Jazz Pharmaceuticals Intrinsic Stock Value – Philip James Wealth Management LLC invests in Jazz Pharmaceuticals, boosting third quarter earnings

November 13, 2024

☀️Trending News

Jazz Pharmaceuticals ($NASDAQ:JAZZ) is a multinational biopharmaceutical company that specializes in developing and commercializing innovative treatments for rare and complex diseases. The company has a diverse portfolio of products, with a focus on neuroscience and oncology. Jazz Pharmaceuticals is listed on the NASDAQ stock exchange and has been experiencing steady growth in recent years. The recent investment from Philip James Wealth Management LLC is seen as a positive sign for Jazz Pharmaceuticals, as it further strengthens their financial position. Philip James Wealth Management LLC is a renowned investment firm with a strong track record of successful investments in the healthcare sector. Their decision to invest in Jazz Pharmaceuticals signals confidence in the company’s potential for growth and success. This investment comes at a crucial time for Jazz Pharmaceuticals, as the company recently reported their third-quarter earnings.

This indicates that the company’s investments in research and development are paying off, as they continue to bring innovative treatments to market. The new investment from Philip James Wealth Management LLC will provide Jazz Pharmaceuticals with additional resources to further their research and development efforts and continue to grow their product portfolio. This is likely to lead to even stronger financial results in the future, which could potentially benefit both the company and its investors. It not only boosts their financial position but also serves as a vote of confidence in their potential for growth and success. With a strong portfolio of products and continued investments in research and development, Jazz Pharmaceuticals is well-positioned to continue delivering positive financial results and making a significant impact in the pharmaceutical industry.

Market Price

Philip James Wealth Management LLC, a leading investment firm, announced its strategic investment in Jazz Pharmaceuticals on Friday, sending the stock soaring. The stock opened at $118.52 and closed at $123.61, an increase of 3.8% from its previous closing price of $119.08. This significant boost in stock price is a testament to the confidence that investors have in Jazz Pharmaceuticals. The investment by Philip James Wealth Management LLC comes as no surprise to industry analysts, as Jazz Pharmaceuticals has been consistently performing well in the market. In fact, the company’s third quarter earnings report showed strong financial results, exceeding expectations. This strategic investment by Philip James Wealth Management LLC will not only benefit Jazz Pharmaceuticals financially, but also bring valuable insights and expertise to the company.

With a track record of successful investments in the healthcare sector, Philip James Wealth Management LLC is well-positioned to support Jazz Pharmaceuticals’ growth and expansion plans. Moreover, this investment comes at a crucial time for Jazz Pharmaceuticals as it continues to expand its product portfolio and pipeline through strategic acquisitions and partnerships. This acquisition is expected to significantly enhance Jazz Pharmaceuticals’ position in the neurology space and further diversify its product offering. With a solid financial performance and promising growth opportunities on the horizon, Jazz Pharmaceuticals is well-positioned for continued success in the market. As the industry eagerly awaits the company’s next move, it is clear that Jazz Pharmaceuticals’ partnership with Philip James Wealth Management LLC will only strengthen its position as a leader in the pharmaceutical industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Jazz Pharmaceuticals. More…

| Total Revenues | Net Income | Net Margin |

| 3.83k | 414.83 | 11.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Jazz Pharmaceuticals. More…

| Operations | Investing | Financing |

| 1.09k | -163.06 | -305.25 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Jazz Pharmaceuticals. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.39k | 7.66k | 59.36 |

Key Ratios Snapshot

Some of the financial key ratios for Jazz Pharmaceuticals are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.5% | -7.9% | 15.3% |

| FCF Margin | ROE | ROA |

| 27.4% | 10.2% | 3.2% |

Analysis – Jazz Pharmaceuticals Intrinsic Stock Value

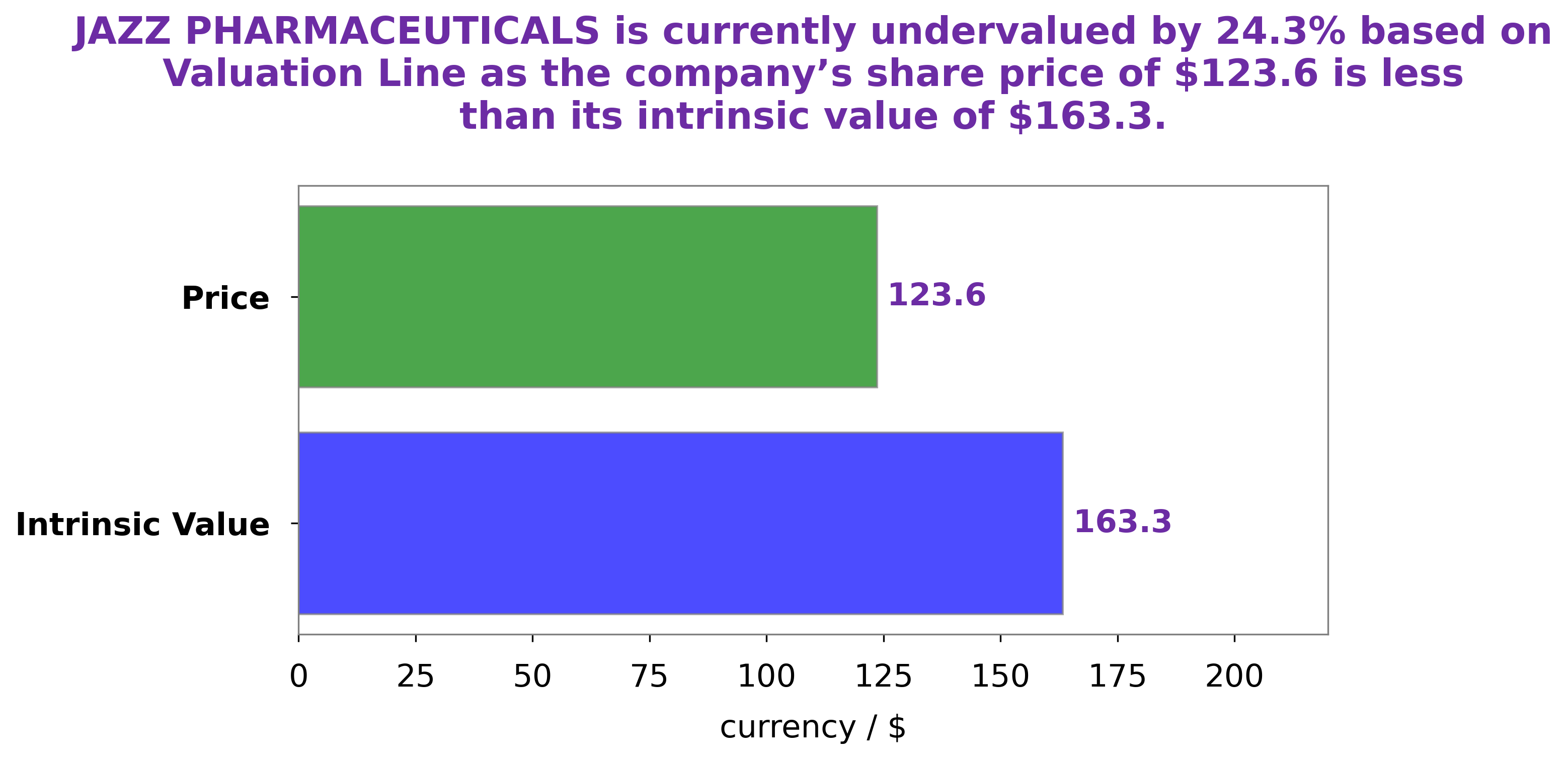

During our analysis of JAZZ PHARMACEUTICALS, we took a comprehensive look at the company’s well-being. We examined various factors such as financial performance, market trends, and industry competition to determine the overall health of the company. Based on our findings, we have calculated the fair value of JAZZ PHARMACEUTICALS’ share to be around $163.3. This was determined using our proprietary Valuation Line, which takes into account multiple aspects of the company’s operations and future prospects. However, we noticed that the current stock price of JAZZ PHARMACEUTICALS is only $123.61. This means that the stock is currently undervalued by 24.3%, which presents a potential buying opportunity for investors. In our opinion, JAZZ PHARMACEUTICALS has strong fundamentals and is well-positioned in the market. Its solid financial performance and promising future outlook make it an attractive investment option. Overall, our analysis leads us to believe that JAZZ PHARMACEUTICALS is a well-managed and thriving company, and its current stock price does not reflect its true value. We recommend keeping an eye on this stock and potentially considering it for investment. More…

Peers

The company has a diversified portfolio of products in central nervous system, hematology/oncology, inflammation and other therapeutic areas. Jazz Pharmaceuticals‘ competitors include Nurix Therapeutics Inc, Incyte Corp, and Poxel SA.

– Nurix Therapeutics Inc ($NASDAQ:NRIX)

Nurix Therapeutics Inc. is a clinical-stage biopharmaceutical company, which focuses on harnessing the body’s own natural mechanisms to regulate protein function for the treatment of cancer and other diseases. The company’s lead product candidate is a first-in-class, orally available, small molecule inhibitor of the proteasome, which is in development for the treatment of relapsed or refractory multiple myeloma. Nurix was founded by Robert L. Gould, Ph.D. and Bruce A. Cohen, M.D. in December 2001 and is headquartered in San Francisco, CA.

– Incyte Corp ($NASDAQ:INCY)

Incyte Corp is a biopharmaceutical company that focuses on the discovery, development, and commercialization of proprietary therapeutics to treat serious unmet medical needs, primarily in oncology. The company’s market cap is 15.34B as of 2022 and its ROE is 9.54%. Incyte’s products include Jakafi, Iclusig, and Jakavi. Jakafi is used to treat myelofibrosis and polycythemia vera, two rare blood disorders. Iclusig is used to treat leukemias, including chronic myeloid leukemia andPhiladelphia chromosome-positive acute lymphoblastic leukemia. Jakavi is used to treat myelofibrosis, polycythemia vera, and essential thrombocythemia.

– Poxel SA ($LTS:0RA2)

Poxel SA is a French pharmaceutical company that focuses on the development and commercialization of drugs for the treatment of diabetes and obesity. The company has a market capitalization of 43.37 million as of 2022 and a return on equity of -705.2%. Poxel SA’s products include Imeglimin, which is in clinical development for the treatment of type 2 diabetes, and PXL065, which is in preclinical development for the treatment of obesity.

Summary

Philip James Wealth Management LLC recently acquired a new stake in Jazz Pharmaceuticals plc during the third quarter. This move may indicate confidence in the company’s potential for growth and profitability. On the day of the acquisition, the stock price also saw an increase, potentially signaling positive sentiment from other investors as well. Overall, this could be a promising sign for Jazz Pharmaceuticals and may attract further attention from investors looking to add pharmaceutical companies to their portfolios.

Recent Posts