Sarepta Set to Receive FDA Advisory Committee Review for Muscular Dystrophy Treatment

April 11, 2023

Trending News 🌥️

Sarepta Therapeutics ($NASDAQ:SRPT) is a biopharmaceutical company focused on developing innovative therapies and treatments for rare neuromuscular diseases. Recently, the company has announced that a meeting of the Advisory Committee for its muscular dystrophy therapy has been scheduled to take place in May. This move has been hailed as a significant milestone on the way to the approval of their groundbreaking therapy. For those suffering from muscular dystrophy, the approval of this treatment could be a life-changing event. Not only would it offer relief to those suffering from the debilitating symptoms of the disease, but it would also open up new possibilities for treatment and research.

The results of the Advisory Committee’s review will be eagerly awaited by both those living with muscular dystrophy and the medical community. Sarepta Therapeutics is at the forefront of pioneering treatments for rare neuromuscular diseases and its potential approval of a muscular dystrophy treatment would be yet another example of the company’s commitment to finding innovative ways to combat serious illnesses. The results of the FDA Advisory Committee review will be closely watched in the months to come.

Market Price

On Monday, SAREPTA THERAPEUTICS stock opened at $139.0 and closed at $140.4, down by 1.5% from prior closing price of 142.6 due to news of the FDA Advisory Committee review for its muscular dystrophy treatment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sarepta Therapeutics. More…

| Total Revenues | Net Income | Net Margin |

| 933.01 | -703.49 | -67.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sarepta Therapeutics. More…

| Operations | Investing | Financing |

| -325.35 | -1.05k | 232.51 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sarepta Therapeutics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.13k | 2.74k | 4.38 |

Key Ratios Snapshot

Some of the financial key ratios for Sarepta Therapeutics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 34.8% | – | -68.2% |

| FCF Margin | ROE | ROA |

| -38.2% | -97.6% | -12.7% |

Analysis

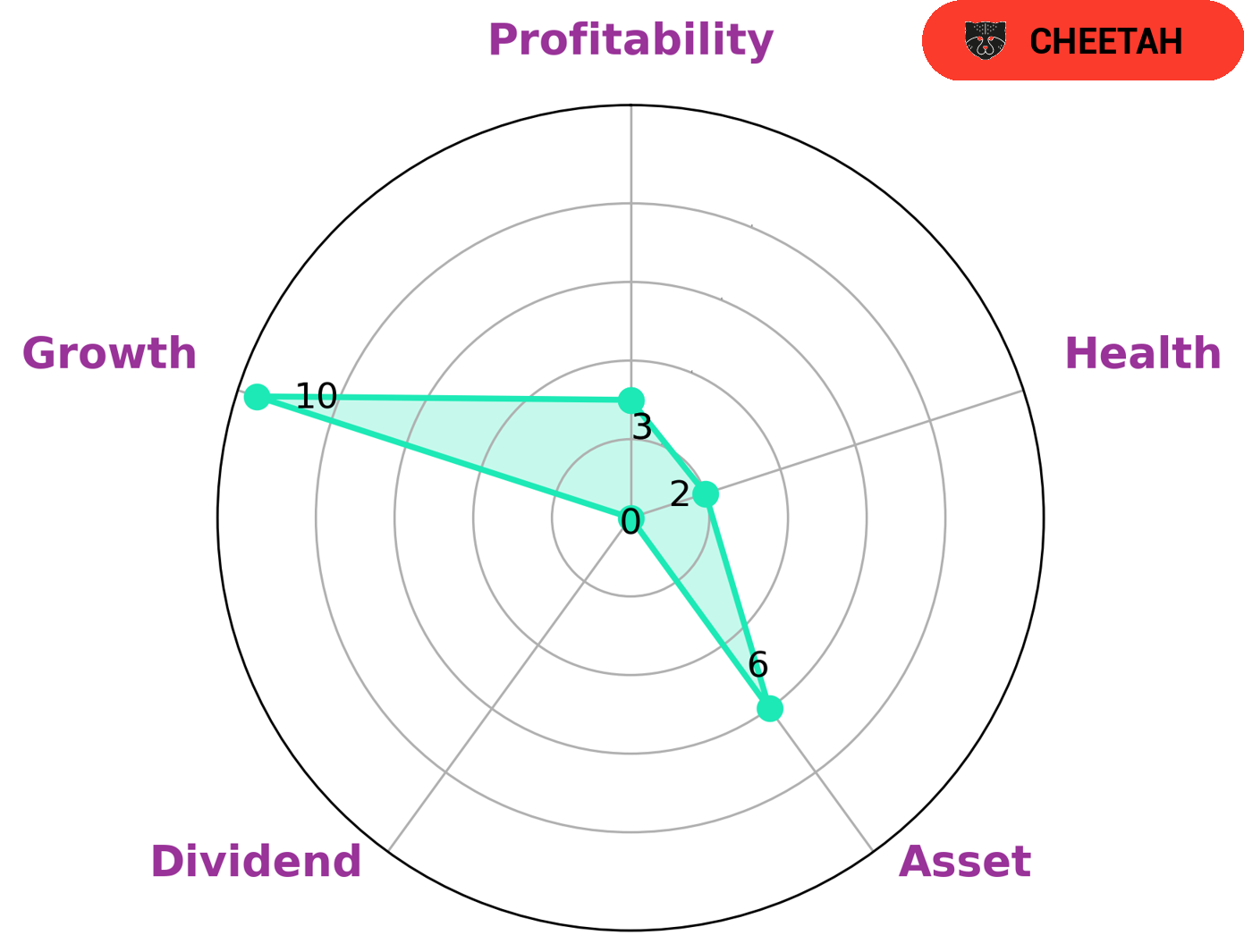

At GoodWhale, we have analyzed the financials of SAREPTA THERAPEUTICS and come up with an assessment of their performance. According to our Star Chart, SAREPTA THERAPEUTICS is strong in growth, medium in asset and weak in dividend and profitability. From this, we have classified them as a ‘cheetah’ – a company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This means that SAREPTA THERAPEUTICS might be an interesting investment opportunity for investors who are looking to take on some risk in order to potentially gain high rewards. However, their low health score of 2/10 considering their cashflows and debt, indicates that they are less likely to sustain future operations in times of crisis. Therefore, investors who are looking for a more secure and stable investment may want to look elsewhere. More…

Peers

The company is headquartered in Cambridge, Massachusetts and was founded in 1980. Sarepta Therapeutics Inc has four main competitors: Genor Biopharma Holdings Ltd, Impel Pharmaceuticals Inc, Entera Bio Ltd, and PTC Therapeutics Inc. These companies are all focused on the development of treatments for DMD and other rare diseases.

– Genor Biopharma Holdings Ltd ($SEHK:06998)

Genor Biopharma Holdings Ltd is a pharmaceutical company that focuses on the development and commercialization of innovative drugs for the treatment of cancer. The company has a market cap of 949.11M as of 2022 and a ROE of -23.99%. The company’s products are designed to target specific genetic mutations that are known to drive the growth and progression of cancer.

– Impel Pharmaceuticals Inc ($NASDAQ:IMPL)

Impel Pharmaceuticals Inc is a pharmaceutical company with a market cap of 94.72M as of 2022. The company has a Return on Equity of -359.89%. Impel Pharmaceuticals Inc is a company that focuses on the development and commercialization of drugs for the treatment of central nervous system disorders.

– Entera Bio Ltd ($NASDAQ:ENTX)

Entera Bio Ltd is a clinical-stage biopharmaceutical company focused on the development and commercialization of oral therapeutics for serious unmet medical needs. The company’s lead product candidate is EB614, an oral biologic that is in clinical development for the treatment of osteoporosis, inflammatory bowel disease, and other immune-mediated diseases. Entera Bio Ltd has a market cap of 24.06M as of 2022, a Return on Equity of -48.6%. The company’s focus on the development and commercialization of oral therapeutics makes it a unique player in the biopharmaceutical market. However, its negative ROE indicates that it is not a profitable company at this time.

Summary

Sarepta Therapeutics, Inc. recently announced an upcoming advisory committee meeting for its muscular dystrophy therapy. Investors are closely watching the company, which is a leader in the development of genetic therapies for treating debilitating diseases. Many are hoping for an approval for the therapy that could bring significant returns on their investments. Analysts have suggested that based on the promising results of clinical trials and the positive response from key opinion leaders, there is a strong probability of the therapy being approved.

This could lead to a surge in Sarepta’s stock price, which has seen declines in recent months. Investors should closely monitor further developments in this sector and consider adding Sarepta to their portfolios if the anticipated approval arrives.

Recent Posts