Revolution Medicines Unveils an Earnings Mystery

February 3, 2023

Trending News 🌥️

Revolution Medicines ($NASDAQ:RVMD) Inc. recently unveiled an earnings enigma that has sent investors into a frenzy. It is publicly listed on the Nasdaq and has a market capitalization of around $6 billion. Revolution Medicines Inc. has a portfolio of promising drug candidates and has made significant progress in clinical development. Additionally, they are developing several additional drugs in various stages of clinical development.

However, the company’s most recent earnings report revealed a mystery. This has caused some investors to question whether the company’s current strategies are sound or if they are running into unexpected obstacles. The cause of this earnings enigma remains unclear, but the company is determined to find an answer. In order to do so, they have assembled a team of experts to investigate the situation and determine what went wrong. This team includes financial analysts, industry experts, and clinicians, who are all working together to uncover the cause of this mysterious earnings report. Given the progress made in clinical development and the promising outlook for their drug candidates, many investors remain optimistic about Revolution Medicines Inc. Despite the current mystery surrounding their earnings report, the company is confident that they will be able to resolve the issue and continue their mission of providing innovative therapies for cancer and other serious diseases.

Share Price

Revolution Medicines Inc. unveiled an earnings mystery on Thursday as their stock opened at $27.4 and closed at $27.5, up by 1.6% from its previous closing price of 27.1. The mystery surrounding the earnings of Revolution Medicines Inc. is intriguing, given the fact that the company has recently been investing heavily in research and development, and has made several strategic acquisitions in the biotech sector. The company also announced that it has entered into a collaboration with Gilead Sciences to develop treatments for patients with cancer and other serious diseases. Despite these investments, Revolution Medicines Inc. has not yet shown any signs of significant growth in earnings. Analysts speculate that this could be due to the company’s investments not yet bearing fruit or the market not recognizing its potential. It is also possible that the company’s earnings are being held back by other factors such as competition or pricing issues.

Regardless, investors will be keeping a close eye on Revolution Medicines Inc. to see if it will be able to unlock its potential and deliver on its promise of innovation and growth. With its recent investments and strategic acquisitions, the company appears to have the necessary resources and expertise to achieve success in the long run. Whether or not Revolution Medicines Inc. will be able to deliver on its promise of strong earnings remains to be seen. For now, investors will have to wait and see how the mystery of its earnings unfolds. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Revolution Medicines. More…

| Total Revenues | Net Income | Net Margin |

| 29.51 | -244.87 | -829.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Revolution Medicines. More…

| Operations | Investing | Financing |

| -201.88 | -8.48 | 260.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Revolution Medicines. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 825.91 | 144.49 | 7.76 |

Key Ratios Snapshot

Some of the financial key ratios for Revolution Medicines are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -15.1% | – | -830.8% |

| FCF Margin | ROE | ROA |

| -715.0% | -26.0% | -18.6% |

Analysis

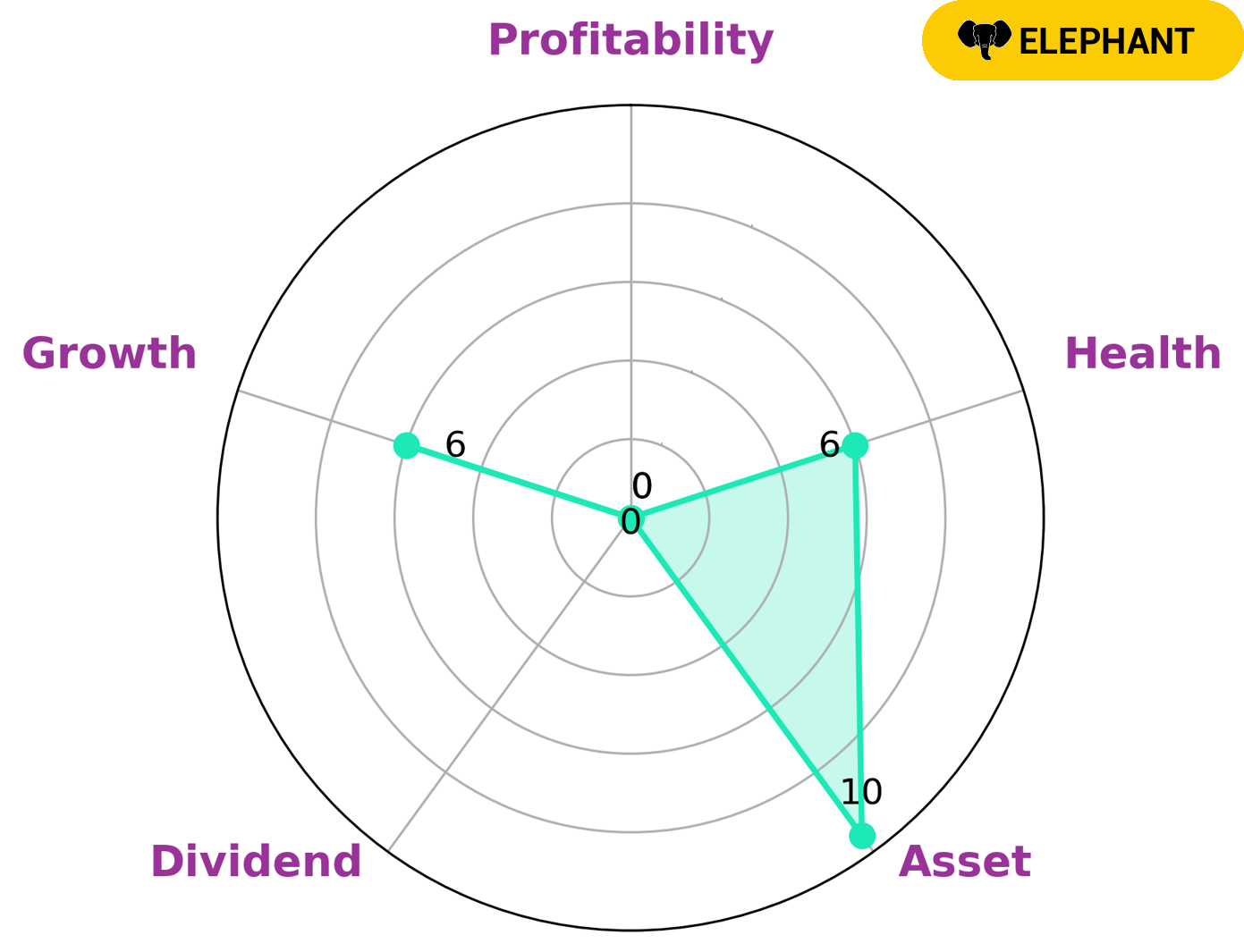

REVOLUTION MEDICINES can be analyzed with the financial analysis tool GoodWhale. According to the Star Chart, the company has an intermediate health score of 6/10, meaning it is in a relatively stable position and should be able to handle any financial crisis without the risk of bankruptcy. Additionally, REVOLUTION MEDICINES is classified as an ‘elephant’, which means that it has a high amount of assets after deducting off liabilities. This type of company would likely be attractive to investors who are looking for a large and secure investment, such as institutional investors and pension funds. REVOLUTION MEDICINES is strong in asset, but average in terms of growth, dividend and profitability, meaning that investors should not expect to see a high return on their investment. However, due to the company’s large amount of assets, the risk of a financial collapse is low and thus investors may be willing to overlook the lack of growth potential. More…

Peers

The company’s most advanced product candidate is RMC-4630, which is in development for the treatment of solid tumors. The company’s competitors include Rain Therapeutics Inc, Chinook Therapeutics Inc, and Erasca Inc.

– Rain Therapeutics Inc ($NASDAQ:RAIN)

Rain Therapeutics Inc is a clinical-stage biopharmaceutical company focused on discovering, developing and commercializing small molecule drugs to treat patients with cancer. The company’s lead product candidate is rivoceranib, a small molecule inhibitor of the tyrosine kinase receptor VEGFR2, which is in Phase III clinical trials for the treatment of second-line non-small cell lung cancer (NSCLC).

– Chinook Therapeutics Inc ($NASDAQ:KDNY)

Chinook Therapeutics Inc is a clinical-stage biopharmaceutical company focused on discovering, developing and commercializing targeted therapies for serious kidney diseases. The company’s lead product candidate, CHK-336, is a first-in-class, orally-administered small molecule inhibitor of the renal outer medullary potassium channel, or ROMK, which is being developed for the treatment of autosomal dominant polycystic kidney disease, or ADPKD. As of 2022, the company had a market cap of 1.38B and a return on equity of -11.14%.

– Erasca Inc ($NASDAQ:ERAS)

Erasca Inc is a biopharmaceutical company that focuses on the development of cancer therapies. The company has a market cap of 1.03B as of 2022 and a return on equity of -20.55%. Erasca’s focus on developing cancer therapies makes it a unique biopharmaceutical company, and its market cap and ROE reflect this. Erasca is a relatively new company, and its lack of profitability is to be expected. However, its focus on developing innovative cancer therapies gives it great potential for future growth.

Summary

Revolution Medicines Inc. has released its latest earnings report, and the numbers have surprised many. The company’s net income was higher than expected, but the sales and revenues were lower than anticipated. This has left investors wondering what to make of the results.

Analysts are examining the numbers carefully to determine whether the higher income was due to one-time gains or if there is something more fundamental behind the surprise increase. Investors need to consider the company’s fundamentals, competitive landscape, and potential catalysts for growth before making any investing decisions.

Recent Posts