Moderna Stock Fair Value – Moderna [MRNA] Shares Drop 1.85% Following Wall Street Analyst Initiation

May 13, 2023

Trending News 🌥️

Moderna ($NASDAQ:MRNA) Inc. NASDAQ: MRNA is a biotechnology company based in Cambridge, Massachusetts, focused on the development of transformative medicines and vaccines enabled by mRNA technology. On the last trading session, MRNA shares dropped 1.85%, reaching $128.41 per share, following the initiation of coverage by Wall Street Analyst. Wall Street Analyst initiated coverage on Moderna Inc. with a cautious stance and their outlook on the stock was mostly neutral. As a result, the stock dropped 1.85% on the last day of trading, although analysts’ recommendation remained hold. Analysts commented on Moderna’s broad pipeline of mRNA-based therapeutics and vaccines under development, saying that their potential is promising. Furthermore, analysts noted the company’s partnerships with several organizations, such as Merck, Vertex Pharmaceuticals and Lonza, as well as its strategic collaborations with the U.S. government and other entities, which could further boost the company’s growth.

However, analysts also expressed some concerns about Moderna’s dependence on government funding and the risks related to its clinical trials, which could affect its future success.

Analysis – Moderna Stock Fair Value

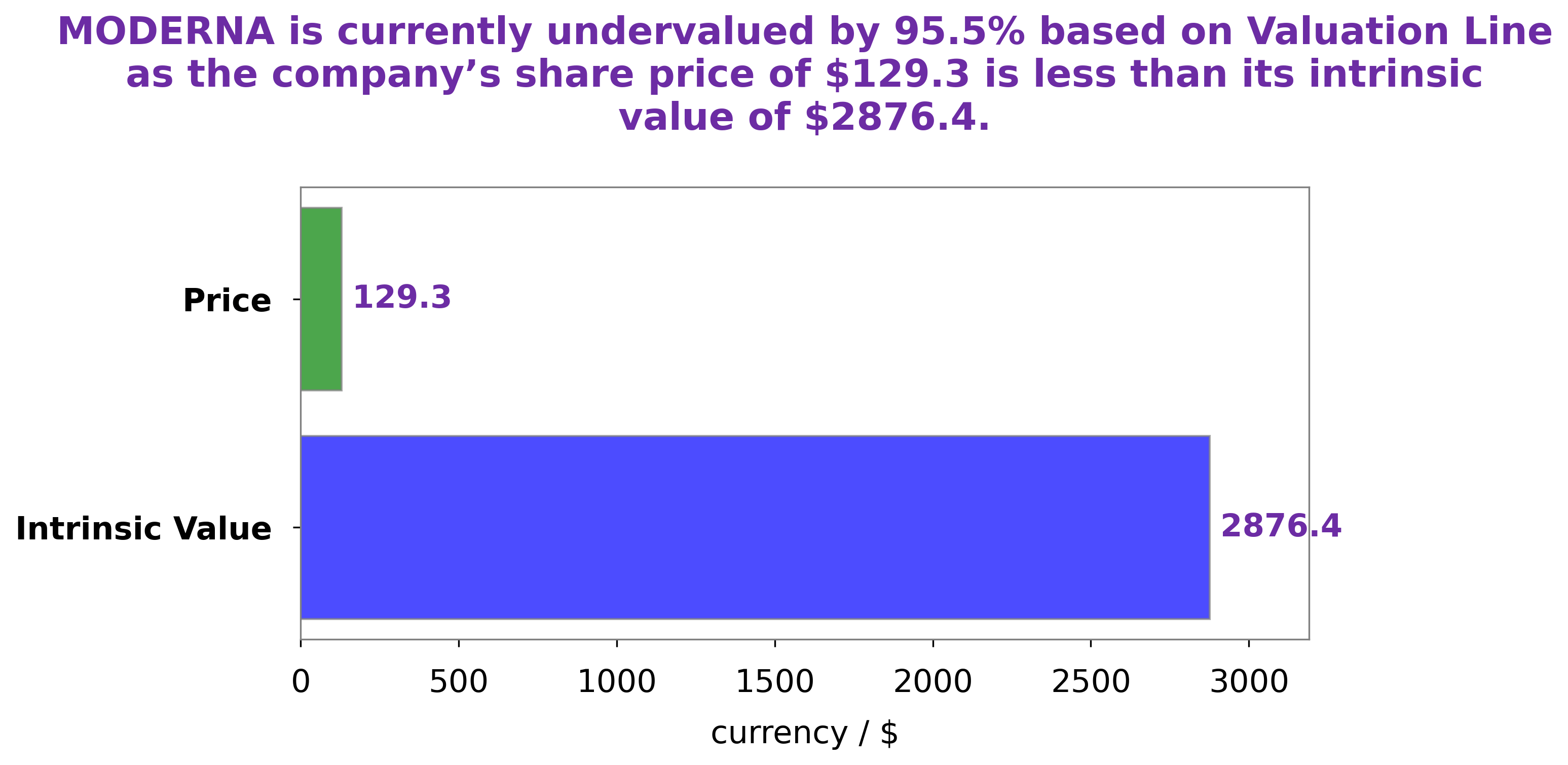

At GoodWhale, we have conducted an analysis of MODERNA’s fundamentals and have come to a conclusion on the intrinsic value of its shares. Our proprietary Valuation Line has calculated that the intrinsic value of a MODERNA share is around $2876.4. In comparison to this, MODERNA stock is currently traded at $129.3, meaning that it is highly undervalued by 95.5%. This presents a unique opportunity for potential investors. Moderna_MRNA_Shares_Drop_1.85_Following_Wall_Street_Analyst_Initiation”>More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Moderna. More…

| Total Revenues | Net Income | Net Margin |

| 14.8k | 4.78k | 32.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Moderna. More…

| Operations | Investing | Financing |

| 993 | 756 | -3.35k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Moderna. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 24.12k | 5.26k | 48.91 |

Key Ratios Snapshot

Some of the financial key ratios for Moderna are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 627.8% | – | 33.8% |

| FCF Margin | ROE | ROA |

| 4.1% | 16.5% | 13.0% |

Peers

Moderna Inc is a biotechnology company that develops and manufactures drugs, vaccines, and diagnostics. The company was founded in 2006 and is headquartered in Cambridge, Massachusetts. Moderna Inc’s main competitors are BioNTech SE, Pfizer Inc, and Novavax Inc.

– BioNTech SE ($NASDAQ:BNTX)

BioNTech SE is a German biotechnology company founded in 2008. The company has a market cap of 33.72B as of 2022 and a Return on Equity of 71.82%. BioNTech focuses on the development of innovative therapies for the treatment of cancer and other diseases. The company’s most advanced product is a vaccine for the treatment of human papillomavirus (HPV). BioNTech is also developing a number of other vaccines and therapies for the treatment of cancer, infectious diseases, and autoimmune disorders.

– Pfizer Inc ($NYSE:PFE)

Pfizer Inc is a global pharmaceutical company with a market cap of 247.45B as of 2022. The company’s return on equity is 24.63%. Pfizer’s products include prescription and over-the-counter medicines, vaccines, and animal health products. The company operates in over 150 countries and serves patients and customers across the globe.

– Novavax Inc ($NASDAQ:NVAX)

Novavax is a clinical-stage biotechnology company focused on the discovery, development and commercialization of vaccines to prevent serious infectious diseases. Novavax’s market cap as of 2022 is 1.46B and its ROE is 487.21%. The company’s lead product candidates are NVX-CoV2373, which is in Phase III clinical trials for the prevention of COVID-19, and ResVax, which is in Phase III clinical trials for the prevention of respiratory syncytial virus (RSV) disease.

Summary

Wall Street analysts have initiated coverage of Moderna Inc. (NASDAQ: MRNA), with a negative outlook, citing the stock’s recent $128.41 per share loss of 1.85%. Analysts are concerned about the short-term outlook, noting the stock is expensive compared to its peers and has risen too quickly in the past year. They point to the company’s dependence on government contracts for its vaccine and medicines as a risk factor, as well as its heavy reliance on debt. Analysts suggest investors take a wait-and-see approach given the uncertainties in the market.

Additionally, some analysts recommend focusing on long-term potential rather than short-term price movement. Overall, it is recommended that investors research Moderna’s financials and potential growth opportunities before investing in the stock.

Recent Posts