Novavax Intrinsic Value Calculation – NOVAVAX Approved for Adolescent Use in Singapore COVID Vaccine Rollout

May 13, 2023

Trending News ☀️

NOVAVAX ($NASDAQ:NVAX), a leading biotechnology company and vaccine developer, has recently been granted extended approval by Singapore to administer their COVID-19 vaccine to adolescents. This marks an important milestone in the global fight against the virus, as it demonstrates the safety and efficacy of the vaccine in a younger population. NOVAVAX is a biotechnology company that develops vaccines to prevent serious infectious diseases. Its mission is to prevent the spread of these diseases around the world through innovative research and development.

As a result of the company’s commitment to developing effective vaccines, they have been successful in producing and distributing their COVID-19 vaccine in many countries. The expanded approval in Singapore marks an important step forward in protecting adolescents from the virus as well.

Price History

NOVAVAX, a leading biotechnology company, was approved for adolescent use in Singapore’s COVID-19 vaccine rollout on Friday. This news sparked an initial increase in stock price, which opened at $9.0. However, the stock closed at $8.4, down by 4.9% from its last closing price of 8.9. This decline could be attributed to the market’s reaction to the news and could signal a trend of volatility to come for NOVAVAX. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Novavax. More…

| Total Revenues | Net Income | Net Margin |

| 1.98k | -657.94 | -33.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Novavax. More…

| Operations | Investing | Financing |

| -415.94 | -92.98 | 324.99 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Novavax. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.26k | 2.89k | -7.37 |

Key Ratios Snapshot

Some of the financial key ratios for Novavax are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 373.6% | – | -32.0% |

| FCF Margin | ROE | ROA |

| -25.7% | 66.0% | -17.5% |

Analysis – Novavax Intrinsic Value Calculation

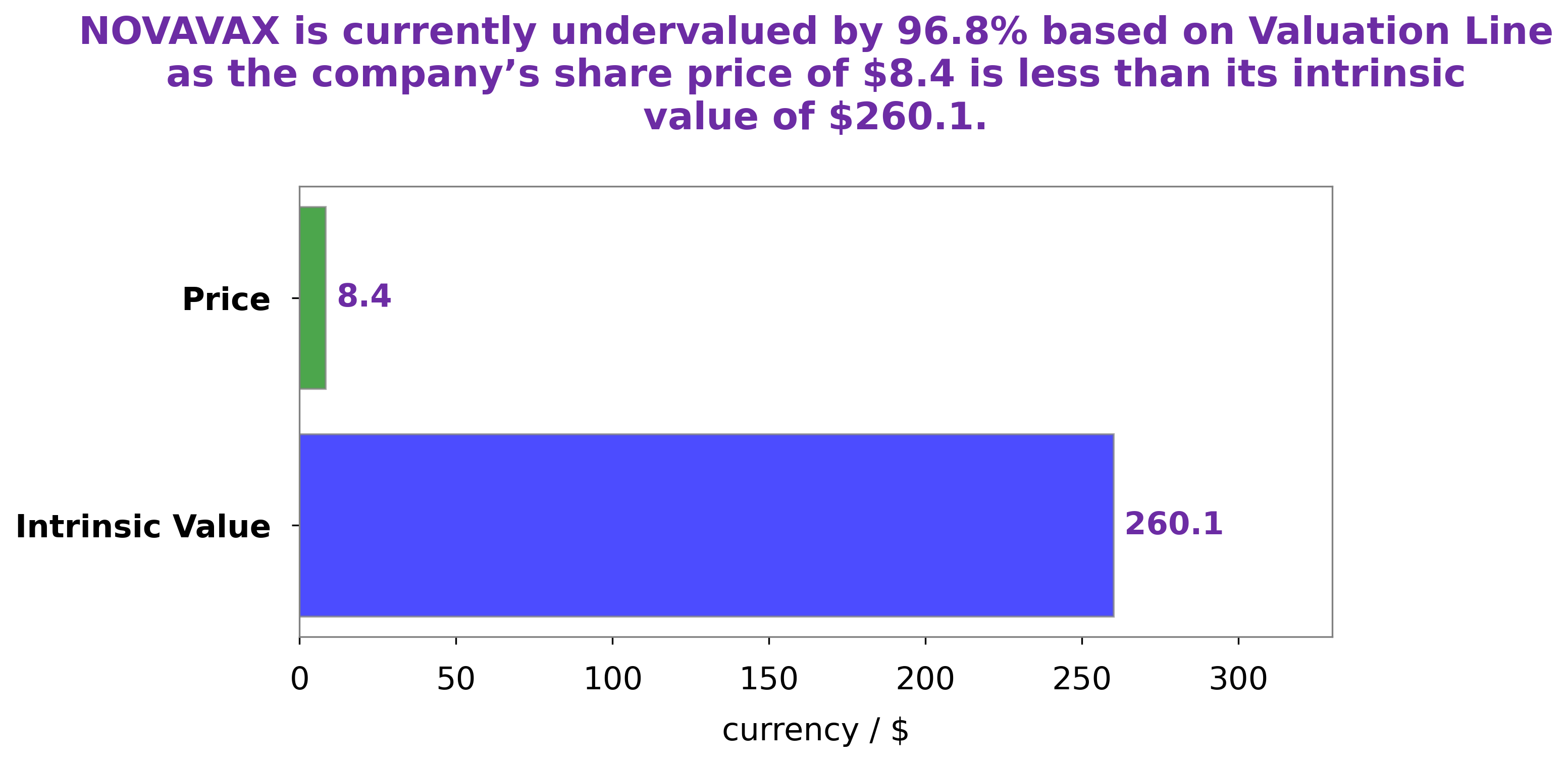

GoodWhale has taken a deep dive into NOVAVAX‘s fundamentals and have come up with a comprehensive analysis. Our proprietary Valuation Line estimates the intrinsic value of each NOVAVAX share to be around $260.1. That means that the current market price for NOVAVAX stock at $8.4 is undervalued by 96.8%. This presents a great opportunity for investors to buy shares of NOVAVAX at a heavily discounted rate and reap the benefits when the stock eventually rises to its true value. More…

Peers

The competition between Novavax Inc and its competitors is fierce. Moderna Inc, BioNTech SE, and Pfizer Inc are all major players in the vaccine industry, and each company is striving to develop the most effective vaccine possible. While Novavax Inc has made great strides in recent years, its competitors are not far behind.

– Moderna Inc ($NASDAQ:MRNA)

Moderna Inc is a clinical stage biotechnology company that discovers, develops, and commercializes therapeutics and vaccines based on RNA. As of 2022, Moderna Inc has a market cap of 48.32B and a ROE of 80.28%. Moderna Inc’s mission is to harness the power of RNA to revolutionize medicine and change the way diseases are prevented, treated, and cured.

– BioNTech SE ($NASDAQ:BNTX)

As of 2022, BioNTech SE has a market cap of 32.44B and a Return on Equity of 71.82%. The company is a German biotechnology company that develops and manufactures vaccines and antibody therapeutics. The company has developed a platform that allows it to rapidly design and produce custom-made vaccines and therapeutics.

– Pfizer Inc ($NYSE:PFE)

Pfizer Inc is a pharmaceutical company with a market cap of 247.45B as of 2022. The company has a return on equity of 24.63%. Pfizer Inc is a research-based, global pharmaceutical company that discovers, develops, manufactures, and markets safe, effective, and affordable human and veterinary medicines. The company is one of the world’s largest research-based pharmaceutical companies, with products available in more than 150 countries.

Summary

Novavax (NVAX) is a biotechnology company focused on developing innovative vaccines. Its stock price recently dropped after the company was granted an extended nod to provide its COVID-19 shot to adolescents in Singapore. Investors should consider whether this event has a short-term or long-term effect on the company’s prospects and value. A detailed analysis of the financials, fundamentals, and competitive landscape of the company is advisable for those considering Novavax as an investment.

Novavax has had an impressive track record, with the COVID-19 vaccine among the first to be approved for use in the U.S., so investors should consider whether the Singapore approval provides a signal that more approvals are coming and whether this could result in an increase in valuation. The company’s good management and strong balance sheet may signal further upside potential as well. Investors should do their own research and assess their risk tolerance before investing in Novavax.

Recent Posts