Merus Shares Surge 13% After Positive Data on Head and Neck Cancer Candidate

April 18, 2023

Trending News ☀️

MERUS N.V ($NASDAQ:MRUS) is a biotechnology company working to develop treatments for cancer. The company has recently released positive data on their head and neck cancer candidate, resulting in a surge of 13% in their shares. This news has invigorated the investment community and given a boost to the company’s stock. The positive data indicates that the candidate has a good safety profile, showing no adverse effects in the patient study. Furthermore, the candidate has also shown signs of efficacy as it was able to reduce tumor size in some patients. This promising news has caused investors to take notice and invest in Merus’ stock.

This news is especially encouraging for Merus as their candidate has the potential to become the first therapy designed specifically for head and neck cancer. This could be a major breakthrough in the area of cancer treatment, and would be beneficial for those suffering from head and neck cancer. Merus has also stated that they are continuing to investigate the effects of their candidate on head and neck cancer in other patient studies, with results expected soon. If these studies are successful, Merus could become a leader in the field of cancer research and treatment. Investors are sure to keep a close eye on Merus and its stock as they await further news.

Stock Price

On Monday, MERUS N.V shares showed an impressive increase with stock opening at $23.3 and closing at $23.9, marking a 13% surge from its prior closing price of 21.8. The candidate was found to be well tolerated and has shown positive signs of efficacy in early clinical trials. With this news, investors have gained a renewed confidence in MERUS N.V and its potential treatments for cancer. This surge in share prices is likely to be the start of a positive trend for the company in the months ahead. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Merus N.v. More…

| Total Revenues | Net Income | Net Margin |

| 41.59 | -131.19 | -353.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Merus N.v. More…

| Operations | Investing | Financing |

| -149.9 | 2.8 | 58.74 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Merus N.v. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 376.54 | 129.49 | 5.33 |

Key Ratios Snapshot

Some of the financial key ratios for Merus N.v are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.1% | – | -384.8% |

| FCF Margin | ROE | ROA |

| -378.8% | -36.7% | -26.6% |

Analysis

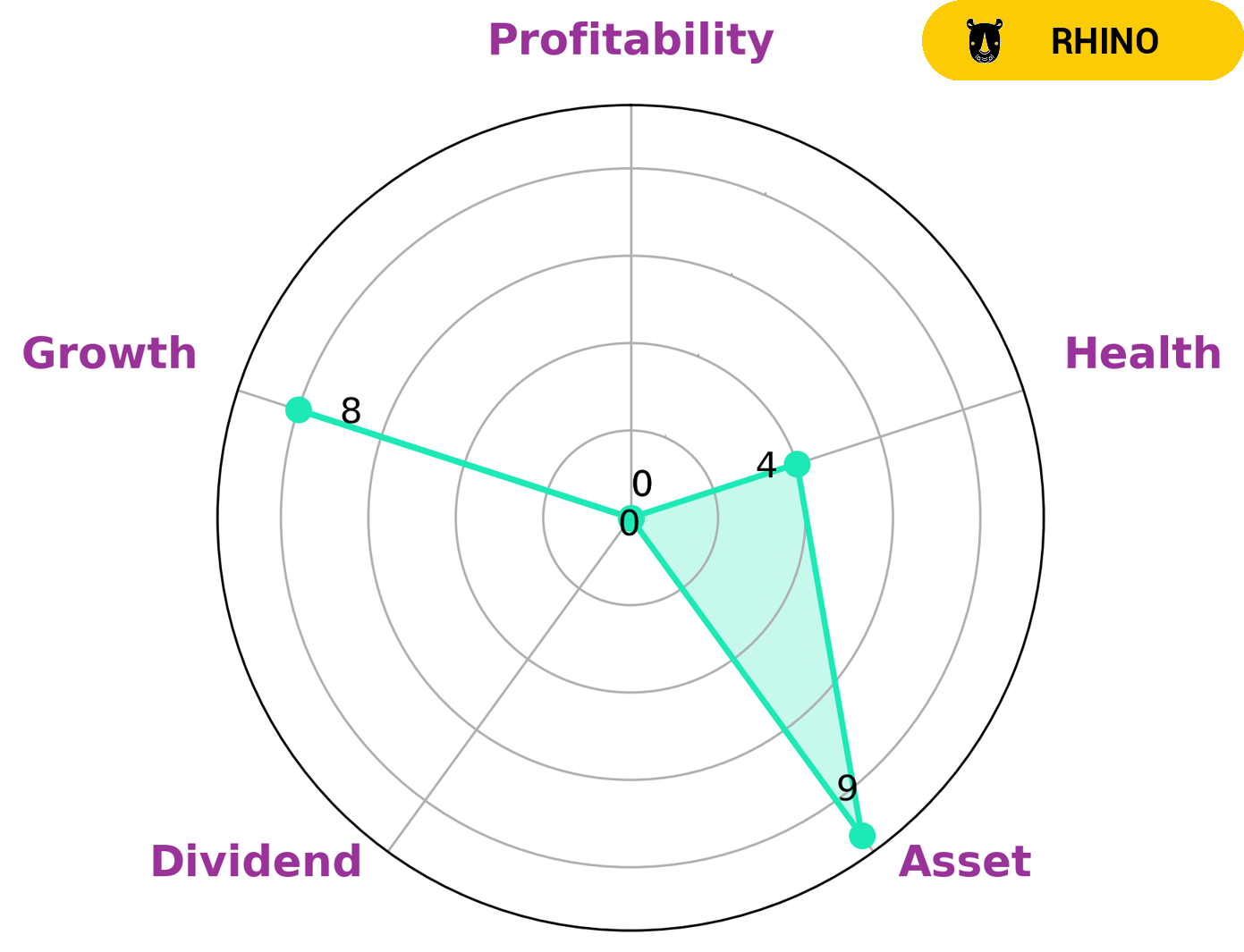

Upon examining the financials of MERUS N.V., GoodWhale’s Star Chart reveals that the company is strong in asset and growth, but weak in dividend and profitability. According to GoodWhale’s analysis, MERUS N.V is classified as a ‘rhino’, which is a type of company that has achieved moderate revenue or earnings growth. Investors who are looking for companies with lower risk but still moderate growth rate may be interested in investing in MERUS N.V. Furthermore, the company has an intermediate health score of 4/10 in regards to cashflows and debt, indicating that it may be able to pay off debt and fund future operations. More…

Peers

The company’s lead product candidate, MCLA-158, is a bispecific antibody that is in Phase II clinical trials for the treatment of solid tumors. Merus’ other product candidates are in preclinical development for the treatment of hematologic malignancies and autoimmune diseases. The company competes with F-star Therapeutics Inc, Talaris Therapeutics Inc, and Day One Biopharmaceuticals Inc.

– F-star Therapeutics Inc ($NASDAQ:FSTX)

F-star Therapeutics Inc is a clinical-stage biopharmaceutical company, which focuses on the development of antibody therapeutics. Its pipeline includes programs in cancer and autoimmune disease. The company was founded by Andrew J. Allen, Charles J. Wilson and Christoph Rader in 2016 and is headquartered in Cambridge, MA.

– Talaris Therapeutics Inc ($NASDAQ:TALS)

Talaris Therapeutics is a clinical-stage biopharmaceutical company that is focused on developing and commercializing a cell-based therapy to treat patients with bleeding disorders. The company’s product candidate, TARA-002, is an autologous, off-the-shelf product that is being developed for the treatment of hemophilia A and B. Talaris Therapeutics has a market cap of 61.31M as of 2022 and a Return on Equity of -19.06%.

– Day One Biopharmaceuticals Inc ($NASDAQ:DAWN)

One Biopharmaceuticals Inc is a publicly traded company with a market cap of 1.45B as of 2022. The company has a Return on Equity of -32.5%. One Biopharmaceuticals Inc is a pharmaceutical company that focuses on the development and commercialization of innovative therapies for patients with serious and life-threatening diseases.

Summary

MERUS N.V is a biotechnology company that develops cancer treatments for patients with head and neck cancer. Their recent data has shown an impressive 13% improvement in candidate treatments, which drove their stock price to up in the same day. For potential investors, this could be an excellent opportunity to get involved in the company’s progress. As the company continues to advance their treatments and show promising results, investors can assess the possibilities of growth and possible returns.

Additionally, with a more stable history in the biotechnology sector, MERUS N.V has the potential to increase its stock price, making it an attractive option for investors.

Recent Posts