Morse Asset Management Inc Boosts Stake in Vertex Pharmaceuticals Inc by 13.1% on July 25, 2023

July 30, 2023

☀️Trending News

Vertex Pharmaceuticals ($NASDAQ:VRTX) Incorporated is a biotechnology company that researches, develops and manufactures innovative medicines for serious diseases. On July 25, 2023, Morse Asset Management Inc displayed its confidence in the potential of Vertex Pharmaceuticals by significantly raising its stake in the company by 13.1%. This move has caused a significant buzz in the biotech industry, suggesting that Vertex could become a major player in the market. Vertex Pharmaceuticals Incorporated is at the forefront of developing treatments for cystic fibrosis, alpha-1 antitrypsin deficiency, and other rare diseases. The company is involved in collaborations with several other biopharmaceutical companies to develop transformative medicines for these types of diseases.

In addition, Vertex has a strong presence in the genetic medicine space, with a pipeline of potential treatments for a variety of genetic diseases. The move represents an investment of confidence in Vertex’s future and could be indicative of further developments in the industry. Vertex Pharmaceuticals is well-positioned to capitalize on its current momentum and could become a major player in the biotech market in the future.

Analysis

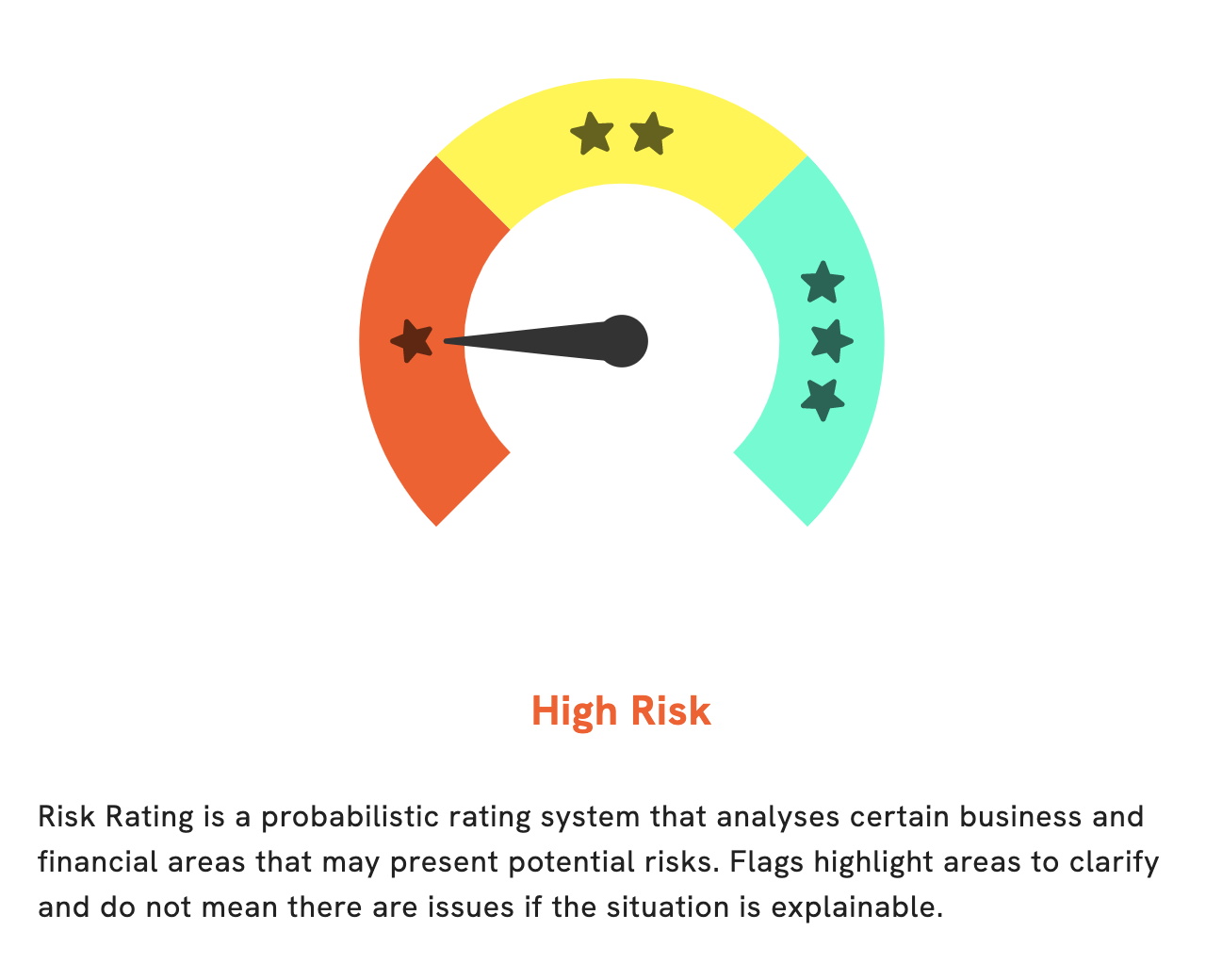

At GoodWhale, we have conducted an analysis of VERTEX PHARMACEUTICALS‘ financials. Based on our Risk Rating, VERTEX PHARMACEUTICALS is considered a high risk investment, as there may be financial and business risks associated with this company. In particular, our analysis has detected 4 risk warnings across the income sheet, balance sheet, cashflow statement and non-financial areas. If you are interested in exploring further, please become a registered user of our service to get more in-depth analysis. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Vertex Pharmaceuticals. More…

| Total Revenues | Net Income | Net Margin |

| 9.21k | 3.26k | 38.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Vertex Pharmaceuticals. More…

| Operations | Investing | Financing |

| 4.13k | -321.1 | -67.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Vertex Pharmaceuticals. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 18.97k | 4.54k | 54.01 |

Key Ratios Snapshot

Some of the financial key ratios for Vertex Pharmaceuticals are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 24.1% | 39.3% | 45.8% |

| FCF Margin | ROE | ROA |

| 42.6% | 19.0% | 13.9% |

Peers

The competition in the pharmaceutical industry is intense, with companies vying for market share in a constantly changing landscape. Vertex Pharmaceuticals Inc is no stranger to this competition, and its competitors include Nyrada Inc, Incyte Corp, and Gain Therapeutics Inc.

– Nyrada Inc ($ASX:NYR)

Nyrada Inc is a clinical stage biopharmaceutical company focused on the development of novel therapeutics to treat diseases of the eye, central nervous system and other organ systems. The company’s lead product candidate, NYX-2925, is a small molecule that inhibits the activity of the protein kinase C-beta (PKC-beta) enzyme. NYX-2925 is in clinical development for the treatment of dry eye disease and age-related macular degeneration.

Nyrada’s market cap is $21.06 million and its ROE is -20.85%. The company is focused on the development of novel therapeutics to treat diseases of the eye, central nervous system and other organ systems.

– Incyte Corp ($NASDAQ:INCY)

Incyte Corporation is a Wilmington, Delaware-based biopharmaceutical company that focuses on the discovery, development, and commercialization of proprietary small molecule drugs to treat serious unmet medical needs, primarily in oncology.

As of 2022, Incyte Corporation had a market capitalization of $15.48 billion and a return on equity of 9.54%. The company’s main product is Jakafi (ruxolitinib), which is approved for the treatment of myelofibrosis and polycythemia vera, two rare blood disorders. Incyte is also developing several other drugs in clinical trials for various cancers.

– Gain Therapeutics Inc ($NASDAQ:GANX)

Gain Therapeutics Inc is a clinical-stage biopharmaceutical company focused on the development of precision medicines for patients with serious diseases. The company’s lead product candidate is GT-004, a small molecule inhibitor of the oncogene c-Myc, which is in development for the treatment of solid tumors. Gain Therapeutics has a market cap of $36.13 million and a negative return on equity of 33.26%. The company’s products are still in development and have not yet been approved for sale by the FDA.

Summary

Vertex Pharmaceuticals Incorporated is an attractive option for investors looking for growth in the biotechnology industry. Analysts have given Vertex a “buy” rating due to its strong revenue growth, high operating margins, low debt levels and positive clinical trial results. The company has also established strategic collaborations with numerous partners, providing access to high-quality research and development resources.

Recent Posts