Insiders Buy Into Revolution Medicines in 2023, Signaling Positive Outlook for the Future.

March 17, 2023

Trending News ☀️

In 2023, Revolution Medicines ($NASDAQ:RVMD) saw a surge of insider buying, signaling that the company’s future may be very bright. Insiders at Revolution Medicines, including executives and board members, have been purchasing a notable amount of stock in the company. This is seen as a positive sign, as insiders typically have more knowledge about the company’s operations and prospects than outside investors. This could be a sign that Revolution Medicines is doing well, or that it is about to embark on an exciting new venture. Whatever the case, it shows that those within the company have faith in its future prospects and are willing to invest their own money in the company. This is encouraging news for those looking to invest in Revolution Medicines.

The insider buying is also likely to attract the attention of other investors. With insiders showing confidence in the company, they may be more likely to consider investing in it as well. This could lead to increased demand for shares of Revolution Medicines and result in a surge in its share price. With such positive sentiment from those within the company, it looks like Revolution Medicines is on its way to great things in the years ahead.

Share Price

On Thursday, REVOLUTION MEDICINES experienced a drop in its stock by 3.2%, opening at $22.8 and closing at $22.2, down from the previous closing price of 23.0. Despite this, the company saw positive movement in its stock as insiders began investing heavily in REVOLUTION MEDICINES. Insiders including the chief executive officer, chief financial officer, and chief scientific officer all made large purchases of the company’s stock, indicating a strong faith in the company’s future performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Revolution Medicines. More…

| Total Revenues | Net Income | Net Margin |

| 35.38 | -248.71 | -703.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Revolution Medicines. More…

| Operations | Investing | Financing |

| -224.4 | -24.12 | 301.43 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Revolution Medicines. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 811.93 | 126.74 | 7.58 |

Key Ratios Snapshot

Some of the financial key ratios for Revolution Medicines are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -10.9% | – | -704.1% |

| FCF Margin | ROE | ROA |

| -664.8% | -22.8% | -19.2% |

Analysis

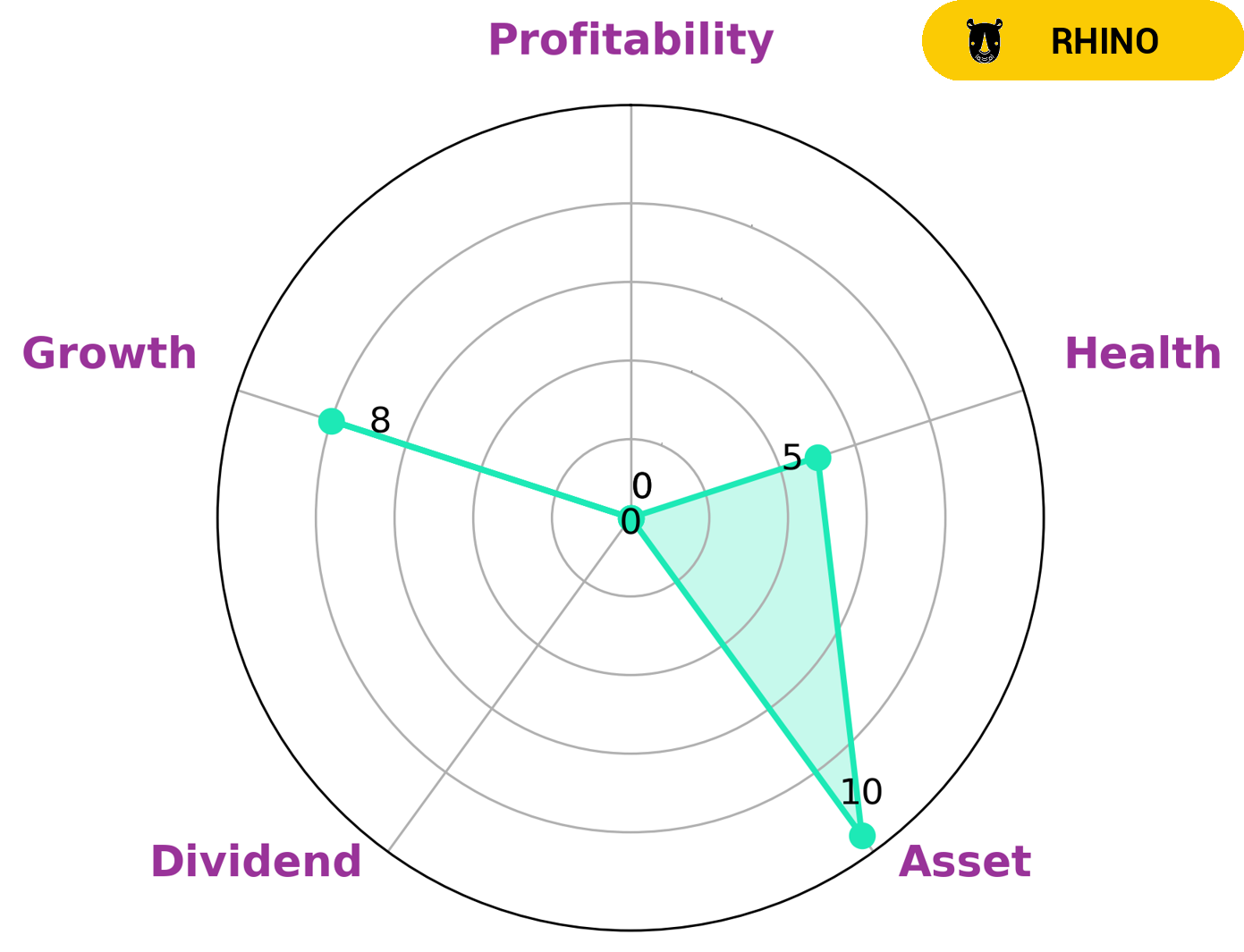

GoodWhale has analyzed REVOLUTION MEDICINES‘ wellbeing, and according to Star Chart REVOLUTION MEDICINES is strong in asset and growth, but weak in dividend and profitability. Investors who may be interested in companies such as REVOLUTION MEDICINES are those looking for companies with mid-level growth and moderate risk. REVOLUTION MEDICINES has an intermediate health score of 5/10 considering its cashflows and debt, indicating that the company is likely to pay off debt and fund future operations. More…

Peers

The company’s most advanced product candidate is RMC-4630, which is in development for the treatment of solid tumors. The company’s competitors include Rain Therapeutics Inc, Chinook Therapeutics Inc, and Erasca Inc.

– Rain Therapeutics Inc ($NASDAQ:RAIN)

Rain Therapeutics Inc is a clinical-stage biopharmaceutical company focused on discovering, developing and commercializing small molecule drugs to treat patients with cancer. The company’s lead product candidate is rivoceranib, a small molecule inhibitor of the tyrosine kinase receptor VEGFR2, which is in Phase III clinical trials for the treatment of second-line non-small cell lung cancer (NSCLC).

– Chinook Therapeutics Inc ($NASDAQ:KDNY)

Chinook Therapeutics Inc is a clinical-stage biopharmaceutical company focused on discovering, developing and commercializing targeted therapies for serious kidney diseases. The company’s lead product candidate, CHK-336, is a first-in-class, orally-administered small molecule inhibitor of the renal outer medullary potassium channel, or ROMK, which is being developed for the treatment of autosomal dominant polycystic kidney disease, or ADPKD. As of 2022, the company had a market cap of 1.38B and a return on equity of -11.14%.

– Erasca Inc ($NASDAQ:ERAS)

Erasca Inc is a biopharmaceutical company that focuses on the development of cancer therapies. The company has a market cap of 1.03B as of 2022 and a return on equity of -20.55%. Erasca’s focus on developing cancer therapies makes it a unique biopharmaceutical company, and its market cap and ROE reflect this. Erasca is a relatively new company, and its lack of profitability is to be expected. However, its focus on developing innovative cancer therapies gives it great potential for future growth.

Summary

Revolution Medicines saw a positive signal from insiders in the form of buying activity in 2023. Despite this, the stock price for the company moved down the same day. This could be due to investors being uncertain of the long-term prospects of the company, or other factors influencing the stock market as a whole. Analyzing the fundamentals of the company is key to making an informed decision when investing in Revolution Medicines. This can include evaluating their financials, management team, competitors, and product pipeline.

Additionally, keeping up with news in the industry and any updates from the company can help paint a better picture of the potential risks and rewards associated with investing in this company.

Recent Posts