PepGen Publishes Slide Deck to Accompany Event Presentation.

February 12, 2023

Trending News 🌥️

PEPGEN ($NASDAQ:PEPG): PepGen Inc. (PEPG) is a biotechnology company that focuses on developing innovative treatments for cancer, autoimmune and infectious diseases, as well as other therapeutic areas. The company’s core technologies include peptide-based drug discovery and development, gene-editing, and platform drug delivery. PepGen has recently released a slide deck in connection with their event presentation, which is accessible through Seeking Alpha Transcripts at the link provided. The slide deck provides a brief overview of the company’s progress in recent years, specifically focusing on their development of small molecule inhibitors for cancer, as well as their gene-editing and platform drug delivery capabilities. It also touches on the various investments and licensing agreements that have been made in order to expand their intellectual property portfolio. Overall, the slide deck serves as an informative tool for investors who are interested in learning more about PepGen’s current status and future plans. It is an excellent resource for those looking to gain insight into the company’s operations, as well as its potential for success in the long run.

Additionally, the slide deck may also provide investors with an opportunity to identify investment opportunities, as PepGen’s progress in the field of cancer treatment could be highly beneficial in the near future.

Share Price

On Friday, PEPGEN Inc. published a slide deck to accompany the upcoming event presentation. This announcement was well received by the market, as indicated by the stock’s 4.8% increase from the previous closing price of $16.3, opening at $16.1 and closing at $17.1. The slide deck was designed to give investors and customers a comprehensive overview of the company’s plans and initiatives, including a detailed description of its products and services, along with presentations from PEPGEN’s leadership team. The slides also featured information such as PEPGEN’s overall mission and vision, strategic objectives, financial performance and potential risks and opportunities.

Additionally, the slides featured highlights from PEPGEN’s recent successes, including high customer satisfaction and industry awards. The publishing of the slide deck shows PEPGEN’s commitment to transparency and providing all stakeholders with a comprehensive picture of the company’s current and future operations. This strategy is expected to help PEPGEN continue to build investor confidence in its direction and secure long-term success in the market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Pepgen Inc. More…

| Total Revenues | Net Income | Net Margin |

| – | – | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Pepgen Inc. More…

| Operations | Investing | Financing |

| – | – | – |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Pepgen Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| – | – | – |

Key Ratios Snapshot

Some of the financial key ratios for Pepgen Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

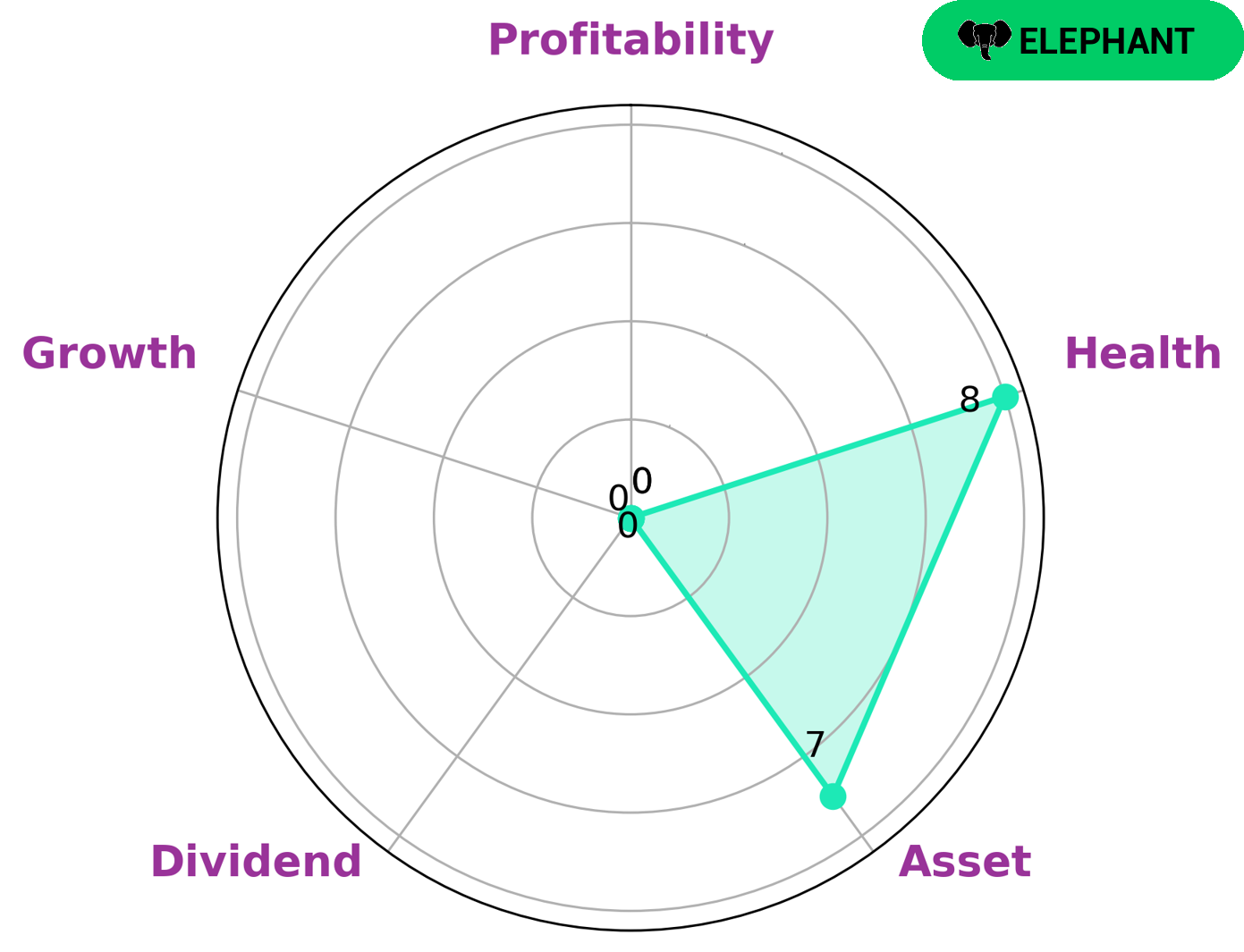

GoodWhale conducted an analysis of PEPGEN INC’s fundamentals and used the Star Chart to evaluate the company. It was determined that PEPGEN INC had strong assets, but weak dividend, growth, and profitability. This put it in the ‘elephant’ category, which is a type of company that has more assets than liabilities. This type of company could be attractive to value investors, growth investors, or momentum investors. Value investors may be interested in the value of the company’s assets, while growth investors may be drawn to the potential for growth. Momentum investors may be attracted to the stock’s trend. Furthermore, PEPGEN INC had a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable of safely weathering any crisis without significantly increasing its risk of bankruptcy. This could be an additional incentive to attract investors. More…

Peers

The company’s focus is on the development of first-in-class small molecule drugs that target the epigenome. PepGen’s most advanced product candidate is PEP-3074, a small molecule inhibitor of DOT1L, which is in Phase II clinical trials for the treatment of acute myeloid leukemia (AML) and mixed lineage leukemia (MLL). The company is also developing PEP-3102, a small molecule inhibitor of BET bromodomain proteins, which is in Phase I clinical trials for the treatment of advanced solid tumors. PepGen’s competitors include Autolus Therapeutics PLC, Aldeyra Therapeutics Inc, Cyclerion Therapeutics Inc, and others.

– Autolus Therapeutics PLC ($NASDAQ:AUTL)

Autolus Therapeutics PLC is a clinical-stage biopharmaceutical company, which engages in the research and development of programmed T cell therapies for the treatment of cancer. It operates through the following segments: Autologous and Allogeneic. The Autologous segment develops products derived from a patient’s own cells. The Allogeneic segment focuses on developing off-the-shelf product candidates, which are designed to be administered to any patient without the need for pre-treatment. The company was founded by Christian B. Behrens and Martin Pule on March 3, 2014 and is headquartered in London, the United Kingdom.

– Aldeyra Therapeutics Inc ($NASDAQ:ALDX)

Aldeyra Therapeutics is a biopharmaceutical company focused on the development and commercialization of products to treat diseases related to inflammation, injury, and dysfunction of the eye. The company’s lead product candidate, Reproxalap, is in Phase 3 clinical development for the treatment of non-infectious anterior uveitis, allergic conjunctivitis, and dry eye disease. Aldeyra reported a loss of $16.4 million in 2020, and its market cap was $320.8 million as of 2022. The company’s return on equity was -22.1%.

– Cyclerion Therapeutics Inc ($NASDAQ:CYCN)

Cyclerion Therapeutics Inc is a clinical-stage biopharmaceutical company developing novel small molecule therapeutics to treat patients with serious and neglected diseases. The company’s lead product candidate, linaclotide, is in development for the treatment of rare gastrointestinal disorders. Cyclerion Therapeutics Inc has a market cap of 20.67M as of 2022, a Return on Equity of -145.28%.

Summary

PepGen Inc. has been an attractive investment opportunity for investors recently. On the same day the company published a slide deck to accompany a presentation, the stock price moved up significantly. This has increased the interest in PepGen from potential investors, as the company appears to be in a strong financial position. Analysts have suggested that the company’s pipeline of patented products is attractive and could lead to future growth.

Additionally, their experience with the biopharmaceutical industry may hold them in good stead when dealing with investors. With all these factors, PepGen Inc. remains a viable investment option for those interested in the biotech market.

Recent Posts