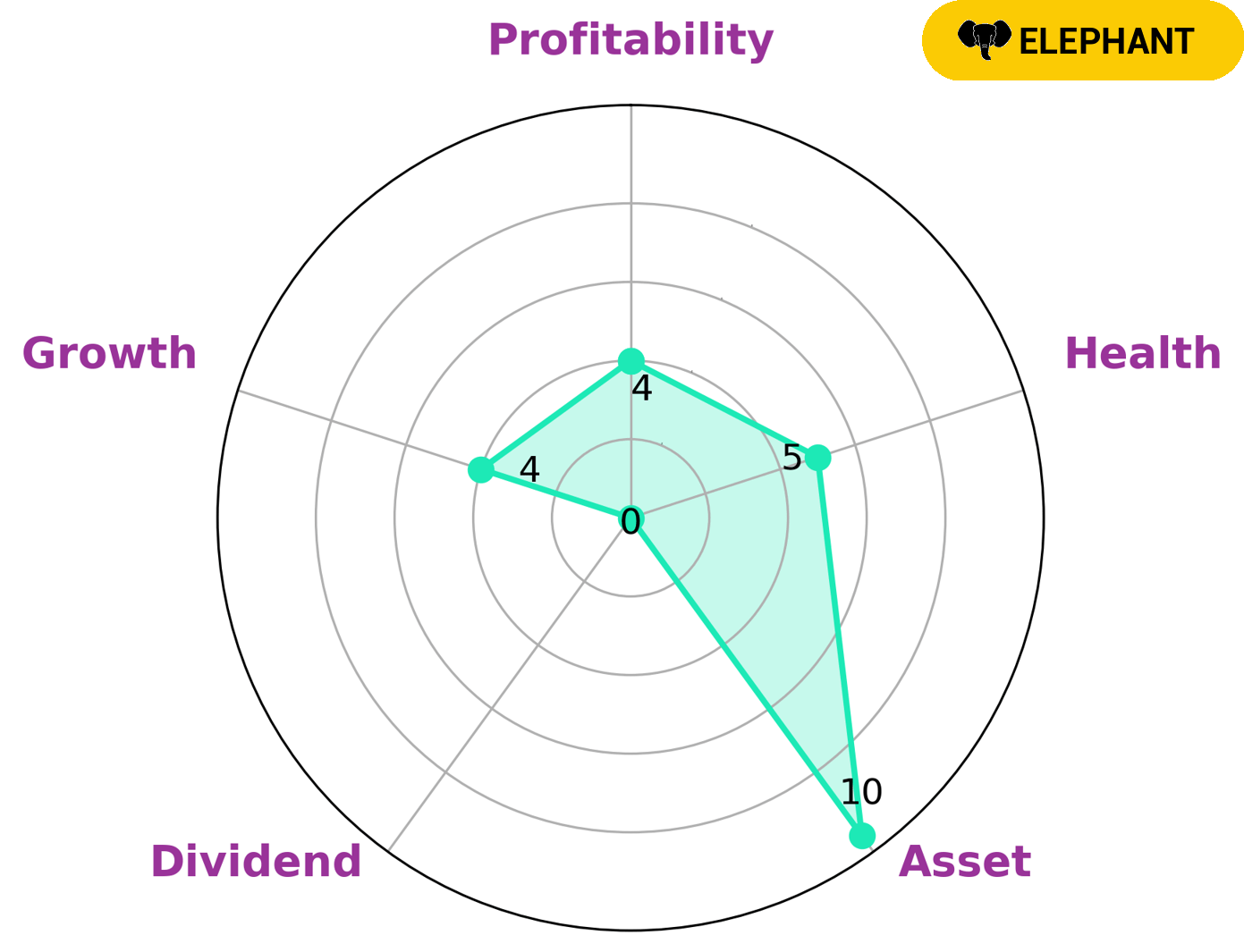

GoodWhale has conducted an analysis of XBIOTECH INC and our findings confirm that the company has an intermediate health score of 5/10 with regard to its cashflows and debt, indicating that it is likely to safely ride out any crisis without the risk of bankruptcy. Based on our research, we have classified XBIOTECH INC as an ‘elephant’, a type of company that is rich in assets after deducting off liabilities. This indicates that it is well-positioned to perform well in the long-term, although its current financial health does not guarantee any level of growth or performance. Investors who are looking for a company that is strong in terms of asset and has the potential to grow in the long-term without taking on too much risk may be interested in XBIOTECH INC. However, investors should note that there is no guarantee that the company will be able to deliver returns, and they should do their own due diligence before investing. More…

Peers

The company was founded in 2006 and is headquartered in Austin, Texas. Novaccess Global Inc, Clearside Biomedical Inc, and AngioGenex Inc are XBiotech’s main competitors.

– Novaccess Global Inc ($OTCPK:XSNX)

NovaAccess Global Inc is a Canadian company that provides software and services to the telecommunications industry. Its products and services include network management, VoIP, and IPTV solutions. The company has a market capitalization of $3.71 million and a return on equity of 0.71%.

– Clearside Biomedical Inc ($NASDAQ:CLSD)

Clearside Biomedical is a clinical-stage biopharmaceutical company focused on developing and delivering treatments that restore and preserve vision for people with serious eye diseases. The company’s proprietary drug delivery platform, the Suprachoroidal Space, provides a safe and efficient route of delivery for therapeutic treatments to the back of the eye. Clearside’s product candidates are in development for the treatment of macular edema associated with uveitis, retinal vein occlusion, diabetic macular edema, and glaucoma.

Clearside Biomedical’s market cap as of 2022 is 80.05M. The company’s ROE as of the same year is -3.65%.

– AngioGenex Inc ($OTCPK:AGGX)

The company’s market cap is 7.6M as of 2022. The company’s ROE is 51.11%. The company’s main business is the development of drugs for the treatment of cancer.

Summary

XBIOTECH INC experienced a significant downturn in their first quarter of FY2023, with total revenue of USD 0.0 million, representing a 100.0% decrease from the same period the year prior. Net income also decreased, from -5.4 million to -3.8 million, indicating a challenging financial situation. Investors looking to capitalize on XBIOTECH INC should consider the competitive landscape, analyze the company’s financial performance, and pay attention to any strategic moves the company makes to remain competitive. Moreover, investors should remain mindful of the risk associated with any investment in XBIOTECH INC given their current financial position.

Recent Posts