Vivani Medical Stock Intrinsic Value – VIVANI MEDICAL Sets Terms for $15M IPO, Poised to Revolutionize Vision Restoration Technology

June 10, 2023

☀️Trending News

Cortigent, the manufacturer of groundbreaking vision restoration technology, has established the terms for its $15 million Initial Public Offering (IPO). The company, VIVANI MEDICAL ($NASDAQ:VANI), is poised to revolutionize ophthalmology with its cutting-edge eye-tracking technology. Already, its products are revolutionizing the industry and allowing people with vision impairments to regain sight and improve their quality of life. The proceeds of the offering are intended to fund the company’s growth and development of new products. It also aims to provide liquidity to existing shareholders.

The IPO for VIVANI MEDICAL could prove to be a major milestone in the company’s history. With the funds raised, they can continue to develop their vision restoration technology and bring it to a wider audience. This could create a whole new industry, allowing more people to benefit from the company’s innovative products. It is an investment opportunity that is sure to generate strong returns for those who are willing to take the risk.

Stock Price

VIVANI MEDICAL made history on Thursday with its 15 million dollar initial public offering (IPO). The company is a leader in the development of vision restoration technology and is poised to revolutionize the industry. At the IPO’s opening, VIVANI MEDICAL’s stock opened at $1.5 and closed at $1.4, down 1.4% from the prior closing price of $1.4. Even with the dip in the stock price, the company has been lauded for its impressive entry into the public market.

VIVANI MEDICAL is one of many companies making a major impact on the industry of vision restoration technology. By setting the terms for their initial public offering at $15 million, they are setting an example for other companies to follow. With the success of their IPO, they are sure to have a bright future ahead. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Vivani Medical. More…

| Total Revenues | Net Income | Net Margin |

| 0 | -16.28 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Vivani Medical. More…

| Operations | Investing | Financing |

| -22.58 | -0.34 | 55.39 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Vivani Medical. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 44.58 | 6.21 | 0.76 |

Key Ratios Snapshot

Some of the financial key ratios for Vivani Medical are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | -36.2% | -33.6% |

Analysis – Vivani Medical Stock Intrinsic Value

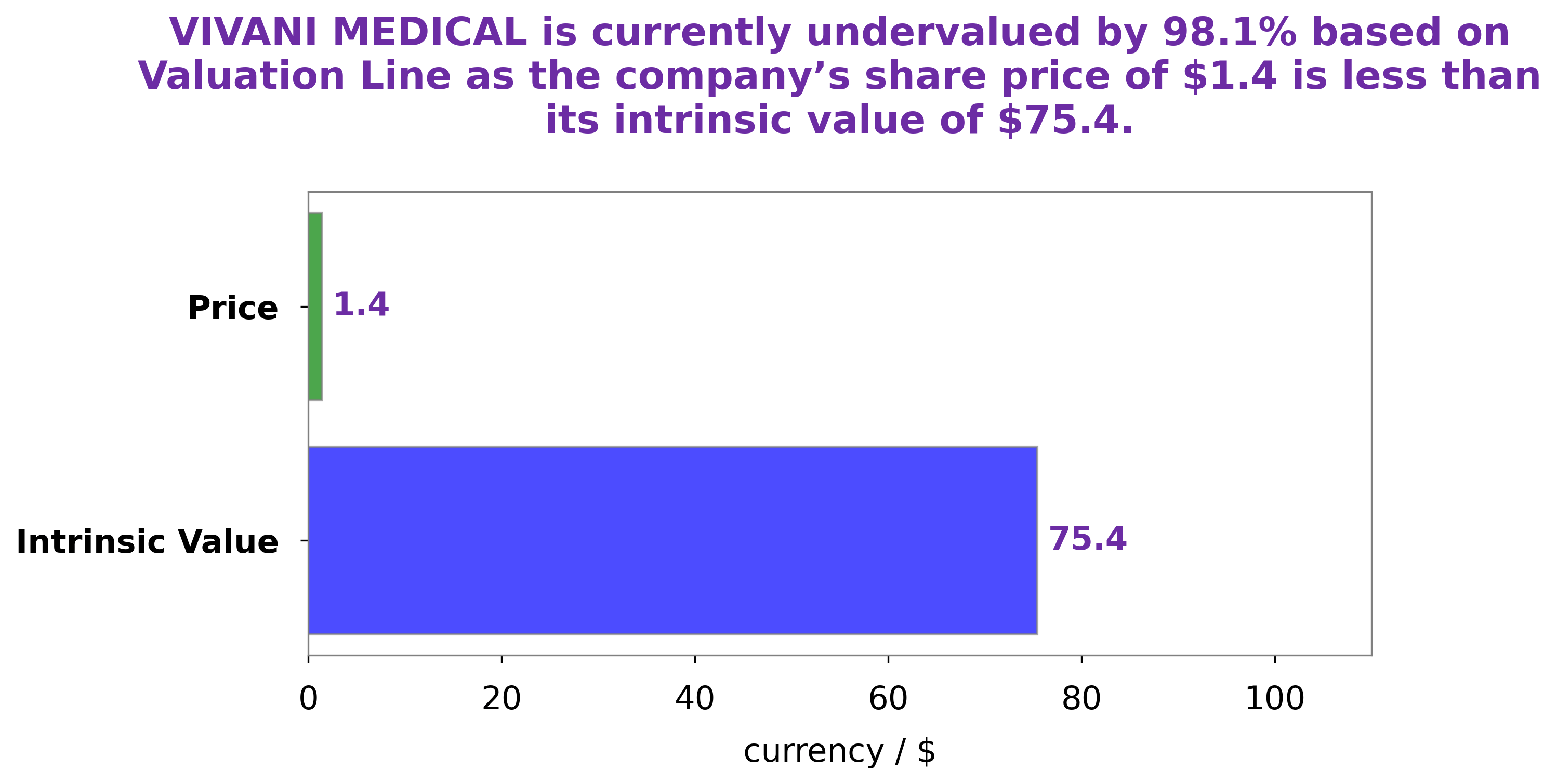

At GoodWhale, we have conducted an analysis of VIVANI MEDICAL‘s financials. Our proprietary Valuation Line revealed that the intrinsic value of VIVANI MEDICAL share is approximately $75.4. However, the current trading price of the stock is only at $1.4, indicating that it is undervalued by 98.1%. This presents a great opportunity for investors to buy the stock and possibly benefit from potential price appreciation. More…

Peers

Vivani Medical Inc is in a fierce competition with some of the leading players in the industry, such as Perimeter Medical Imaging AI Inc, Aziyo Biologics Inc and Affluent Medical. These companies are all striving to become the top provider of innovative medical solutions and services, and the competition is heating up as each of them seeks to gain an edge over the other.

– Perimeter Medical Imaging AI Inc ($TSXV:PINK)

Perimeter Medical Imaging AI Inc is a medical imaging AI company that uses deep learning to develop automated tools for wound imaging. It has a market cap of 109.38 million as of 2023, which is an indication of its popularity in the market. The company’s Return on Equity (ROE) of -20.14% indicates that the company is not necessarily profitable, and that it may be in the process of making investments to increase its profits.

– Aziyo Biologics Inc ($NASDAQ:AZYO)

Aziyo Biologics Inc is a biopharmaceutical company specializing in regenerative medicine products and therapies. With a market cap of 23.8 million as of 2023, the company is well positioned to continue its trend of rapid growth. Aziyo’s Return on Equity, or ROE, stands at 219.4%, an impressive sign of the company’s financial health and profitability. Aziyo’s products are used by surgeons to repair damaged tissue, enabling the body to heal itself. The company’s impressive ROE is a testament to its success in this area, and suggests that its future looks bright.

– Affluent Medical ($BER:0JZ)

Affluent Medical is a medical device manufacturer that specializes in creating products that aid in the diagnosis and treatment of a variety of medical conditions. The company’s current market cap of 37.97M as of 2023 represents the total value of its outstanding shares. Furthermore, its Return on Equity (ROE) of -20.98% shows that the company has been struggling to maintain a positive return on investment. This could be due to a variety of factors, such as mismanagement or competition from other companies in the industry. Nonetheless, Affluent Medical continues to remain a relevant player in the medical device manufacturing industry.

Summary

VIVANI MEDICAL has set terms for its upcoming $15M initial public offering (IPO). Analysts recommend that investors consider investing in VIVANI MEDICAL, as the company has a strong product portfolio and could benefit from an increasing demand for vision restoration devices. The proceeds of the IPO will help the company further develop its products and expand its geographic reach.

Additionally, VIVANI MEDICAL could also benefit from the current trend of increased adoption of medical technology and greater demand for healthcare services. With strong fundamentals and promising prospects, VIVANI MEDICAL looks to be a promising investment opportunity.

Recent Posts