Shareholders of Adaptive Biotechnologies See Dramatic Three-Year Loss of 76%

December 31, 2022

Trending News 🌧️

Adaptive Biotechnologies ($NASDAQ:ADPT) (NASDAQ:ADPT) is a biotechnology company based in Seattle, Washington. The company focuses on developing technologies for precision medicine and cancer immunology. Its core technology is a “molecular barcode” platform that enables scientists to rapidly identify and monitor millions of individual cells in the body. Adaptive Biotechnologies is also developing other technologies and products for diagnostics, biomarkers, and drug development. This week, Adaptive Biotechnologies saw its stock drop 17%, resulting in a three-year total loss of 76% for its shareholders. This dramatic decline was largely due to the company’s struggles to commercialize its products and to raise additional capital. This has caused a significant disruption to its operations and led to delays in product development and sales. The company has also had to lay off staff and reduce its research and development activities in order to cut costs.

Despite these challenges, Adaptive Biotechnologies remains committed to its mission of creating transformative technologies to advance precision medicine. The company is continuing to invest in research and development, and it has recently announced partnerships with several leading healthcare organizations to expand its reach. Adaptive Biotechnologies is also exploring strategic options to raise additional capital and to drive new revenue growth. With its focus on technology development, Adaptive Biotechnologies is well-positioned to benefit from the ongoing expansion of precision medicine. Its core barcode platform is expected to unlock new insights into the biology of diseases and lead to more effective treatments. As the company continues to grow and innovate, there is still hope that shareholders will eventually see a return on their investments.

Stock Price

Right now, news about Adaptive Biotechnologies is mostly mixed. These figures indicate that investors have not been particularly bullish on Adaptive Biotechnologies, but the positive increase in its stock price could be a sign that the company is beginning to turn things around. The company has been investing heavily in research and development and hiring new talent to help further its progress, and this could be a sign that they are beginning to see some payoff from their efforts. Adaptive Biotechnologies has also been making strategic partnerships with other companies in the biotech space, which could give them a competitive edge and help them gain market share.

Furthermore, they have recently received approval from the FDA for a new diagnostic test that could help diagnose diseases more quickly and accurately than ever before. These developments could help boost Adaptive Biotechnologies’ stock in the future, but for now, shareholders will have to wait and see if these recent moves will be enough to make up for the drastic three-year loss. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Adaptive Biotechnologies. More…

| Total Revenues | Net Income | Net Margin |

| 168.04 | -221.5 | -131.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Adaptive Biotechnologies. More…

| Operations | Investing | Financing |

| -207.75 | 167.66 | 135.54 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Adaptive Biotechnologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 884.21 | 396.39 | 3.41 |

Key Ratios Snapshot

Some of the financial key ratios for Adaptive Biotechnologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 29.1% | – | -132.5% |

| FCF Margin | ROE | ROA |

| -137.4% | -27.7% | -15.7% |

VI Analysis

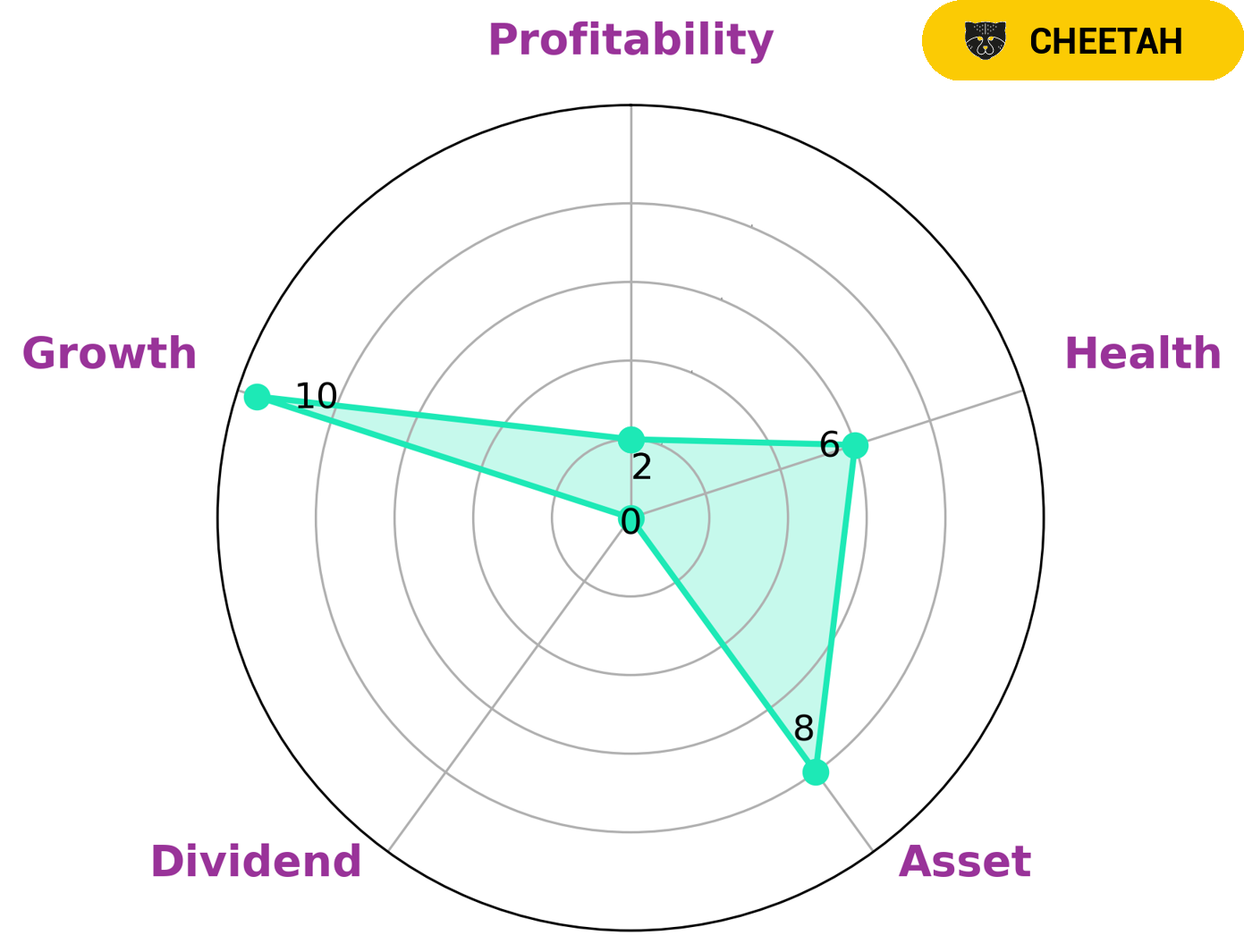

Investors looking to capitalize on the long-term potential of Adaptive Biotechnologies should consider the fundamentals of the company. VI’s Star Chart analysis shows that Adaptive Biotechnologies is strong in terms of assets and growth, but weak in dividend and profitability. Despite this, Adaptive Biotechnologies has an intermediate health score of 6/10 with regard to its cashflows and debt, indicating that it may be able to pay off debt and fund future operations. This means investors interested in companies with potential for long-term growth can look at Adaptive Biotechnologies despite its lower profitability. The company has also seen increased interest from investors in recent years, and its stock price has been steadily increasing. This suggests that, despite its weak profitability, Adaptive Biotechnologies’ long-term potential is attractive to many investors. Overall, Adaptive Biotechnologies is a company worth considering for those looking for potential long-term returns. Investors should review the company’s fundamentals carefully, as well as the stability of its cashflows and debt, in order to make an informed decision about their investment. More…

VI Peers

Adaptive Biotechnologies Corp is a biotechnology company that develops products to diagnose and treat cancer and other diseases. The company’s products are based on its proprietary technology platforms, which enable the company to identify and target cancer cells and other diseased cells. The company’s products include diagnostic tests and treatments for cancer, autoimmune diseases, and infectious diseases.

The company’s main competitors are Forte Biosciences Inc, Synaptogenix Inc, and Resverlogix Corp.

– Forte Biosciences Inc ($NASDAQ:FBRX)

Forte Biosciences Inc is a clinical-stage biopharmaceutical company that focuses on the development of therapeutics to improve patient outcomes in dermatology and immunology. The company’s lead product candidate is Vixari, a topical formulation of an anti-TNF-alpha biologic, which is in Phase 2 clinical trials for the treatment of plaque psoriasis. Forte Biosciences has a market cap of 20.95M as of 2022 and a Return on Equity of -42.75%. The company’s focus on developing therapeutics to improve patient outcomes in dermatology and immunology makes it a promising investment opportunity in the healthcare sector.

– Synaptogenix Inc ($NASDAQ:SNPX)

Synaptogenix is a clinical-stage biotechnology company developing drugs to treat neurodegenerative diseases. The company’s lead product candidate, SYN-115, is in development for the treatment of Alzheimer’s disease. Synaptogenix has a market cap of $43.23 million as of 2022 and a return on equity (ROE) of -38.9%. The company’s clinical-stage drugs are not yet approved for commercial use, which makes it a high-risk investment. However, the potential rewards for investors are significant if Synaptogenix is successful in developing an effective treatment for Alzheimer’s disease.

– Resverlogix Corp ($TSX:RVX)

Resverlogix Corp. is a biopharmaceutical company, which engages in the development of small molecule therapeutics for the treatment of atherosclerosis and associated diseases. Its products include RVX-208, RVX-210, and BETonMACE. The company was founded by Norman W. Wong on February 3, 2004 and is headquartered in Calgary, Canada.

Summary

Investing in Adaptive Biotechnologies is a risky endeavor. Despite the company’s recent three-year loss of 76%, there are some signs that point to potential positive gains for investors. First, news about the company has been generally positive lately. It has been involved in a number of successful partnerships and collaborations with other companies in the biotechnology sector. Second, Adaptive Biotechnologies’ stock price has been increasing recently, which suggests that there is some investor confidence in the company. Furthermore, Adaptive Biotechnologies has a strong research and development pipeline. The company is focused on developing cutting-edge technology and treatments for diseases such as cancer and autoimmune conditions. This could lead to the development of new drugs and treatments that could significantly increase the company’s revenue and profits. Additionally, Adaptive Biotechnologies has been expanding its product portfolio and entering new markets, which could also help drive growth.

However, investing in Adaptive Biotechnologies is still a risky proposition. The company’s losses over the past three years indicate that it is operating in a highly competitive and volatile industry. Furthermore, the company’s products are still in their early stages and may not be commercially successful. As such, potential investors should research and analyze the company’s business model and potential risks before making any investments.

Recent Posts