POINT BIOPHARMA GLOBAL Reports FY2023 Q1 Earnings Results for Period Ending May 15 2023.

May 26, 2023

Earnings Overview

POINT BIOPHARMA GLOBAL ($NASDAQ:PNT) released its financial results for the first quarter of FY2023 on March 31 2023, with total revenue increasing to USD 9.5 million from 0.0 million in the same period of the previous year. Despite this, the company’s net income decreased slightly to USD -16.5 million, compared to -16.4 million reported a year ago.

Price History

On Monday, POINT BIOPHARMA GLOBAL announced its financial results for its first quarter of FY2023 ending May 15 2023. POINT BIOPHARMA GLOBAL reported strong earnings results with the stock opening at $9.9 and closing at $10.5, a rise of 9.8% from the prior closing price of $9.6. This marks a strong start for the company as it looks to continue gaining momentum throughout the fiscal year with positive results and expansion.

The company is looking to capitalize on new opportunities and partnerships in order to continue growing this quarter and beyond. Going forward, POINT BIOPHARMA GLOBAL is confident in its ability to deliver steady growth for investors and shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for PNT. More…

| Total Revenues | Net Income | Net Margin |

| 236.04 | 98.14 | 39.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for PNT. More…

| Operations | Investing | Financing |

| 171.62 | -418.37 | 130.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for PNT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 558.52 | 86.74 | 4.46 |

Key Ratios Snapshot

Some of the financial key ratios for PNT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 50.6% |

| FCF Margin | ROE | ROA |

| 66.2% | 15.6% | 13.4% |

Analysis

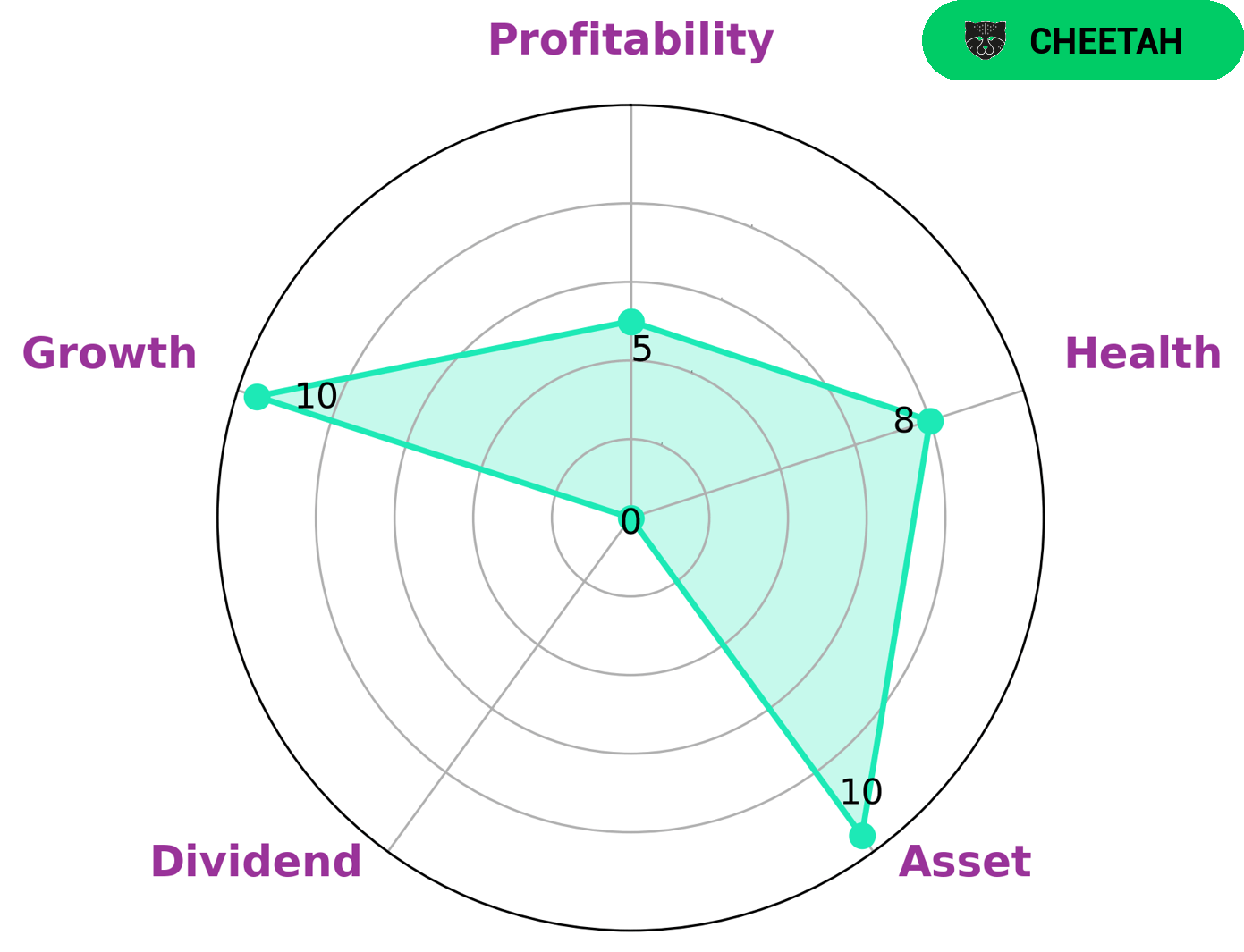

Using GoodWhale’s fundamentals analysis, we can analyze the financial health of POINT BIOPHARMA GLOBAL. According to our Star Chart, POINT BIOPHARMA GLOBAL has a high health score of 8/10, indicating its ability to sustain future operations in times of crisis. We classify the company as a ‘cheetah’, meaning it achieved high revenue or earnings growth but is considered less stable due to lower profitability. For investors looking to get involved in POINT BIOPHARMA GLOBAL, we believe it is strong in asset and growth, medium in profitability, and weak in dividend. Its stability and potential for growth make it an attractive investment opportunity for those who are looking for higher-risk, higher-reward investments. With our analysis, investors can be confident that their investments with POINT BIOPHARMA GLOBAL will be well-protected. More…

Peers

The company’s main competitors are Annovis Bio Inc, Plus Therapeutics Inc, and Jazz Pharmaceuticals PLC. All of these companies are working to develop new and innovative treatments for cancer.

– Annovis Bio Inc ($NYSE:ANVS)

Annovis Bio Inc is a clinical stage biopharmaceutical company developing a pipeline of therapeutic candidates for the treatment of neurological diseases. The company’s lead product candidate, ANVS-401, is a monoclonal antibody being developed for the treatment of Alzheimer’s disease. Annovis Bio Inc has a market cap of 100.01M as of 2022, a Return on Equity of -37.92%.

Annovis Bio Inc is a clinical stage biopharmaceutical company developing a pipeline of therapeutic candidates for the treatment of neurological diseases. The company’s lead product candidate, ANVS-401, is a monoclonal antibody being developed for the treatment of Alzheimer’s disease. Annovis Bio Inc’s market cap is 100.01M as of 2022, and its ROE is -37.92%.

– Plus Therapeutics Inc ($NASDAQ:PSTV)

The company’s market cap is 14.14M as of 2022 and its ROE is -106.7%. The company is engaged in the development of therapeutics for the treatment of cancer.

– Jazz Pharmaceuticals PLC ($NASDAQ:JAZZ)

Jazz Pharmaceuticals PLC is a biopharmaceutical company that focuses on the research, development, and commercialization of pharmaceutical products. The company has a market cap of $9.11 billion and a return on equity of 4.24%. Jazz Pharmaceuticals PLC focuses on the treatment of central nervous system disorders, including sleep disorders, pain, and psychiatric disorders. The company’s products include Xyrem, Erwinaze, Defitelio, and Vyxeos.

Summary

Investors in Point Biopharma Global are likely encouraged by the increase in total revenue reported for the first quarter of FY2023. Despite this, the company posted a net income of -16.5 million, a slight decrease from the prior year. It is recommended that investors examine the company’s financials and business operations more closely in order to make an informed decision about investing in the company. Furthermore, with stock prices moving up on the news, it is important to consider the potential risks associated with investing in Point Biopharma Global.

Recent Posts