Ranting About ACADIA Pharmaceuticals Inc: What You Need to Know

February 17, 2023

Trending News 🌥️

ACADIA ($NASDAQ:ACAD) Pharmaceuticals Inc. is a biopharmaceutical company dedicated to developing and commercializing treatments for central nervous system disorders. Although their focus has been on delivering treatments to patients suffering from these conditions, they have also become a major player in the field of neuroscience research and development. The company has made some significant advances in its research and development, such as creating treatments for Parkinson’s Disease that has shown to have a dramatic effect on patients, resulting in improved motor and cognitive functions. The company also created Nuplazid, a drug approved by the US Food and Drug Administration (FDA) to treat the symptoms of psychosis associated with Parkinson’s Disease. Other products from ACADIA are in late stage clinical trials, and it is anticipated that in the near future they will be able to provide treatments for a variety of psychiatric and neurological disorders. Despite their success, there are also some controversial aspects of ACADIA Pharmaceuticals Inc. that need to be addressed. The company has been accused of overcharging for its products, which are often expensive compared to other drugs on the market. This has led to criticism from health care providers and has been a source of tension between ACADIA and government regulators.

Additionally, there have been allegations that the company may be involved in shady practices in order to further their own interests. While they have achieved success in this area, there have also been issues with pricing and accusations of unethical behavior that need to be addressed.

Market Price

ACADIA Pharmaceuticals Inc. has received mostly positive media coverage till now, with a rising stock trajectory. On Monday, ACADIA PHARMACEUTICALS stock opened at $19.0 and closed at $19.2, representing a 1.1% increase from its previous closing price of 19.0. This slight increase could be indicative of the stock’s future prospects, and investors should take note of the company’s growth potential. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Acadia Pharmaceuticals. More…

| Total Revenues | Net Income | Net Margin |

| 511.5 | -217.34 | -42.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Acadia Pharmaceuticals. More…

| Operations | Investing | Financing |

| -113.3 | 162.54 | 10.95 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Acadia Pharmaceuticals. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 602.49 | 176.81 | 2.63 |

Key Ratios Snapshot

Some of the financial key ratios for Acadia Pharmaceuticals are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.4% | – | -43.4% |

| FCF Margin | ROE | ROA |

| -22.2% | -32.3% | -23.0% |

Analysis

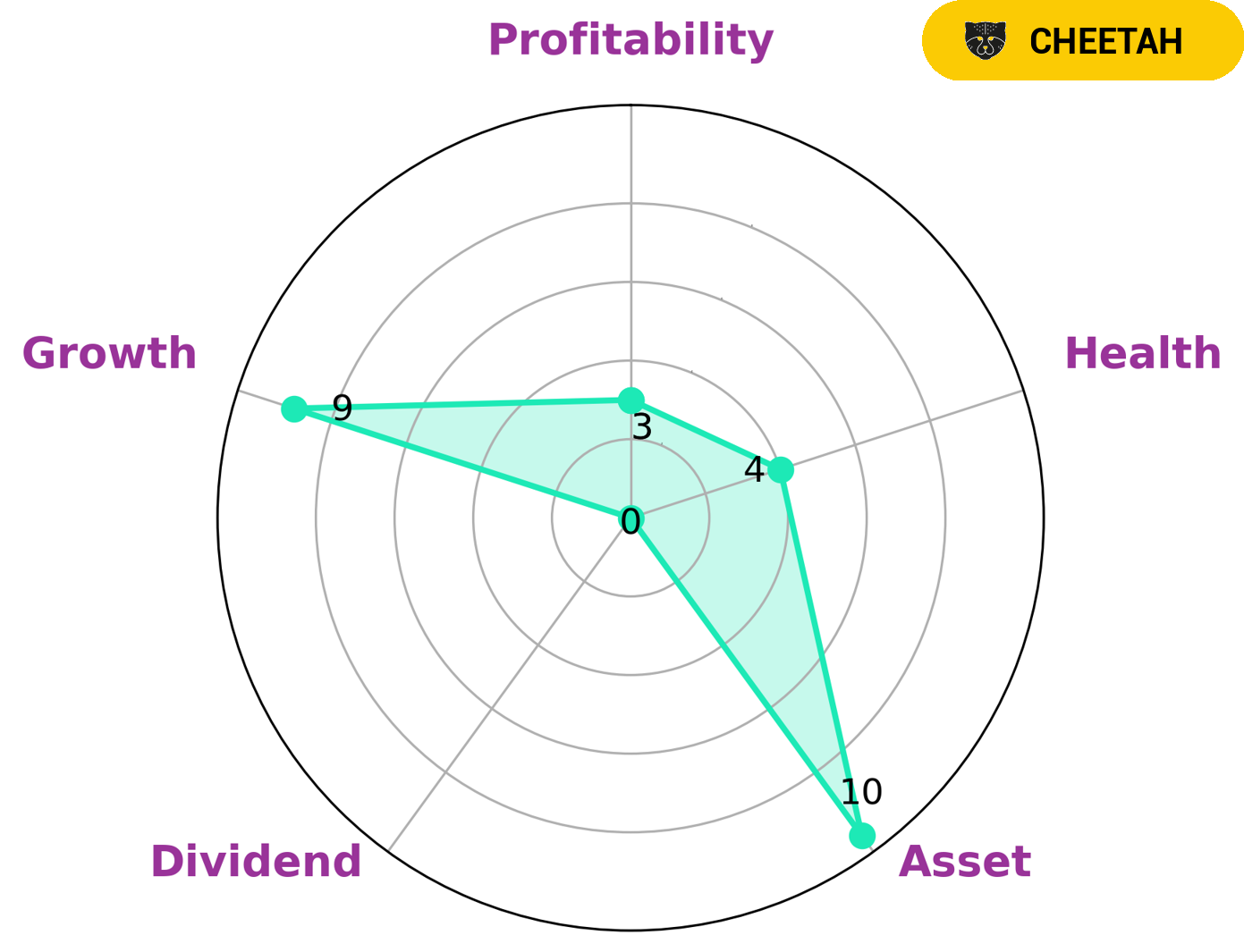

After analyzing ACADIA PHARMACEUTICALS with GoodWhale, it’s easy to see their performance. According to the Star Chart, ACADIA PHARMACEUTICALS is classified as a ‘cheetah’ company, and this means that they have achieved high revenue or earnings growth but are considered less stable because of lower profitability. As a result, this may be interesting for certain types of investors. When looking at ACADIA PHARMACEUTICALS’ fundamentals, we can see that they are strong in terms of asset and growth, but weak in terms of dividend and profitability. They also have an intermediate health score of 4/10 with regard to their cashflows and debt; this means that they may be able to safely ride out any crisis without the risk of bankruptcy. Therefore, investors interested in investing in ACADIA PHARMACEUTICALS should consider all of these factors carefully before making any decision. More…

Peers

ACADIA Pharmaceuticals Inc is a company that focuses on the development of drugs for the treatment of central nervous system disorders. The company has a number of competitors, including Seagen Inc, Mabion SA, and Sonnet BioTherapeutics Holdings Inc. Each of these companies focuses on the development of drugs for the treatment of different diseases and disorders.

– Seagen Inc ($NASDAQ:SGEN)

Seagen Inc. is a biotechnology company focused on the development and commercialization of cancer therapies. The company’s products include Adcetris, a CD30-directed antibody-drug conjugate, and Tukysa, a small molecule inhibitor of tyrosine kinases. Seagen Inc. has a market cap of $23.95 billion and a return on equity of -14.89%. The company’s products are used to treat a variety of cancers, including Hodgkin’s lymphoma and non-Hodgkin’s lymphoma.

– Mabion SA ($LTS:0QGW)

Mabion is a publicly traded company on the Warsaw Stock Exchange. The company’s market capitalization is $345.53 million as of 2022. The company’s return on equity is 23.01%. Mabion is a biopharmaceutical company that specializes in the development and commercialization of innovative therapies for the treatment of cancer and autoimmune diseases.

– Sonnet BioTherapeutics Holdings Inc ($NASDAQ:SONN)

Sonnet BioTherapeutics is a clinical-stage biopharmaceutical company developing next-generation Antibody-Drug Conjugates (ADCs) for the treatment of cancer. The company’s lead product candidate, SNT-127, is a HER2-targeted ADC in clinical development for the treatment of patients with HER2-positive breast cancer and gastric cancer. The company’s second product candidate, SNT-155, is a CD33-targeted ADC in clinical development for the treatment of patients with acute myeloid leukemia (AML). Sonnet BioTherapeutics is headquartered in New York, New York.

As of 2022, Sonnet BioTherapeutics has a market cap of 5.11M and a Return on Equity of -393.11%. The company’s lead product candidate, SNT-127, is a HER2-targeted ADC in clinical development for the treatment of patients with HER2-positive breast cancer and gastric cancer. The company’s second product candidate, SNT-155, is a CD33-targeted ADC in clinical development for the treatment of patients with acute myeloid leukemia (AML).

Summary

ACADIA Pharmaceuticals Inc. has seen an increase in its share price over the past year, and recent media coverage has been mostly positive. Analysts suggest that the focus is on its current product offerings, as well as their development of CNS-focused therapeutics to treat serious neurological and psychiatric disorders. Investors have credited the company with strong financials and a pipeline of potential drugs that could help reduce costs for patients and healthcare providers, leading to further growth for ACADIA.

The company’s upcoming clinical trials are closely watched and expected to provide an indication of the company’s long-term prospects. As such, investors should closely monitor clinical results and the progress of drug development to help inform an investment strategy in ACADIA.

Recent Posts