How Shareholders Can Profit from Revolution Medicines Stock Despite Recent Market Decline

April 30, 2023

Trending News ☀️

Shareholders looking to beat the market with Revolution Medicines ($NASDAQ:RVMD) Inc. stock should take note that, as of the close of business yesterday, the stock had fallen -2.98% from its prior closing price of $25.18 to $24.43. Despite this decrease in share price, investors may still be able to profit from this promising medical company. The company leverages a unique combination of capabilities to discover, develop, and commercialize a variety of therapies, including small molecules and biologics. The company is focused on small molecules that target cancer-driving proteins and small molecules that target cancer metabolism.

In addition, Revolution Medicines has initiated collaborations with pharmaceutical giants Bristol-Myers Squibb and Novartis to further develop its compounds. These partnerships provide additional funding and expertise to help advance the development of new therapies. Revolution Medicines has also announced plans to expand its clinical development activities. This expansion will allow the company to move more compounds into late-stage clinical trials, allowing for potentially larger profits for shareholders once the drugs reach the market. Despite recent market decline, investors can still profit from Revolution Medicines stock. The company’s strong drug development pipeline, expanding clinical development activities, and collaborations with large pharmaceutical companies make it an attractive option for investors looking for long-term returns.

Market Price

On Monday, REVOLUTION MEDICINES stock opened at $24.2 and closed at $23.0, representing a drop of 5.2% from its prior closing price of 24.3. One way for shareholders to capitalize on the stock is to research the company’s business model and make an informed decision about when to buy and sell. By analyzing the company’s performance, shareholders can gain insight into its potential for growth, which can help them decide when to buy or sell.

Additionally, investors can also keep an eye on external factors such as industry trends and macroeconomic events that could affect the stock price in the short and long-term. Another strategy for shareholders to consider is to diversify their portfolio with REVOLUTION MEDICINES stock, rather than committing all of their capital in one single stock. By diversifying, investors can spread their risk across different stocks and sectors, reducing their exposure to market downturns. Finally, shareholders should keep a long-term perspective when investing in REVOLUTION MEDICINES stock. Although the company has experienced a drop in its stocks recently, it could still be a profitable investment in the long run if the company is able to successfully execute its strategy and capitalize on growth opportunities in the future. By taking a long-term view, investors can ride out short-term market fluctuations and benefit from REVOLUTION MEDICINES stock over time. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Revolution Medicines. More…

| Total Revenues | Net Income | Net Margin |

| 35.38 | -248.71 | -703.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Revolution Medicines. More…

| Operations | Investing | Financing |

| -224.4 | -24.12 | 301.43 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Revolution Medicines. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 811.93 | 126.74 | 7.58 |

Key Ratios Snapshot

Some of the financial key ratios for Revolution Medicines are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -10.9% | – | -704.1% |

| FCF Margin | ROE | ROA |

| -664.8% | -22.8% | -19.2% |

Analysis

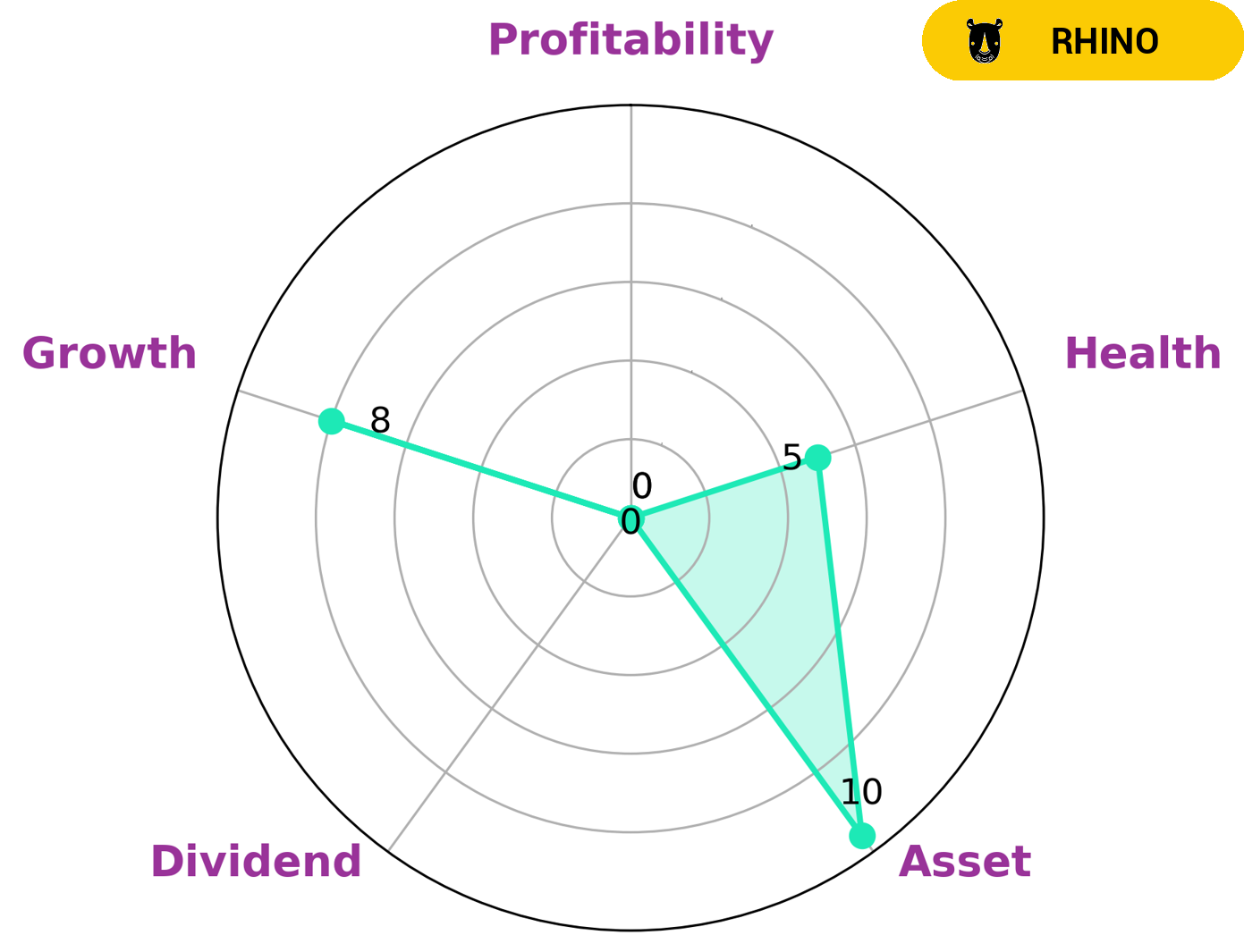

As GoodWhale analysts, we’ve taken a close look at the fundamentals of REVOLUTION MEDICINES. Based on our Star Chart, it is classified as “rhino,” meaning it has achieved moderate revenue or earnings growth. Analyzing further, we see that REVOLUTION MEDICINES is strong in asset and growth but weak in dividend and profitability. It has an intermediate health score of 5/10 with regard to its cashflows and debt, which means it might be able to pay off debt and fund future operations. Given its fundamentals, REVOLUTION MEDICINES may be attractive to investors looking for a company with the potential for growth but that hasn’t yet returned a strong dividend yield. Whether or not REVOLUTION MEDICINES is the right investment for an individual investor is a decision they need to make carefully. More…

Peers

The company’s most advanced product candidate is RMC-4630, which is in development for the treatment of solid tumors. The company’s competitors include Rain Therapeutics Inc, Chinook Therapeutics Inc, and Erasca Inc.

– Rain Therapeutics Inc ($NASDAQ:RAIN)

Rain Therapeutics Inc is a clinical-stage biopharmaceutical company focused on discovering, developing and commercializing small molecule drugs to treat patients with cancer. The company’s lead product candidate is rivoceranib, a small molecule inhibitor of the tyrosine kinase receptor VEGFR2, which is in Phase III clinical trials for the treatment of second-line non-small cell lung cancer (NSCLC).

– Chinook Therapeutics Inc ($NASDAQ:KDNY)

Chinook Therapeutics Inc is a clinical-stage biopharmaceutical company focused on discovering, developing and commercializing targeted therapies for serious kidney diseases. The company’s lead product candidate, CHK-336, is a first-in-class, orally-administered small molecule inhibitor of the renal outer medullary potassium channel, or ROMK, which is being developed for the treatment of autosomal dominant polycystic kidney disease, or ADPKD. As of 2022, the company had a market cap of 1.38B and a return on equity of -11.14%.

– Erasca Inc ($NASDAQ:ERAS)

Erasca Inc is a biopharmaceutical company that focuses on the development of cancer therapies. The company has a market cap of 1.03B as of 2022 and a return on equity of -20.55%. Erasca’s focus on developing cancer therapies makes it a unique biopharmaceutical company, and its market cap and ROE reflect this. Erasca is a relatively new company, and its lack of profitability is to be expected. However, its focus on developing innovative cancer therapies gives it great potential for future growth.

Summary

Investors looking to capitalize on REVOLUTION MEDICINES should be aware that the stock price has recently decreased. As of close of business yesterday, the stock closed at $24.43, down -2.98% from its previous closing price of $25.18. Consequently, investors should evaluate their potential returns carefully, and consider potential risks associated with investing in this stock.

Additionally, investors should continually monitor financial news related to the company, such as earnings reports, to stay informed and make wise investment decisions. Ultimately, investors should use their individual circumstances and assessment of risk to determine whether investing in REVOLUTION MEDICINES is suitable for them.

Recent Posts