Novavax Stock Fair Value – TD Cowen Cautions Investors Against Novavax Amid COVID Uncertainty

April 22, 2023

Trending News 🌧️

NOVAVAX ($NASDAQ:NVAX) is a biotechnology company specializing in the development of vaccines and related therapeutic products. The company has seen great success over the last few years, including the approval of its influenza vaccine, NanoFlu.

However, uncertainty surrounding the coronavirus pandemic has caused TD Cowen to downgrade the stock. TD Cowen has recently downgraded the stock of NOVAVAX due to the uncertainty surrounding the COVID-19 pandemic. The biotechnology company had previously been optimistic about the development of a vaccine but with the current climate of unpredictability, TD Cowen is taking a more cautious approach. They have advised investors to be wary of investing in NOVAVAX until more is known about the effects of COVID-19 and its impact on the global economy. The downgrade from TD Cowen comes at a time when other biotechnology companies are seeing success in their development of vaccines. However, with the uncertainty surrounding the current pandemic, investors should take precautions when investing in NOVAVAX. TD Cowen has cautioned against investing in the company until more is known about how COVID-19 will affect the world economy.

Market Price

On Thursday, TD Cowen voiced its caution against investing in Novavax due to the uncertainty surrounding the development of its potential COVID-19 vaccine. This announcement reflected in the stock prices, as Novavax opened at $8.5 and closed at $8.2, a drop of 8.1% from the previous day’s closing price of $9.0. TD Cowen’s announcement may have caused investors to be wary of Novavax, which contributed to the decline in stock prices. With the uncertain nature of the development of Novavax’s vaccine and the resulting stock performance, investors must weigh the risk versus potential reward when considering investing in Novavax. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Novavax. More…

| Total Revenues | Net Income | Net Margin |

| 1.98k | -657.94 | -33.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Novavax. More…

| Operations | Investing | Financing |

| -415.94 | -92.98 | 324.99 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Novavax. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.26k | 2.89k | -7.37 |

Key Ratios Snapshot

Some of the financial key ratios for Novavax are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 373.6% | – | -32.0% |

| FCF Margin | ROE | ROA |

| -25.7% | 66.0% | -17.5% |

Analysis – Novavax Stock Fair Value

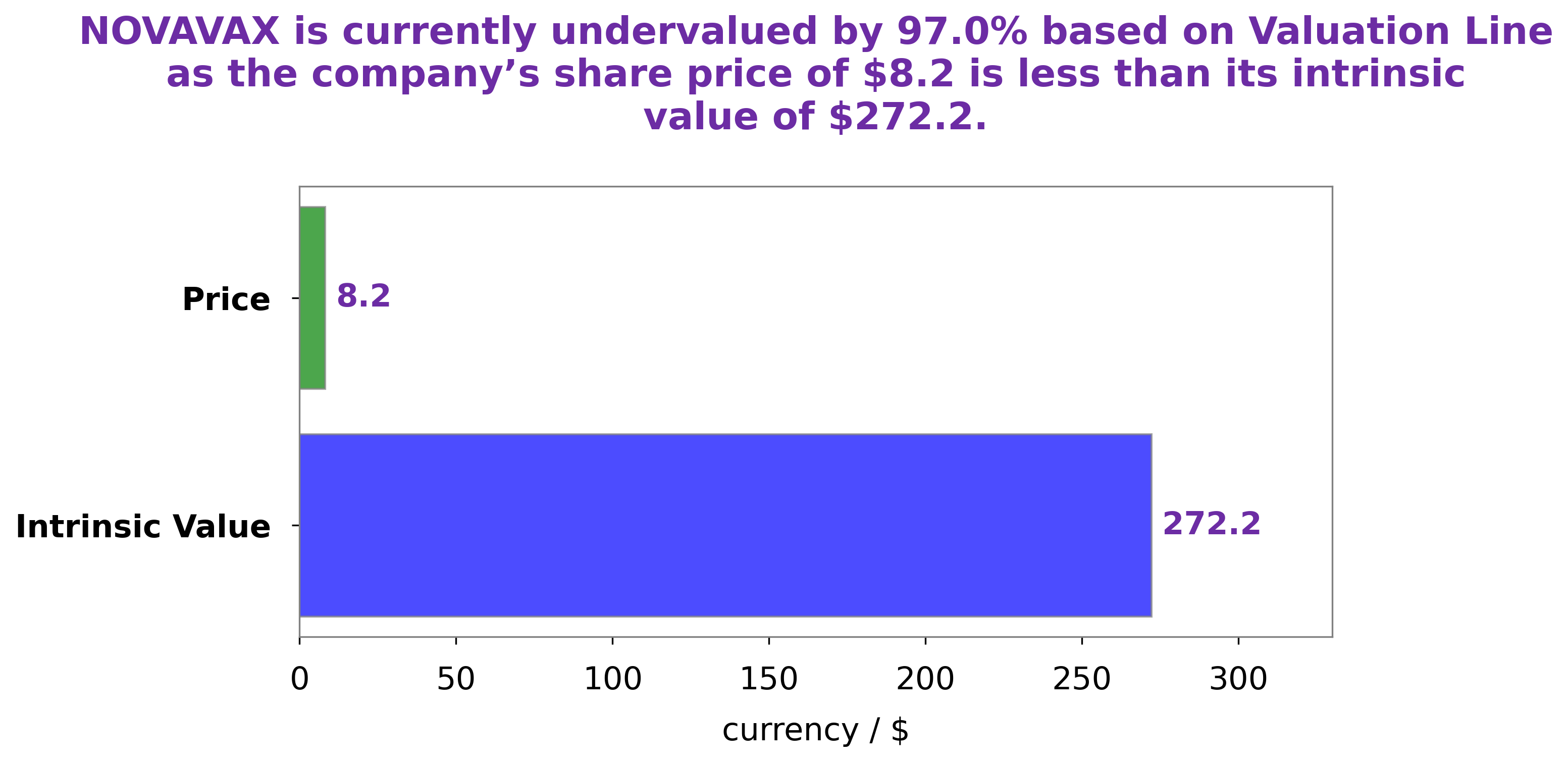

GoodWhale has conducted an analysis of NOVAVAX‘s wellbeing and, based on our proprietary Valuation Line, have concluded that the intrinsic value of the company’s share is approximately $272.2. This suggests that NOVAVAX is currently trading at $8.2, which is a 97.0% discount to its intrinsic value. This indicates that it is significantly undervalued, presenting an excellent opportunity for investors. More…

Peers

The competition between Novavax Inc and its competitors is fierce. Moderna Inc, BioNTech SE, and Pfizer Inc are all major players in the vaccine industry, and each company is striving to develop the most effective vaccine possible. While Novavax Inc has made great strides in recent years, its competitors are not far behind.

– Moderna Inc ($NASDAQ:MRNA)

Moderna Inc is a clinical stage biotechnology company that discovers, develops, and commercializes therapeutics and vaccines based on RNA. As of 2022, Moderna Inc has a market cap of 48.32B and a ROE of 80.28%. Moderna Inc’s mission is to harness the power of RNA to revolutionize medicine and change the way diseases are prevented, treated, and cured.

– BioNTech SE ($NASDAQ:BNTX)

As of 2022, BioNTech SE has a market cap of 32.44B and a Return on Equity of 71.82%. The company is a German biotechnology company that develops and manufactures vaccines and antibody therapeutics. The company has developed a platform that allows it to rapidly design and produce custom-made vaccines and therapeutics.

– Pfizer Inc ($NYSE:PFE)

Pfizer Inc is a pharmaceutical company with a market cap of 247.45B as of 2022. The company has a return on equity of 24.63%. Pfizer Inc is a research-based, global pharmaceutical company that discovers, develops, manufactures, and markets safe, effective, and affordable human and veterinary medicines. The company is one of the world’s largest research-based pharmaceutical companies, with products available in more than 150 countries.

Summary

Novavax (NVAX) is a biotechnology company that specializes in the development of novel vaccines and adjuvants. Recently, TD Cowen downgraded the stock due to ongoing uncertainty surrounding the company’s COVID-19 vaccine development. This caused the stock to decline on the same day. For investors, it is important to consider the risks and rewards of investing in Novavax.

On the one hand, the company has been making strong progress on its vaccine development and has demonstrated promising results in its current clinical trials. On the other hand, the uncertainty surrounding its COVID-19 vaccine and its ability to bring it to market could prove to be a challenge for investors. It is therefore important to assess both the potential upside and downside of investing in Novavax before making any decision.

Recent Posts