HALOZYME THERAPEUTICS Reports Third Quarter Earnings for FY2023

December 4, 2023

🌥️Earnings Overview

On November 6 2023, HALOZYME THERAPEUTICS ($NASDAQ:HALO) reported its third quarter financial results for FY2023. Revenue for the quarter ended September 30 2023 was USD 216.0 million, an increase of 3.4% from the comparable period of the prior year. Net income for the quarter rose by 32.8%, amounting to USD 81.8 million.

Share Price

The company’s stock opened at $35.4 and closed at $35.3, which was a decrease of 0.9% from the previous closing price of 35.6. HALOZYME THERAPEUTICS attributed its strong quarterly performance to continued growth in their pharmaceuticals and diagnostics portfolio. Additionally, the company has increased its R&D investments, resulting in several new product launches. HALOZYME THERAPEUTICS is optimistic about its future prospects and is confident that their current performance will continue in the coming quarters. The company is focused on expanding its product portfolio and strengthening its market presence by expanding into new markets. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Halozyme Therapeutics. More…

| Total Revenues | Net Income | Net Margin |

| 780.71 | 253.91 | 30.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Halozyme Therapeutics. More…

| Operations | Investing | Financing |

| 368.67 | -90.36 | -151.74 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Halozyme Therapeutics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.89k | 1.64k | 1.89 |

Key Ratios Snapshot

Some of the financial key ratios for Halozyme Therapeutics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 57.6% | 108.0% | 43.0% |

| FCF Margin | ROE | ROA |

| 45.3% | 105.0% | 11.1% |

Analysis

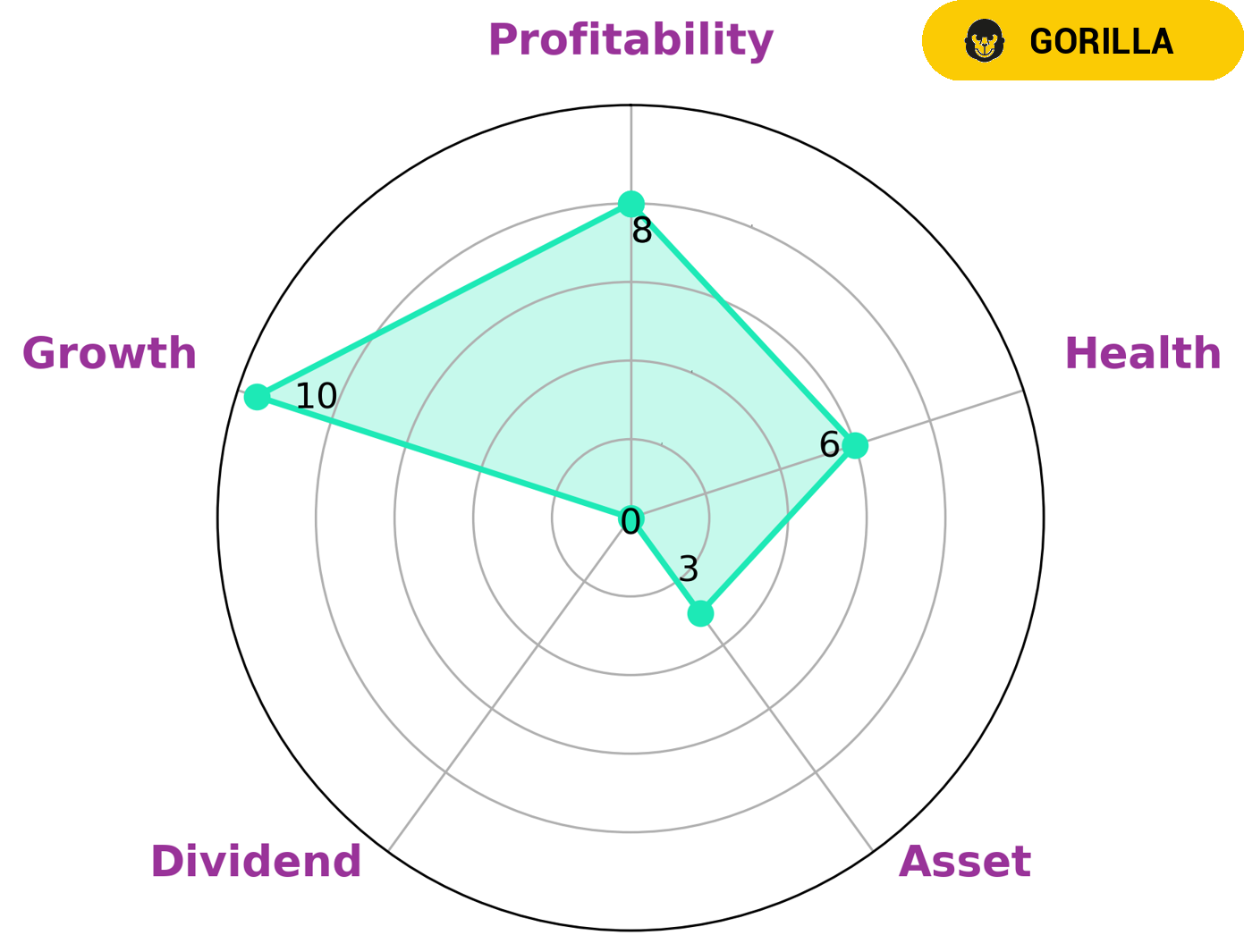

At GoodWhale, we analyze HALOZYME THERAPEUTICS‘s fundamentals to give investors a comprehensive view of the company. According to our Star Chart, HALOZYME THERAPEUTICS is classified as ‘gorilla’, which we classify as a company that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. Investors looking for a company with strong growth, profitability and weak in asset and dividend, may find HALOZYME THERAPEUTICS an attractive option. Additionally, HALOZYME THERAPEUTICS has an intermediate health score of 6/10 with regard to its cashflows and debt, allowing us to confidently conclude that the company is likely to ride out any crisis without the risk of bankruptcy. More…

Peers

The Company’s enzyme-based product candidates target the tumor microenvironment, enabling the delivery of cancer drugs directly to the site of the tumor. Halozyme has four product candidates in clinical development, PEGPH20, Hylenex, HALO-102 and HALO-201. Keymed Biosciences Inc, Verona Pharma PLC, Xencor Inc are Halozyme’s competitors in the biopharmaceutical market.

– Keymed Biosciences Inc ($SEHK:02162)

Keymed Biosciences Inc is a biopharmaceutical company that focuses on the development and commercialization of novel therapeutics for the treatment of cancer and other serious diseases. The company’s market cap is 12.95B as of 2022 and has a ROE of -4.34%. Keymed Biosciences Inc’s products are designed to target key drivers of disease progression and to provide patients with new treatment options. The company’s lead product, KEY-184, is a first-in-class, orally-available small molecule inhibitor of the MDM2 oncoprotein.

– Verona Pharma PLC ($NASDAQ:VRNA)

Verona Pharma PLC is a pharmaceutical company that focuses on the development of drugs for the treatment of respiratory diseases. The company has a market cap of 790.27M as of 2022 and a Return on Equity of -28.69%. Verona Pharma PLC is headquartered in London, United Kingdom.

– Xencor Inc ($NASDAQ:XNCR)

Xencor Inc is a clinical-stage biopharmaceutical company focused on the discovery and development of engineered monoclonal antibodies for the treatment of cancer and autoimmune diseases. The company’s market cap as of 2022 is 1.64B with a ROE of 4.05%. Xencor is currently working on several clinical-stage programs including XmAb5871 for the treatment of B-cell malignancies, autoimmune diseases, and asthma.

Summary

Halozyme Therapeutics recently reported its earnings results for the third quarter of FY2023, showing total revenue of USD 216.0 million and net income of USD 81.8 million. This marks a 3.4% and 32.8% increase year over year, respectively. Investors have reacted positively to the news, with analysts expecting stock prices to rise in the coming weeks.

The company has seen consistent growth in terms of revenue and profitability, making it a sound investment opportunity for those interested in the pharmaceuticals industry. Halozyme’s performance has been consistently strong, making it a reliable option for long-term investments.

Recent Posts