PHENOMEX INC Reports Q1 Earnings of USD 18.5 Million, 8.4% Decrease From Last Year.

May 26, 2023

Earnings Overview

On March 31, 2023, PHENOMEX INC ($BER:64B) reported their Q1 earnings results for the fiscal year 2023, with total revenue of USD 18.5 million, 8.4% lower than the prior year’s figure. The company reported a net income of USD -23.4 million, compared to -21.4 million in Q1 of the previous year.

Analysis

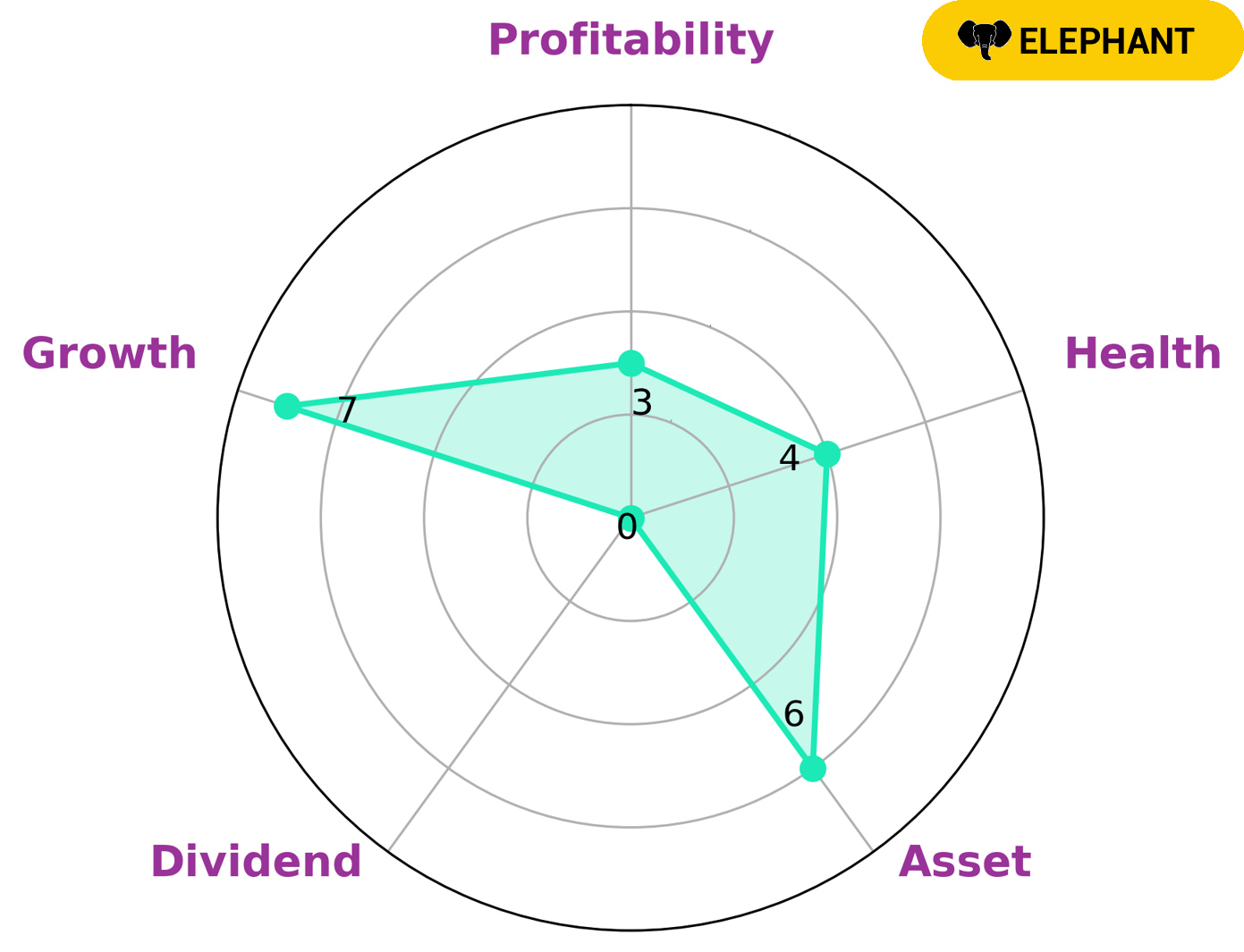

GoodWhale’s analysis of PHENOMEX INC‘s wellbeing has revealed that the company is classified as an ‘elephant’, meaning that it is rich in assets after deducting off liabilities. This makes it an appealing option for investors who are looking for a company with strong growth prospects. PHENOMEX INC has a medium level of asset and a weak level of dividend and profitability, although its intermediate health score of 4/10 with regard to cashflows and debt indicates that there is some potential for the company to be able to pay off debt and fund future operation. As such, those looking for a company with potential for long-term growth would be well-suited to PHENOMEX INC as an investment. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Phenomex Inc. More…

| Total Revenues | Net Income | Net Margin |

| 76.91 | -100.03 | -126.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Phenomex Inc. More…

| Operations | Investing | Financing |

| -57.02 | -43.87 | 57.65 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Phenomex Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 300.56 | 142.82 | 1.6 |

Key Ratios Snapshot

Some of the financial key ratios for Phenomex Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.0% | – | -128.6% |

| FCF Margin | ROE | ROA |

| -79.5% | -41.2% | -20.6% |

Summary

Investors analyzing PHENOMEX INC should take note of the company’s Q1 earnings results for the fiscal year 2023, reporting total revenue of USD 18.5 million, a decrease of 8.4% from the prior year. Net income was reported to be USD -23.4 million, compared to the year before. Given this news, the stock price fell on the same day.

Investors should weigh the risks and potential rewards of investing in PHENOMEX INC carefully given this financial performance. Positive developments such as future cost savings or increased revenue may be necessary for the company to climb back into profitability.

Recent Posts