Moderna Announces Free COVID-19 Vaccine Access for All Americans, Even After Pandemic Emergency Expiration.

February 17, 2023

Trending News ☀️

Moderna ($NASDAQ:MRNA)’s announcement to provide free access to the vaccine ensures that all Americans will have access to the medication for free, regardless of the state of the pandemic. This decision was made in response to the Biden administration’s extension of the public health emergency last week, and it will ensure that Americans can receive the vaccine even after the emergency is set to expire in May. During the emergency, the government has been procuring the vaccine and building up a federal stockpile which will no longer be available when the emergency ends. The vaccine is critical in helping to protect individuals against contracting COVID-19 and is a key part of the Biden administration’s plan to combat the pandemic.

Moderna’s decision to provide free access to the vaccine, regardless of the state of the pandemic, will ensure that all Americans have equal access to this life-saving medication. This announcement is an important step in the fight against coronavirus and will help to bring us one step closer to ending this pandemic.

Market Price

On Wednesday, Moderna announced that it will provide free COVID-19 vaccine access for all Americans, even after the pandemic emergency expiration. This news has been largely welcomed by the public, and has shown positive results in the company’s stock market performance. The stock opened at $173.2 and closed at $177.3, an increase of 0.9% from the closing price of 175.6 the day prior. This is a promising sign for the company and could potentially lead to future profits for its investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Moderna. More…

| Total Revenues | Net Income | Net Margin |

| 20.68k | 11.77k | 57.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Moderna. More…

| Operations | Investing | Financing |

| 6.63k | -5.27k | -3.88k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Moderna. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 26.06k | 8.06k | 46.49 |

Key Ratios Snapshot

Some of the financial key ratios for Moderna are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 565.0% | – | 64.6% |

| FCF Margin | ROE | ROA |

| 30.0% | 46.4% | 32.0% |

Analysis

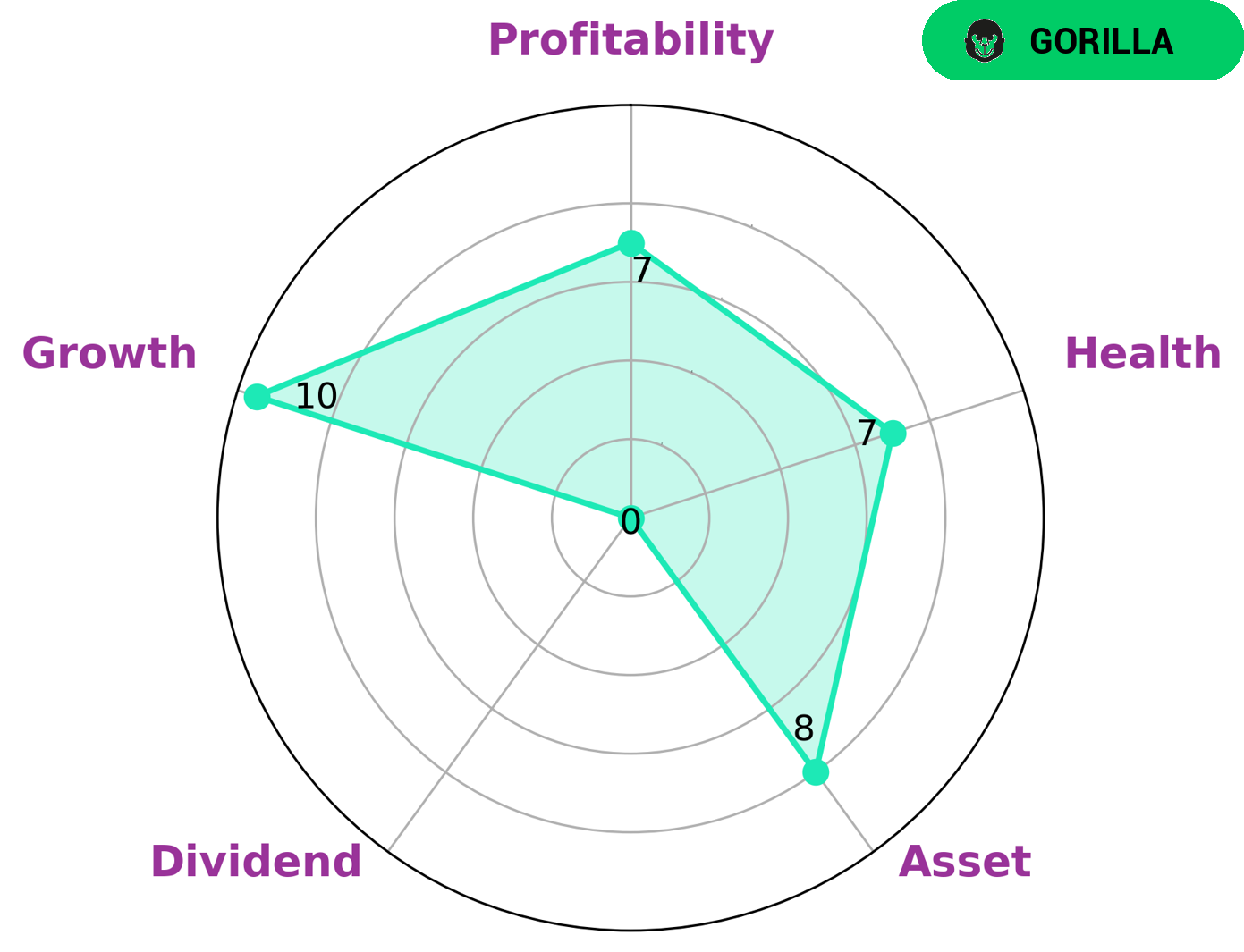

At GoodWhale, we recently conducted a thorough analysis of MODERNA‘s wellbeing and the results were superb! Based on our Star Chart analysis, MODERNA has a high health score of 7/10 with regard to its cashflows and debt, indicating that it is well-equipped to ride out any crisis without facing bankruptcy risks. This makes MODERNA an attractive candidate for many types of investors, such as growth investors who are looking for high returns, or value investors seeking stocks with potential for significant appreciation. Additionally, MODERNA is strong in asset, growth and profitability, however it does not pay dividends, which may be a major disadvantage for some investors. All in all, MODERNA is an ideal candidate for many types of investors and can offer steady returns with minimal risks. More…

Peers

Moderna Inc is a biotechnology company that develops and manufactures drugs, vaccines, and diagnostics. The company was founded in 2006 and is headquartered in Cambridge, Massachusetts. Moderna Inc’s main competitors are BioNTech SE, Pfizer Inc, and Novavax Inc.

– BioNTech SE ($NASDAQ:BNTX)

BioNTech SE is a German biotechnology company founded in 2008. The company has a market cap of 33.72B as of 2022 and a Return on Equity of 71.82%. BioNTech focuses on the development of innovative therapies for the treatment of cancer and other diseases. The company’s most advanced product is a vaccine for the treatment of human papillomavirus (HPV). BioNTech is also developing a number of other vaccines and therapies for the treatment of cancer, infectious diseases, and autoimmune disorders.

– Pfizer Inc ($NYSE:PFE)

Pfizer Inc is a global pharmaceutical company with a market cap of 247.45B as of 2022. The company’s return on equity is 24.63%. Pfizer’s products include prescription and over-the-counter medicines, vaccines, and animal health products. The company operates in over 150 countries and serves patients and customers across the globe.

– Novavax Inc ($NASDAQ:NVAX)

Novavax is a clinical-stage biotechnology company focused on the discovery, development and commercialization of vaccines to prevent serious infectious diseases. Novavax’s market cap as of 2022 is 1.46B and its ROE is 487.21%. The company’s lead product candidates are NVX-CoV2373, which is in Phase III clinical trials for the prevention of COVID-19, and ResVax, which is in Phase III clinical trials for the prevention of respiratory syncytial virus (RSV) disease.

Summary

MODERNA has seen a surge in share prices since its groundbreaking announcement to make their COVID-19 vaccine free and accessible to all Americans, even after the pandemic emergency is over. This is undoubtedly a positive sign for investors, as there is a strong potential for strong financial returns. As the pandemic continues to spread, the demand for MODERNA’s vaccine is expected to rise, leading to further growth in MODERNA’s share price. Analysts believe that any positive news regarding the efficacy and availability of MODERNA’s vaccine could cause more investors to join the company, thus driving up the company’s value.

There are also rumors of possible partnerships with various pharmaceutical companies that could further increase their stock prices. Investors can rest assured that MODERNA is well-positioned to continue gaining momentum in the coming months.

Recent Posts