MacroGenics’ Fiscal 2023 Net Loss Narrows as Revenue Increases.

March 25, 2023

Trending News 🌧️

MACROGENICS ($NASDAQ:MGNX): MacroGenics recently reported its fiscal 2023 financial results and the results show a reduction in net loss as revenue has increased. The company saw a revenue growth in fiscal 2022, which contributed to the overall decrease in net loss. The company attributed the revenue growth to a combination of increased royalties from its partnered programs and higher product sales from its oncology and immuno-oncology drug candidates. In particular, the company saw strong progress with its lead drug candidate, margetuximab.

The drug is currently in phase 3 clinical trials and if approved, it could provide a significant source of revenue for MacroGenics. Overall, the results showed that MacroGenics is making progress towards achieving profitability as revenue continues to increase. The company is hopeful that with continued investment in research and development and potential approvals of its drug candidates, it can eventually become a profitable business.

Price History

Recent media sentiment towards MACROGENICS, a biopharmaceutical company, has been largely negative. However, on Thursday the stock opened at $7.2 and closed at $7.0, up by 3.6% from its previous close of 6.7. This was likely due to the company’s recently reported fiscal 2023 net loss which had narrowed even as their revenue increased. This is a positive sign for the company as it indicates that their business strategies and financial policies are working and that they are making progress towards profitability. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Macrogenics. More…

| Total Revenues | Net Income | Net Margin |

| 150.02 | -119.76 | -79.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Macrogenics. More…

| Operations | Investing | Financing |

| -86.96 | 70.72 | 1.66 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Macrogenics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 280.47 | 138.46 | 2.3 |

Key Ratios Snapshot

Some of the financial key ratios for Macrogenics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 34.2% | – | -80.9% |

| FCF Margin | ROE | ROA |

| -60.4% | -57.3% | -27.1% |

Analysis

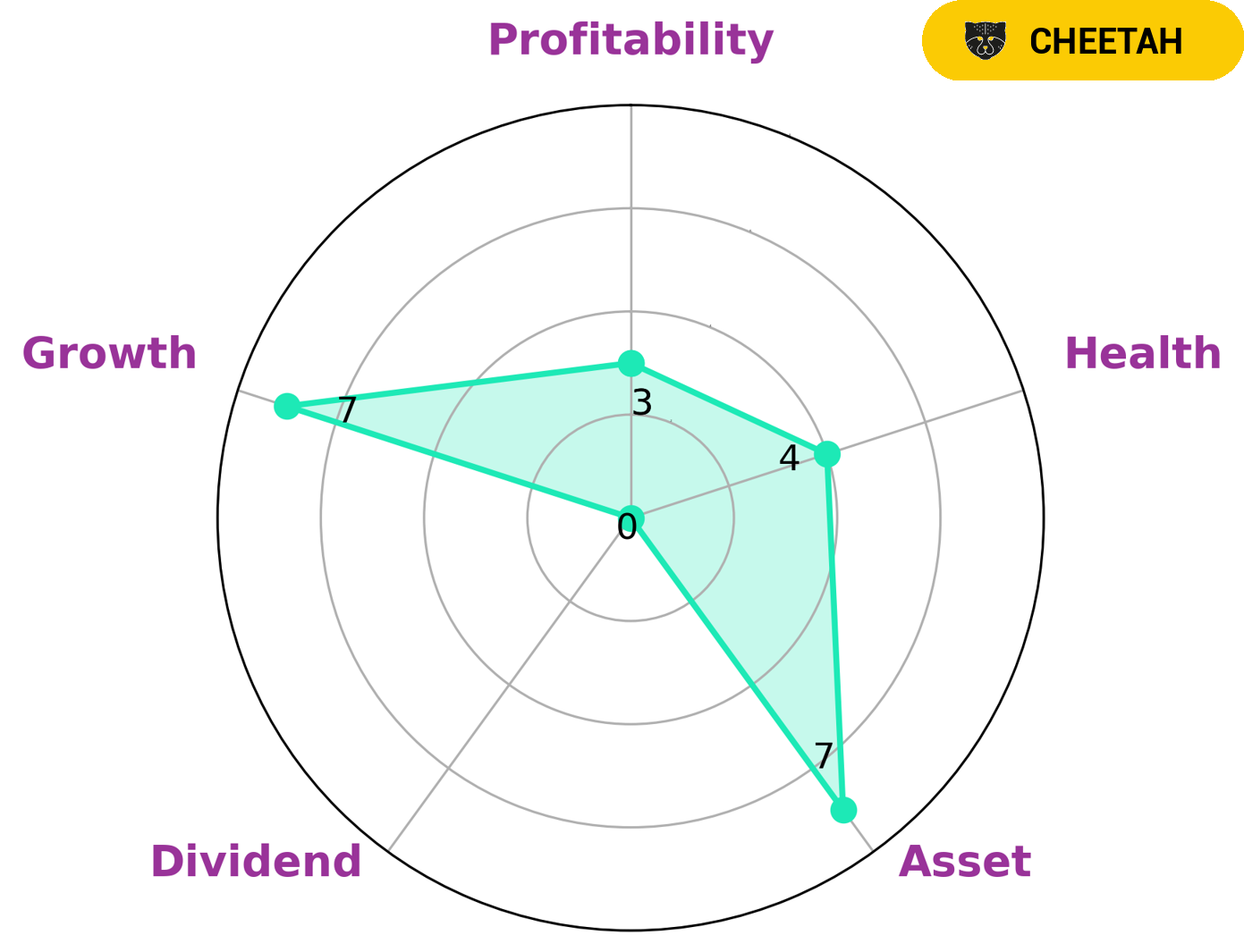

At GoodWhale, we have conducted an analysis of MACROGENICS’s fundamentals. Our Star Chart classification for MACROGENICS was “cheetah”, which indicates that the company has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors interested in such companies may find MACROGENICS to be appealing. We have determined that MACROGENICS has an intermediate health score of 4/10 with regard to its cashflows and debt, suggesting that it is likely to survive any crisis without the risk of bankruptcy. In terms of its strength and weaknesses, MACROGENICS is strong in asset and growth, but weak in dividend and profitability. More…

Peers

Macrogenics’ proprietary technology involves the use of engineered human antibodies to target disease-causing proteins. The company has four product candidates in clinical development for the treatment of various cancers and autoimmune diseases. Macrogenics’ competitors in the antibody therapeutics market include Nuvation Bio, Inc., Adocia, and Tonix Pharmaceuticals Holding Corp.

– Nuvation Bio Inc ($NYSE:NUVB)

Nuvation Bio Inc is a clinical-stage biopharmaceutical company. The Company focuses on the development and commercialization of therapeutics for the treatment of cancer and other serious diseases. Its lead product candidate is rovalpituzumab tesirine, an antibody-drug conjugate (ADC) targeting delta-like protein 3 (DLL3), which is in Phase II clinical development for the treatment of small cell lung cancer (SCLC), non-small cell lung cancer (NSCLC), mesothelioma, and pancreatic cancer. The Company is also developing NB-01, a DLL3-targeted ADC for the treatment of SCLC and NSCLC, which is in preclinical development.

– Adocia ($LTS:0QAI)

Adocia is a company that produces medicines and treatments for diabetes. The company has a market cap of 30.91M as of 2022 and a Return on Equity of 33.93%. Adocia’s products include insulin, GLP-1 analogs, and SGLT2 inhibitors. The company’s products are used to treat type 1 and type 2 diabetes.

– Tonix Pharmaceuticals Holding Corp ($NASDAQ:TNXP)

Tonix Pharmaceuticals Holding Corp is a clinical-stage biopharmaceutical company. The company’s focus is on discovering, licensing, acquiring and developing small molecule drugs, biologics and natural product drugs to treat serious neurological, psychiatric and immunologic disorders.

Summary

MacroGenics Inc. has reported improved financial results for fiscal year 2023. Revenue has increased significantly year-over-year, leading to a narrowing net loss. Despite the current negative media sentiment, the company’s stock price has responded positively and moved up on the same day of the results announcement. As such, investors are encouraged to take a closer look at MacroGenics and consider it a worthwhile investment opportunity.

MacroGenics has a strong balance sheet, a robust pipeline of products in late-stage clinical development and several key partnerships with leading pharmaceutical companies. The company also boasts an experienced management team dedicated to driving long-term growth. For investors looking for potential upside, MacroGenics could be worth considering.

Recent Posts