Mineralys Therapeutics Launches IPO, Sets New Standard in Hypertension Drug Development

April 22, 2023

Trending News 🌥️

Mineralys Therapeutics ($NASDAQ:MLYS), a leader in the development of innovative hypertension drugs, has recently launched its initial public offering (IPO) and is set to revolutionize the hypertension drug market. The company has seen rapid growth since its inception, boasting a strong portfolio of products that are in various stages of development. The launch of Mineralys’ IPO marks a major milestone for the company and sets a new standard for hypertension drug development. With the IPO, shareholders will have access to the company’s financials, giving them a more transparent view of Mineralys’ operations and progress.

This will also allow for greater capital injection into research and development activities as the company continues to develop its pipeline of therapies. The IPO also serves as a testament to Mineralys’ commitment to providing innovative, personalized treatments for patients suffering from hypertension. With its experienced team of researchers and medical experts and access to greater capital resources, Mineralys is well positioned to continue leading the way in hypertension drug development.

Stock Price

On Friday, Mineralys Therapeutics announced its Initial Public Offering (IPO). The stock opened at $13.6 and closed at $14.2, representing a 3.3% increase from its prior closing price of 13.8. This successful launch of the company’s stock marks a new standard in hypertension drug development and showcases the potential of Mineralys’ innovative approach to treating high blood pressure. The launch of Mineralys’ IPO has been met with an encouraging response from investors, signaling that the company is on track to become a leader in the hypertension drug development space.

With its groundbreaking research, Mineralys is setting a new standard for hypertension drug development and promising a more effective and efficient way to treat this condition. In light of the successful launch of Mineralys’ IPO, investors are hopeful that the company will continue to make strides in hypertension drug development that could eventually lead to more effective treatments for the millions of individuals living with high blood pressure. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mineralys Therapeutics. More…

| Total Revenues | Net Income | Net Margin |

| 0 | -29.8 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mineralys Therapeutics. More…

| Operations | Investing | Financing |

| -29.22 | -21.76 | 128.02 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mineralys Therapeutics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 114.44 | 166.71 | – |

Key Ratios Snapshot

Some of the financial key ratios for Mineralys Therapeutics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | 41.1% | -17.2% |

Analysis

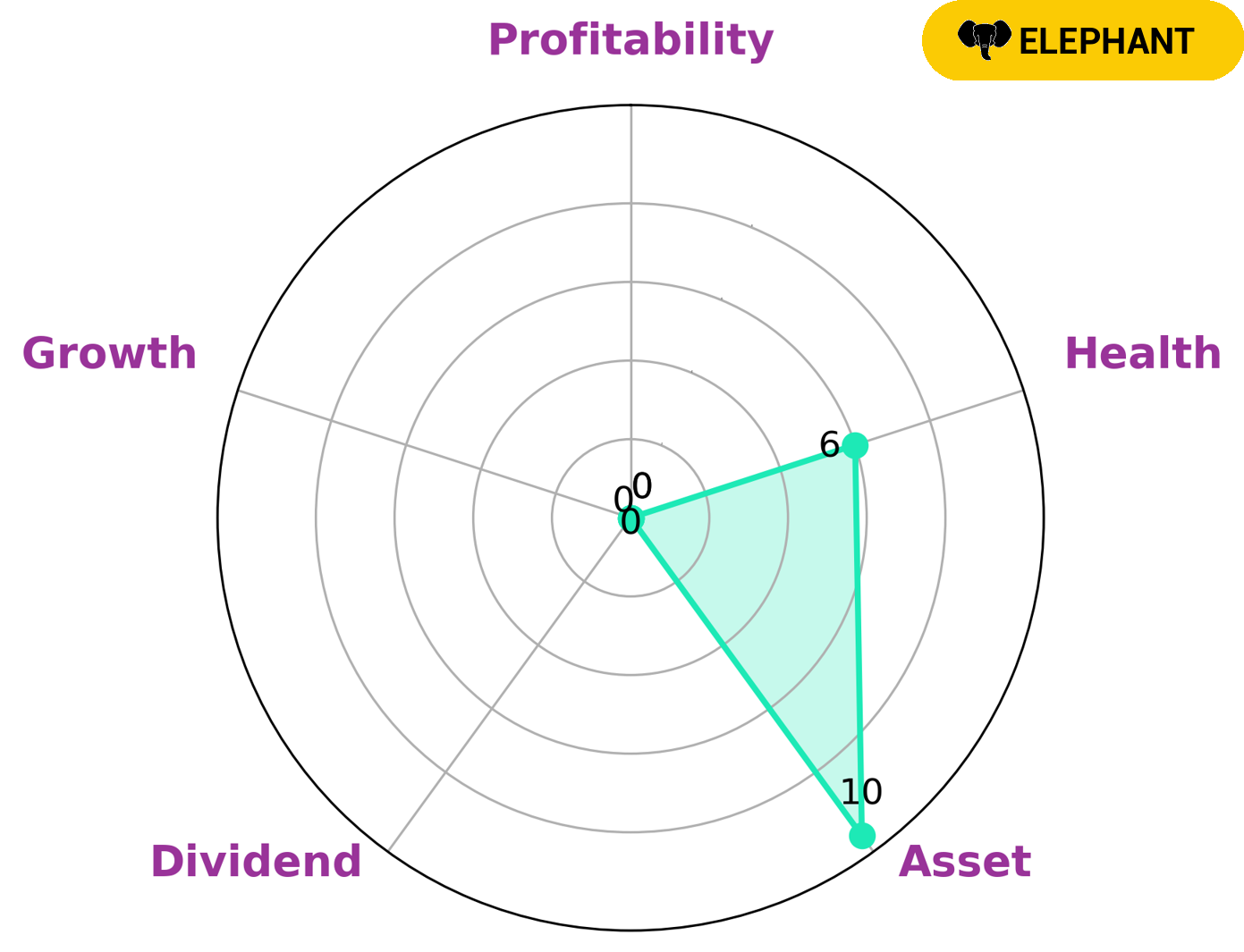

At GoodWhale, we analyze the wellbeing of MINERALYS THERAPEUTICS using our Star Chart to identify trends in asset, dividend, growth and profitability. Our analysis reveals that MINERALYS THERAPEUTICS is strong in asset and weak in dividend, growth and profitability. The company’s intermediate health score of 6/10 indicates that it might be able to pay off debt and fund future operations. Based on our analysis, MINERALYS THERAPEUTICS is classified as an ‘elephant’, a type of company that is rich in assets after deducting off liabilities. Investors who are looking for companies that have strong positions in the asset department may be interested in this type of company. More…

Peers

Founded in 2021, Mineralys is one of several companies in the industry, such as Kiniksa Pharmaceuticals Ltd., Viridian Therapeutics Inc., and Edgewise Therapeutics Inc., who are all involved in the development of innovative therapies for rare, complex diseases.

– Kiniksa Pharmaceuticals Ltd ($NASDAQ:KNSA)

Kiniksa Pharmaceuticals Ltd is a biopharmaceutical company focused on discovering, acquiring, developing and commercializing therapeutic medicines to treat debilitating and life-threatening diseases. The company has a market cap of 813.32M as of 2023 which reflects the company’s strong financial position. It also has a Return on Equity of 1.57%, indicating that the company has been able to generate significant returns on its equity investments. Kiniksa is committed to developing innovative therapies for various diseases and is focused on providing better treatment options for patients suffering from these diseases.

– Viridian Therapeutics Inc ($NASDAQ:VRDN)

Viridian Therapeutics Inc is a biopharmaceutical company that develops therapies for rare diseases and complex disorders. The company has a market capitalization of 1.27B as of 2023, which is the total value of all of its outstanding shares. The Return on Equity (ROE) for Viridian is -20.11%, indicating that the company has not been effective in generating profit from the funds it has received from shareholders. Viridian’s current focus is on developing treatments for diseases such as cystic fibrosis, haemophilia and Gaucher disease.

– Edgewise Therapeutics Inc ($NASDAQ:EWTX)

Edgewise Therapeutics Inc is a biopharmaceutical company that focuses on the development and commercialization of products for the treatment of genetic and rare diseases. The company’s market cap as of 2023 stands at 482.06M and its Return on Equity (ROE) is -12.65%. This reflects that the company has had difficulty generating returns on its investments. A negative ROE indicates Edgewise Therapeutics Inc has used more debt than equity to finance its operations, making it a higher risk in terms of generating returns.

Summary

Mineralys Therapeutics is a recently-listed pharmaceutical company on the stock market specializing in the development of treatments for hypertension. Its initial public offering (IPO) was met with positive investor sentiment, causing the stock price to appreciate significantly on the first day of trading. Analysts cite Mineralys’ strong clinical trial program and drug pipeline of promising treatments as the main driver of investors’ confidence in the company.

Beyond its clinical trials, Mineralys has been observed to have a well-rounded management team and a comprehensive strategy to capture the hypertension market. With such promising fundamentals and an encouraging start, investors are enticed to gain exposure to this company’s potential upside.

Recent Posts