RELAY THERAPEUTICS Shares Plunge Following Release of RLY-2608 Cancer Drug Data

April 19, 2023

Trending News 🌧️

Shares of Relay Therapeutics ($NASDAQ:RLAY), a biopharmaceutical company focused on the development of medicines to treat cancer, took a plunge of almost 30% following the release of the first results of its experimental cancer drug, RLY-2608. Relay Therapeutics is a publicly listed company dedicated to the development of therapies to treat cancer by specifically targeting protein dynamics. They have developed a technology platform to study and modulate protein dynamics, which they believe will enable them to develop innovative medicines with potential efficacy advantages over existing cancer treatments. Since the release of its first round of results for RLY-2608, which showed promising activity against certain types of cancer, investors were eager to find out more information about the drug’s efficacy.

However, the results from the most recent trial were not as promising as investors had hoped, leading to a sharp decline in Relay’s stock price. Investors are now keeping a close eye on the company’s next move and the overall performance of its other experimental drugs.

Price History

On Tuesday, RELAY THERAPEUTICS stock experienced a sharp decline of 36.2% from its closing price of 18.2 the previous day, leaving its stock to open at $18.0 and close at 11.6. The plunge in the company’s stock was triggered by the release of RLY-2608 cancer drug data that showed disappointing results. RELAY THERAPEUTICS had been counting on the drug to be a breakthrough treatment for certain types of cancer.

Due to the low efficacy and safety data, investors were concerned that the drug would not be able to receive approval and the company’s growth prospects were threatened. Consequently, investors reacted to the news with a selloff that caused the sharp decline in RELAY THERAPEUTICS’ stock price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Relay Therapeutics. More…

| Total Revenues | Net Income | Net Margin |

| 1.38 | -290.51 | -21881.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Relay Therapeutics. More…

| Operations | Investing | Financing |

| -229.49 | -188.75 | 289.91 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Relay Therapeutics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.1k | 149.55 | 7.85 |

Key Ratios Snapshot

Some of the financial key ratios for Relay Therapeutics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -22516.4% |

| FCF Margin | ROE | ROA |

| -17273.9% | -19.9% | -17.7% |

Analysis

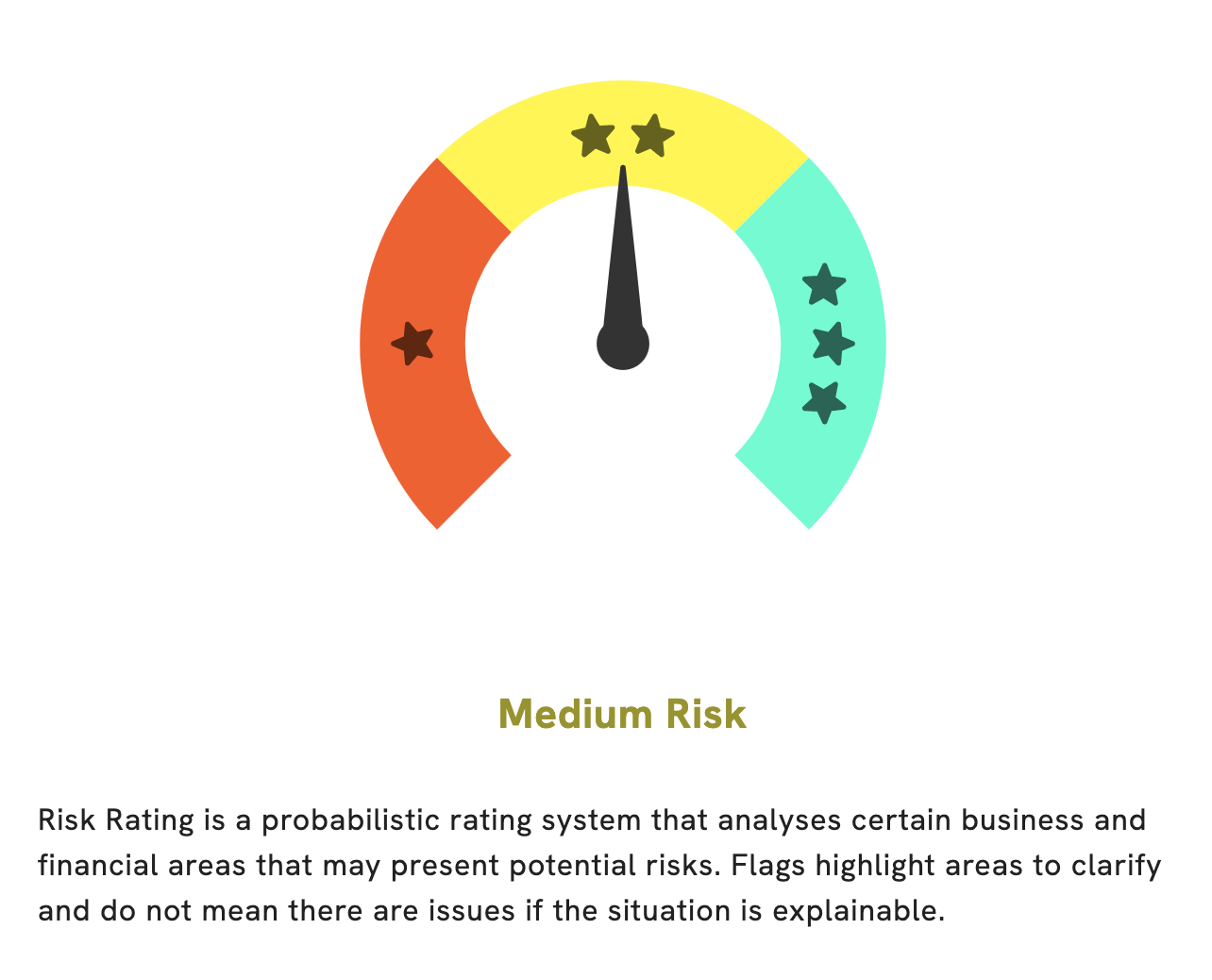

At GoodWhale, we have conducted an analysis of RELAY THERAPEUTICS‘s fundamentals. According to our Risk Rating, RELAY THERAPEUTICS is a medium risk investment in terms of financial and business aspects. We have detected two risk warnings in their balance sheet and cash flow statement. If you want to find out more, simply become a registered user to gain access to our detailed analysis. More…

Peers

The company uses artificial intelligence to design and develop small molecule therapeutics for cancer patients. Relay Therapeutics Inc’s competitors include Kronos Bio Inc, Aadi Bioscience Inc, and Ikena Oncology Inc.

– Kronos Bio Inc ($NASDAQ:KRON)

Kronos Bio Inc is a clinical-stage biopharmaceutical company focused on the discovery and development of next-generation cancer therapies. The company’s lead product candidate is entospletinib, a selective inhibitor of the tyrosine kinase activity of the epidermal growth factor receptor (EGFR) family of proteins. Kronos Bio Inc has a market cap of 146.46M as of 2022, a Return on Equity of -33.99%. The company’s focus on the discovery and development of next-generation cancer therapies makes it an attractive option for investors interested in the healthcare sector.

– Aadi Bioscience Inc ($NASDAQ:AADI)

Aadi Bioscience Inc is a clinical-stage biopharmaceutical company focused on the development of novel therapeutics for the treatment of cancer. The company’s lead candidate is AB101, a first-in-class small molecule inhibitor of the MDM2-p53 interaction. AB101 is currently being evaluated in a Phase 1/2 clinical trial in patients with advanced solid tumors. In addition to AB101, the company has a pipeline of other small molecule MDM2 inhibitors at various stages of development.

Aadi Bioscience Inc has a market cap of 305.67M as of 2022. The company’s return on equity for the same period is -72.24%. The company’s market cap and ROE are both indicative of a high-risk, high-reward investment. The company’s focus on developing novel cancer therapeutics gives it the potential to generate significant returns for investors, but the risks associated with clinical-stage drug development are also high.

– Ikena Oncology Inc ($NASDAQ:IKNA)

Ikena Oncology Inc is a clinical stage biopharmaceutical company, developing cancer therapies. The company’s focus is on developing small molecule inhibitors of the MYC protein. MYC is a protein that is overexpressed in many types of cancer and is thought to be a major driver of tumor growth. Ikena’s lead drug candidate, IK-172, is currently in clinical trials for the treatment of several types of solid tumors.

Ikena has a market cap of 92.44M as of 2022 and a Return on Equity of -16.89%. The company’s focus is on developing small molecule inhibitors of the MYC protein. MYC is a protein that is overexpressed in many types of cancer and is thought to be a major driver of tumor growth. Ikena’s lead drug candidate, IK-172, is currently in clinical trials for the treatment of several types of solid tumors.

Summary

Relay Therapeutics saw a significant drop in their stock price on the same day that initial data from their drug RLY-2608 was released. Investors are concerned that the results were not as promising as first anticipated, which is causing the stock to slump by almost 30%. It is important to remember that the development of new drugs is a long and complex process and much more information must be considered before making any decisions related to investing in Relay Therapeutics.

In the short term, this data may have caused investors to have a more negative outlook on the potential success of RLY-2608, however in the long term, it is important to monitor the progress of this drug and other products from Relay Therapeutics. With a careful evaluation of the risks and rewards, investing in Relay could prove to be profitable for investors.

Recent Posts