VERTEX PHARMACEUTICALS Reports FY2022 Q4 Earnings Results After Year-End Close on December 31, 2022.

February 22, 2023

Earnings Overview

VERTEX PHARMACEUTICALS ($NASDAQ:VRTX) reported total revenue of USD 818.9 million and net income of USD 2302.7 million for the fourth quarter of the FY2022 on February 7, 2023. This marked an increase of 6.3% and 11.1% respectively, when compared to the year prior.

Transcripts Simplified

Vertex’s fourth quarter and full year 2022 results represent strong execution and financial performance. Fourth quarter 2022 revenue increased 11% year-over-year to $2.3 billion, led by 24% growth outside the U.S. US CF revenue grew 5% year-over-year. Full year 2022 revenue of $8.93 billion represents 18% growth. Full year 2022 international revenue increased 41% and full year US revenue increased 8% compared to 2021. Fourth quarter combined non-GAAP R&D, acquired IP R&D, and SG&A expenses were $872 million, a 5% increase compared to the fourth quarter of 2021. Full year 2022 combined non-GAAP R&D, acquired IP R&D, and SG&A expenses were $3.07 billion, a decrease of 11% versus the prior year.

Fourth quarter 2022 non-GAAP operating margin was 50% and full year 2022 non-GAAP operating margin was 54%. Vertex ended the quarter with $10.8 billion in cash and investments. The HSR period for the Entrada collaboration expired last night and the transaction is expected to close within days. 2023 product revenue guidance is set at $9.55 billion – $9.7 billion, representing 7% – 9% year-over-year growth.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Vertex Pharmaceuticals. More…

| Total Revenues | Net Income | Net Margin |

| 8.93k | 3.32k | 37.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Vertex Pharmaceuticals. More…

| Operations | Investing | Financing |

| 4.13k | -321.1 | -67.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Vertex Pharmaceuticals. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 18.15k | 4.24k | 50.77 |

Key Ratios Snapshot

Some of the financial key ratios for Vertex Pharmaceuticals are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 29.0% | 53.7% | 48.0% |

| FCF Margin | ROE | ROA |

| 44.0% | 19.9% | 14.8% |

Market Price

On Tuesday, VERTEX PHARMACEUTICALS reported their FY2022 fourth-quarter earnings results after year-end close on December 31, 2022. The stock opened at $303.6 and closed at $308.5, up by 1.2% from its last closing price of $304.9. This marked a significant increase in the stock’s price and many investors have taken note of this trend and anticipate future growth potential. The company has seen an increase in sales figures, especially in the fourth quarter of FY2022, as they have successfully implemented several new strategies and initiatives to further the company’s growth.

Additionally, the company reported that they have expanded business operations in both domestic and international markets, allowing them to better serve customers and further their position in the industry. VERTEX PHARMACEUTICALS has also made significant investments in technology and research and development in order to improve the quality of their products and services offered to customers. They have also made efforts to increase their presence within the healthcare community, by forging strategic partnerships withother key industry players. Overall, investors are encouraged by VERTEX PHARMACEUTICALS’ performance in the fourth quarter of FY2022 and anticipate a positive outlook for the company moving forward. With the implementation of various strategies to streamline its operations and increase sales figures, investors anticipate further success for VERTEX PHARMACEUTICALS in the near future. Live Quote…

Analysis

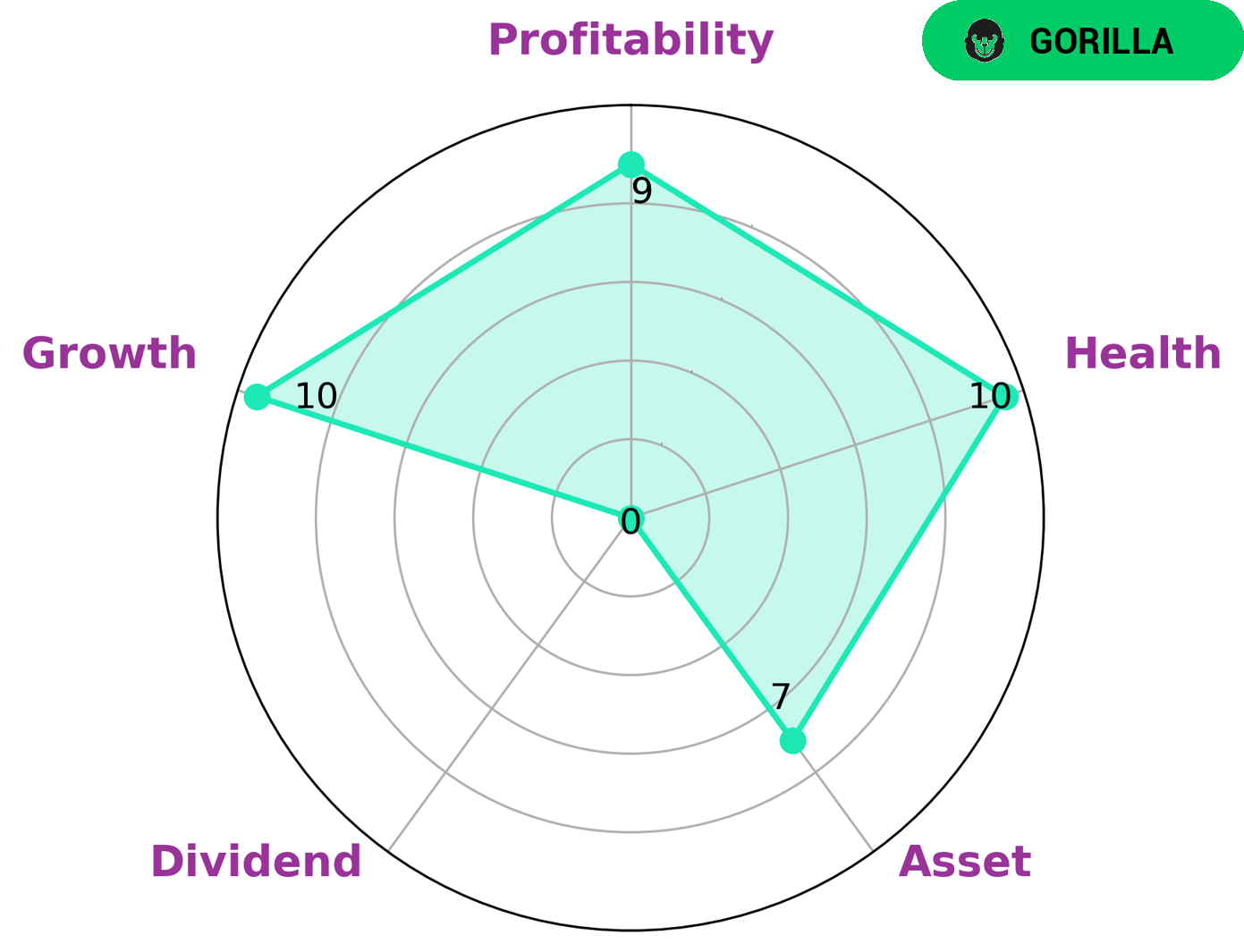

At GoodWhale, we conducted an analysis of VERTEX PHARMACEUTICALS‘s wellbeing. Our Star Chart showed that VERTEX PHARMACEUTICALS has a high health score of 10/10 with regard to its cashflows and debt, indicating that it is capable to sustain future operations in times of crisis. Furthermore, VERTEX PHARMACEUTICALS is strong in asset, growth, and profitability, though it is weak in dividend. With this combination, they are classified as ‘gorilla’, a type of company that achieved stable and high revenue or earnings growth due to its strong competitive advantage. Such a dynamic and powerful company may be attractive to a variety of investors. Long-term investors may be drawn in by the company’s financial health and long-term outlook. Other investors, such as growth investors, may be drawn in by the company’s promising growth potential. Finally, value investors may appreciate the discounted value of the company compared to its peers. More…

Peers

The competition in the pharmaceutical industry is intense, with companies vying for market share in a constantly changing landscape. Vertex Pharmaceuticals Inc is no stranger to this competition, and its competitors include Nyrada Inc, Incyte Corp, and Gain Therapeutics Inc.

– Nyrada Inc ($ASX:NYR)

Nyrada Inc is a clinical stage biopharmaceutical company focused on the development of novel therapeutics to treat diseases of the eye, central nervous system and other organ systems. The company’s lead product candidate, NYX-2925, is a small molecule that inhibits the activity of the protein kinase C-beta (PKC-beta) enzyme. NYX-2925 is in clinical development for the treatment of dry eye disease and age-related macular degeneration.

Nyrada’s market cap is $21.06 million and its ROE is -20.85%. The company is focused on the development of novel therapeutics to treat diseases of the eye, central nervous system and other organ systems.

– Incyte Corp ($NASDAQ:INCY)

Incyte Corporation is a Wilmington, Delaware-based biopharmaceutical company that focuses on the discovery, development, and commercialization of proprietary small molecule drugs to treat serious unmet medical needs, primarily in oncology.

As of 2022, Incyte Corporation had a market capitalization of $15.48 billion and a return on equity of 9.54%. The company’s main product is Jakafi (ruxolitinib), which is approved for the treatment of myelofibrosis and polycythemia vera, two rare blood disorders. Incyte is also developing several other drugs in clinical trials for various cancers.

– Gain Therapeutics Inc ($NASDAQ:GANX)

Gain Therapeutics Inc is a clinical-stage biopharmaceutical company focused on the development of precision medicines for patients with serious diseases. The company’s lead product candidate is GT-004, a small molecule inhibitor of the oncogene c-Myc, which is in development for the treatment of solid tumors. Gain Therapeutics has a market cap of $36.13 million and a negative return on equity of 33.26%. The company’s products are still in development and have not yet been approved for sale by the FDA.

Summary

Vertex Pharmaceuticals reported strong financial results in their fourth quarter of FY2022, with total revenue of USD 818.9 million and net income of USD 2302.7 million, indicating a 6.3% and 11.1% year-over-year increase, respectively. This is a promising sign for potential investors, considering Vertex’s standing as a top biotechnology firm. Moreover, the company’s research and development efforts have advanced significantly in recent years, suggesting that Vertex’s product pipeline is robust and could yield further growth in the future. Thus, Vertex Pharmaceuticals may be an attractive investment opportunity.

Recent Posts