MODERNA Reports Fourth Quarter 2022 Earnings Results for Fiscal Year Ending February 2023

March 2, 2023

Earnings report

MODERNA ($NASDAQ:MRNA) reported their earnings results for the fourth quarter of the fiscal year ending February 2023 on December 31, 2022. Total revenue for the quarter was USD 1.5 billion, a 70.0% decrease compared to the same period the year prior. This drop in revenue was accompanied by a similar decline in net income, which came in at USD 5.1 billion, a 26.9% decrease over the same period the year prior. The company attributed the decrease in revenue and earnings primarily to decreased demand and rising materials costs.

In addition, MODERNA experienced a decrease in market share which further contributed to their decreased earnings. Despite these losses, they remain committed to providing a quality product and optimizing their operations in order to capitalize on future growth potential. Overall, MODERNA is confident that they will be able to turn around their financial performance over the course of the next fiscal year. They are optimistic that their strategies will be successful in allowing them to regain lost ground and propel their earnings growth. With this in mind, investors should keep a close eye on the company as they move forward.

Stock Price

The results were underwhelming compared to expectations, as evidenced by the 6.7% drop in stock prices from 158.2 to 147.6. This saw MODERNA‘s stock open at 153.7 and close at 147.6. With lackluster results, investors are tempted to sell their MODERNA stocks and pursue other opportunities. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Moderna. More…

| Total Revenues | Net Income | Net Margin |

| 18.88k | 8.36k | 44.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Moderna. More…

| Operations | Investing | Financing |

| 4.98k | -5.18k | -3.45k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Moderna. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 25.86k | 6.74k | 49.67 |

Key Ratios Snapshot

Some of the financial key ratios for Moderna are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 632.4% | – | 50.9% |

| FCF Margin | ROE | ROA |

| 24.3% | 32.3% | 23.2% |

Analysis

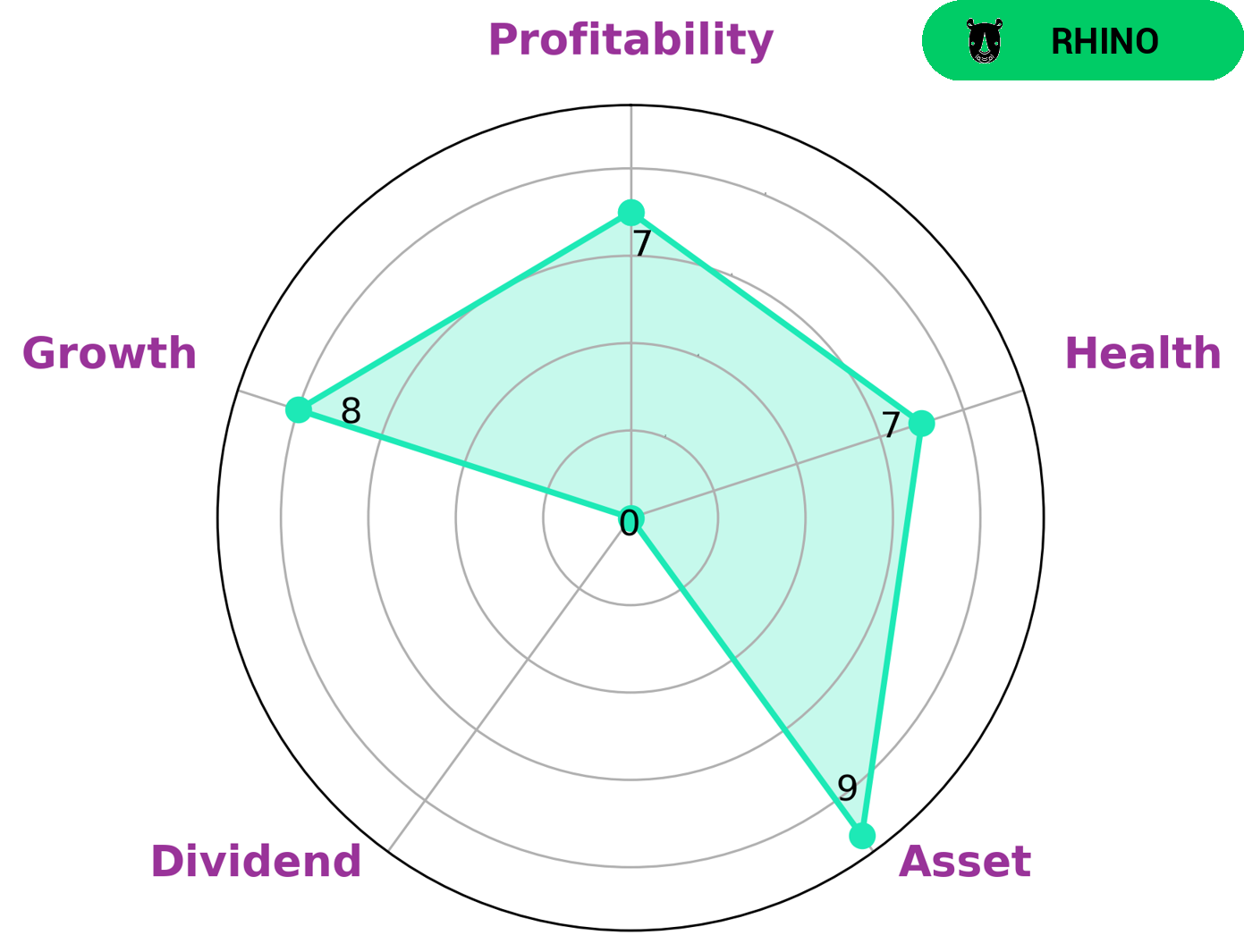

GoodWhale has analyzed MODERNA‘s fundamentals and found it to be strong in terms of asset and growth as indicated by its Star Chart. The chart also shows that MODERNA is weak in dividend, but is capable to sustain future operations in times of crisis. This is reflected in its high health score of 7/10 with regard to its cashflows and debt. Further, MODERNA has been classified as a “rhino”: a type of company that has achieved moderate revenue or earnings growth. This makes it an attractive proposition for investors seeking steady returns, with the upside of potential capital appreciation. Investors may also be interested in MODERNA’s focus on long-term value creation, rather than focusing on short-term gains. As such, MODERNA could provide suitable investors with a steady source of passive income, through its dividends, as well as a potential for capital appreciation. More…

Peers

Moderna Inc is a biotechnology company that develops and manufactures drugs, vaccines, and diagnostics. The company was founded in 2006 and is headquartered in Cambridge, Massachusetts. Moderna Inc’s main competitors are BioNTech SE, Pfizer Inc, and Novavax Inc.

– BioNTech SE ($NASDAQ:BNTX)

BioNTech SE is a German biotechnology company founded in 2008. The company has a market cap of 33.72B as of 2022 and a Return on Equity of 71.82%. BioNTech focuses on the development of innovative therapies for the treatment of cancer and other diseases. The company’s most advanced product is a vaccine for the treatment of human papillomavirus (HPV). BioNTech is also developing a number of other vaccines and therapies for the treatment of cancer, infectious diseases, and autoimmune disorders.

– Pfizer Inc ($NYSE:PFE)

Pfizer Inc is a global pharmaceutical company with a market cap of 247.45B as of 2022. The company’s return on equity is 24.63%. Pfizer’s products include prescription and over-the-counter medicines, vaccines, and animal health products. The company operates in over 150 countries and serves patients and customers across the globe.

– Novavax Inc ($NASDAQ:NVAX)

Novavax is a clinical-stage biotechnology company focused on the discovery, development and commercialization of vaccines to prevent serious infectious diseases. Novavax’s market cap as of 2022 is 1.46B and its ROE is 487.21%. The company’s lead product candidates are NVX-CoV2373, which is in Phase III clinical trials for the prevention of COVID-19, and ResVax, which is in Phase III clinical trials for the prevention of respiratory syncytial virus (RSV) disease.

Summary

Investors analyzed the most recent quarterly results of Moderna, a biotechnology company, to assess their performance. Total revenue for the quarter amounted to USD 1.5 billion, a decrease of 70.0% year-over-year. Net income also decreased 26.9% year over year, coming in at USD 5.1 billion. Stock prices responded negatively, falling in the same day.

These results may indicate investors’ concern over Moderna’s ability to generate enough revenue to cover its operating costs. Investors may wish to research and assess the latest sector trends and developments in Moderna’s products and services before making any investment decision.

Recent Posts