Pfizer Spinoff SpringWorks Therapeutics Has Promising Therapeutic Pipeline

April 15, 2023

Trending News ☀️

SPRINGWORKS ($NASDAQ:SWTX): Pfizer, one of the biggest pharmaceutical companies in the world, recently spun off its subsidiary SpringWorks Therapeutics, which is now an independent biopharmaceutical company. SpringWorks Therapeutics has a promising pipeline of therapeutics in development, with the potential to transform the lives of millions of people. The company’s focus is on developing innovative therapies for rare and underserved conditions, such as cancer, neurological diseases and rare genetic diseases. SpringWorks Therapeutics has forged numerous strategic partnerships with research institutions and other pharmaceutical companies to accelerate its research and development efforts. It has also raised several rounds of financing from private investors and public markets to fund its research. SpringWorks Therapeutics has already achieved a number of milestones in its short history, including several successful clinical trials and the launch of multiple products on the market.

The company’s product portfolio comprises a range of treatments that are designed to improve the quality of life of patients suffering from rare and underserved conditions. Furthermore, SpringWorks Therapeutics has formed collaborations with other industry leaders to explore additional opportunities and expand its portfolio of treatments. With its innovative pipeline of therapeutics, Pfizer’s spinoff SpringWorks Therapeutics has the potential to make a lasting impact on the lives of patients with rare and underserved diseases. The company’s focus on research and development and strong partnerships with other institutions and organizations make it well-positioned for continued success in the future.

Share Price

On Friday, SPRINGWORKS THERAPEUTICS, a Pfizer spinoff, saw its stock open at $25.2 and close at $23.9, representing a 5.6% drop from the previous closing price of 25.3. The company has a promising therapeutic pipeline and is focused on the development and commercialization of treatments for rare diseases. SPRINGWORKS THERAPEUTICS has an established network of strategic collaborations to help in these efforts. Currently, the company has two clinical-stage programs that are targeting certain rare genetic disorders.

Additionally, the company has a preclinical-stage program that is focused on an orphan indication. SPRINGWORKS THERAPEUTICS is committed to making a difference in rare disease communities and bringing much-needed therapeutics to those suffering with rare diseases. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Springworks Therapeutics. More…

| Total Revenues | Net Income | Net Margin |

| 0 | -277.42 | -130.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Springworks Therapeutics. More…

| Operations | Investing | Financing |

| -161.56 | -215.6 | 340.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Springworks Therapeutics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 630.24 | 72.05 | 8.94 |

Key Ratios Snapshot

Some of the financial key ratios for Springworks Therapeutics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.0% | – | -132.4% |

| FCF Margin | ROE | ROA |

| -93.8% | -30.0% | -27.8% |

Analysis

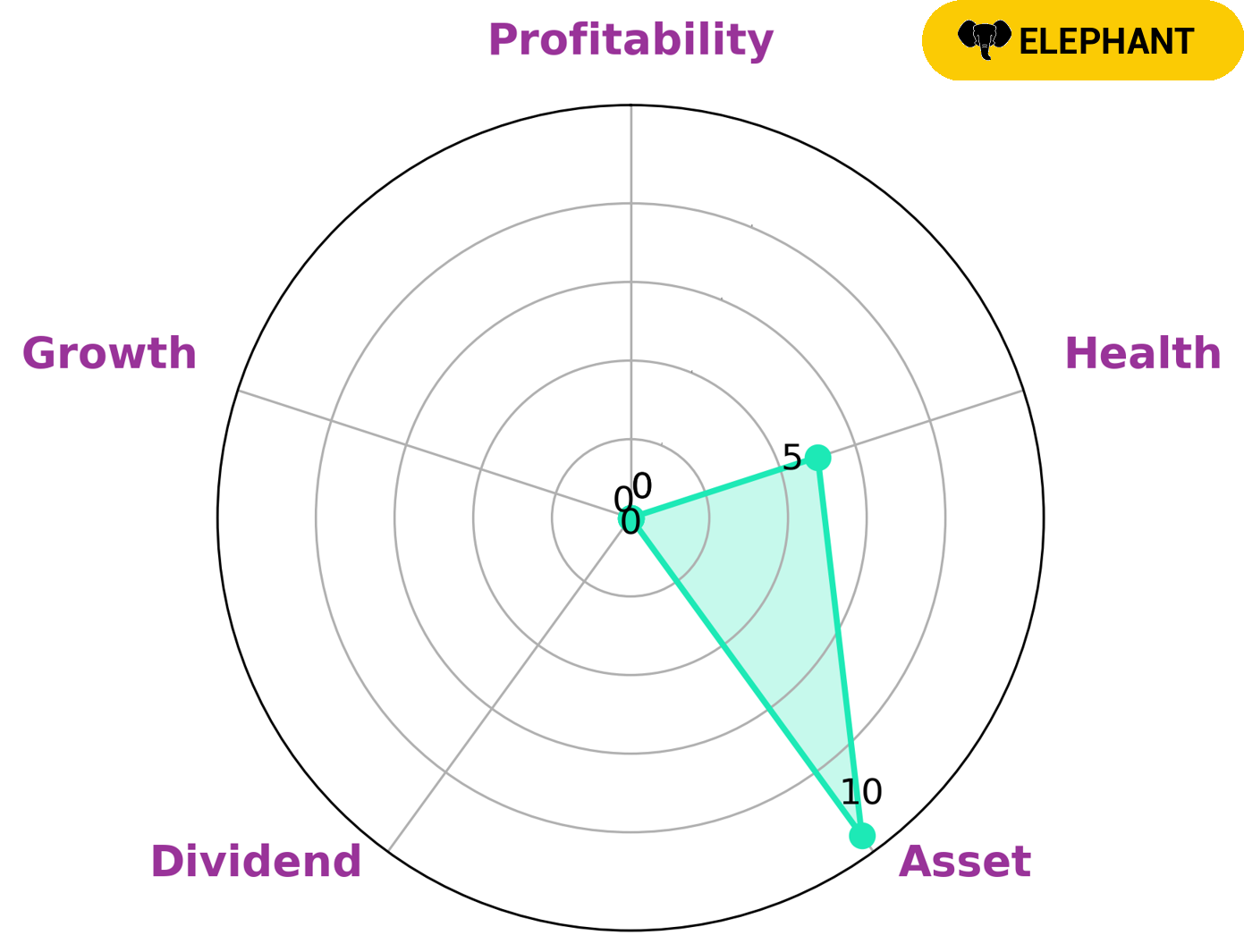

At GoodWhale, we have conducted an analysis of SPRINGWORKS THERAPEUTICS‘s wellbeing. According to our Star Chart, the financial health of SPRINGWORKS THERAPEUTICS is rated at an intermediate level of 5/10. This suggests that SPRINGWORKS THERAPEUTICS may be able to pay off their debt and continue to fund future operations. Following our analysis, we have concluded that SPRINGWORKS THERAPEUTICS is classified as an ‘elephant’, a type of company that is rich in assets after deducting off liabilities. As such, it is likely to be attractive to investors who are looking for a long-term investment. However, despite its strong asset base, SPRINGWORKS THERAPEUTICS may not be suitable for investors who are seeking high dividend payments or who are looking for a company with strong growth and profitability. More…

Peers

The company is focused on developing and commercializing therapies for the treatment of rare and underserved diseases. SpringWorks Therapeutics Inc’s competitors include Aadi Bioscience Inc, Avalo Therapeutics Inc, and Immunic Inc.

– Aadi Bioscience Inc ($NASDAQ:AADI)

Aadi Bioscience Inc is a clinical-stage biopharmaceutical company focused on the development and commercialization of small molecule drugs for the treatment of cancer and other diseases. The company’s lead product candidate is AB-101, a small molecule inhibitor of the PI3K/mTOR pathway, which is in Phase I clinical trials for the treatment of solid tumors. Aadi Bioscience Inc has a market cap of 317.87M as of 2022, a Return on Equity of -28.05%.

– Avalo Therapeutics Inc ($NASDAQ:AVTX)

Avalo Therapeutics Inc is a clinical stage biopharmaceutical company developing novel cancer therapies. The company’s market cap as of 2022 is 50.93M and its ROE is 729.23%. Avalo’s pipeline of products includes two clinical stage programs: AVL-292, a first-in-class, small molecule inhibitor of checkpoint kinase 1 (Chk1) for the treatment of solid tumors, and AVL-181, a first-in-class, small molecule inhibitor of checkpoint kinase 2 (Chk2) for the treatment of hematologic malignancies.

– Immunic Inc ($NASDAQ:IMUX)

Immunic, Inc. is a clinical-stage biopharmaceutical company, which focuses on developing oral therapies for the treatment of immune-mediated diseases. Its pipeline includes IMU-838 that is in Phase II clinical trial for the treatment of plaque psoriasis and atopic dermatitis; and IMU-935, which is in Phase I clinical trial for the treatment of autoimmune diseases. The company was founded by Daniel M. Adelman, Michael J. Brenner and William T. Symonds on December 15, 2006 and is headquartered in New York, NY.

Summary

SpringWorks Therapeutics is an offshoot of Pfizer with a promising pipeline of treatments for rare diseases and other conditions. The company’s stock price declined on the same day, which may indicate that the current market sentiment is pessimistic. Investing in SpringWorks could prove to be a smart move in the long term, since the company has several treatments in the early stages of clinical trials that have the potential to significantly increase shareholder value.

In addition, the company’s partnerships with major pharmaceutical companies provide further evidence of the potential upside. Investors should carefully analyze the benefits and risks associated with investing in SpringWorks Therapeutics before making any financial commitments.

Recent Posts