Sage Therapeutics Stock Fair Value Calculator – Sage Therapeutics Shares Drop by 1.31% After Correction Rumors

April 28, 2023

Trending News 🌥️

Sage Therapeutics ($NASDAQ:SAGE) Inc., a biopharmaceutical company focused on the development of novel medicines to treat central nervous system disorders, has seen its share price decline by 1.31% after rumors of a potential correction on the market. Closing at $46.81, down from the previous closing price of $47.43, investors may be expecting a positive shift in the company’s stock. Sage Therapeutics Inc. has a solid portfolio, with many of its drugs currently in clinical trials. The company is also actively working on treatments for post-traumatic stress disorder, major depressive disorder, and anxiety disorder, and has been successful in developing new treatments for rare diseases such as Niemann-Pick Type C and Lennox-Gastaut Syndrome.

With a strong portfolio and ongoing research, investors are hopeful that Sage Therapeutics Inc. can turn their shares around. If the rumors of a correction prove to be true, it could be a great opportunity for investors to get in on the ground floor and reap the rewards of this innovative company. Only time will tell if a turnaround is on the horizon.

Share Price

On Monday, Sage Therapeutics Inc. shares dropped by 1.31%. This drop was the result of rumors that suggested a correction in the stock market. The opening price of SAGE THERAPEUTICS stock on Monday was $47.6, and it closed at $47.2, which was a 0.6% drop from the previous closing price of $47.5.

This decline indicates that investors felt wary of the rumors and were not willing to continue investing in the company. It remains to be seen how the stock will fare in the future, and if the correction rumors are true. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sage Therapeutics. More…

| Total Revenues | Net Income | Net Margin |

| 7.69 | -532.78 | -6931.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sage Therapeutics. More…

| Operations | Investing | Financing |

| -460.04 | 325.43 | 3.07 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sage Therapeutics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.36k | 103.85 | 21.05 |

Key Ratios Snapshot

Some of the financial key ratios for Sage Therapeutics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.8% | – | -7116.7% |

| FCF Margin | ROE | ROA |

| -5997.6% | -26.0% | -25.2% |

Analysis – Sage Therapeutics Stock Fair Value Calculator

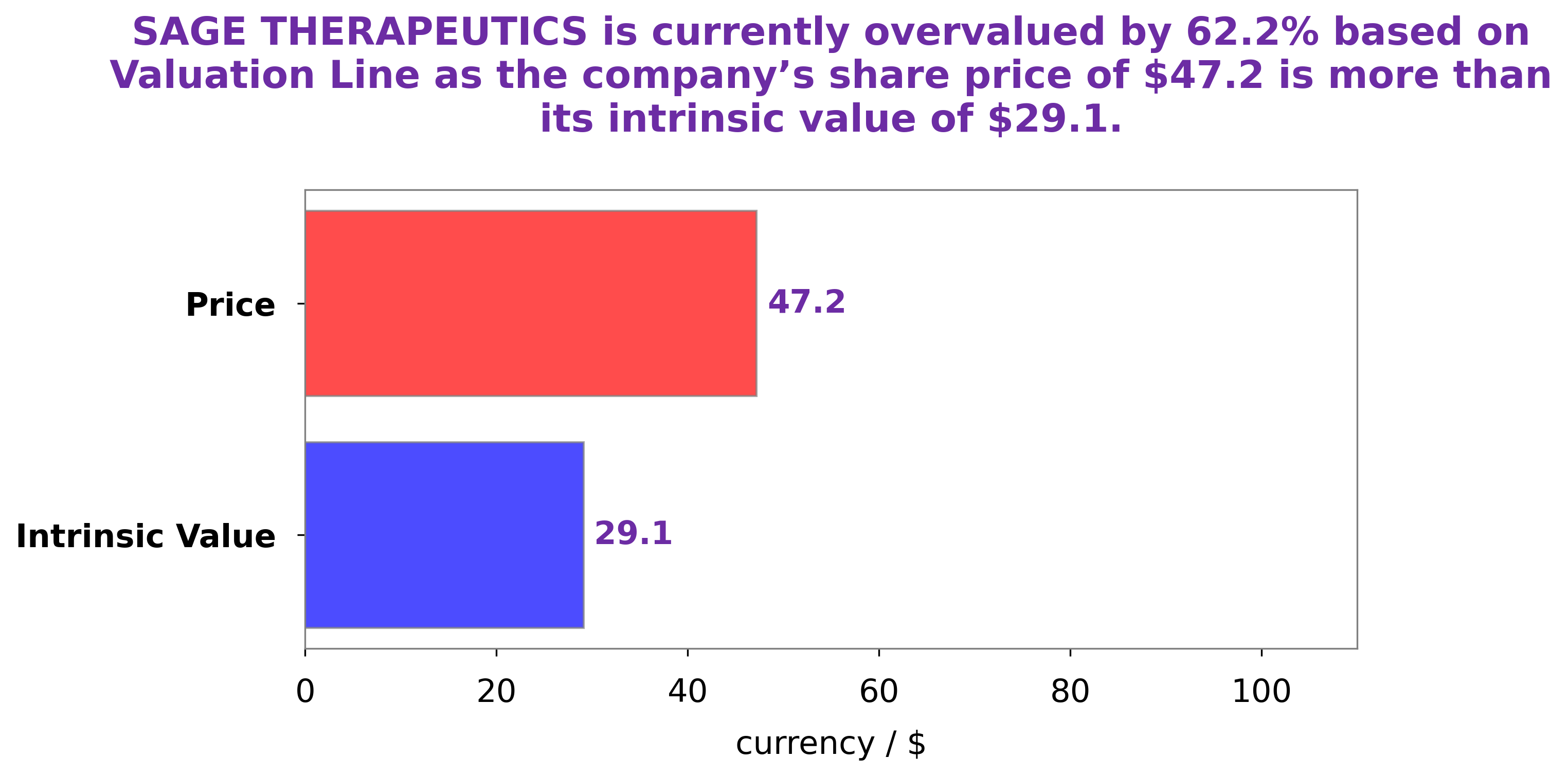

GoodWhale performed an analysis of SAGE THERAPEUTICS‘ financials and found that the fair value of its shares is around $29.1. This value was calculated using our proprietary Valuation Line, which takes into consideration a range of metrics such as the company’s historical performance, current market conditions, and more. However, SAGE THERAPEUTICS stock is currently being traded at $47.2, meaning that it is overvalued by 62.2%. This could be because of bullish sentiment in the market, or because investors are expecting good news from SAGE THERAPEUTICS in the near future. Whatever the reason may be, it is worth keeping an eye on SAGE THERAPEUTICS share price to see if it will come down to its fair value or continue to remain overvalued. More…

Peers

The company has a strong focus on the development of novel therapies for the treatment of rare and orphan diseases. The company has a portfolio of products in various stages of development. The company’s products include Sage-547, an intravenous formulation of zolmitriptan for the treatment of migraines; Sage-217, an oral formulation of zolmitriptan for the treatment of cluster headaches; and Sage-689, an intranasal formulation of zolmitriptan for the treatment of migraines. The company is also developing product candidates for the treatment of Alzheimer’s disease, Parkinson’s disease, and epilepsy.

– Rocket Pharmaceuticals Inc ($NASDAQ:RCKT)

Rocket Pharmaceuticals Inc has a market cap of 1.48B as of 2022, a Return on Equity of -32.38%. The company focuses on the development and commercialization of innovative therapies for rare genetic diseases. The company’s mission is to provide hope to patients and their families by delivering life-changing treatments.

– Aileron Therapeutics Inc ($NASDAQ:ALRN)

Aileron Therapeutics Inc is a clinical-stage biopharmaceutical company. The company focuses on the development of drugs for the treatment of cancer. Its lead product candidate is ALRN-6924, which is in Phase I clinical trials for the treatment of solid tumors and hematologic malignancies. Aileron Therapeutics Inc has a market cap of 305.62M as of 2022, a Return on Equity of -56.6%.

– CinCor Pharma Inc ($NASDAQ:CINC)

CinCor Pharma Inc is a pharmaceutical company with a market cap of 1.23B as of 2022 and a ROE of 78.34%. The company’s main focus is on the development and commercialization of treatments for cancer and other diseases. CinCor has a portfolio of products in various stages of development, including two products that are currently approved by the FDA. The company’s most advanced product is in Phase III clinical trials for the treatment of gastric cancer. CinCor is also developing a number of other products for the treatment of various cancers and other diseases.

Summary

Sage Therapeutics Inc. is a biopharmaceutical company focused on developing and commercializing innovative medicines for central nervous system (CNS) disorders. In the latest trading session, shares of Sage Therapeutics Inc. closed at $46.81, a 1.31% decrease from the previous closing price of $47.43. This downturn could be an opportunity for potential investors to enter the market and capitalize on Sage Therapeutics’ potential.

Analysts have indicated that the company’s clinical-stage CNS pipeline, which includes several drug candidates in Phase 3 clinical trials, could lead to strong long-term performance in the future. Overall, Sage Therapeutics appears to be a promising investment option in the biopharmaceutical space, and investors should closely monitor the company and its developments going forward.

Recent Posts