GlobalData: Ultragenyx’s UX053 Phase I/II Study Termination a Minor Setback for mRNA Therapeutics

May 17, 2023

Trending News 🌥️

Ultragenyx Pharmaceutical ($NASDAQ:RARE) Inc. is a clinical-stage biopharmaceutical company dedicated to the development and commercialization of novel products for rare and ultra-rare diseases. The company focuses on the development of therapeutic candidates for patients with serious medical conditions who have few or no treatment options. This includes the development of mRNA (messenger ribonucleic acid) therapeutics. The study was designed to evaluate the safety, efficacy, and pharmacokinetics of UX053 in adults with ornithine transcarbamylase (OTC) deficiency. The termination of the study is a minor setback for mRNA therapeutics as it could have provided valuable insight into its potential use in treating rare genetic diseases like OTC deficiency. Despite this, Ultragenyx remains committed to the development of mRNA therapeutics for rare and ultra-rare diseases.

The company is developing a portfolio of mRNA therapeutics that are aimed at addressing unmet medical needs in patients with rare diseases. The company is also focused on advancing its deep pipeline of clinical-stage programs and expanding its research into new disease areas. Overall, although the termination of Ultragenyx’s UX053 Phase I/II study is a minor setback for mRNA therapeutics, the company is continuing to move forward in its efforts to develop novel therapies for rare and ultra-rare diseases. This is a testament to Ultragenyx’s commitment to providing much needed treatments to those who suffer from serious medical conditions with few or no treatment options.

Price History

On Monday, Ultragenyx Pharmaceutical stock opened at $47.0 and closed at $49.0, representing a 4.1% increase from its previous closing price of 47.1. This increase in stock value came despite news that the company had decided to terminate its Phase I/II study of the mRNA therapeutic UX053 early. The company had been investigating UX053 as an experimental treatment for a rare genetic disorder, mucopolysaccharidosis type VII (MPS VII). Despite the setback, Ultragenyx remains committed to advancing its mRNA therapeutics program and is currently focusing on other treatments in development. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ultragenyx Pharmaceutical. More…

| Total Revenues | Net Income | Net Margin |

| 383.89 | -719.07 | -185.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ultragenyx Pharmaceutical. More…

| Operations | Investing | Financing |

| -419.81 | -142.99 | 498.87 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ultragenyx Pharmaceutical. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.38k | 1.16k | 3.12 |

Key Ratios Snapshot

Some of the financial key ratios for Ultragenyx Pharmaceutical are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 46.6% | – | -172.3% |

| FCF Margin | ROE | ROA |

| -137.7% | -144.3% | -29.9% |

Analysis

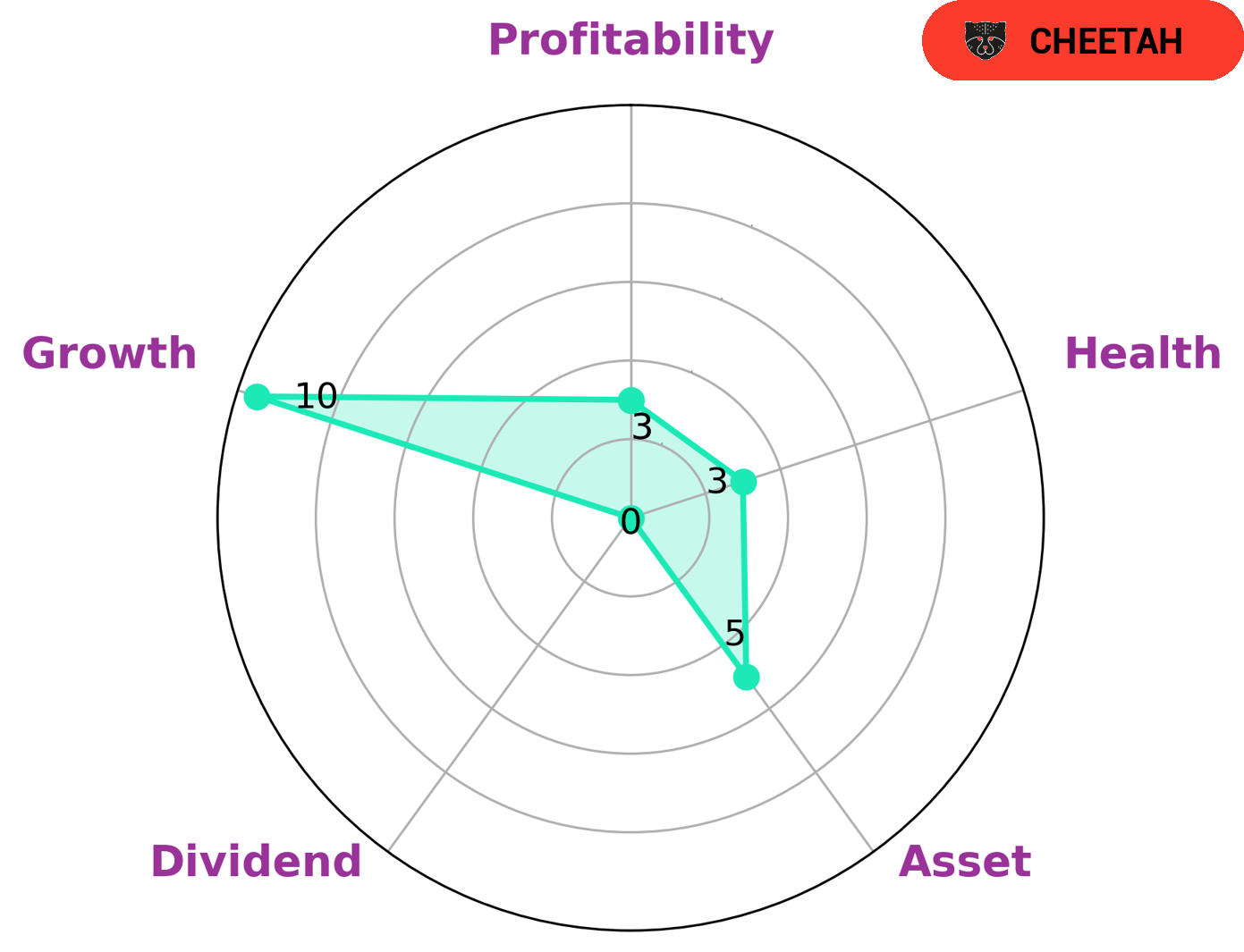

GoodWhale conducted an analysis of ULTRAGENYX PHARMACEUTICAL‘s wellbeing and found that according to our Star Chart, the company has a low health score of 3/10. This score is based on a combination of cashflows and debt, and suggests that the company is less likely to sustain future operations in times of crisis. In addition, ULTRAGENYX PHARMACEUTICAL is classified as ‘cheetah’, which means that the company has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. We predict that this type of company will attract investors who are looking for high-growth opportunities but who are also prepared to take on more risk. In terms of financial traits, ULTRAGENYX PHARMACEUTICAL is strong in terms of growth, medium in terms of asset and weak in terms of dividend and profitability. These traits should be taken into consideration by potential investors when deciding whether to invest in the company. More…

Peers

The competition in the pharmaceutical industry is fierce, with companies constantly vying for market share. This is especially true in the area of rare disease treatments, where there are often only a few companies competing for patients. Ultragenyx Pharmaceutical Inc is one such company, and it competes against Cassiopea SpA, Poxel SA, and Ampio Pharmaceuticals Inc, among others.

– Cassiopea SpA ($LTS:0RA2)

Poxel SA is a pharmaceutical company that focuses on the development of treatments for diabetes and obesity. The company has a market capitalization of $42.92 million and a return on equity of -705.2%. Poxel SA’s products include Imeglimin, which is in clinical development for the treatment of type 2 diabetes, and PXL065, which is in preclinical development for the treatment of obesity.

Summary

Ultrogenyx Pharmaceutical is a biopharmaceutical company engaged in the development of treatments for rare and ultra-rare genetic diseases. Recently, the company’s Phase I/II study of its experimental therapy UX053 was terminated, causing a minor setback for its mRNA therapeutics. Despite this event, investors remain optimistic as the stock price moved up the same day. Analysts point to the fact that Ultrogenyx has several other promising treatments in the pipeline which could fill the gap caused by the termination of the UX053 trial.

Additionally, the company has a number of potential licensing and partnering deals which could provide additional revenue streams. Overall, investors are advised to remain upbeat on Ultrogenyx Pharmaceutical as its long term prospects seem positive.

Recent Posts