TCRR Price Target Lowered to $1.68, Maintaining Neutral Rating for 2023.

March 26, 2023

Trending News 🌧️

The firm maintained its Neutral rating on the stock. Wedbush’s decision to lower their price target reflects the decreased confidence in TCR2 ($NASDAQ:TCRR) Therapeutics Inc. from analysts. The decrease is based on the company’s performance in recent quarters, as well as their outlook for the future. Despite the lowered price target, the Neutral rating keeps investors from taking a large negative stance on the company. Wedbush’s decision to maintain their Neutral rating may provide some relief to investors, who have seen the stock decline significantly in recent months.

The firm believes that the company is still a viable investment option and that it has potential to rebound in the near future. Overall, Wedbush believes that TCR2 Therapeutics Inc. is still a good option for investors, despite the decline in the stock price. They remain optimistic that the company will recover and be able to reach profitability by 2023. In the meantime, investors should keep an eye on the company’s progress and adjust their positions accordingly.

Market Price

On Friday, TCR2 Therapeutics saw its stock open at $1.4 and close at $1.5, representing a 5.6% increase from its previous closing price of 1.4. Despite this increase in share value, an analyst has lowered the price target for TCR2 Therapeutics to $1.68 and maintained a neutral rating for 2023. This lowered price target and neutral outlook could be a sign of a market uncertain of the company’s long-term prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tcr2 Therapeutics. More…

| Total Revenues | Net Income | Net Margin |

| 0 | -151.82 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tcr2 Therapeutics. More…

| Operations | Investing | Financing |

| -101.46 | -88.49 | 0.12 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tcr2 Therapeutics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 208.24 | 67.38 | 3.59 |

Key Ratios Snapshot

Some of the financial key ratios for Tcr2 Therapeutics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.0% | – | – |

| FCF Margin | ROE | ROA |

| – | -45.3% | -36.9% |

Analysis

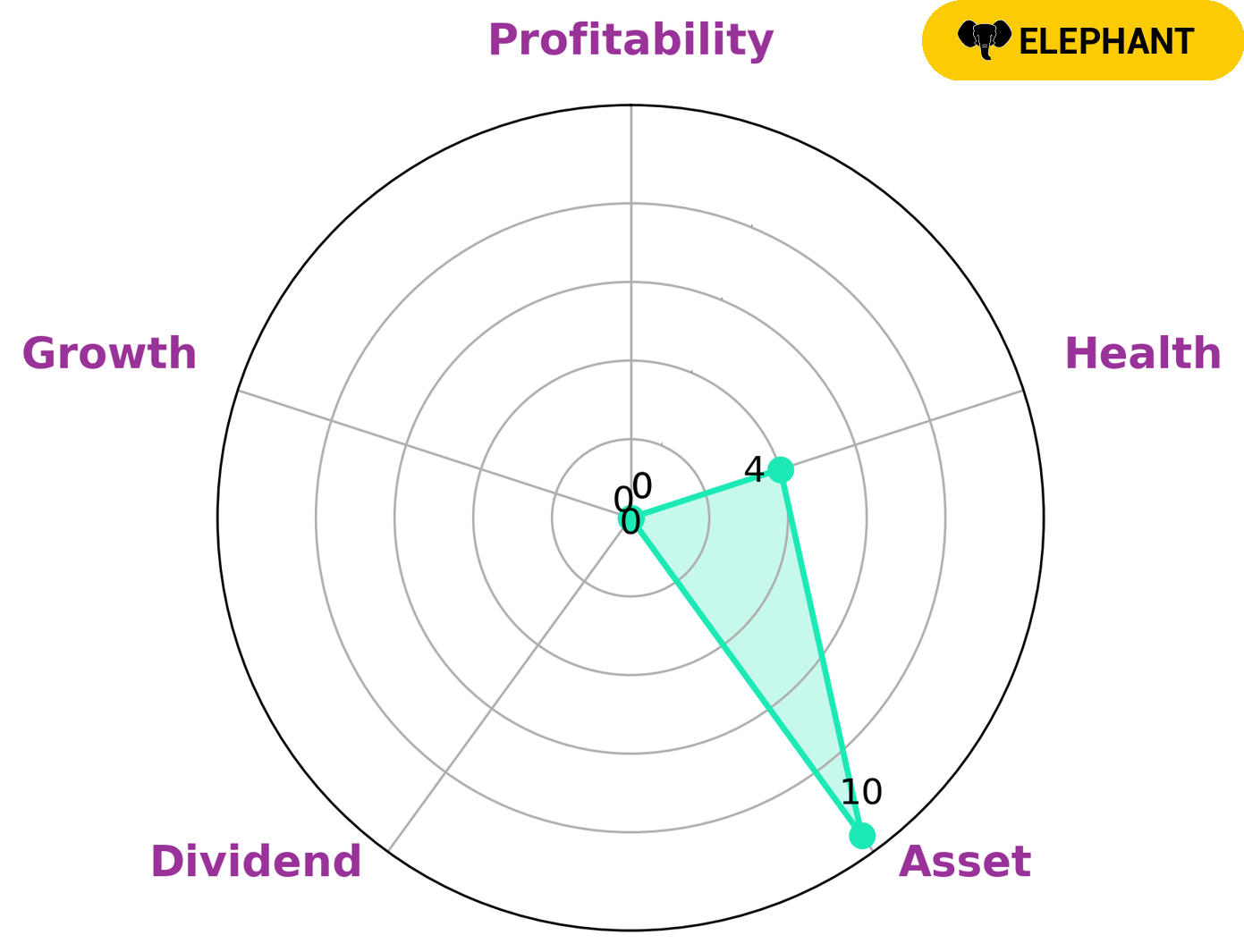

After conducting an analysis of TCR2 THERAPEUTICS‘ wellbeing using the GoodWhale Star Chart, we have concluded that TCR2 THERAPEUTICS is classified as an ‘elephant’, a type of company that is strong in assets when liabilities are deducted. Investors who may be interested in such a company include those with a long-term view, looking for a steady return on their investment. When looking at TCR2 THERAPEUTICS’ finite resources, we find that they are strong in assets and weak in dividends, growth, and profitability. This suggests that regular payouts to shareholders will not be forthcoming. However, the company has an intermediate health score of 4/10, considering its cashflows and debt, meaning that it might be able to sustain future operations in times of financial crisis. More…

Peers

The company’s lead program is Tigatuzumab, which is in Phase II clinical trials for the treatment of solid tumors. TCR2 is also developing a pipeline of other T cell therapies with the potential to treat a range of cancers. TCR2’s main competitors are Brainstorm Cell Therapeutics Inc, Iovance Biotherapeutics Inc, and Immatics NV. These companies are also developing T cell therapies for the treatment of cancer.

– Brainstorm Cell Therapeutics Inc ($NASDAQ:BCLI)

Brainstorm Cell Therapeutics Inc is a biotechnology company that develops and commercializes adult stem cell therapies for neurodegenerative diseases. The company has a market cap of 59.84M and a ROE of -137.41%. Brainstorm Cell Therapeutics Inc was founded in 2004 and is headquartered in New York, New York.

– Iovance Biotherapeutics Inc ($NASDAQ:IOVA)

Iovance Biotherapeutics Inc is a clinical-stage biopharmaceutical company, which focuses on the development and commercialization of cancer immunotherapy products based on tumor-infiltrating lymphocytes (TIL). The company’s product candidates include LN-144, LN-145, LN-168, and LN-169. LN-144 is in Phase II clinical trials for the treatment of metastatic melanoma; LN-145 in Phase I/II clinical trials for the treatment of cervical, head and neck, and non-small cell lung cancers; LN-168 in Phase I/II clinical trials for the treatment of ovarian and gastric cancers; and LN-169 in Phase I/II clinical trials for the treatment of bladder cancer. Iovance Biotherapeutics was founded by Philip D. Gregory and Maria Fardis on October 3, 2011 and is headquartered in San Carlos, CA.

– Immatics NV ($NASDAQ:IMTX)

Immatics NV, a clinical-stage biopharmaceutical company, focuses on the development of T cell-based immunotherapies for the treatment of cancer. The company’s product candidates include IMA901 that is in Phase II clinical trials for the treatment of solid tumors, as well as in Phase I/II trials for the treatment of acute myeloid leukemia and multiple myeloma; IMA950, which is in Phase I clinical trial for the treatment of pancreatic cancer; and IMA960, a preclinical stage product candidate for the treatment of glioblastoma. Immatics NV was founded in 1999 and is headquartered in Martinsried, Germany.

Summary

Despite the lowered price target, the stock price moved up on the same day, suggesting that investors are still anticipating growth in the company. Investors should take into consideration TCRR’s current financials and performance before making an investment decision. There are a number of factors to consider when evaluating TCRR Therapeutics as an investment opportunity, such as the company’s competitive advantage, potential risks, and potential opportunities.

Furthermore, investors should keep track of any news or events that could potentially affect the stock price in the future. By conducting careful analysis and research, investors can make a more informed decision when it comes to investing in TCRR Therapeutics.

Recent Posts