Kinnate Biopharma Intrinsic Value – HC Wainwright Lowers Q2 2023 Earnings Estimates for Kinnate Biopharma

May 25, 2023

Trending News 🌧️

Analysts at HC Wainwright have recently lowered their earnings per share outlook for Kinnate Biopharma ($NASDAQ:KNTE) Inc. for the second quarter of 2023. Kinnate Biopharma Inc. is a biotechnology company that focuses on the discovery and development of novel therapeutic drugs for patients with solid tumors. The company has a strong pipeline of products which are being evaluated for the treatment of cancer and other diseases. According to the analysts, this downward revision is attributed to the current market conditions and the company’s inability to meet certain deadlines and milestones.

The revised outlook may be concerning for some investors of Kinnate Biopharma Inc., but the company appears to be confident in delivering on its long-term goals. Kinnate Biopharma Inc. continues to make progress in its research and development initiatives, and its strong portfolio of programs should help the company reach its goals in the future.

Earnings

In the report, it is revealed that KINNATE BIOPHARMA lost 0.0M USD in total revenue and 32.94M USD in net income. Compared to the previous year, KINNATE BIOPHARMA’s total revenue has decreased from 0.0M USD to 0.0M USD in the last 3 years, leading to the current loss of earnings.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Kinnate Biopharma. More…

| Total Revenues | Net Income | Net Margin |

| 0 | -122.31 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Kinnate Biopharma. More…

| Operations | Investing | Financing |

| -95.67 | 113.22 | -8.08 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Kinnate Biopharma. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 243.88 | 21.12 | 4.78 |

Key Ratios Snapshot

Some of the financial key ratios for Kinnate Biopharma are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.0% | – | – |

| FCF Margin | ROE | ROA |

| – | -35.3% | -32.3% |

Market Price

This news caused Kinnate Biopharma‘s stock to open at $4.0 and close at the same price, a 1.0% increase from its closing price the day before. Despite the positive movement in stock prices, investors remain cautious about the company’s future performance when taking into account the revised estimates. Live Quote…

Analysis – Kinnate Biopharma Intrinsic Value

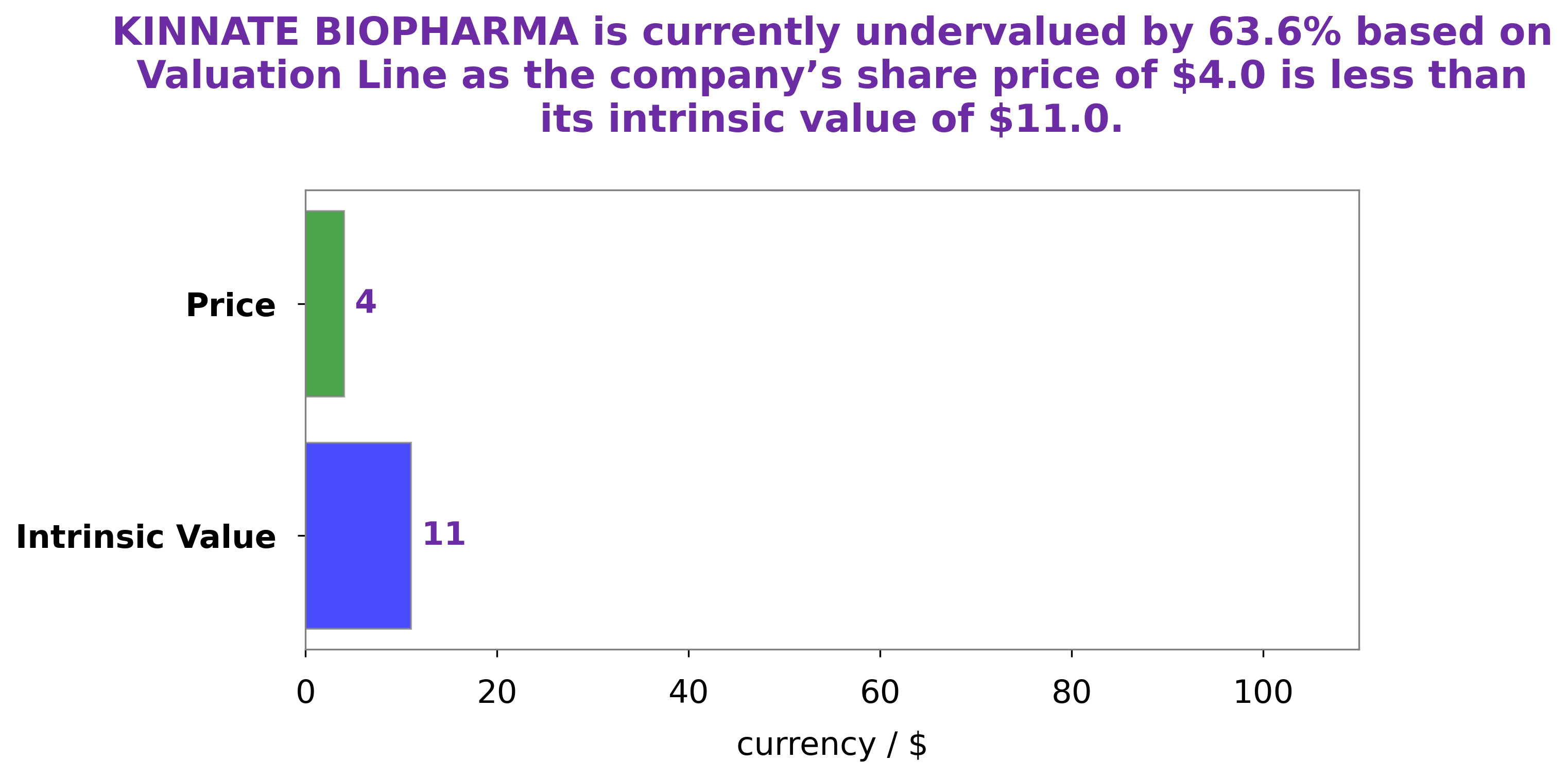

GoodWhale has analyzed the financials of KINNATE BIOPHARMA and our proprietary Valuation Line has calculated the intrinsic value of their share to be around $11.0. Currently, KINNATE BIOPHARMA is trading at $4.0, making it undervalued by 63.6%. If you are looking for a good investment opportunity, KINNATE BIOPHARMA presents a great chance to buy a stock with potential for growth at an attractive price. More…

Peers

The company’s lead product candidate, IPI-549, is an orally-available, small molecule inhibitor of PI3Kγ. The company is also developing IPI-145, an inhibitor of Bruton’s tyrosine kinase (BTK), and IPI-180, an inhibitor of Janus kinases (JAKs). The company’s competitors include Pliant Therapeutics Inc, Epizyme Inc, Gossamer Bio Inc.

– Pliant Therapeutics Inc ($NASDAQ:PLRX)

Pliant Therapeutics, Inc. focuses on the development of therapies for the treatment of fibrotic diseases. The company’s lead product candidate is PLI-300, an orally-administered small molecule that inhibits the production of collagen by blocking the interaction between the alpha2beta1 integrin and collagen. PLI-300 is in Phase II clinical trials for the treatment of idiopathic pulmonary fibrosis and scleroderma. The company was founded in 2015 and is headquartered in San Francisco, California.

– Epizyme Inc ($NASDAQ:GOSS)

Gossamer Bio Inc. is a clinical-stage biopharmaceutical company focused on discovering, developing and commercializing therapeutics in the disease areas of immunology, inflammation and oncology. The company’s market cap is $990.28 million and its ROE is -1952.91%. Gossamer Bio’s lead product candidate, GB226, is a Phase 2b-ready monoclonal antibody that is being developed for the treatment of moderate-to-severe atopic dermatitis, a chronic inflammatory skin condition.

Summary

Investors should analyze the company’s financial performance to determine whether or not this is a sign of a potential decline in the company’s financials, or if it is merely a short-term adjustment. Further considerations should be taken into account when analyzing the stock, such as the company’s past performance, current market trends, and the competitive landscape. Investors should also pay close attention to any new developments and potential strategic partnerships that could influence the company’s growth in the future.

Recent Posts