Glenmede Trust Co. NA Divests 5611 Shares of Cytokinetics, Incorporated.

February 2, 2023

Trending News ☀️

Cytokinetics ($NASDAQ:CYTK), Incorporated is a biopharmaceutical company focused on discovering, developing, and commercializing muscle activators and inhibitors as potential treatments for debilitating diseases in which muscle performance is compromised and/or declines. The company’s lead product candidates are omecamtiv mecarbil, a novel cardiac muscle activator, and reldesemtiv, a skeletal muscle activator. Glenmede Trust Co. NA recently divested 5611 shares of Cytokinetics, Incorporated, reducing its position in the company. Cytokinetics is committed to advancing the science of muscle biology and its application to the discovery and development of novel therapies to improve the lives of patients with neuromuscular, cardiovascular, and metabolic diseases. The company is focused on developing small molecule drugs that modulate cellular function to improve the contractility of muscles involved in cardiac and skeletal muscle performance. Cytokinetics has collaborations with Amgen Inc., Astellas Pharma Inc., and Servier S.A.S. to research, develop, and/or commercialize its products.

In addition to its research and development activities, Cytokinetics also provides consulting services to pharmaceutical companies. The company’s research portfolio includes programs focused on skeletal muscle contractility modifiers, cardiac muscle contractility modifiers, metabolic modulators, and neuromuscular junction modulators. Cytokinetics is committed to developing therapies that have the potential to improve the lives of patients with debilitating diseases. This move comes as a surprise to many investors, as the company has made significant strides in advancing its research and development programs. While the impact of this divestment on Cytokinetics’ stock price remains to be seen, the company remains focused on bringing novel therapies to market that can potentially improve the lives of patients with debilitating diseases.

Market Price

On Wednesday, CYTOKINETICS opened at $42.4 and closed at $42.8, up by 0.8% from the prior closing price of 42.5. The company has a portfolio of products in various stages of development and has established collaborations with Amgen, Astellas and Servier. Investors seem optimistic about Cytokinetics’ future prospects given its recent performance.

Cytokinetics is continuing to move towards clinical development and commercialization in order to make its drugs available to patients with serious diseases and medical conditions. With its strong portfolio of products and collaborations, Cytokinetics is well-positioned to capitalize on the potential in the biopharmaceutical sector. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cytokinetics. More…

| Total Revenues | Net Income | Net Margin |

| 148.23 | -282.14 | -173.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cytokinetics. More…

| Operations | Investing | Financing |

| -246.06 | -244.05 | 505.79 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cytokinetics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.08k | 1.09k | 1.3 |

Key Ratios Snapshot

Some of the financial key ratios for Cytokinetics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 68.4% | – | -161.1% |

| FCF Margin | ROE | ROA |

| -183.5% | -312.7% | -13.9% |

Analysis

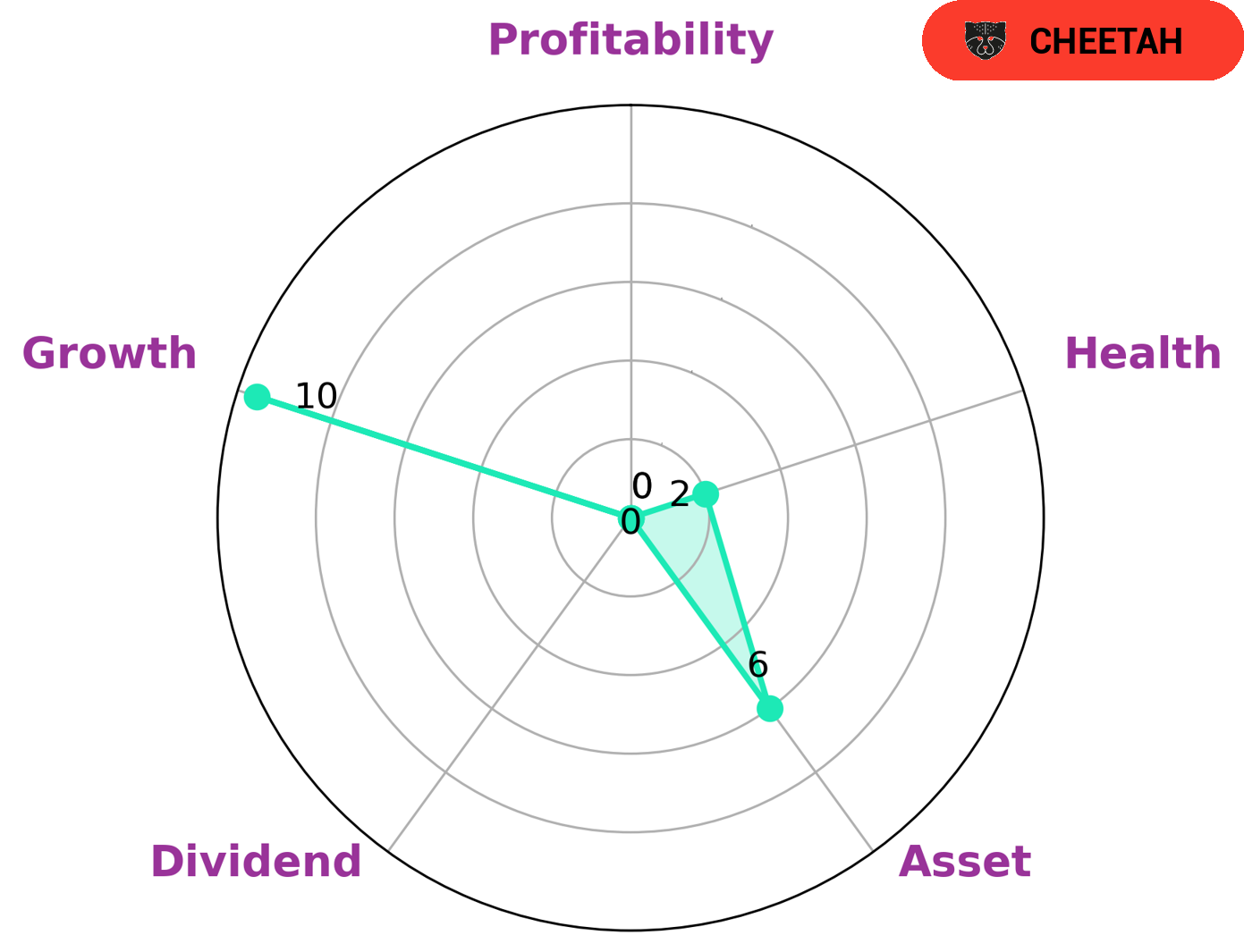

CYTOKINETICS is classified as a ‘cheetah’ company according to GoodWhale’s Star Chart, which describes companies that have achieved high revenue or earnings growth but are considered less stable due to lower profitability. CYTOKINETICS exhibits strong growth potential but its health score of 2/10 with regard to its cashflows and debt indicate that it is less likely to pay off debt and fund future operations. Investors looking for high returns may find CYTOKINETICS interesting due to its strong growth prospects. However, they must be aware that this type of company is less stable than others, as indicated by its medium asset and weak dividend and profitability scores. Additionally, its low health score suggests that it is more vulnerable to external factors such as market downturns or interest rate changes. Investors should be aware that CYTOKINETICS is a high-risk, high-reward type of company, and should only invest if they are comfortable with the level of risk involved. Furthermore, investors should conduct their own research into the company and its financials before investing in order to make an informed decision. More…

Peers

The company’s main competitors are Rubius Therapeutics Inc, XSpray Pharma AB, and Proteo Inc.

– Rubius Therapeutics Inc ($NASDAQ:RUBY)

Rubius Therapeutics Inc is a clinical-stage biopharmaceutical company focused on the development of a new class of therapeutics called Red Cell Therapeutics (RCTs). RCTs are living medicines that are derived from red blood cells and have the potential to treat a wide range of diseases with a single administration. The company’s lead product candidate, RTX-134, is in development for the treatment of severe combined immunodeficiency (SCID), a rare and potentially fatal genetic disease. Rubius has completed a Phase 1/2 clinical trial of RTX-134 in SCID patients and is preparing for a Phase 3 clinical trial.

Rubius has a market capitalization of $31.69 million and a negative return on equity of 105.38%. The company’s lead product candidate, RTX-134, is in development for the treatment of severe combined immunodeficiency (SCID), a rare and potentially fatal genetic disease. Rubius has completed a Phase 1/2 clinical trial of RTX-134 in SCID patients and is preparing for a Phase 3 clinical trial.

– XSpray Pharma AB ($LTS:0GHZ)

Spray Pharma AB is a pharmaceutical company with a market cap of 1.28B as of 2022. The company has a Return on Equity of -12.71%. Spray Pharma AB focuses on the development and commercialization of drugs for the treatment of rare diseases.

Summary

Investing in Cytokinetics, Incorporated (CYTOK) can be a worthwhile endeavor for investors. Recent news of Glenmede Trust Co. NA divesting 5611 shares of the company indicate a potential upside for investors. Analysts have noted that the stock is undervalued and has a strong upside potential, making it an attractive option for investors.

Additionally, recent news sentiment has been mostly positive, which could be a sign of long-term growth for CYTOK. Investors should consider researching the company further to determine if the stock is right for them. With careful analysis and research, CYTOK could be a profitable investment for those looking to diversify their portfolios.

Recent Posts