Jazz Pharmaceuticals Intrinsic Stock Value – JAZZ PHARMACEUTICALS Reports Second Quarter Earnings Results for FY2023

August 17, 2023

🌥️Earnings Overview

JAZZ PHARMACEUTICALS ($NASDAQ:JAZZ) reported their earnings results for the second quarter of FY2023, which ended on June 30 2023, on August 9 2023. The total revenue recorded was USD 957.3 million, representing a year-over-year increase of 2.6%. Furthermore, net income was USD 104.4 million, compared to the USD 34.7 million reported in the same quarter of the previous year.

Share Price

The stock opened at $132.6 and closed at $133.0, up by 0.6% from last closing price of 132.2. With this strong financial performance, JAZZ PHARMACEUTICALS is well positioned to continue to bring innovative, life-changing therapies to patients in need. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Jazz Pharmaceuticals. More…

| Total Revenues | Net Income | Net Margin |

| 3.76k | -86.51 | 5.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Jazz Pharmaceuticals. More…

| Operations | Investing | Financing |

| 1.38k | -410.34 | -395.91 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Jazz Pharmaceuticals. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.26k | 7.73k | 55.61 |

Key Ratios Snapshot

Some of the financial key ratios for Jazz Pharmaceuticals are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.3% | -2.4% | 1.0% |

| FCF Margin | ROE | ROA |

| 26.2% | 0.7% | 0.2% |

Analysis – Jazz Pharmaceuticals Intrinsic Stock Value

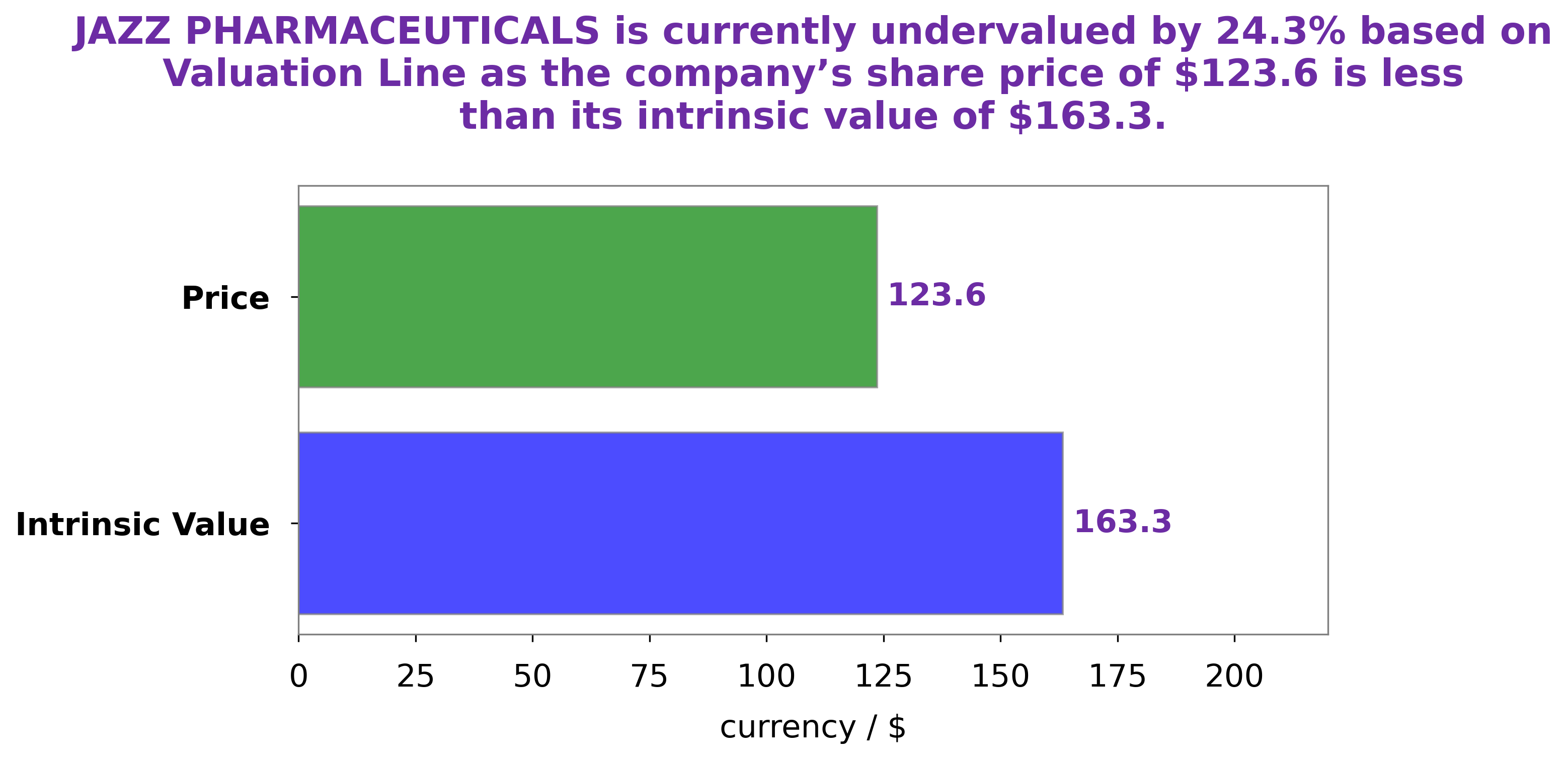

At GoodWhale, we specialize in analyzing the financials of publicly-traded companies like JAZZ PHARMACEUTICALS. After conducting a comprehensive review, we have determined that the intrinsic value of a share of JAZZ PHARMACEUTICALS is around $173.8, as determined by our proprietary Valuation Line. Currently, the stock is trading at $133.0, which means that it is undervalued by 23.5%. This could be a great opportunity for investors to take advantage of the gap between the actual and intrinsic value of the stock. More…

Peers

The company has a diversified portfolio of products in central nervous system, hematology/oncology, inflammation and other therapeutic areas. Jazz Pharmaceuticals‘ competitors include Nurix Therapeutics Inc, Incyte Corp, and Poxel SA.

– Nurix Therapeutics Inc ($NASDAQ:NRIX)

Nurix Therapeutics Inc. is a clinical-stage biopharmaceutical company, which focuses on harnessing the body’s own natural mechanisms to regulate protein function for the treatment of cancer and other diseases. The company’s lead product candidate is a first-in-class, orally available, small molecule inhibitor of the proteasome, which is in development for the treatment of relapsed or refractory multiple myeloma. Nurix was founded by Robert L. Gould, Ph.D. and Bruce A. Cohen, M.D. in December 2001 and is headquartered in San Francisco, CA.

– Incyte Corp ($NASDAQ:INCY)

Incyte Corp is a biopharmaceutical company that focuses on the discovery, development, and commercialization of proprietary therapeutics to treat serious unmet medical needs, primarily in oncology. The company’s market cap is 15.34B as of 2022 and its ROE is 9.54%. Incyte’s products include Jakafi, Iclusig, and Jakavi. Jakafi is used to treat myelofibrosis and polycythemia vera, two rare blood disorders. Iclusig is used to treat leukemias, including chronic myeloid leukemia andPhiladelphia chromosome-positive acute lymphoblastic leukemia. Jakavi is used to treat myelofibrosis, polycythemia vera, and essential thrombocythemia.

– Poxel SA ($LTS:0RA2)

Poxel SA is a French pharmaceutical company that focuses on the development and commercialization of drugs for the treatment of diabetes and obesity. The company has a market capitalization of 43.37 million as of 2022 and a return on equity of -705.2%. Poxel SA’s products include Imeglimin, which is in clinical development for the treatment of type 2 diabetes, and PXL065, which is in preclinical development for the treatment of obesity.

Summary

Jazz Pharmaceuticals reported strong second quarter earnings for the period ending June 30, 2023. Revenue increased by 2.6% year-over-year, to a total of USD 957.3 million. This impressive performance is indicative of Jazz Pharmaceuticals’ strong fundamentals and potential for continued growth in the near future, making it an intriguing option for investors to consider.

Recent Posts