Harpoon Therapeutics Stock Fair Value – Harpoon Therapeutics Reports Positive Results with Revenues Surpassing Expectations

May 12, 2023

Trending News ☀️

Harpoon Therapeutics ($NASDAQ:HARP), Inc. is a biotechnology company that develops novel proprietary T cell engaging therapies for the treatment of cancer and other diseases. Recently, the company reported positive results with their GAAP EPS of -$0.31, exceeding expectations by $0.08, and revenue of $8.58M, surpassing estimates by $3.77M. The strong financial results are encouraging for Harpoon Therapeutics, and a testament to their innovative treatments and promising pipeline of products.

It appears that the market is bullish on Harpoon Therapeutics, as evidenced by their strong stock performance and increased investor confidence. This bodes well for the future of the company and its ability to develop additional treatments that can improve lives.

Earnings

HARPOON THERAPEUTICS has reported positive earnings in its FY2022 Q4 period ending December 31 2022. The company earned 4.09M USD in total revenue during this period and incurred a net loss of 18.42M USD. Compared to the same period the previous year, the company experienced a 5.3% decrease in total revenue. This marks the third consecutive year that HARPOON THERAPEUTICS’s total revenue has decreased, going from 7.49M USD to 4.09M USD over the course of three years.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Harpoon Therapeutics. More…

| Total Revenues | Net Income | Net Margin |

| 31.91 | -67.73 | -212.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Harpoon Therapeutics. More…

| Operations | Investing | Financing |

| -89.18 | 89.74 | 6.37 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Harpoon Therapeutics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 73.73 | 68.33 | 0.51 |

Key Ratios Snapshot

Some of the financial key ratios for Harpoon Therapeutics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 76.8% | – | -214.1% |

| FCF Margin | ROE | ROA |

| -280.5% | -382.8% | -57.9% |

Market Price

Harpoon Therapeutics, a leading biotech company, reported positive results for the quarter ending December 31st. On Thursday, the stock opened at $0.8 and closed at $0.8, up by 3.1% from the previous closing price of 0.8. This indicates a positive sentiment in the market towards the company and its performance. Importantly, the company reported a surge in revenue, surpassing even the most optimistic estimates. This is a strong sign that their current business model is delivering positive returns and the company is on track to achieve its long-term growth plans.

The company’s shares have seen a steady increase over the past few quarters and this latest report is likely to keep this trend going. Overall, Harpoon Therapeutics is in an enviable position as its stock has performed strongly despite uncertain market conditions, proving that its strategies are having a positive impact. Going forward, investors should keep an eye on their progress and monitor the stock to benefit from any further gains. Live Quote…

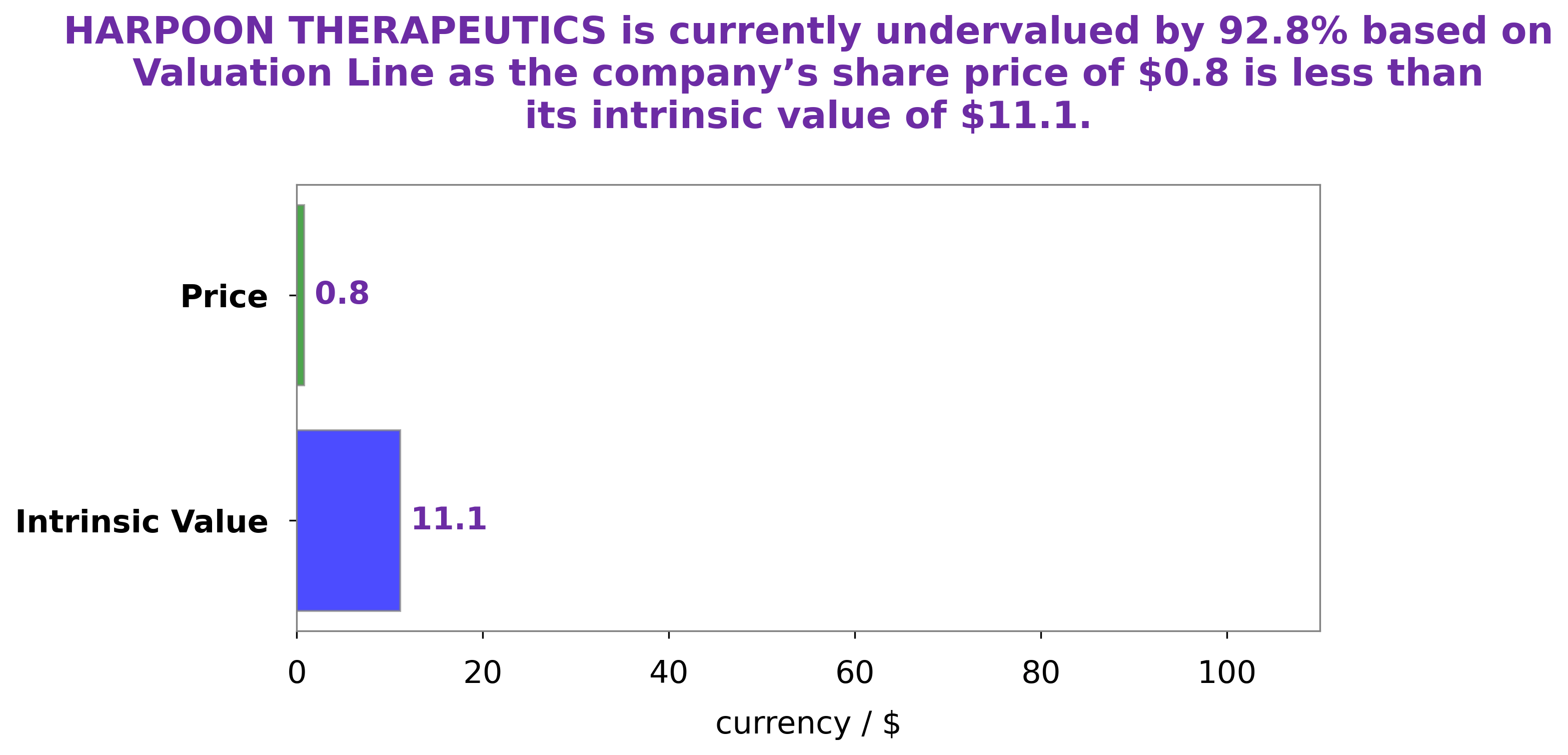

Analysis – Harpoon Therapeutics Stock Fair Value

At GoodWhale, we have performed an analysis of HARPOON THERAPEUTICS‘ financials, calculating the intrinsic value of its share to be around $11.1 using our proprietary Valuation Line. This value is significantly higher than the current trading price of $0.8, indicating that the stock is being undervalued by 92.8%. This discrepancy provides an attractive investment opportunity for those looking to add HARPOON THERAPEUTICS to their portfolio. More…

Peers

The company’s pipeline includes two Phase 1 clinical trials for its lead product, HPN424, and a Phase 2 clinical trial for HPN536. Harpoon’s competitors include BrightPath Biotherapeutics Co Ltd, Talaris Therapeutics Inc, and F-Star Therapeutics Inc.

– BrightPath Biotherapeutics Co Ltd ($TSE:4594)

BrightPath Biotherapeutics Co Ltd is a clinical-stage biopharmaceutical company focused on developing and commercializing innovative therapies for the treatment of cancer. The company’s lead product candidate is BH-301, a novel immunotherapy that is in clinical development for the treatment of solid tumors. BrightPath Biotherapeutics Co Ltd has a market cap of 7.71B as of 2022, a Return on Equity of -43.51%. The company’s focus on developing innovative therapies for the treatment of cancer makes it a compelling investment opportunity for investors interested in the healthcare sector.

– Talaris Therapeutics Inc ($NASDAQ:TALS)

Talaris Therapeutics Inc is a clinical stage biopharmaceutical company. The Company is focused on developing and commercializing a proprietary cell therapy platform to treat patients with autoimmune diseases, inflammatory disorders and blood-based cancers. The Company’s product candidates include T cell receptor (TCR) modified T cells, natural killer (NK) cells, and CAR T cells. Talaris Therapeutics Inc is headquartered in Cambridge, Massachusetts.

– F-star Therapeutics Inc ($NASDAQ:FSTX)

F-star Therapeutics Inc is a clinical-stage biopharmaceutical company, which engages in the research and development of novel antibody therapeutics. Its pipeline includes FS102, FS103, and FS404. The company was founded by Andrew J. Allen, Christoph A. Borner, and James P. Allison in 2016 and is headquartered in Cambridge, MA.

Summary

Harpoon Therapeutics is an American biopharmaceutical company that develops novel T cell-engaging therapies for the treatment of cancer and other diseases. Following this, the stock price of Harpoon Therapeutics moved up the same day. Overall, investors are encouraged by the strong financial performance of Harpoon Therapeutics as it signals good progress in its mission to develop T cell-engaging therapies and potential gains in the long term. This is reflected in the stock price movement right after the earnings report was released.

However, investors should be aware that Harpoon Therapeutics is still a developing company and its stock price may be volatile in the future.

Recent Posts