Palatin Technologies Intrinsic Stock Value – Palatin Technologies Posts Loss Despite Revenues Beating Expectations

May 17, 2023

Trending News 🌥️

Palatin Technologies ($NYSEAM:PTN) recently reported its first quarter financial results, and the results were a mixed bag. The company posted a net GAAP EPS of -$0.63, which was lower than the expected -$0.53. Revenue, however, surged to $1.19M, beating expectations of $1.11M. PALATIN TECHNOLOGIES is a biopharmaceutical company that discovers and develops innovative, safe and efficacious medicines for the treatment of diseases and conditions with high unmet medical need. The company focuses on peptide therapeutics, specifically targeting melanocortin and natriuretic peptide receptor systems within the human body. Despite the better-than-expected revenue, the net loss was still significant, highlighting the need for continued cost control by the company. It is worth noting that the company’s costs have been rising due to higher research & development expenses as well as higher general & administrative expenses.

Moving forward, Palatin Technologies will need to focus on cutting costs in order to become profitable in the coming quarters. Overall, Palatin Technologies reported mixed results for the first quarter. While revenue was higher than expected, the net loss was greater than anticipated. Going forward, the company needs to focus on cost control in order to become profitable.

Price History

PALATIN TECHNOLOGIES reported a loss in its most recent quarter, despite revenues beating expectations. On Tuesday, the stock opened at $2.5 and closed at $2.6, representing a 0.4% decrease from the previous closing price of 2.6. This loss in value comes despite the company’s higher-than-expected revenue growth over the past quarter. The company has been investing heavily into research and development as well as expanding its distribution and marketing divisions in order to capitalize on the increased demand for its products and services.

PALATIN TECHNOLOGIES is confident that its long-term strategy of investing in these areas will lead to increased profitability and market share in the future. Despite these positive elements, the markets were not impressed by this quarter’s results and the company’s share price declined on the day. Investors will be looking to see if the company can continue to outperform expectations, as it has done in the past few quarters, in order to drive further gains in share price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Palatin Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 2.88 | -30.08 | -1097.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Palatin Technologies. More…

| Operations | Investing | Financing |

| -34.62 | -0.38 | 8.85 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Palatin Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 31.98 | 15.63 | 1.58 |

Key Ratios Snapshot

Some of the financial key ratios for Palatin Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -63.7% | – | -1204.2% |

| FCF Margin | ROE | ROA |

| -1213.9% | -175.0% | -67.9% |

Analysis – Palatin Technologies Intrinsic Stock Value

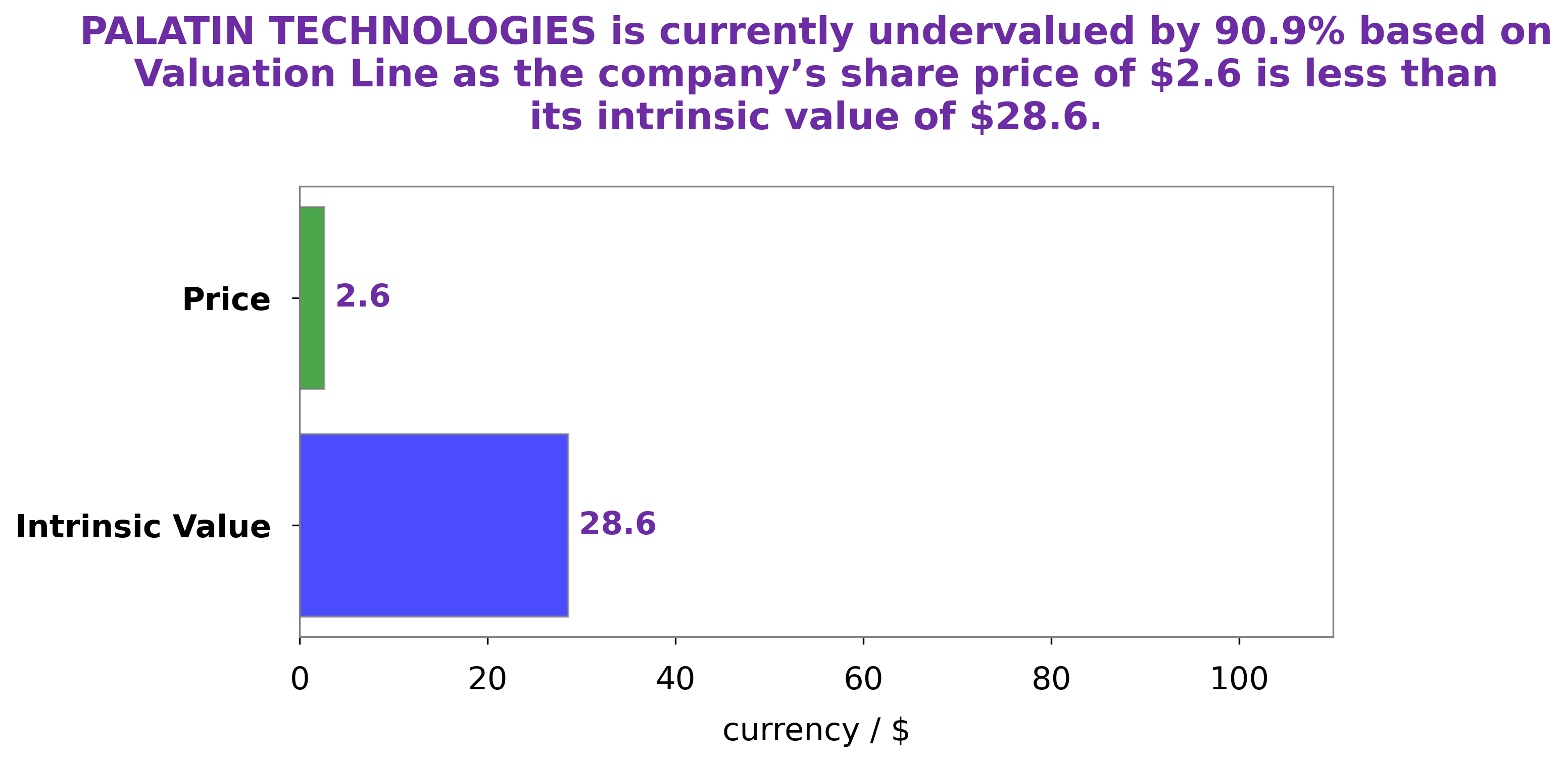

At GoodWhale, we have conducted an analysis of PALATIN TECHNOLOGIES‘ financials. Our proprietary Valuation Line has determined the fair value of PALATIN TECHNOLOGIES’ shares to be around $28.6. However, the stock is currently being traded at $2.6 – a massive 90.9% discount to the fair value. This presents a great opportunity for potential investors to acquire the stock at a discounted rate. We are confident that those who take the opportunity to invest in PALATIN TECHNOLOGIES before the stock corrects itself will be handsomely rewarded. More…

Peers

The company’s products are based on its proprietary technology platforms, which enable the targeted delivery of biologic and small molecule drugs. Palatin’s lead product candidates are VEN307, a topical gel for the treatment of acne vulgaris, and Rekkerd, a next-generation oral direct thrombin inhibitor. Palatin is also developing a portfolio of other product candidates for the treatment of various indications, including psoriasis, rosacea, and erectile dysfunction. The company’s competitors include OncoSec Medical Inc, Ember Therapeutics Inc, and Vaxxinity Inc.

– OncoSec Medical Inc ($NASDAQ:ONCS)

OncoSec Medical Inc is a clinical-stage biopharmaceutical company that focuses on the development and commercialization of novel cancer therapeutics. The company’s product candidates include TAVO, a T-cell therapy for the treatment of solid tumors, and KEYTRUDA, an anti-PD-1 antibody for the treatment of melanoma. OncoSec Medical Inc has a market cap of 7.52M as of 2022, a Return on Equity of -234.25%. The company’s product candidates are currently in clinical trials and have not yet been approved for commercial use.

– Ember Therapeutics Inc ($OTCPK:EMBT)

Ember Therapeutics Inc is a clinical stage biopharmaceutical company that focuses on the discovery, development, and commercialization of small molecule drugs to treat metabolic diseases. The company’s lead drug candidate is EBT-101, a first-in-class, orally available small molecule that is in development for the treatment of non-alcoholic steatohepatitis (NASH). Ember Therapeutics Inc has a market cap of 926.88k as of 2022 and a Return on Equity of 3.46%. The company’s focus on the discovery, development, and commercialization of small molecule drugs to treat metabolic diseases makes it a promising player in the healthcare industry.

– Vaxxinity Inc ($NASDAQ:VAXX)

Vaxxinity Inc is a clinical-stage biotechnology company focused on the development and commercialization of next-generation vaccines. The company has a market cap of 205.47M as of 2022 and a return on equity of -67.46%. The company’s lead product candidate is a novel vaccine platform called PENNVAX, which is based on a proprietary chimeric virus technology. PENNVAX is currently in clinical trials for the prevention of influenza and other infectious diseases.

Summary

Going forward, investors should consider Palatin’s potential for growth, analyzing factors such as the company’s liquidity and historical performance. Additionally, any potential risks for investors should be considered carefully before investing in Palatin Technologies.

Recent Posts