Julie Papanek Grant Sells 25000 Shares of Day One Biopharmaceuticals,

January 8, 2023

Trending News ☀️

Day One Biopharmaceuticals ($NASDAQ:DAWN), Inc. is an innovative biotechnology company that develops and manufactures advanced therapeutics, diagnostics and medical devices for the treatment of various diseases and conditions. The company, which is headquartered in Cambridge, Massachusetts, is dedicated to providing innovative treatments to patients suffering from life-threatening illnesses. Julie Papanek Grant recently sold 25000 shares of Day One Biopharmaceuticals, Inc. stock. This marks the first time that the majority shareholder, Julie Papanek Grant, has disposed of shares in the company. The sale of the 25000 shares signifies a major shift in the company’s ownership structure and could potentially be indicative of a change in the company’s strategy moving forward. The sale of the 25000 shares could potentially have an effect on the stock’s performance in the near future. Although the exact reasons for the sale are not yet known, analysts have speculated that the sale could indicate a lack of confidence in the company’s future prospects or a desire to diversify investments. As a result, investors may want to take a more cautious approach when considering investing in Day One Biopharmaceuticals, Inc. Despite the sale of 25000 shares, Julie Papanek Grant remains the majority shareholder of Day One Biopharmaceuticals, Inc. It is important to remember that this sale does not necessarily indicate any negative news about the company or its future prospects.

However, investors should remain aware of any significant changes in ownership as they could potentially affect the stock’s performance in the near future.

Stock Price

Despite this, the current media sentiment surrounding the stock is mostly positive. On Thursday, Day One Biopharmaceuticals opened at $20.9 and closed at $21.1, up 0.9% from its prior closing price of $21.0. Day One Biopharmaceuticals’ stock has been performing well in the past few weeks, with its share price rising steadily. Investors have been looking to the company for potential gains due to its innovative approach to drug development and its strong portfolio of products.

The recent news of Julie Papanek Grant’s share sale has not had an impact on the company’s stock price, suggesting that investors remain confident in the company’s prospects. The current media sentiment surrounding the stock is mostly positive and investors remain confident in the company’s prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for DAWN. More…

| Total Revenues | Net Income | Net Margin |

| 0 | -124.01 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for DAWN. More…

| Operations | Investing | Financing |

| -87.73 | -252.86 | 164.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for DAWN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 381.86 | 18.79 | 4.94 |

Key Ratios Snapshot

Some of the financial key ratios for DAWN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | -20.9% | -20.6% |

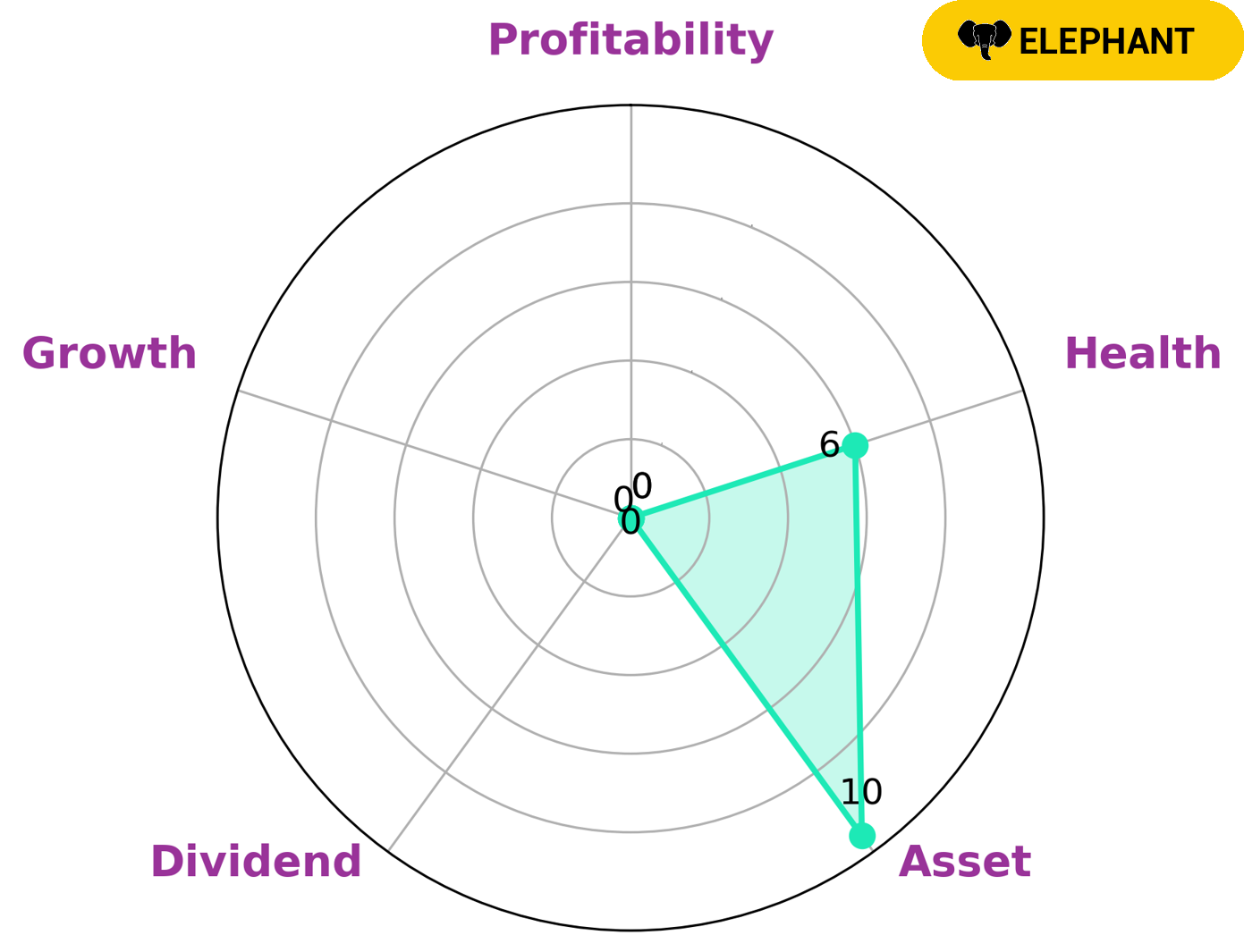

VI Analysis

DAY ONE BIOPHARMACEUTICALS is a company that is strong in asset yet weak in dividend, growth and profitability. With the help of the VI app, investors can easily assess the company’s fundamentals, which reflect its long-term potential. Based on the VI Star Chart, the company is likely to remain safe from bankruptcy with an intermediate health score of 6/10 regarding its cash flows and debt. DAY ONE BIOPHARMACEUTICALS is classified as an ‘elephant’ company, meaning it has a large amount of assets after subtracting off liabilities. Such companies attract different types of investors, ranging from those who are looking for steady income and long-term capital gains to those who are more speculative and aim for short-term capital gains. Investors who are seeking steady, reliable income may prefer investing in ‘elephant’ companies due to their large asset base and potential for dividends. On the other hand, more speculative investors may be drawn to such companies due to their potential for short-term capital gains as they may be able to buy stocks at a lower price. In either case, DAY ONE BIOPHARMACEUTICALS can be attractive to investors looking for opportunities to increase their portfolio value. Investing in such a company can help investors diversify their portfolios and gain exposure to a variety of different assets. Ultimately, it is up to the investor to assess the risks and rewards of investing in DAY ONE BIOPHARMACEUTICALS and decide if it is a suitable investment for them. More…

VI Peers

They are constantly in competition with other big names such as Talaris Therapeutics Inc, F-star Therapeutics Inc, and Forma Therapeutics Holdings Inc. While each company has their own unique approach to the industry, Day One always manages to stay ahead of the curve. This is likely due to their cutting-edge research and development techniques. No matter what the future holds for the biopharmaceutical industry, it is safe to say that Day One will be a major player.

– Talaris Therapeutics Inc ($NASDAQ:TALS)

Talaris Therapeutics Inc is a clinical-stage biopharmaceutical company. The Company is focused on developing and commercializing a cell-based therapy to treat patients with autoimmune and inflammatory diseases, and cancer. The Company’s product candidates are Talsaquelumab and TAL-301. Talsaquelumab is an investigational, humanized monoclonal antibody that binds to and neutralizes interleukin-6 (IL-6). TAL-301 is an investigational, monoclonal antibody that binds to and neutralizes soluble IL-6Ralpha (sIL-6R). The Company is developing Talsaquelumab for the treatment of rheumatoid arthritis, systemic lupus erythematosus, Castleman’s disease, IgA nephropathy and other inflammatory diseases. The Company is also developing TAL-301 for the treatment of Castleman’s disease, multiple sclerosis, IgA nephropathy, scleroderma and other autoimmune diseases.

– F-star Therapeutics Inc ($NASDAQ:FSTX)

F-Star Therapeutics Inc is a clinical-stage biopharmaceutical company, which focuses on the discovery and development of antibodies that target the fibroblast growth factor receptor (FGFR) family of proteins. The company was founded by Andres M. Gutierrez, Nicolas Leupin, and Christian Kopfli in 2008 and is headquartered in Cambridge, MA.

Summary

Investing in Day One Biopharmaceuticals, Inc. can be a great opportunity for investors. Investors should do their own research to determine if investing in Day One Biopharmaceuticals is right for them. They should look into the company’s performance history, revenue, and other financial information to make an informed decision. Day One Biopharmaceuticals has the potential to be a great investment for those willing to take a risk.

Recent Posts