Foghorn Therapeutics Intrinsic Stock Value – Market Sentiment High on Foghorn Therapeutics Stock Ahead of Friday

May 26, 2023

Trending News 🌥️

Foghorn Therapeutics ($NASDAQ:FHTX) Inc. is an innovative biotechnology company focused on developing novel therapies for cancer and rare diseases. Their cutting-edge approach to research and development has put them at the forefront of the healthcare industry, making them a much-talked-about player in the stock market. On Friday, the market will close out the week, and analysts are expecting to see Foghorn’s stock price soar. The company’s stock has been steadily climbing this week, and experts believe that the trend will continue on Friday. Some analysts have even suggested that the company’s stock could hit a new all-time high on Friday, as investors speculate about their potential growth in the near future. Investors have been pouring money into Foghorn’s stock over the past few weeks, citing the company’s strong financial position and promising pipeline of products.

The company has already partnered with several major pharmaceutical firms and is working on a number of promising treatments in fields such as immuno-oncology and gene therapy. This has made it an attractive investment for those looking for long-term returns. Overall, market sentiment is high for Foghorn Therapeutics Inc. stock ahead of Friday’s closing bell. The company has seen a steady rise in its stock price, and investors are expecting even more gains in the coming weeks. With their innovative products and strong financial position, this could be the perfect time to invest in Foghorn’s stock.

Stock Price

On Friday, Foghorn opened at $6.7 and closed at $7.0, a 6.9% increase from the previous closing price of $6.5. Investors are optimistic about the biotech company’s prospects, which is reflected in the stock’s positive performance on its first day of trading. Analysts predict the stock could continue higher as Foghorn’s innovative therapies and treatments gain traction in the industry. The company is already seeing great success with its drugs and therapies, and with further development, could become a major player in the industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Foghorn Therapeutics. More…

| Total Revenues | Net Income | Net Margin |

| 20.62 | -112.46 | -545.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Foghorn Therapeutics. More…

| Operations | Investing | Financing |

| -109.1 | -55.41 | 1.48 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Foghorn Therapeutics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 372.88 | 397.47 | -0.59 |

Key Ratios Snapshot

Some of the financial key ratios for Foghorn Therapeutics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -554.9% |

| FCF Margin | ROE | ROA |

| -536.9% | 584.3% | -19.2% |

Analysis – Foghorn Therapeutics Intrinsic Stock Value

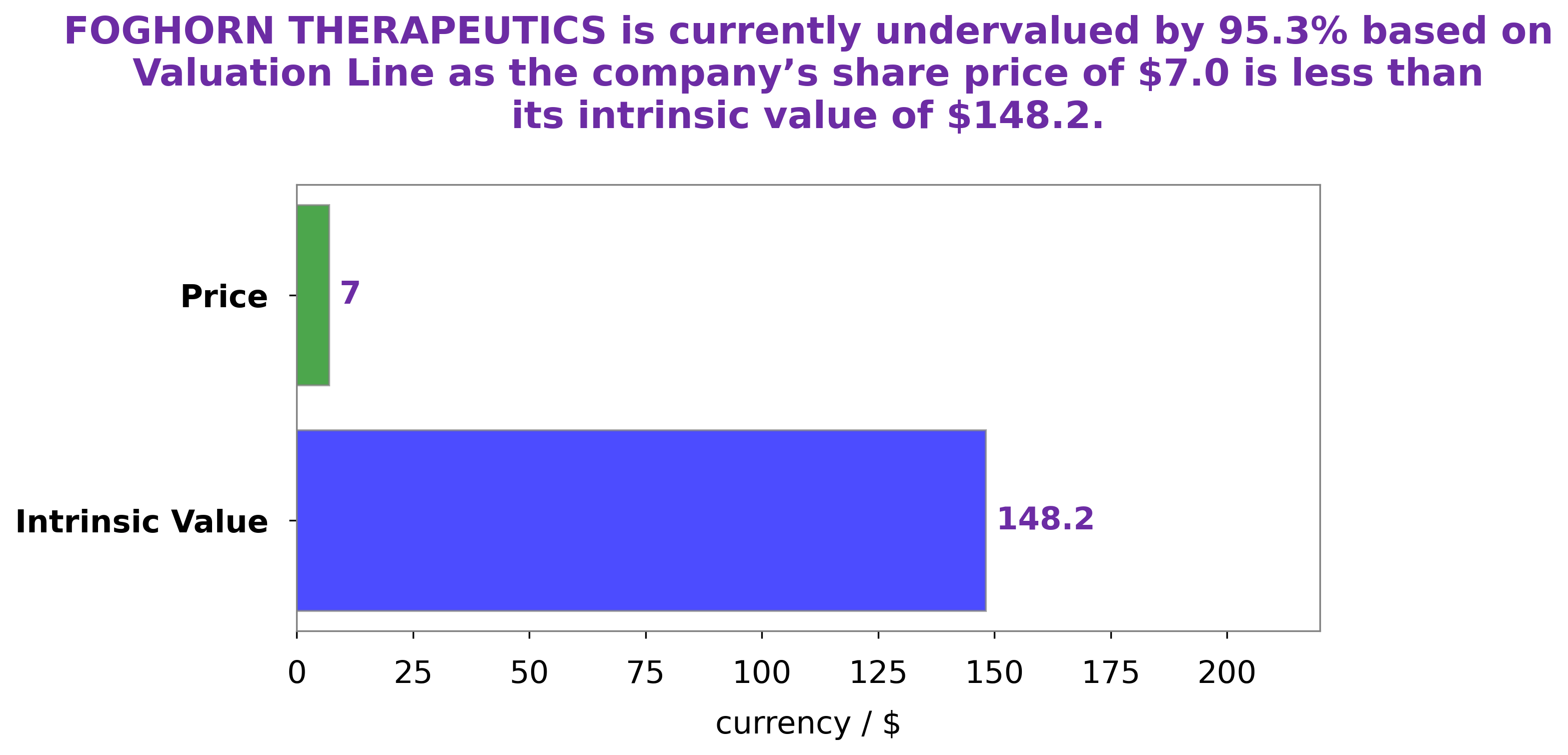

At GoodWhale, we have conducted an analysis of FOGHORN THERAPEUTICS‘s financials. Our proprietary Valuation Line has calculated the fair value of FOGHORN THERAPEUTICS shares to be around $148.2. Currently, FOGHORN THERAPEUTICS stock is trading at $7.0, which represents an undervalue of 95.3%. This provides investors with a significant opportunity for return, should the stock price reach its fair value in the future. More…

Peers

With each of these companies striving to develop innovative treatments and therapies, the race to stay ahead of the competition is ever-present.

– Omega Therapeutics Inc ($NASDAQ:OMGA)

Omega Therapeutics Inc is a biopharmaceutical company based in San Francisco that focuses on the research and development of novel therapies to address unmet needs in immunology. As of 2023, Omega Therapeutics has a market capitalization of 335.71M, which reflects the company’s current value in the public markets. Additionally, Omega Therapeutics has a Return on Equity of -48.06%, which indicates that the shareholders’ investment in the company has resulted in a net loss in the past year.

– TME Pharma NV ($BER:0N6A)

TME Pharma NV is a biopharmaceutical company based in Belgium that is focused on developing innovative treatments for chronic and rare diseases. As of 2023, the company has a market cap of 1.59M. TME Pharma’s Return on Equity (ROE) is -271.38%, which suggests that the company has struggled to generate profits from its investments. Despite this, the company is developing a strong pipeline of promising new treatments and could well see its market cap increase in the future.

– Shattuck Labs Inc ($NASDAQ:STTK)

Shattuck Labs Inc. is a biopharmaceutical company focused on the discovery, development and commercialization of novel immunotherapies for the treatment of cancer and other diseases. It has a market cap of 122.25M as of 2023 and a negative Return on Equity (ROE) of -34.39%. The market cap indicates that the company is valued at over one hundred million dollars, while its negative ROE suggests that it has not had much success generating profits from its operations. Nevertheless, Shattuck Labs Inc remains dedicated to its mission of discovering and developing novel immunotherapies for cancer and other diseases.

Summary

Foghorn Therapeutics Inc. has demonstrated strong market sentiment recently, with their stock price rising on the same day. This is a promising sign for investors, as it suggests that the company may have strong prospects for growth and profitability in the near future. Investors should consider carefully their long-term investment strategies in light of the current market conditions to ensure that they are able to maximize their returns on investment. As Foghorn Therapeutics Inc. continues to show positive signs of growth, it is important to keep up with the latest news and developments to ensure that any potential investment is considered carefully.

Recent Posts